Is CDG safe?

Pros

Cons

Is CDG Global A Scam?

Introduction

CDG Global is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market, offering a variety of trading instruments including forex pairs, commodities, and cryptocurrencies. As more traders venture into forex trading, it is crucial to evaluate the credibility and reliability of the brokers they choose. A broker's legitimacy can significantly impact a trader's experience, from the safety of their investments to the quality of trade execution. This article aims to provide a comprehensive analysis of CDG Global, assessing its regulatory status, company background, trading conditions, and customer experience to determine whether it is a safe trading option or a potential scam. The investigation is based on a review of multiple sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a forex broker. Brokers that are regulated by reputable authorities are generally held to higher standards, providing greater protection to their clients. CDG Global claims to be registered in Saint Vincent and the Grenadines and operates under the Labuan Financial Services Authority (LFSA) in Malaysia. However, the regulatory environment in these jurisdictions is often considered less stringent compared to top-tier regulators like the FCA (UK) or ASIC (Australia).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan Financial Services Authority | N/A | Malaysia | Unverified |

The lack of a valid license from a recognized authority raises concerns about the regulatory oversight of CDG Global. Moreover, the Financial Services Authority (FSA) of Saint Vincent and the Grenadines does not license forex brokers, which means that clients may not receive the protections typically associated with regulated entities. This absence of oversight can expose traders to significant risks, making it essential to question is CDG safe for trading.

Company Background Investigation

CDG Global was established in 2003, claiming to have been founded by a team of experienced traders. Despite its long-standing presence in the market, there is limited publicly available information regarding its ownership structure and management team. A transparent company should provide detailed information about its executives and their backgrounds to instill confidence among potential clients.

The company's website lacks a physical address, which is another red flag that raises questions about its legitimacy. Transparency is vital for any financial institution, and the absence of clear information could suggest a lack of accountability. Given these factors, it is prudent for traders to remain cautious and ask themselves, is CDG safe for their investments?

Trading Conditions Analysis

The trading conditions offered by CDG Global include various account types, leverage options, and fee structures. The broker provides five different account types, with a minimum deposit requirement as low as $50, which is appealing for novice traders. However, the trading costs associated with these accounts may not be as competitive as advertised.

| Fee Type | CDG Global | Industry Average |

|---|---|---|

| Spread for Major Pairs | 3 pips | 1.5 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Not specified | Varies |

The spread for major currency pairs can reach up to 3 pips, significantly higher than the industry average of 1.5 pips. This discrepancy raises concerns about the overall cost of trading with CDG Global, as higher spreads can erode potential profits. Additionally, the broker's commission structure is not clearly defined, which may lead to unexpected costs for traders. Thus, potential clients should carefully assess these conditions and consider whether is CDG safe for their trading needs.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. CDG Global claims to implement measures to protect client funds, such as segregated accounts. However, the lack of detailed information about these security measures raises questions. Without a solid regulatory framework, there is no guarantee that client funds are adequately protected.

The absence of investor protection schemes, such as those offered by brokers regulated in the EU, further complicates the safety of funds. Traders should be aware of the risks involved and consider whether is CDG safe for their investments, especially in light of historical issues faced by unregulated brokers.

Customer Experience and Complaints

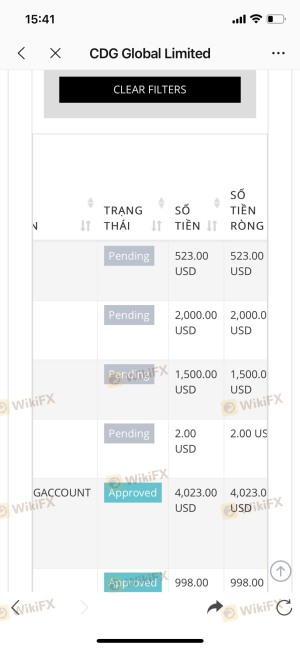

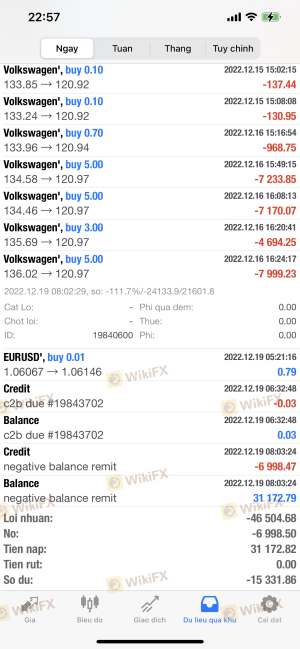

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of CDG Global reveal a mixed bag of experiences, with numerous complaints regarding withdrawal processes and customer support. Many users have reported difficulties in withdrawing their funds, which is a significant red flag for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Access Problems | Medium | Poor support |

For instance, some traders have reported being unable to access their accounts or facing delays in processing withdrawals. The lack of timely responses from customer support only exacerbates these issues, leading to frustrations among clients. Given these concerns, potential traders should seriously consider whether is CDG safe for their trading activities.

Platform and Execution

CDG Global offers the widely used MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and user-friendly interfaces. However, the quality of order execution is equally important. Reports from users indicate varying experiences with order execution, including instances of slippage and rejected orders.

Traders should be vigilant and assess whether the platform's performance aligns with their trading strategies. If there are indications of manipulation or poor execution quality, it could further question is CDG safe for trading.

Risk Assessment

Engaging with an unregulated broker like CDG Global comes with inherent risks. Traders must weigh these risks against their trading objectives and risk tolerance.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and protection |

| Financial Risk | Medium | High spreads and commissions |

| Withdrawal Risk | High | Difficulties in accessing funds |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts where available, and consider diversifying their investments across multiple brokers. This approach can help reduce exposure to any single broker's risks and enhance overall safety.

Conclusion and Recommendations

In summary, the evidence suggests that CDG Global may not be a safe choice for forex trading. The lack of robust regulation, numerous complaints regarding client fund access, and questionable trading conditions all contribute to a concerning picture. Potential traders should approach this broker with caution and consider whether is CDG safe for their investments.

For those seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better protections and a more transparent trading environment, ensuring a safer trading experience.

Is CDG a scam, or is it legit?

The latest exposure and evaluation content of CDG brokers.

CDG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CDG latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.