Edge Finance 2025 Review: Everything You Need to Know

Summary: Edge Finance has garnered significant negative attention in the forex trading community, primarily due to its unregulated status and numerous complaints from users. Key findings indicate that while it offers various trading instruments and a low minimum deposit, the lack of regulatory oversight raises serious concerns about the safety of funds and the overall reliability of the platform.

Note: It is essential to recognize that different entities operate under the Edge Finance name in various regions, which may impact the user experience. This review aims to provide a fair and accurate assessment based on available data.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's services.

Broker Overview

Established in 2023, Edge Finance is an offshore brokerage that claims to offer a wide range of financial services, including forex, stocks, indices, and commodities trading. The platform operates on a proprietary web-based trading platform, which lacks the features and reliability of industry-standard platforms like MT4 or MT5. Edge Finance is unregulated, which is a significant red flag for potential investors, as it does not fall under the oversight of any major financial authority.

Detailed Breakdown

Regulatory Status

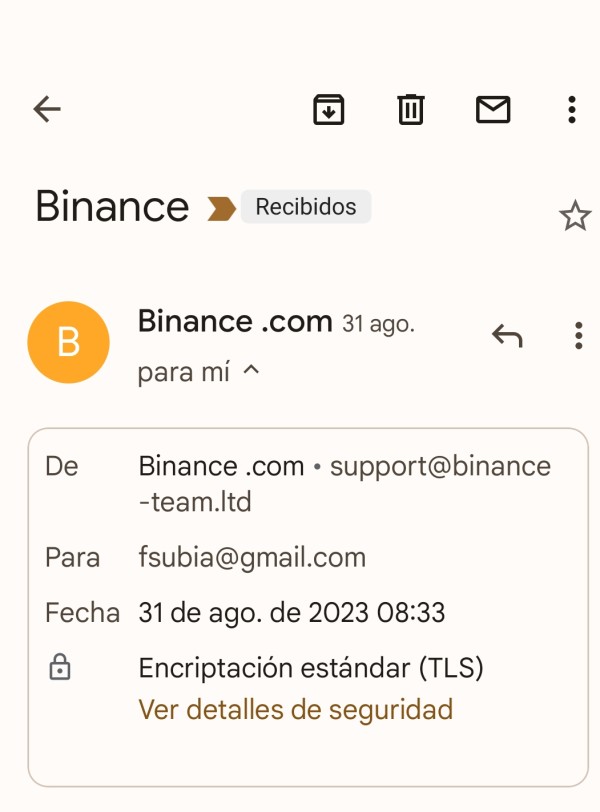

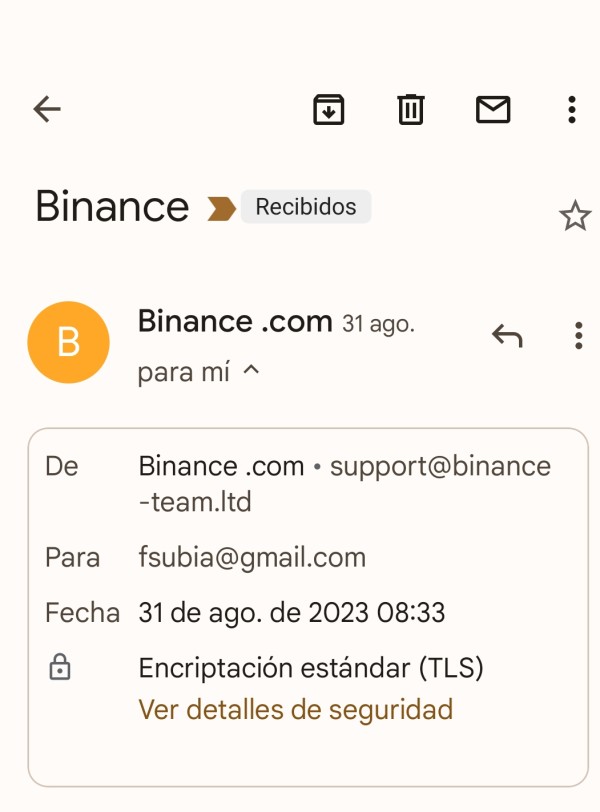

Edge Finance operates without any regulatory oversight, which is a major concern for potential traders. The Autorité des Marchés Financiers (AMF) in France has issued warnings against Edge Finance, labeling it as unauthorized to engage in forex activities. This lack of regulation means that traders have little to no protection for their funds, making it a risky choice for those looking to invest.

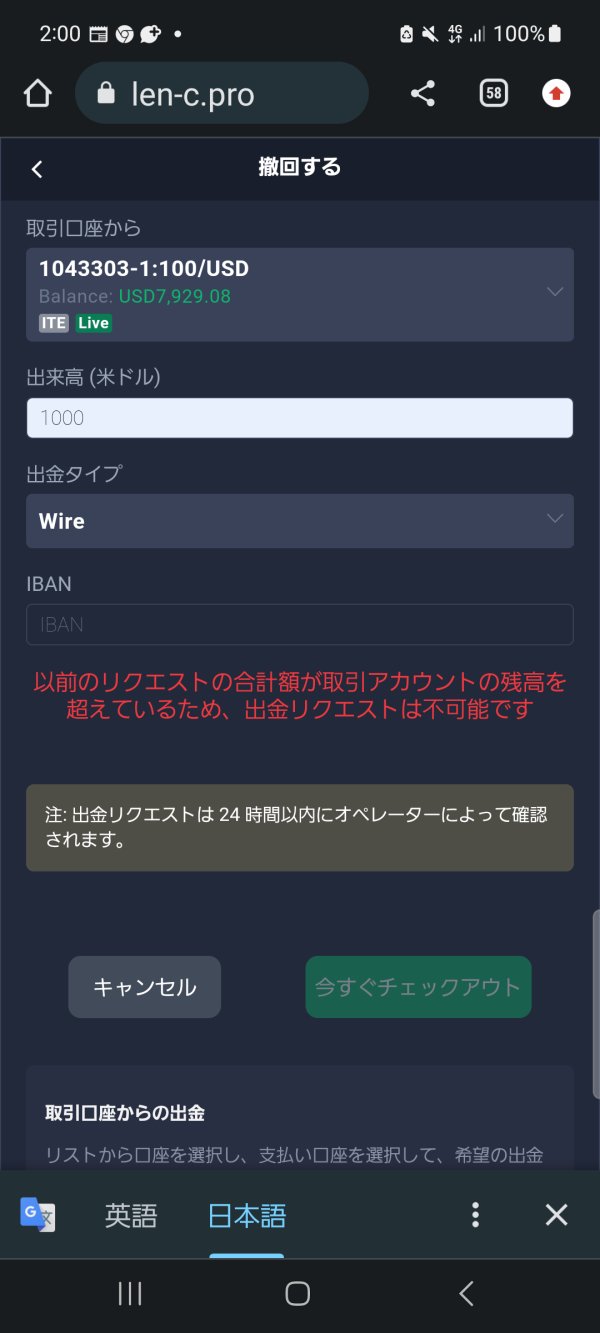

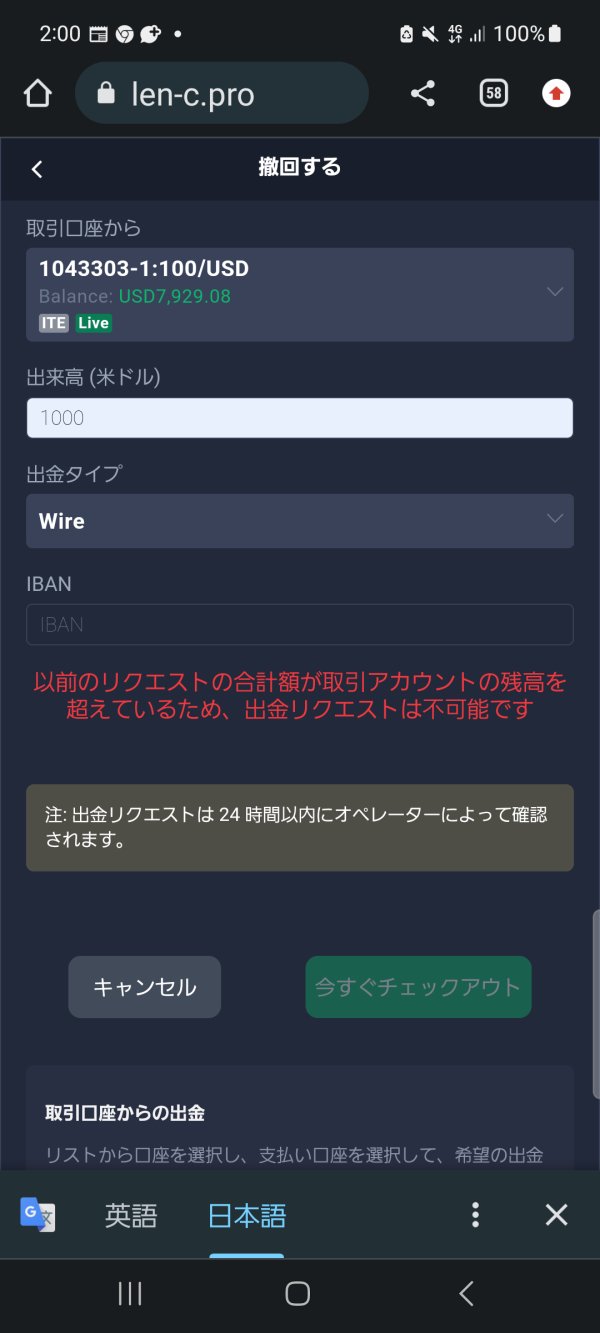

Deposit/Withdrawal Options

The platform accepts deposits primarily through credit cards and wire transfers, with a minimum deposit requirement of $250. However, the withdrawal process remains unclear, with some users reporting difficulties in accessing their funds. This raises significant concerns about the brokers reliability and transparency regarding financial transactions.

Minimum Deposit

The minimum deposit for an Edge Finance account starts at $250 for the Silver account, which is relatively low compared to other brokers. However, the lack of a demo account means that traders must deposit real money to start trading, which can be risky, especially with an unregulated broker.

There is no clear information regarding bonuses or promotional offers provided by Edge Finance. This lack of transparency can be a red flag, as many legitimate brokers offer clear promotional terms to attract new clients.

Tradable Asset Classes

Edge Finance claims to offer a variety of trading instruments, including forex pairs, stocks, indices, and commodities. However, the actual execution and reliability of these offerings are questionable due to the broker's unregulated status.

Costs (Spreads, Fees, Commissions)

While specific spread information is not disclosed, many user reviews indicate that the trading costs may be higher than average. Additionally, the absence of transparency regarding fees could lead to unexpected costs for traders.

Leverage

Edge Finance offers leverage up to 1:200, which is attractive to traders seeking higher risk and potential rewards. However, it's crucial to note that high leverage can also lead to significant losses, especially with an unregulated broker.

The only trading platform available is Edge Finance's proprietary web trader. This platform lacks the advanced features and tools found in more established platforms like MT4 or MT5, which could limit traders' ability to execute effective trading strategies.

Restricted Regions

Edge Finance does not accept clients from certain countries, including the United States and Canada. This restriction may limit its global reach and accessibility for potential traders.

Available Customer Support Languages

Customer support options are limited, with users primarily able to reach out via an email address or inquiry form. The absence of a phone number or live chat option raises concerns about the broker's commitment to providing adequate customer support.

Ratings Revisited

Detailed Rating Breakdown

-

Account Conditions (4/10): While the minimum deposit is low, the lack of a demo account and unclear withdrawal processes detract from the overall value.

Tools and Resources (5/10): The proprietary web trader provides basic functionality but lacks the advanced analytical tools found in established platforms like MT4 or MT5.

Customer Service and Support (3/10): Limited customer support options and no live chat or phone support create challenges for users seeking assistance.

Trading Setup (4/10): The trading experience is hindered by the unregulated status and the basic nature of the trading platform.

Trust Level (2/10): The absence of regulation and numerous user complaints significantly undermine trust in Edge Finance.

User Experience (3/10): Overall user feedback is negative, with many reporting difficulties in fund withdrawals and poor customer service.

In conclusion, the Edge Finance review indicates that while it may offer some appealing features, the unregulated status, lack of transparency, and negative user experiences raise significant concerns. Traders are strongly advised to conduct thorough research and consider regulated alternatives before investing with Edge Finance.