Arta Techfin 2025 Review: Everything You Need to Know

Arta Techfin is a relatively new player in the forex brokerage market, having been established in 2021. Despite its recent inception, the broker has garnered attention for its ambitious plans to integrate traditional finance with blockchain technology. However, user reviews and expert analyses reveal a mixed bag of experiences, with significant concerns regarding regulatory status and customer service.

Note: It is essential to be cautious when dealing with brokers operating across different jurisdictions, as regulatory frameworks can vary significantly. The information presented here aims to provide a fair and accurate overview of Arta Techfin based on available sources.

Ratings Overview

How We Score Brokers: Our scoring system is based on user experiences, expert opinions, and factual data regarding the broker's services.

Broker Overview

Founded in 2021, Arta Techfin operates out of Hong Kong and is positioned as a hybrid financial platform that seeks to bridge traditional finance and blockchain technology. The broker offers access to various asset classes, including forex, securities, and potentially cryptocurrencies as it seeks regulatory approval to expand its services. Arta Techfin is associated with the Securities and Futures Commission of Hong Kong (SFC) but has raised concerns regarding its regulatory status, as it appears to operate under a suspicious license.

Detailed Analysis

Regulated Regions:

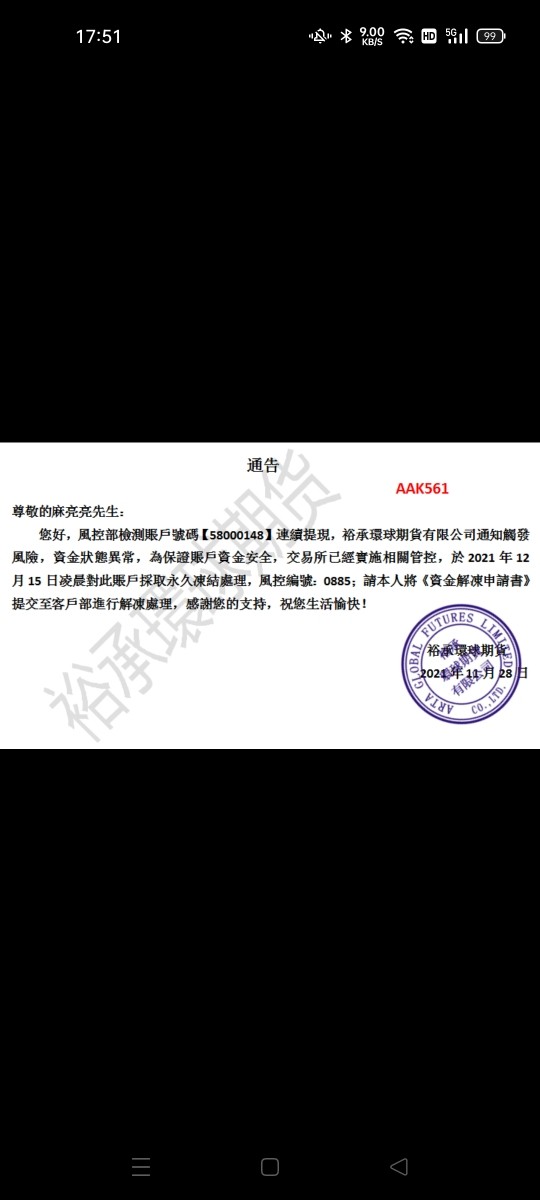

Arta Techfin is based in Hong Kong and is attempting to navigate the regulatory landscape to offer services related to virtual assets. However, its current regulatory status remains unclear, with some sources indicating that it may be operating as a "clone" of regulated entities, raising red flags for potential investors. This lack of clarity significantly impacts its trustworthiness score.

Deposit/Withdrawal Currencies:

While specific information about the currencies supported for deposits and withdrawals is lacking, it is common for brokers in Hong Kong to support major fiat currencies like HKD, USD, and potentially cryptocurrencies as the firm expands its offerings.

Minimum Deposit:

Details regarding the minimum deposit requirements for opening an account with Arta Techfin are not explicitly mentioned in the sources reviewed. However, potential clients should be prepared for typical minimums that can range from $100 to $500, depending on the account type.

Bonuses/Promotions:

There is no current information indicating that Arta Techfin offers bonuses or promotions to new clients. This absence of promotional incentives may deter some traders looking for added value when opening an account.

Tradeable Asset Classes:

Arta Techfin aims to offer a diverse range of financial products, including forex, securities, and potentially cryptocurrencies in the future, contingent upon regulatory approval. However, the lack of clarity regarding the current offerings limits a comprehensive understanding of its trading capabilities.

Costs (Spreads, Fees, Commissions):

The specific costs associated with trading at Arta Techfin, including spreads and commissions, remain ambiguous. This lack of transparency is a significant concern for potential clients, as hidden fees can erode trading profitability.

Leverage:

Information about the leverage offered by Arta Techfin is not readily available. Traders should inquire directly with the broker to understand the leverage options and associated risks, as leverage can significantly impact trading outcomes.

Allowed Trading Platforms:

Arta Techfin appears to utilize modern trading technologies, but specific details regarding the platforms available (such as MT4 or MT5) are not provided. This information is crucial for traders who prefer specific trading environments.

Restricted Regions:

While the broker is based in Hong Kong, there is no clear indication of the regions where Arta Techfin may face restrictions. Prospective clients should verify whether they can legally trade with the broker based on their location.

Available Customer Support Languages:

Arta Techfin primarily offers customer service in Chinese (Simplified), which may limit accessibility for non-Chinese speaking clients. This language barrier can hinder effective communication and support for international traders.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions:

The account conditions at Arta Techfin are not particularly favorable, with concerns about minimum deposit requirements and the lack of clear information regarding account types. The absence of promotional bonuses further detracts from its appeal.

Tools and Resources:

While Arta Techfin aims to provide advanced trading tools, specific details about these resources are scarce. Traders may find themselves lacking essential tools for effective market analysis.

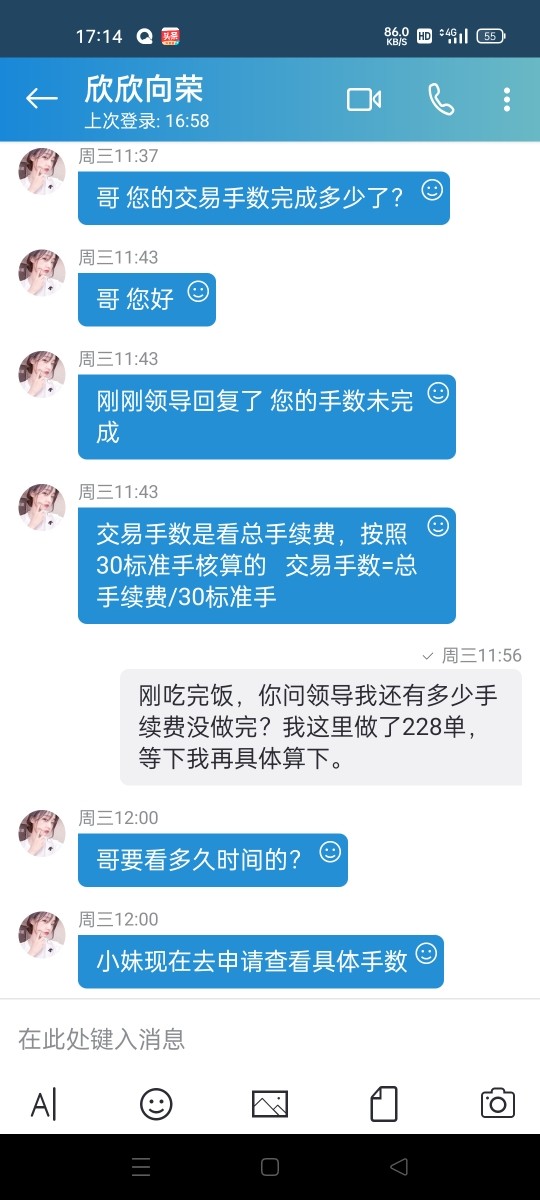

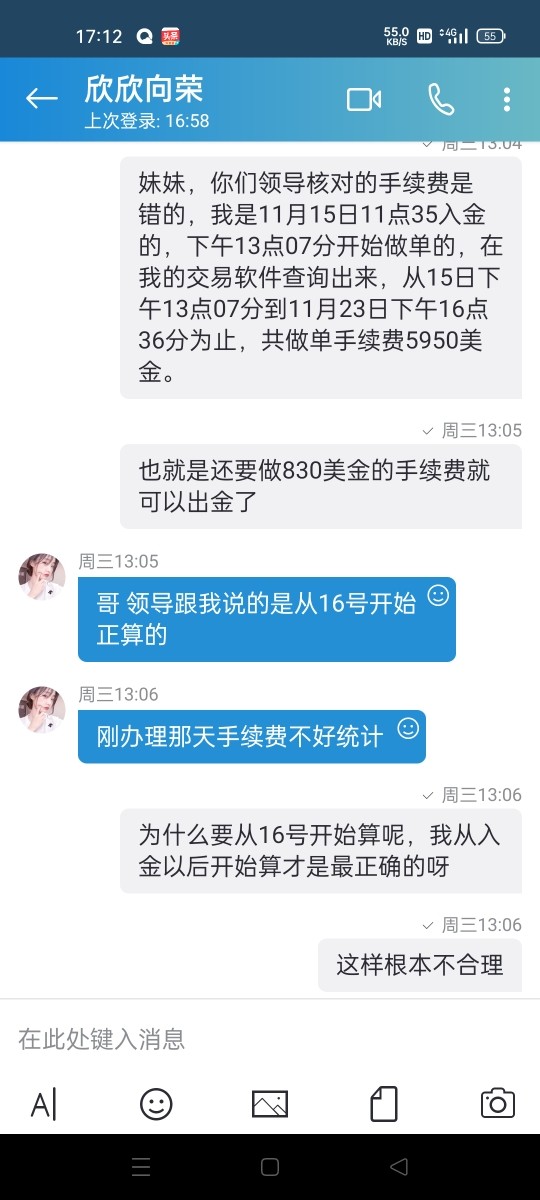

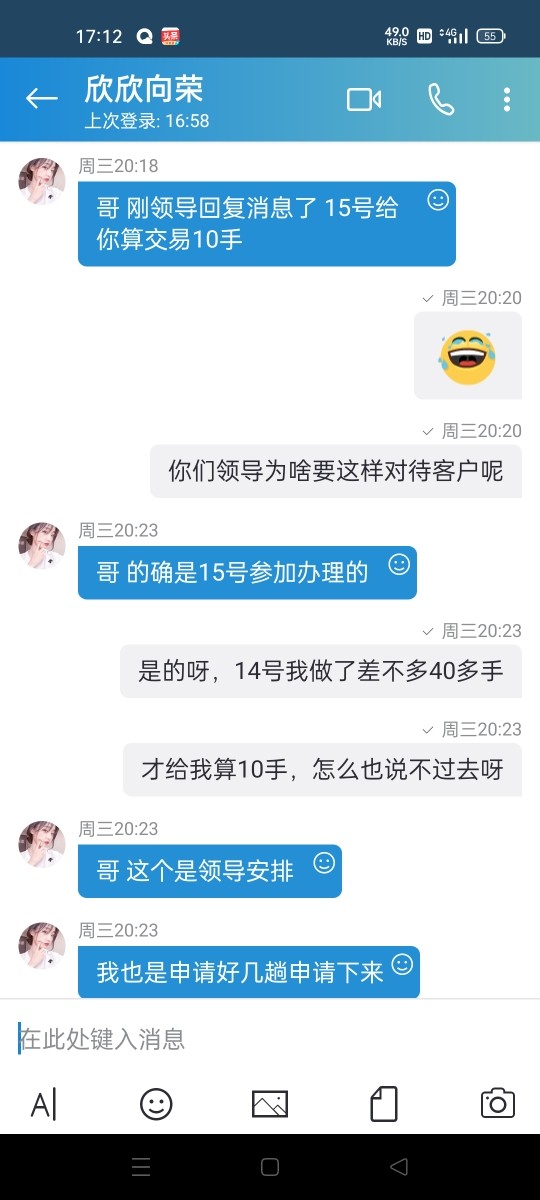

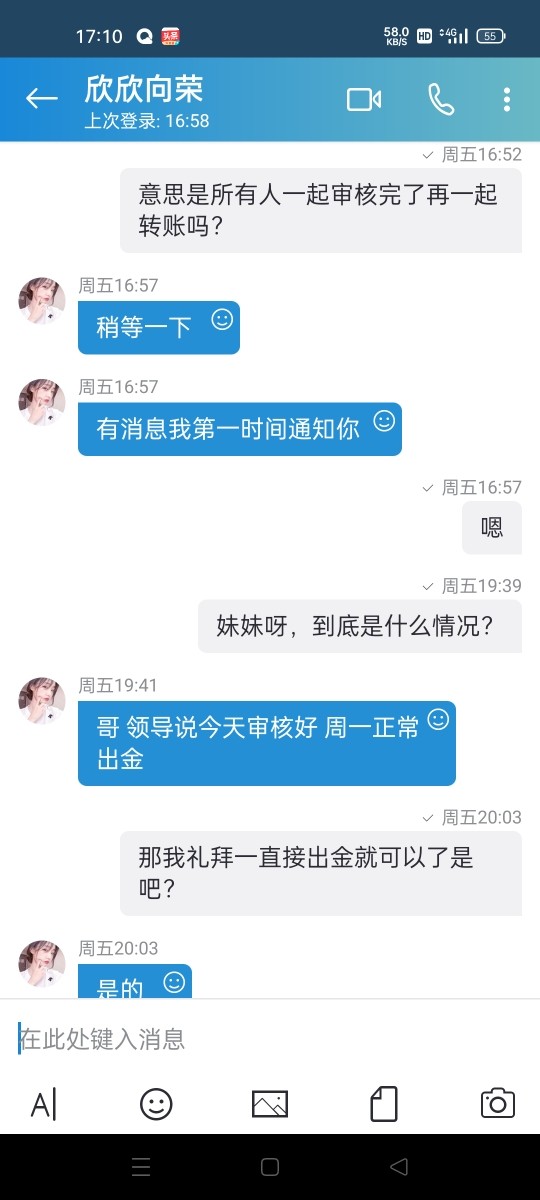

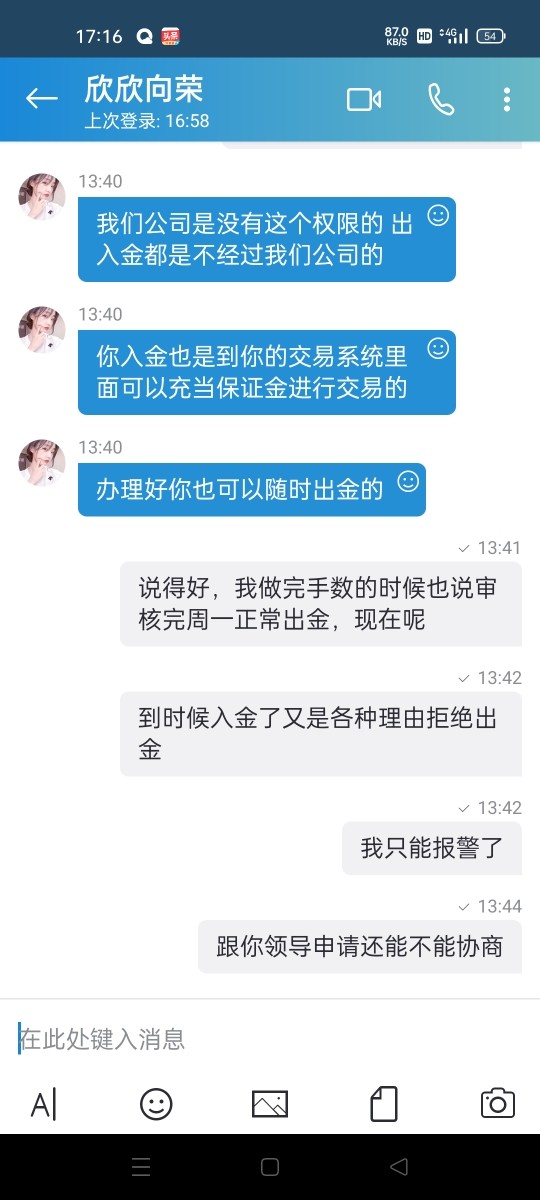

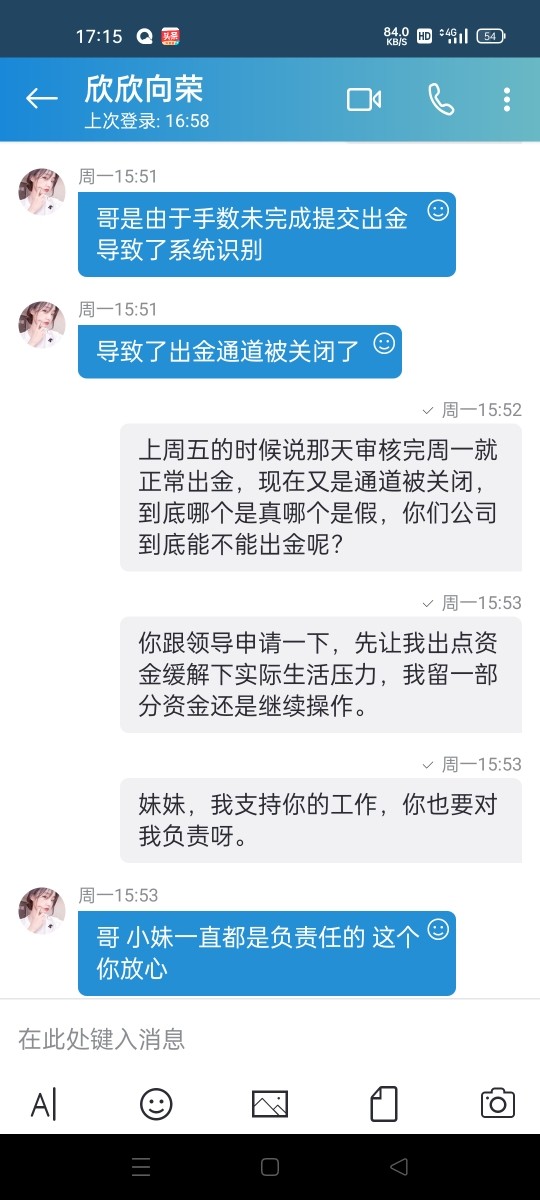

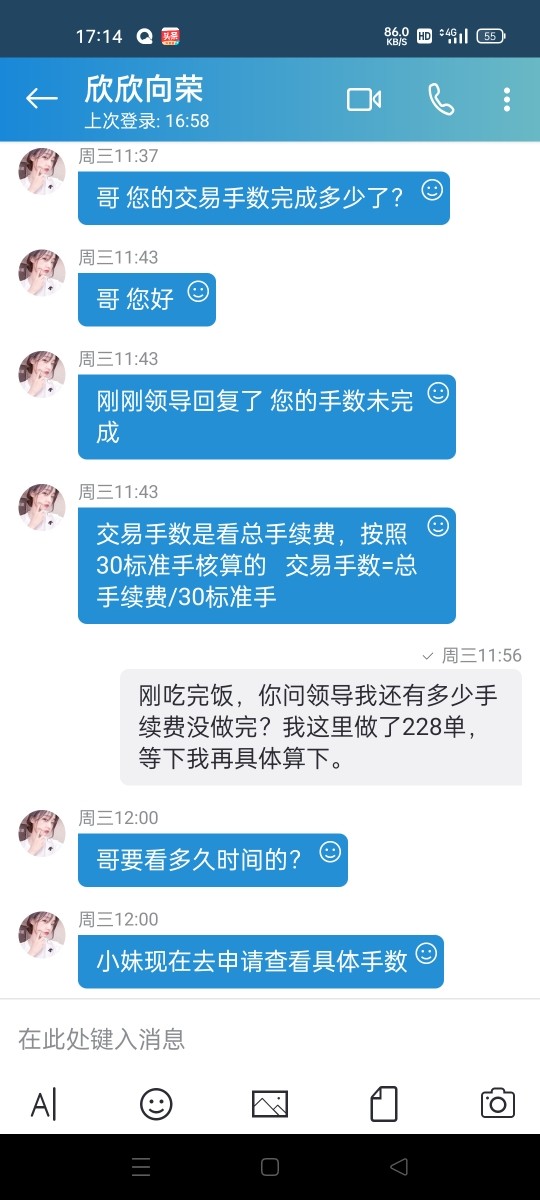

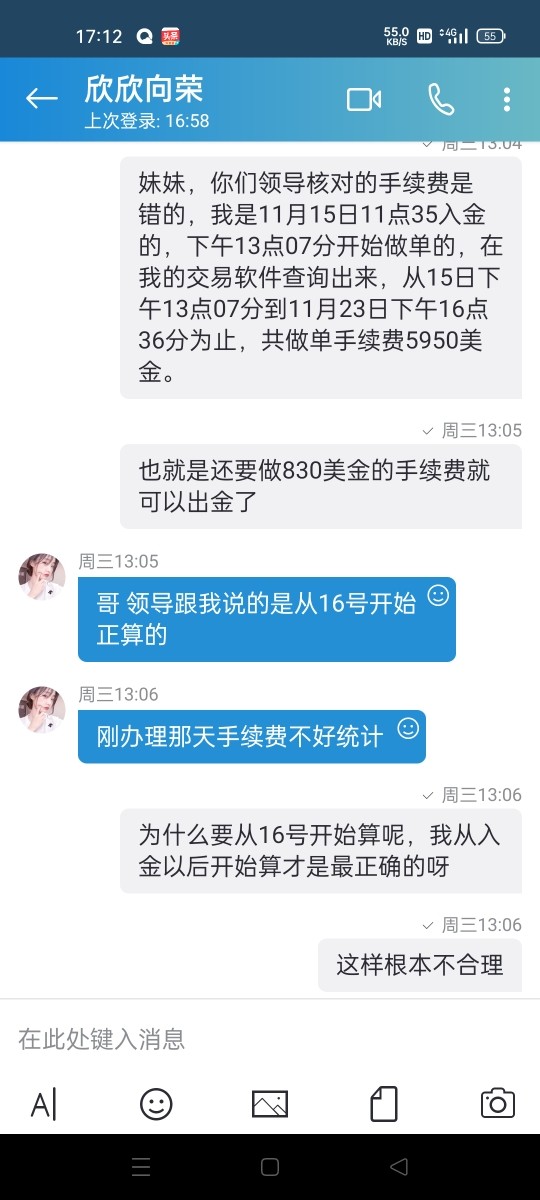

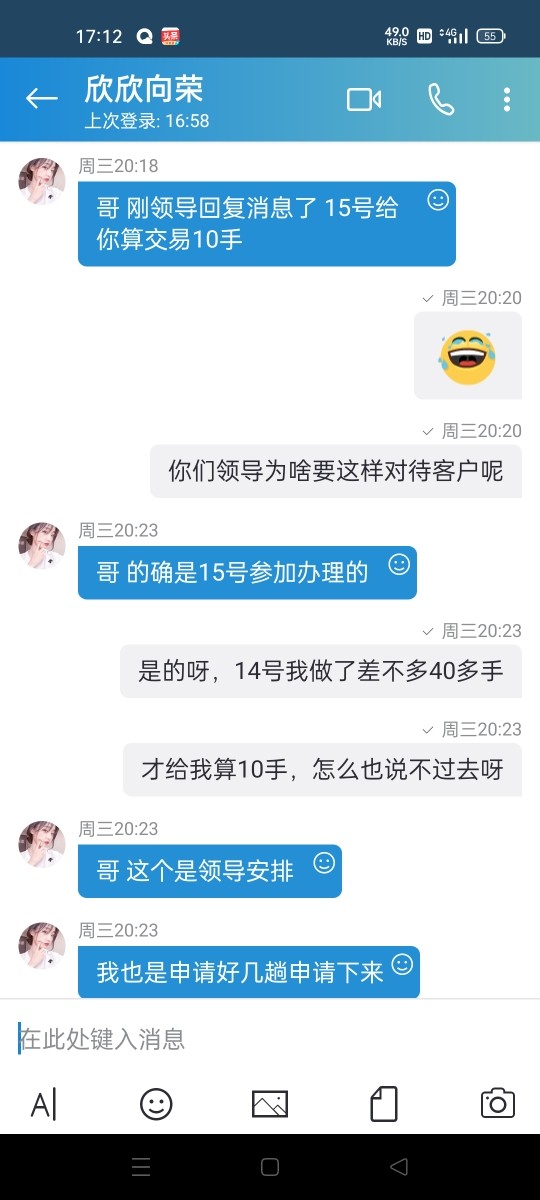

Customer Service and Support:

User experiences indicate significant dissatisfaction with customer service. Reports of unresponsive support and language barriers suggest that clients may struggle to obtain timely assistance.

Trading Setup (Experience):

The trading experience at Arta Techfin is marred by concerns about its regulatory status, which can impact trader confidence. The lack of clarity regarding trading platforms also raises questions about the overall trading setup.

Trustworthiness:

Trustworthiness is a significant concern for Arta Techfin, as the broker has been flagged for potential regulatory issues. The low WikiFX score of 1.43 further emphasizes the need for caution.

User Experience:

Users have reported mixed experiences, with some praising the innovative approach to integrating blockchain technology, while others express concerns about the overall transparency and support provided by the broker.

In summary, while Arta Techfin shows promise with its innovative approach to finance, significant concerns about its regulatory status, customer service, and overall transparency make it a broker that potential clients should approach with caution. As with any investment, thorough research and consideration of personal risk tolerance are essential when deciding whether to engage with Arta Techfin.