Is EDGE Finance safe?

Pros

Cons

Is Edge Finance A Scam?

Introduction

Edge Finance is a relatively new player in the forex market, positioning itself as a broker that offers various trading instruments, including forex, stocks, indices, and commodities. As the financial landscape continues to evolve, traders must exercise caution when selecting a brokerage. The rise of online trading has unfortunately also led to an increase in fraudulent schemes, making it essential for traders to evaluate the credibility of their chosen brokers carefully. This article investigates whether Edge Finance is a safe and legitimate trading platform or if it raises red flags indicating potential scams. Our assessment is based on a thorough review of regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the most critical factors in determining the safety of any broker is its regulatory status. Regulation serves as a safety net for traders, ensuring that brokers comply with strict standards and protect clients' funds. Edge Finance has been flagged by multiple regulatory bodies, raising concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| AMF (France) | N/A | France | Blacklisted |

| FSMA (Belgium) | N/A | Belgium | Blacklisted |

The absence of a valid license from a reputable regulatory authority such as the FCA (UK), ASIC (Australia), or SEC (USA) is a significant red flag. It indicates that Edge Finance operates without oversight, making it difficult for traders to seek recourse in case of disputes. Furthermore, the warnings issued by the AMF and FSMA suggest that Edge Finance is operating outside the bounds of legal trading practices, which is a strong indicator that is Edge Finance safe to trade with is a question that remains unanswered positively.

Company Background Investigation

Edge Finance, which claims to be based in China, lacks transparency in its ownership structure and operational history. The company has not provided sufficient information about its founding members or management team, which raises questions about its credibility. A broker's management team plays a crucial role in establishing trust and reliability, and the absence of detailed bios or professional backgrounds for team members is concerning.

Moreover, the lack of a physical address and contact information further exacerbates the transparency issue. Legitimate brokers typically provide clear contact details and a physical address, allowing clients to verify their existence. The opacity surrounding Edge Finance suggests that it may not be a trustworthy entity, leading us to question whether is Edge Finance safe for traders looking for a reliable platform.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Edge Finance offers a range of account types, each with varying minimum deposits and leverage options. However, the costs associated with trading on this platform may not be as competitive as advertised. Traders must be aware of hidden fees that could impact their overall profitability.

| Fee Type | Edge Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | $6 per lot |

| Overnight Interest Range | 3% | 2% |

The spread for major currency pairs is notably higher than the industry average, which could lead to increased trading costs for clients. Additionally, the absence of a clear commission structure raises questions about potential hidden fees, further complicating the cost analysis for traders. This lack of transparency in trading conditions contributes to the ongoing debate about whether is Edge Finance safe for traders seeking a fair trading environment.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Edge Finance's lack of regulation raises concerns about how it manages and protects client funds. Regulatory bodies often require brokers to keep client funds in segregated accounts, ensuring that these funds are not used for operational expenses. However, Edge Finance has not provided any information regarding its fund management practices.

Furthermore, the absence of investor protection schemes, such as compensation funds, means that traders have little to no recourse in the event of a broker's insolvency or fraudulent activities. The lack of negative balance protection also poses a significant risk, as traders could end up owing more than their initial investment. Given these factors, it is crucial to ask whether is Edge Finance safe when it comes to the protection of client funds.

Customer Experience and Complaints

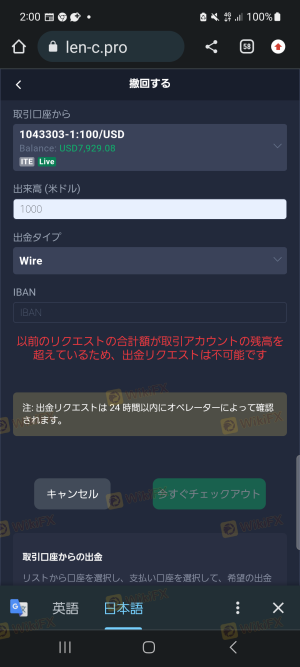

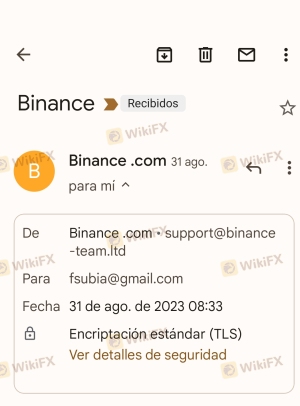

Customer feedback serves as a valuable resource when assessing a broker's reliability. A review of online forums and complaint registries reveals a pattern of negative experiences associated with Edge Finance. Common complaints include difficulty withdrawing funds, unresponsive customer service, and aggressive marketing tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

| Misleading Promotions | High | None |

Several users have reported being unable to withdraw their funds, with some claiming that the company employs high-pressure tactics to discourage withdrawals. One user noted, "I tried to withdraw my money, but they kept delaying the process and eventually stopped responding to my emails." Such experiences raise serious concerns about whether is Edge Finance safe for traders who may find themselves in similar situations.

Platform and Trade Execution

The trading platform provided by Edge Finance is another area of concern. A reliable trading platform should offer stability, fast execution, and a user-friendly experience. However, reports indicate that the Edge Finance platform may suffer from issues such as slippage and order rejections, which can significantly impact trading outcomes.

Moreover, the lack of well-known platforms like MetaTrader 4 or 5 raises questions about the quality of the tools available to traders. The absence of established platforms could indicate that Edge Finance may not be fully committed to providing a robust trading experience, further fueling doubts about whether is Edge Finance safe for traders seeking a reliable platform.

Risk Assessment

Using Edge Finance presents various risks that traders should carefully consider. The absence of regulation and transparency, combined with negative customer feedback, indicates a high level of risk associated with this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Operational Risk | Medium | Potential for hidden fees and poor service |

| Financial Risk | High | Lack of fund protection measures |

To mitigate these risks, traders are advised to conduct thorough research, read reviews, and consider using regulated brokers with a proven track record. The question of whether is Edge Finance safe remains a pressing concern for potential clients.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Edge Finance raises numerous red flags regarding its legitimacy and safety for traders. The absence of regulation, combined with negative customer experiences and a lack of transparency, indicates that this broker may not be a safe choice for trading.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC. These brokers provide a safer trading environment with proper oversight and client protection measures. Ultimately, the question of whether is Edge Finance safe can be answered with caution, and potential traders are encouraged to prioritize their financial security by choosing regulated and reputable brokers.

Is EDGE Finance a scam, or is it legit?

The latest exposure and evaluation content of EDGE Finance brokers.

EDGE Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EDGE Finance latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.