Apolo Trading 2025 Review: Everything You Need to Know

Summary

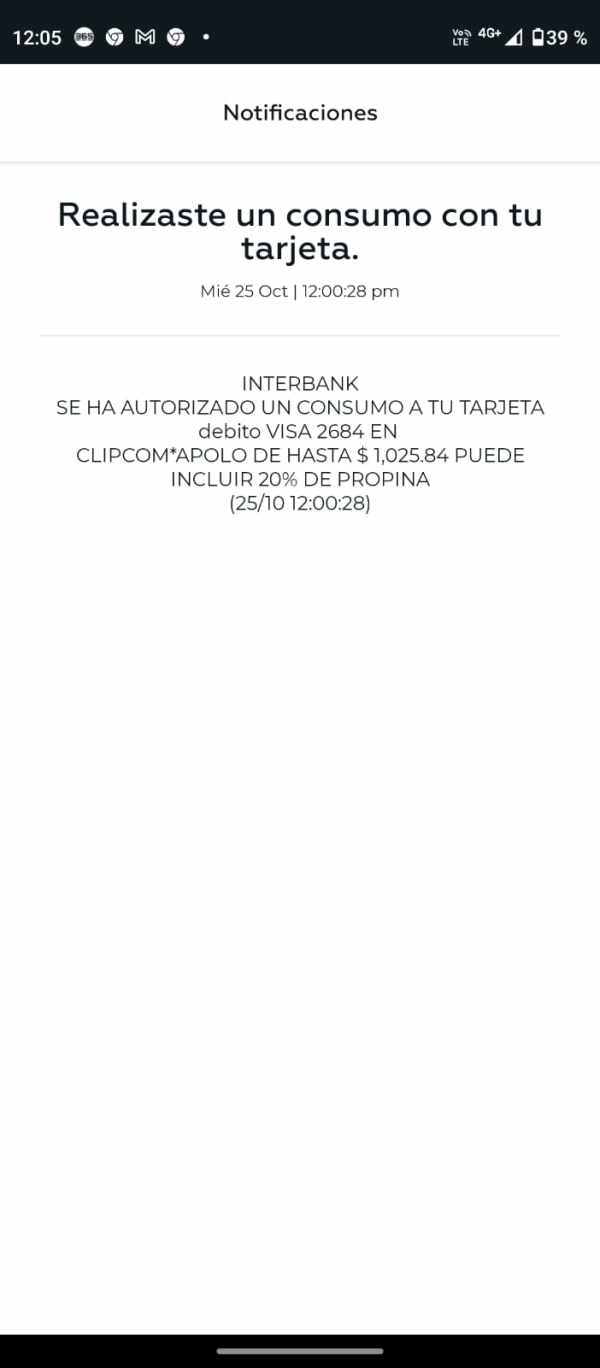

This Apolo Trading review shows a concerning picture of an unregulated broker that operates with big limitations and regulatory gaps. Apolo Trading was established in 2021 and registered in Saint Vincent and the Grenadines, serving UK clients mainly through a basic web-based trading platform. The broker's lack of proper regulatory oversight creates major risks for traders.

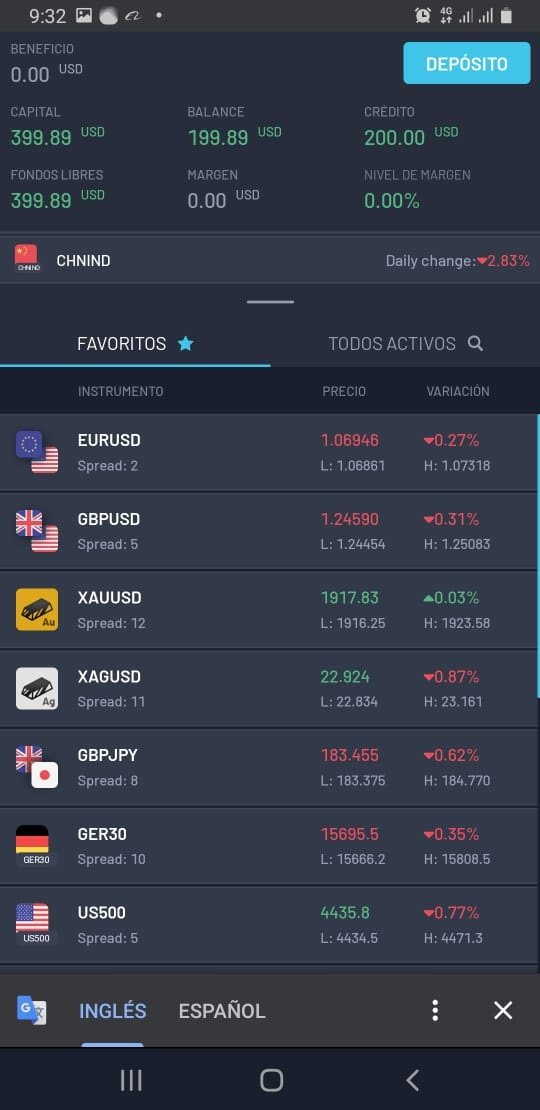

The platform offers a simple trading interface. This might appeal to those seeking straightforward forex trading solutions, but this simplicity comes at the cost of advanced features and comprehensive trading tools that experienced traders typically expect. Apolo Trading has a WikiFX rating of just 1.39 out of 10 and four recorded user complaints. The broker's reputation in the trading community raises serious concerns about service quality and reliability.

Apolo Trading's target demographic appears to be UK-based traders looking for basic forex trading capabilities through an English-language platform. Given the broker's unregulated status and negative user feedback, potential clients should exercise extreme caution before considering this platform for their trading activities. The combination of limited regulatory protection, basic platform functionality, and documented user complaints suggests that traders might be better served by exploring more established and properly regulated alternatives in the competitive forex brokerage landscape.

Important Notice

Regional Entity Differences: Apolo Trading operates primarily for UK clients despite being registered in Saint Vincent and the Grenadines. This jurisdiction is known for its lenient regulatory framework, and this offshore registration means traders lack the protection typically afforded by major financial regulators such as the FCA, ASIC, or CySEC. The absence of proper regulatory oversight significantly increases the risk profile for potential clients.

Review Methodology: This comprehensive Apolo Trading review is based on publicly available information, user feedback, and third-party assessments. Individual trading experiences may vary, and prospective clients should conduct their own due diligence before making any trading decisions. The evaluation considers multiple factors including regulatory status, platform functionality, user satisfaction, and overall market reputation.

Rating Framework

Broker Overview

Company Background and Establishment

Apolo Trading entered the forex brokerage market in 2021. The company positioned itself as a service provider for UK-based traders seeking access to foreign exchange markets, and it established its headquarters in Saint Vincent and the Grenadines, a popular offshore jurisdiction for financial services companies due to its relaxed regulatory requirements. This strategic location allows the broker to operate with minimal regulatory oversight while serving international clients, particularly those in the United Kingdom.

The broker's business model centers around providing unregulated forex trading services through a simplified web-based platform. Apolo Trading supports English-language communication, making it accessible to its primary target market of English-speaking traders, but the company's offshore registration and lack of major regulatory licenses raise questions about client protection and operational transparency that potential users should carefully consider.

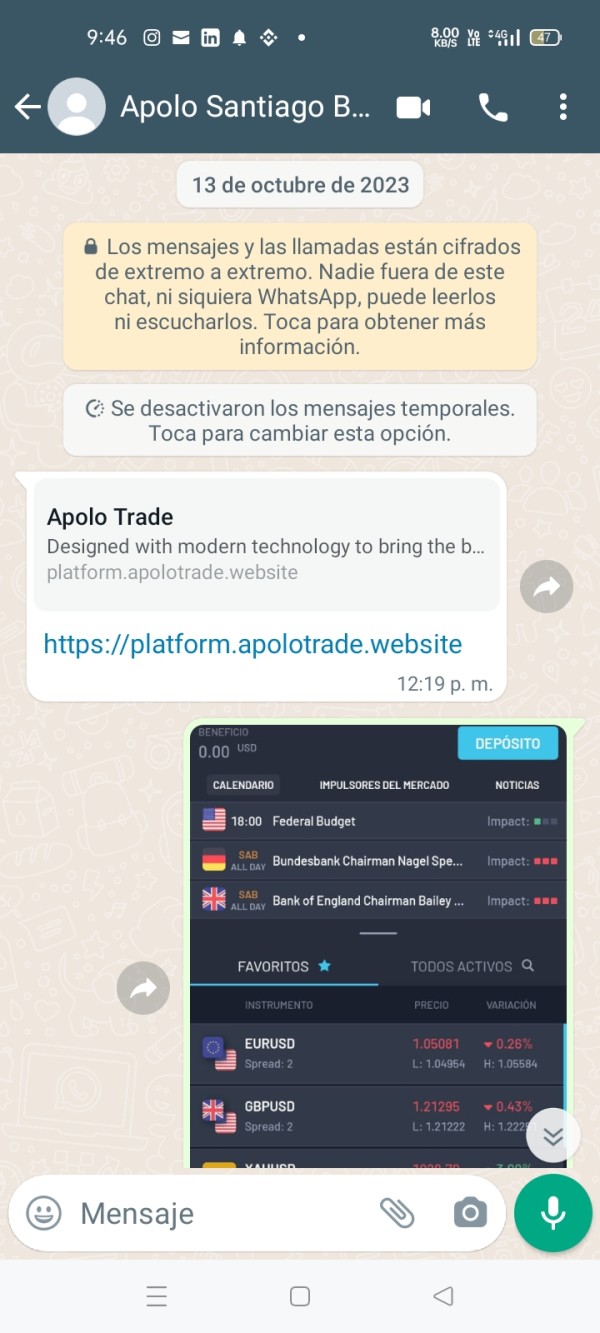

Platform and Service Offerings

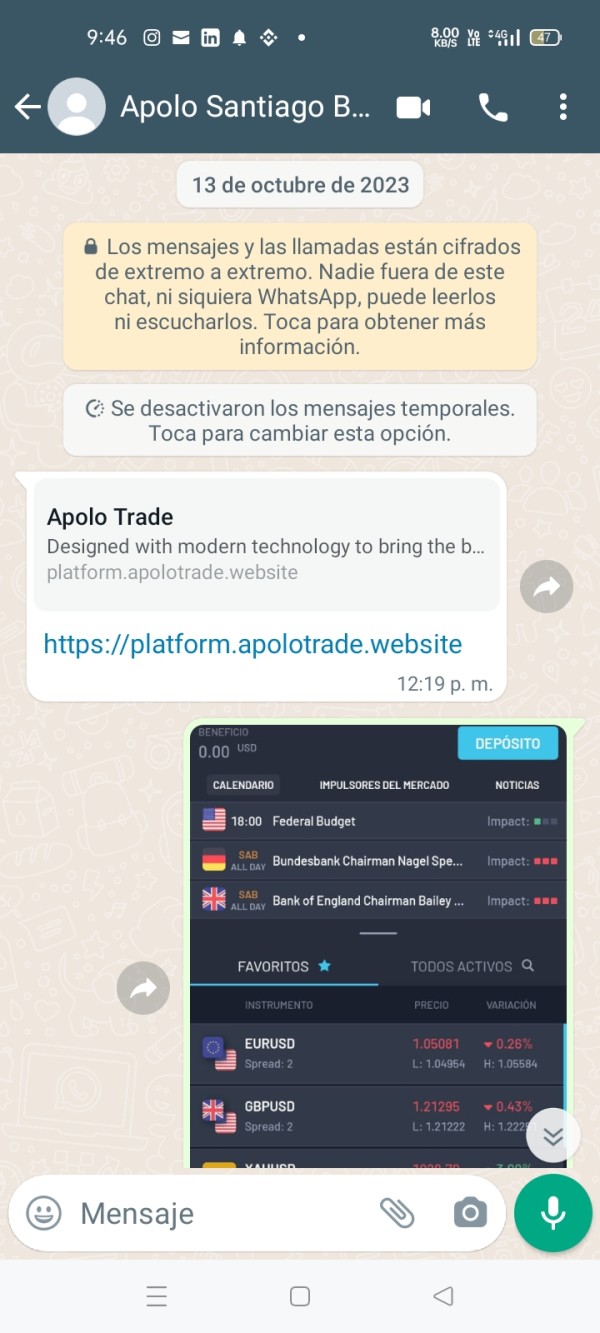

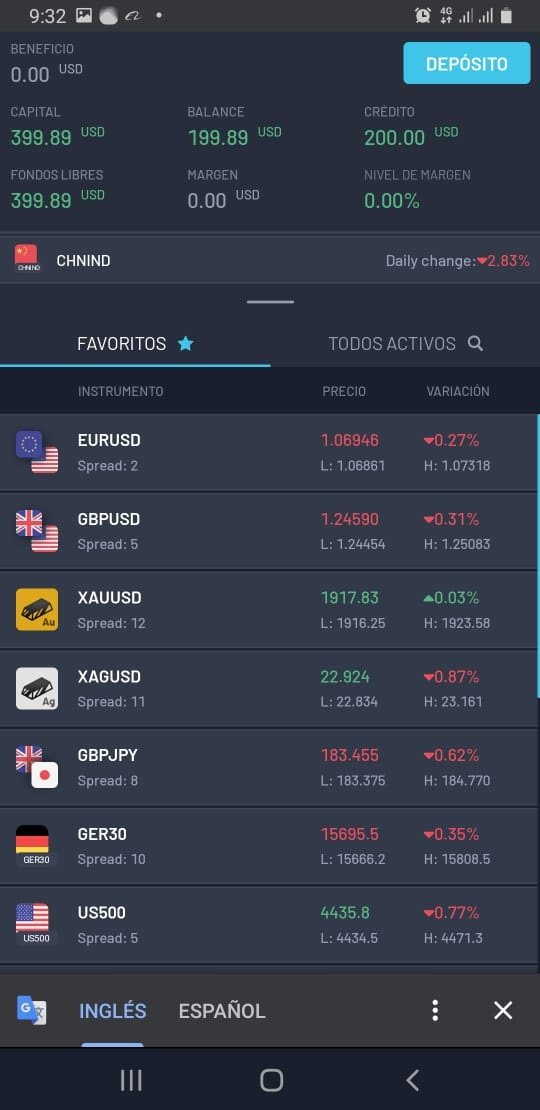

Apolo Trading operates exclusively through a web-based trading platform that emphasizes simplicity over advanced functionality. This Apolo Trading review finds that while the platform may appeal to beginners due to its straightforward interface, it lacks the sophisticated tools and features that experienced traders typically require, and the broker primarily focuses on forex trading, though specific information about additional asset classes such as CFDs remains unclear from available sources.

The platform's limited functionality reflects the broker's overall approach to trading services. This approach appears to prioritize basic market access over comprehensive trading solutions, and this simplified approach may suit traders who prefer uncomplicated trading environments, but it potentially limits the broker's appeal to more sophisticated market participants who require advanced charting tools, automated trading capabilities, and extensive market analysis resources.

Regulatory Status and Jurisdiction

Apolo Trading operates as an unregulated broker registered in Saint Vincent and the Grenadines under the Financial Services Authority. This registration does not constitute proper financial regulation comparable to major jurisdictions like the UK, EU, or Australia.

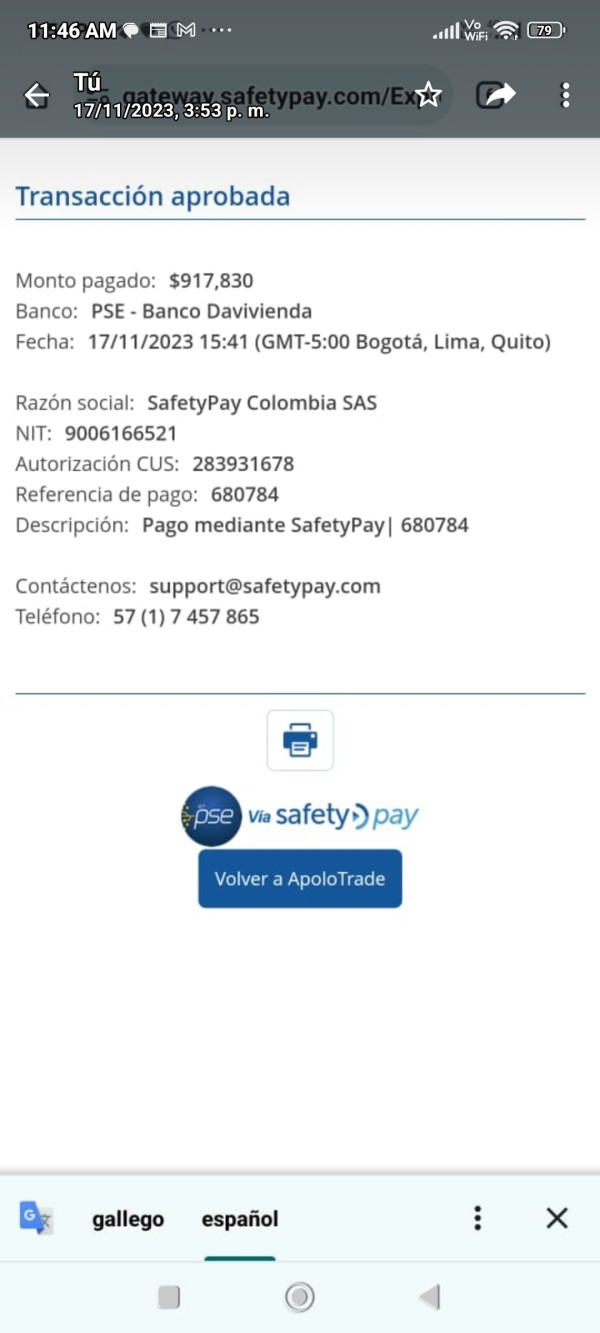

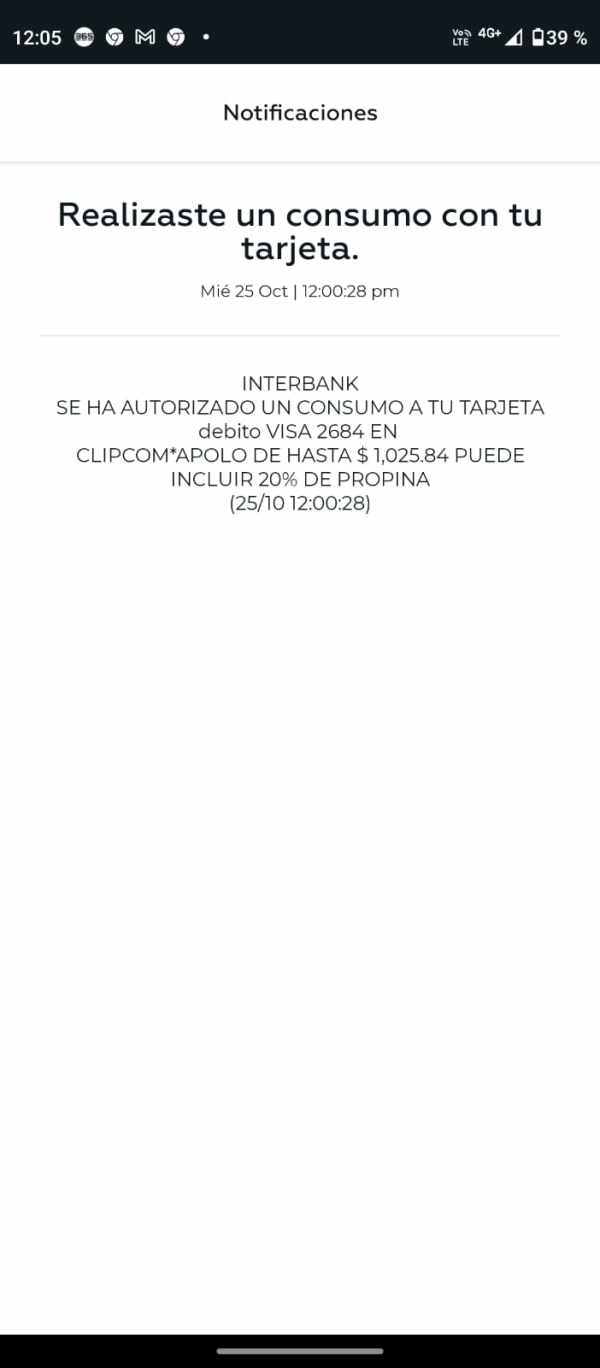

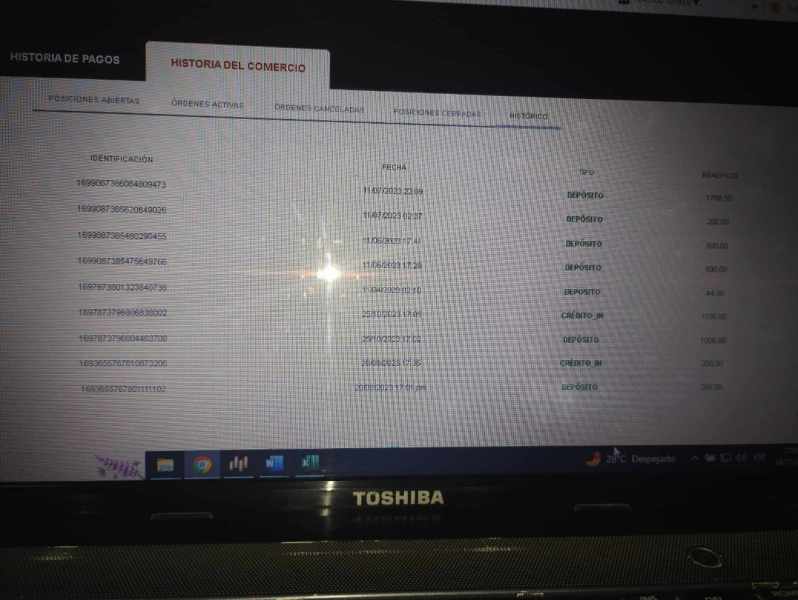

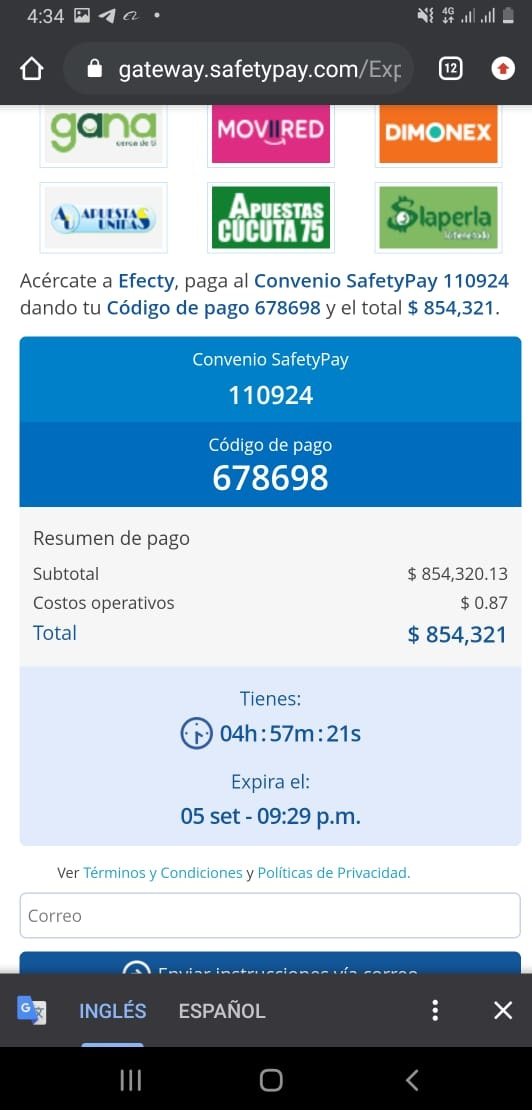

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods is not detailed in available sources. This represents a significant transparency gap that potential clients should investigate directly with the broker.

Minimum Deposit Requirements

The minimum deposit requirement for opening an account with Apolo Trading is not specified in available documentation. This may indicate flexible entry requirements or lack of clear policy communication.

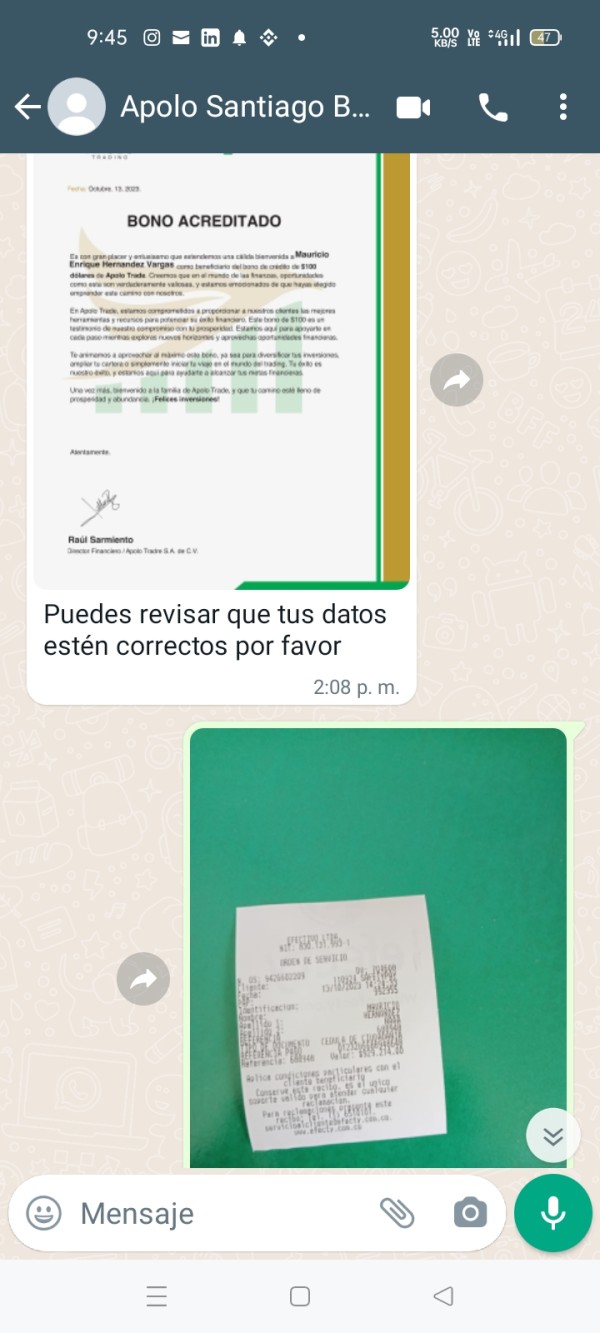

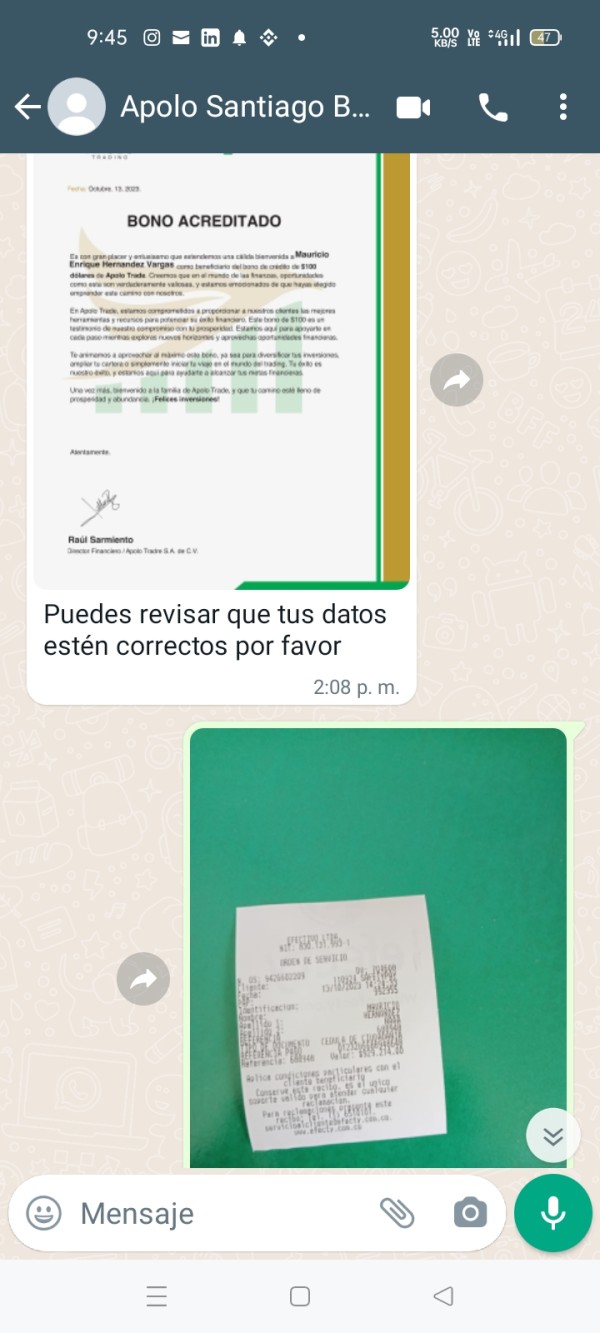

Promotional Offers and Bonuses

Current promotional offers and bonus structures are not mentioned in available sources. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets

The broker primarily offers forex trading services. The complete range of available currency pairs and any additional asset classes like CFDs are not comprehensively detailed in accessible information.

Cost Structure and Fees

Specific information about spreads, commissions, and other trading costs is not provided in available sources. This makes it difficult for this Apolo Trading review to assess the broker's competitiveness in terms of pricing.

Leverage Options

Leverage ratios and margin requirements are not specified in available documentation. This represents another area where potential clients would need to seek direct clarification from the broker.

Platform Selection

The broker offers a web-based trading platform with basic functionality. Specific technical details and platform capabilities remain limited in available information.

Geographic Restrictions

Apolo Trading primarily serves UK clients. Specific geographic restrictions for other jurisdictions are not clearly outlined.

Customer Support Languages

The broker provides customer support in English. This aligns with its primary focus on English-speaking markets.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Apolo Trading remain largely undisclosed in publicly available information. This presents a significant transparency concern for potential clients, and this Apolo Trading review cannot provide specific details about account types, minimum deposit requirements, or special account features due to the lack of comprehensive information from reliable sources.

The absence of clear account condition information suggests either limited transparency in the broker's marketing approach or a simplified account structure that may not cater to diverse trader needs. Professional traders typically expect detailed information about account tiers, minimum deposits, and special features such as Islamic accounts or VIP services, but without specific details about account opening procedures, verification requirements, or account maintenance fees, potential clients face uncertainty about what to expect when engaging with this broker.

This information gap represents a significant disadvantage compared to more established brokers who provide comprehensive account condition details upfront. The lack of transparent account information also raises questions about the broker's commitment to client education and informed decision-making, which are hallmarks of reputable brokerage services.

Apolo Trading's trading tools and resources receive a modest 4/10 rating. This primarily reflects the limitations of their basic web trading platform, and the broker offers a simplified trading interface that lacks the sophisticated analytical tools and resources that modern traders typically expect from competitive brokerage services.

The web-based platform, while functional for basic trading operations, does not appear to include advanced charting capabilities, technical indicators, or automated trading support that are standard features among established brokers. This limitation significantly impacts the platform's utility for traders who rely on comprehensive market analysis and advanced trading strategies, but educational resources, market research, and analytical content are not prominently featured in available information about the broker's offerings.

The absence of these value-added services places Apolo Trading at a disadvantage compared to brokers who provide extensive educational materials, market commentary, and trading guides to support client success. The limited tool set may appeal to absolute beginners who prefer simple interfaces, but it likely fails to meet the needs of intermediate and advanced traders who require sophisticated trading environments to implement their strategies effectively.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern in this evaluation. It earns a low 3/10 rating based on documented user complaints and limited support infrastructure, and according to available information, Apolo Trading has received four user complaints, which represents a concerning pattern for a relatively new broker with limited market presence.

The complaints suggest issues with service delivery, responsiveness, or problem resolution that have led clients to seek external channels for addressing their concerns. This pattern raises questions about the broker's internal customer service processes and commitment to client satisfaction, but while the broker provides English-language support to align with its UK client base, specific information about support channels, availability hours, or response time commitments is not readily available.

The lack of comprehensive customer service information suggests limited infrastructure for client support. The documented complaints, combined with the broker's unregulated status, create additional concerns about clients' ability to seek recourse for service issues or disputes, and without proper regulatory oversight, clients may have limited options for external complaint resolution if internal processes prove inadequate.

Trading Experience Analysis

The trading experience with Apolo Trading receives a moderate 5/10 rating. This reflects the platform's basic functionality balanced against its significant limitations, and the web-based trading platform offers a simplified interface that may suit traders seeking straightforward market access without complex features or advanced capabilities.

Platform stability and execution speed information is not detailed in available sources. This makes it difficult to assess the technical reliability of the trading environment, and order execution quality, including potential slippage and requote issues, remains undocumented in accessible user feedback or technical reviews.

The platform's functional completeness appears limited compared to industry standards. It lacks advanced charting tools, automated trading capabilities, and sophisticated order types that experienced traders typically require, and this simplicity may appeal to beginners but likely frustrates more experienced market participants.

Mobile trading experience details are not provided in available information. This represents a significant gap given the importance of mobile trading in modern forex markets, and the absence of dedicated mobile applications or mobile-optimized platforms may limit the broker's appeal to traders who require flexible trading access.

This Apolo Trading review notes that the overall trading environment appears designed for basic market participation rather than comprehensive trading solutions. This may explain the moderate rating despite documented user concerns.

Trust and Safety Analysis

Trust and safety concerns represent the most significant weakness in Apolo Trading's offering. They earn a low 2/10 rating due to fundamental regulatory and reputational issues, and the broker's unregulated status, despite registration with Saint Vincent and the Grenadines' Financial Services Authority, provides minimal client protection compared to major regulatory frameworks.

The WikiFX rating of 1.39 out of 10 reflects serious concerns about the broker's reliability and trustworthiness within the trading community. This extremely low rating suggests significant issues that potential clients should carefully consider before engaging with the platform, but client fund safety measures are not detailed in available information, raising questions about segregated accounts, deposit protection, and other standard safety protocols that regulated brokers typically implement.

Without proper regulatory oversight, clients face increased risks regarding fund security and operational transparency. The broker's limited operational history since 2021, combined with documented user complaints and poor third-party ratings, creates a concerning profile for risk-conscious traders, and the absence of major regulatory licenses means clients cannot rely on regulatory protection schemes that are standard in properly regulated jurisdictions.

Industry reputation appears significantly compromised based on available assessments. This suggests that the broker has not established the credibility and trust that are essential for successful brokerage operations in competitive markets.

User Experience Analysis

User experience with Apolo Trading receives a 4/10 rating. This reflects mixed feedback with predominantly negative indicators from available sources, and the documented user complaints suggest that client satisfaction levels fall below acceptable standards for professional brokerage services.

The simplified platform interface may offer ease of use for beginners. This simplicity appears to come at the expense of functionality and features that could enhance the overall trading experience, and user feedback suggests that the platform's limitations may frustrate traders who require more sophisticated trading environments.

Registration and account verification processes are not detailed in available sources. This makes it difficult to assess the efficiency and user-friendliness of onboarding procedures, and smooth account opening processes are typically important factors in overall user satisfaction.

Fund operation experiences, including deposit and withdrawal procedures, are not comprehensively documented in available user feedback. The presence of user complaints suggests that some clients have encountered difficulties with various aspects of the service, but common user complaints appear to focus on customer service responsiveness and platform functionality limitations.

The combination of basic platform features and service quality concerns creates a user experience that falls short of industry standards and client expectations.

Conclusion

This comprehensive Apolo Trading review reveals a broker with significant limitations and concerning risk factors that potential clients should carefully consider. As an unregulated broker operating from Saint Vincent and the Grenadines, Apolo Trading lacks the regulatory protection and oversight that traders typically expect from reputable brokerage services, but the broker's simplified web trading platform and basic service offerings may appeal to absolute beginners seeking uncomplicated market access.

The combination of limited functionality, documented user complaints, and poor third-party ratings creates a risk profile that is unsuitable for most serious traders. The WikiFX rating of 1.39 out of 10 and four recorded user complaints paint a concerning picture of service quality and reliability, but while Apolo Trading offers English-language support and focuses on the UK market, these advantages are significantly outweighed by the fundamental issues of regulatory protection, platform limitations, and documented service problems.

Traders seeking reliable, well-regulated, and feature-rich trading environments would be better served by exploring established brokers with proper regulatory licenses and proven track records in client service and platform reliability.