profitfx Review 1

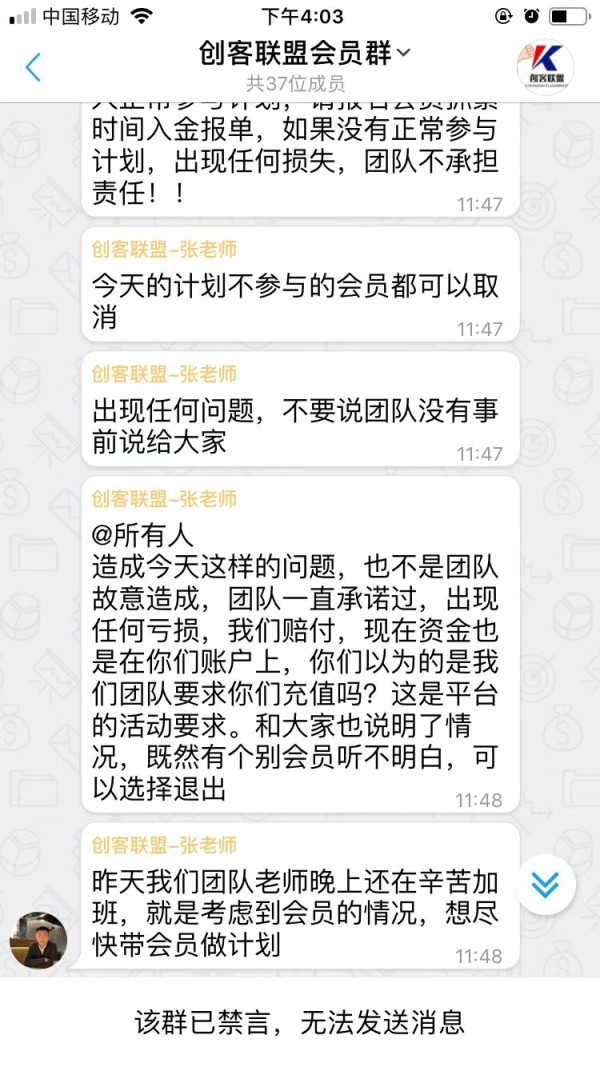

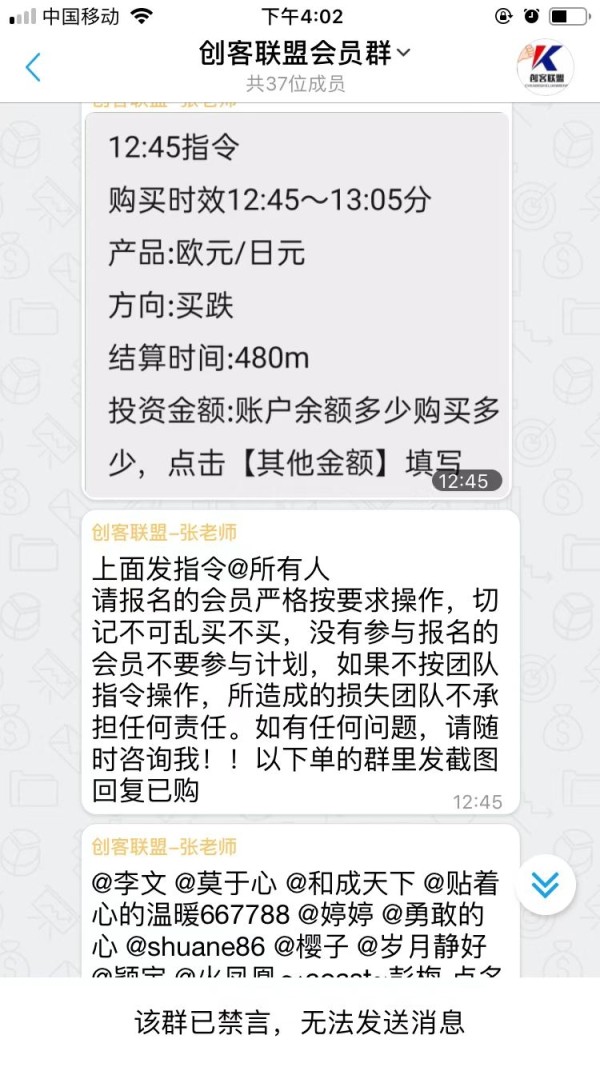

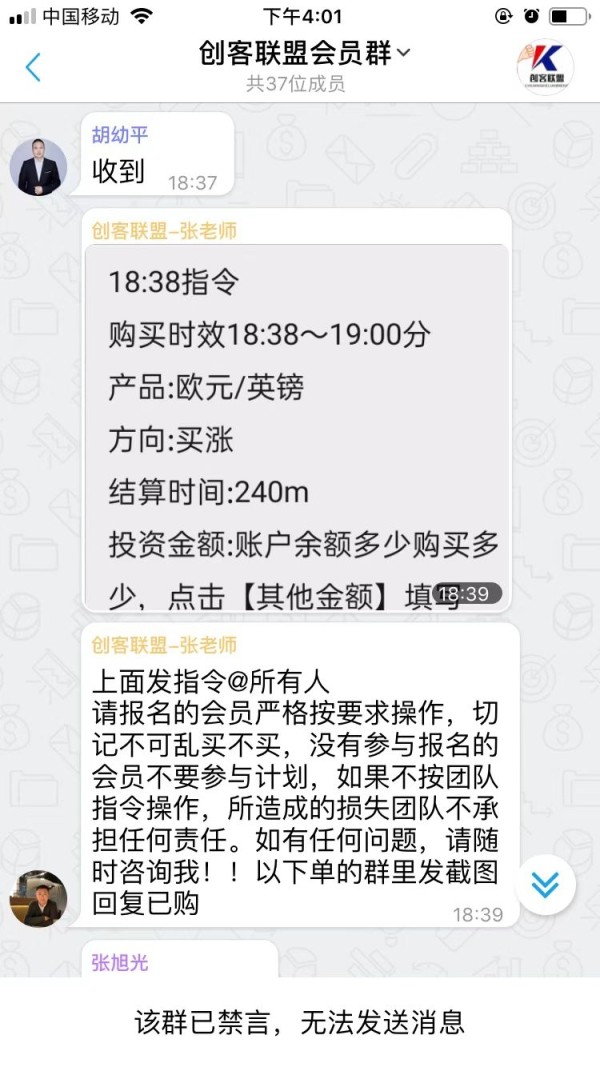

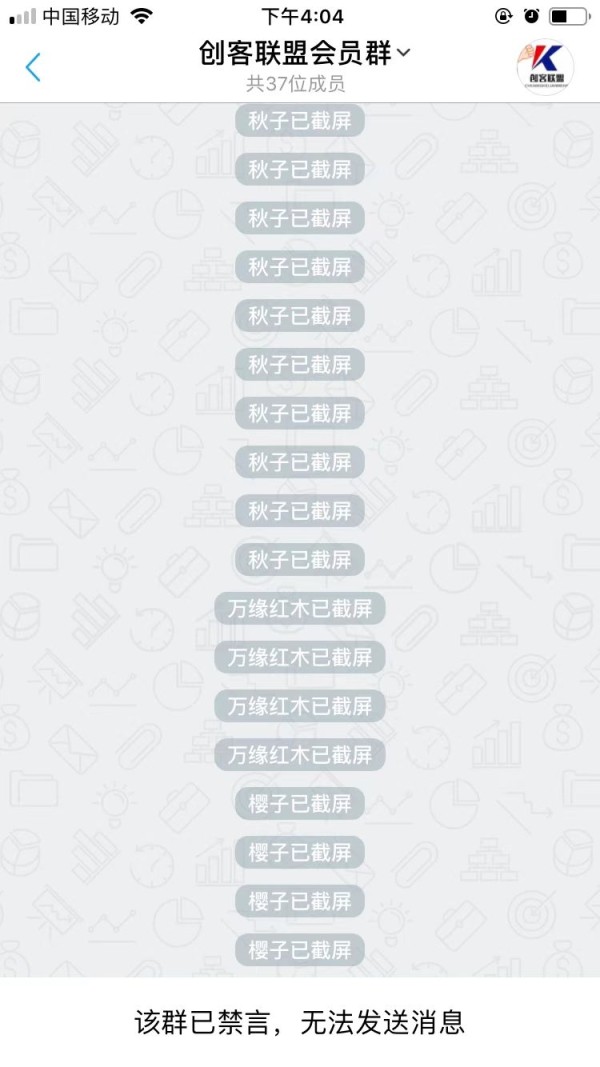

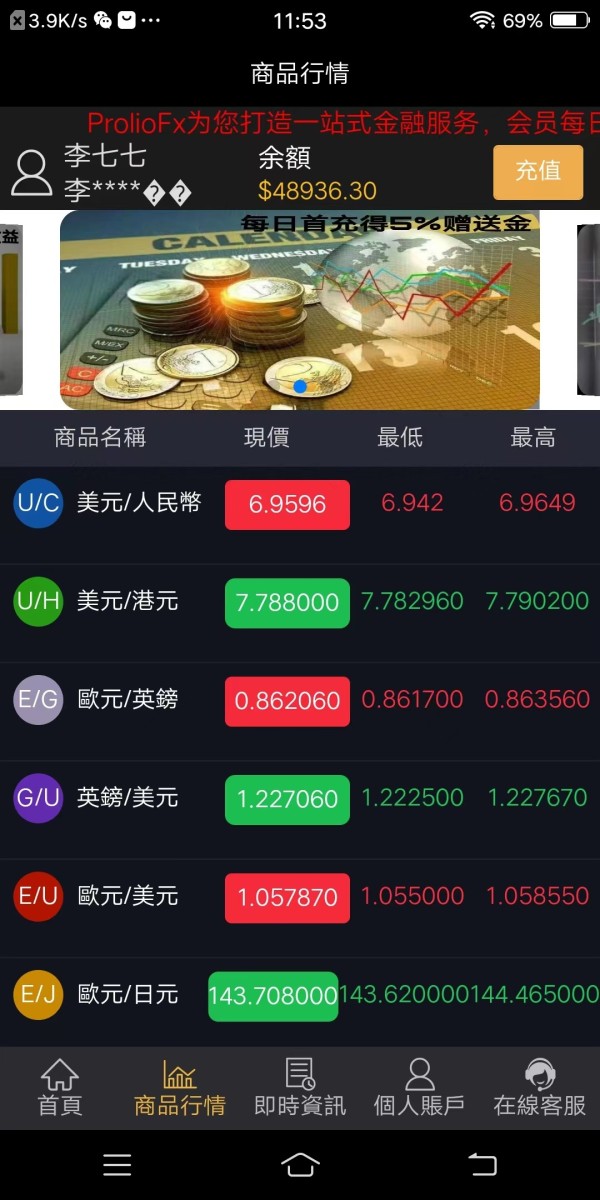

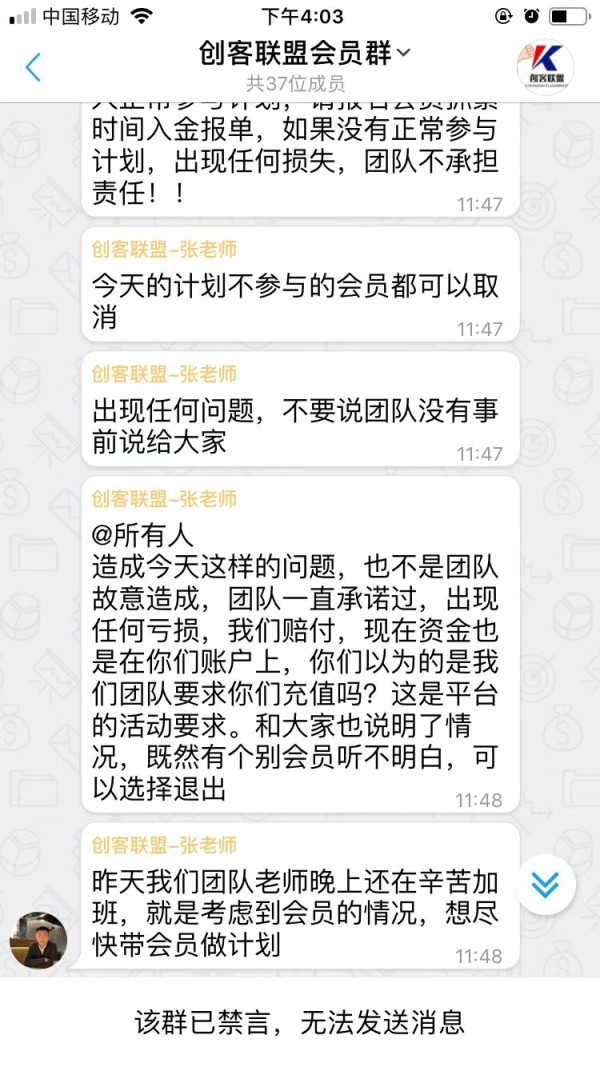

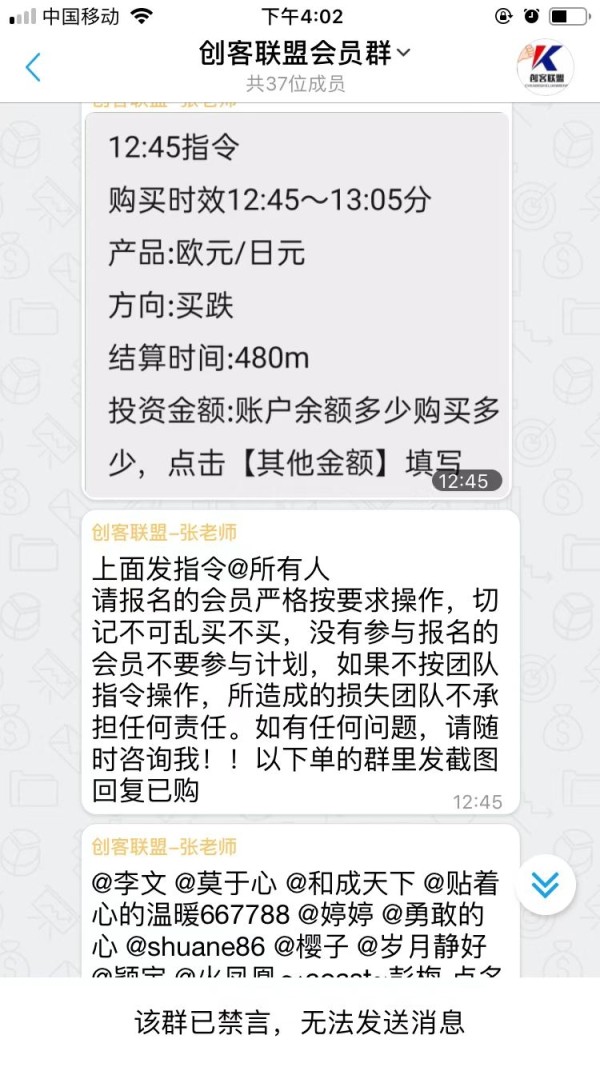

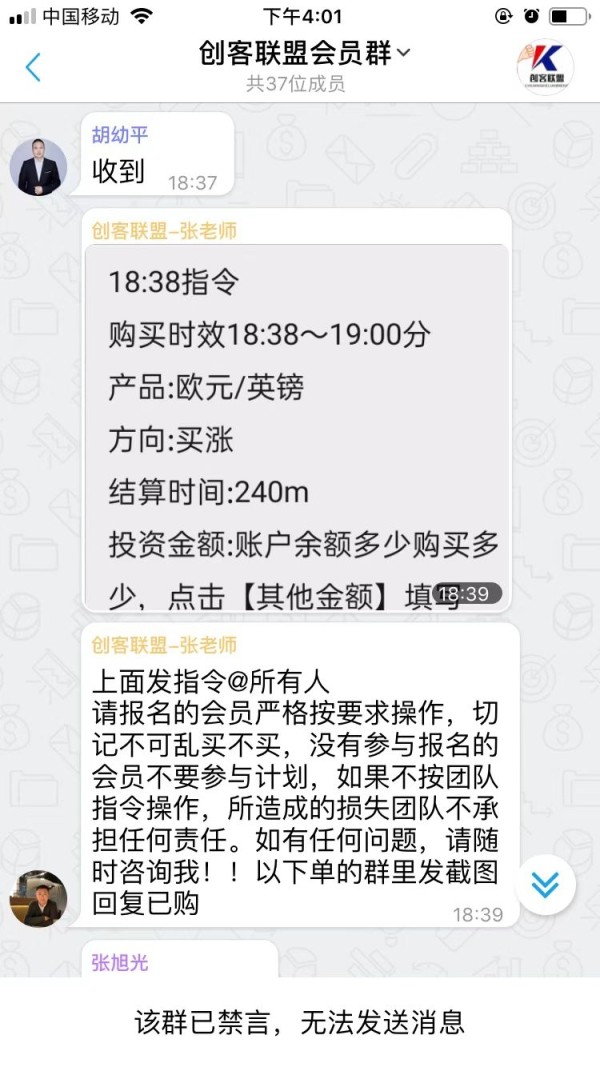

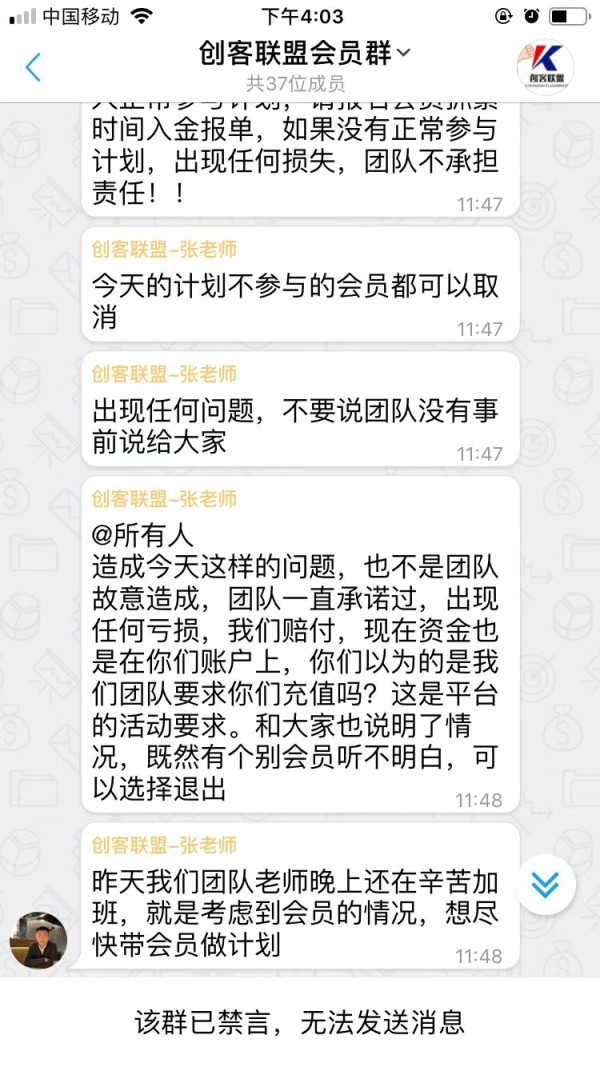

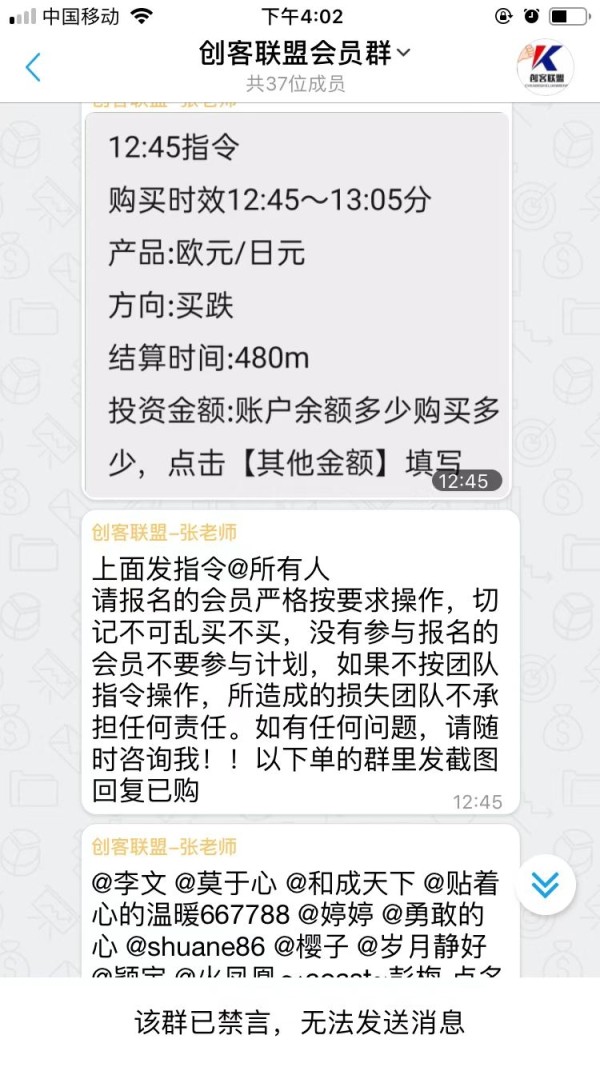

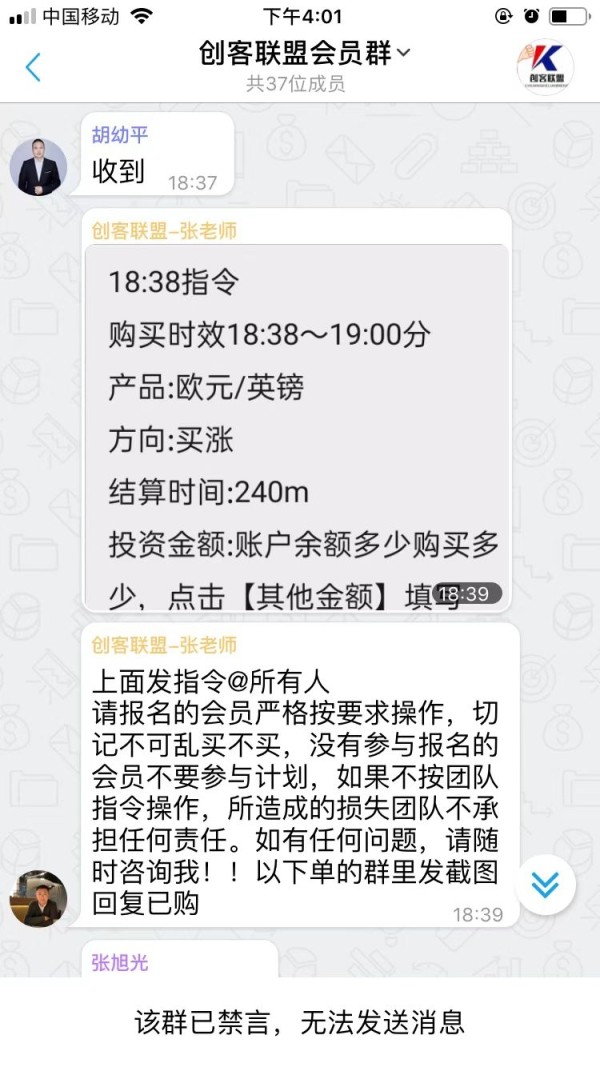

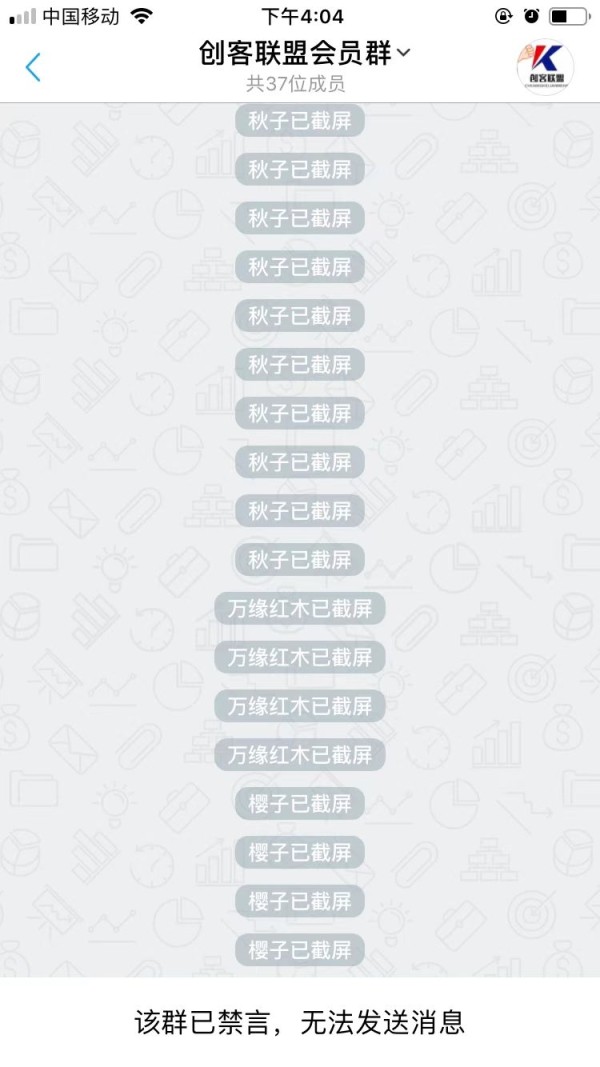

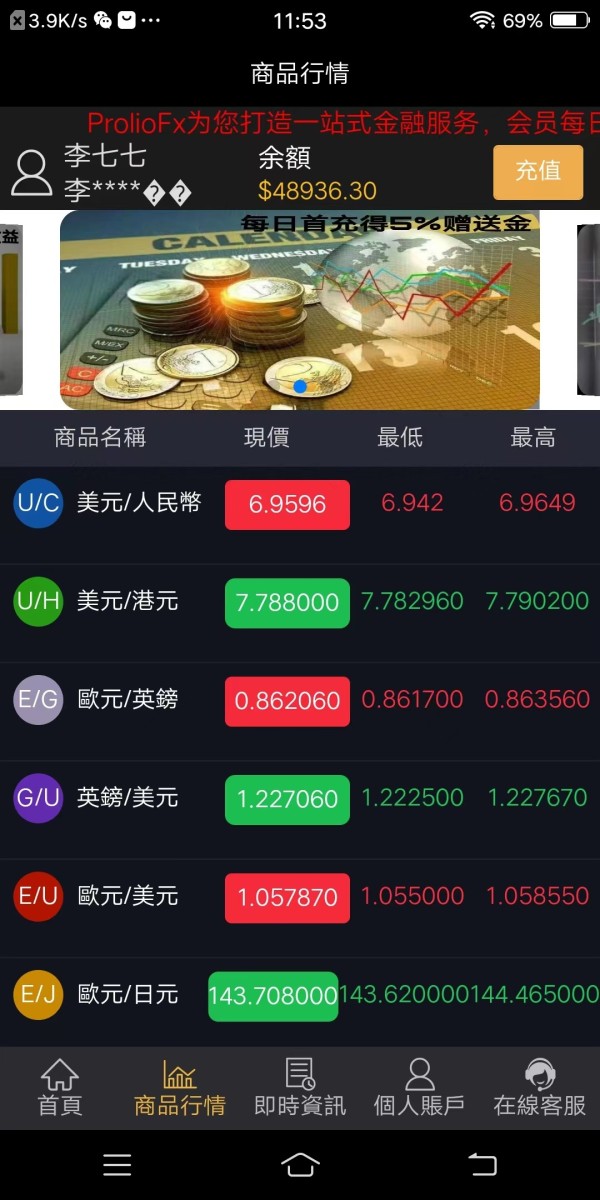

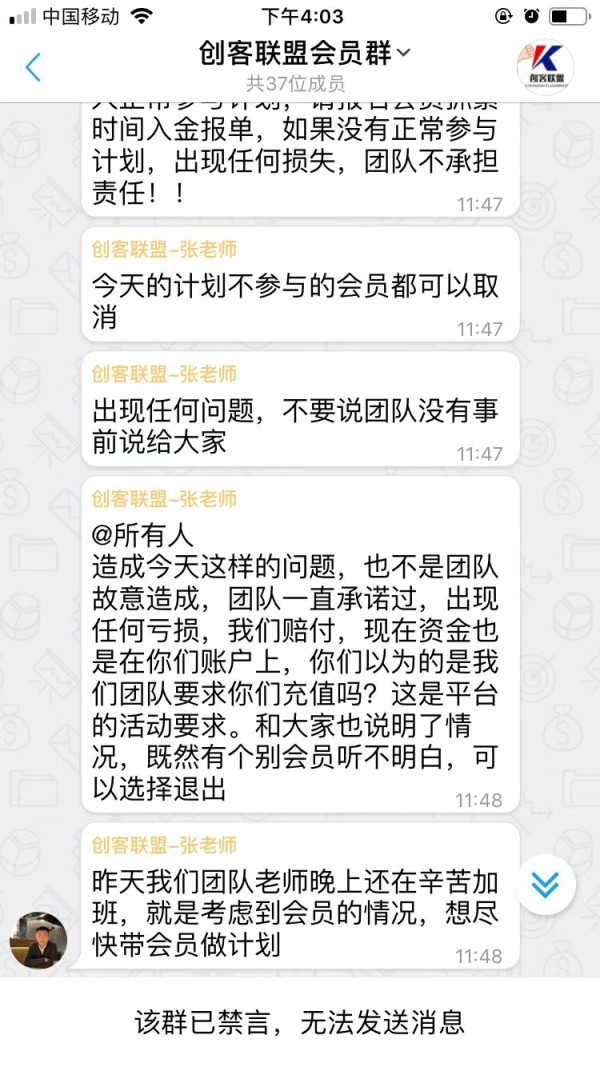

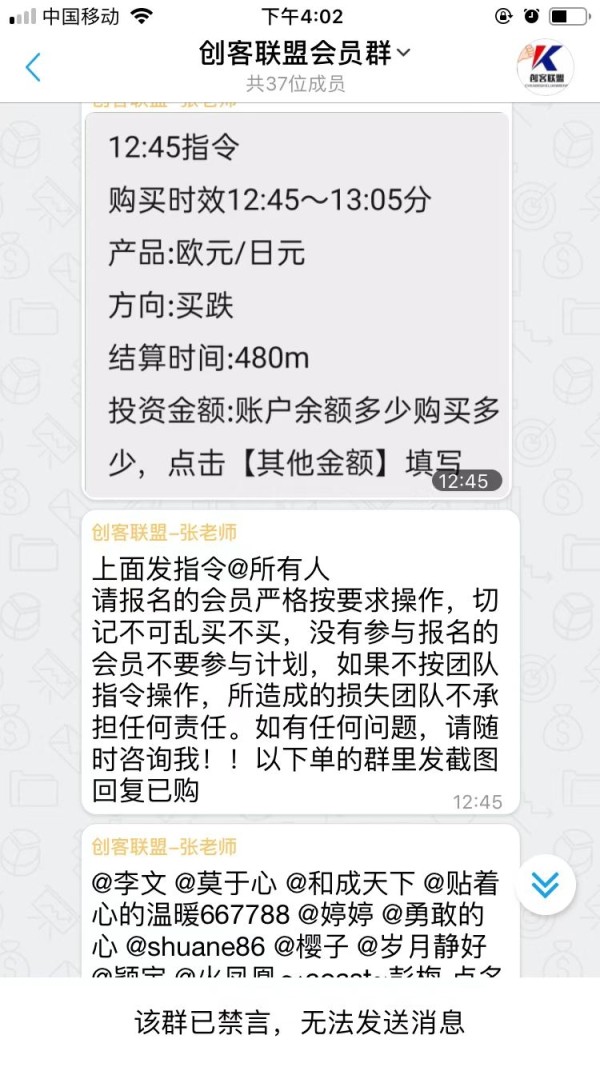

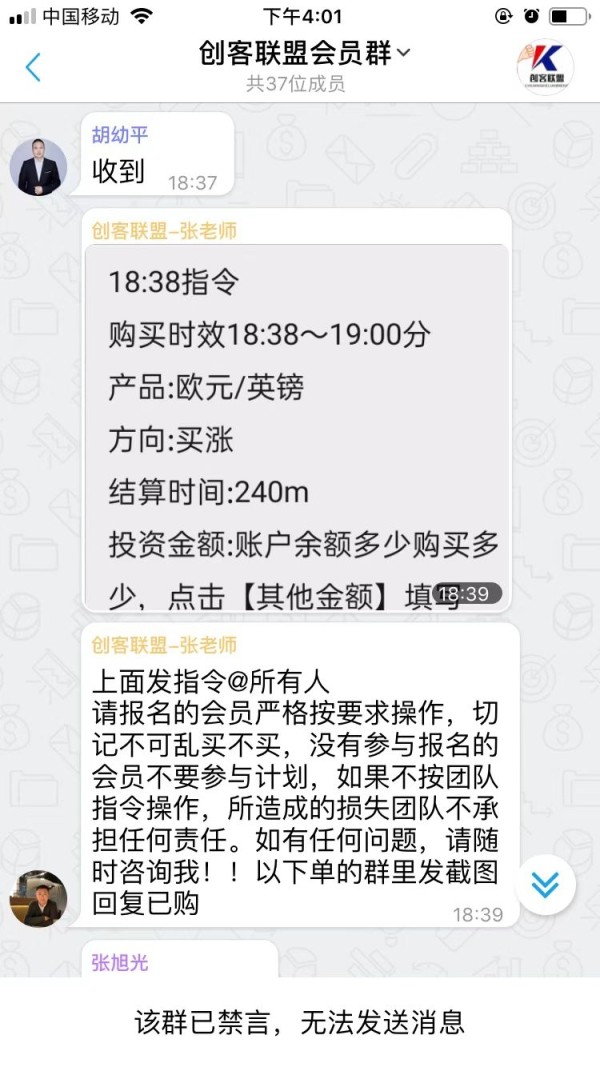

Forex fraud, absconded! huge loss! A screenshot is attached, hoping to get help to get back the principal

profitfx Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Forex fraud, absconded! huge loss! A screenshot is attached, hoping to get help to get back the principal

ProfitFX is an unregulated forex broker. It has been operating since 2018, specializing in foreign exchange and contracts for difference trading services. This comprehensive profitfx review examines the broker's offerings. It highlights its main features including demo account availability and swap-free trading options designed to accommodate different trading preferences and religious requirements.

The broker positions itself as a service provider for global clients. It places particular emphasis on educational resources and development opportunities for traders at various experience levels. According to available information from WikiBit and ForexBrokerz, ProfitFX operates without regulatory oversight. This significantly impacts its overall credibility and safety profile.

ProfitFX's target demographic includes international traders seeking educational support and flexible trading conditions. However, the lack of regulatory supervision raises important questions about fund security and operational transparency. Potential clients must carefully consider these factors before engaging with this broker.

ProfitFX operates as an unregulated broker. Regulatory conditions may vary significantly across different jurisdictions. Users should carefully review their local legal requirements and financial regulations before engaging with this broker's services.

This review is based on publicly available information and user feedback from various sources including TheForexReview and industry analysis platforms. Individual trading experiences may differ based on personal circumstances, trading strategies, and regional factors.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Poor |

| Tools and Resources | 6/10 | Average |

| Customer Service and Support | 5/10 | Below Average |

| Trading Experience | 5/10 | Below Average |

| Trust Factor | 3/10 | Poor |

| User Experience | 5/10 | Below Average |

ProfitFX entered the forex market in 2018. It focuses on foreign exchange and CFD trading services as a specialized broker. The company has positioned itself to serve a global client base. However, specific details about its corporate structure and management team remain limited in publicly available sources. The broker's business model centers on providing accessible trading opportunities while emphasizing educational support for developing traders.

According to ForexBrokerz reports, ProfitFX operates with a focus on delivering educational resources and development opportunities to its international clientele. The broker's approach appears designed to attract newer traders seeking guidance and support in their trading journey. However, the lack of regulatory oversight presents significant concerns for potential clients.

The broker offers foreign exchange and CFD trading across various financial instruments. Specific details about asset coverage and trading conditions are not comprehensively documented in available sources. This profitfx review notes that the company's unregulated status significantly impacts its market position and credibility within the competitive forex brokerage landscape.

Regulatory Status: ProfitFX operates without regulatory oversight from recognized financial authorities. This unregulated status means the broker does not follow standard industry protection protocols. These protocols are typically required by major regulatory bodies.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures is not detailed in available source materials. This creates uncertainty about funding convenience and accessibility.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in accessible documentation. This makes it difficult to assess entry-level accessibility.

Bonus and Promotions: Available sources do not provide specific information about promotional offers, welcome bonuses, or ongoing incentive programs. These may be available to clients.

Tradeable Assets: The broker provides access to foreign exchange markets and contracts for difference trading. However, the complete range of available instruments and markets is not comprehensively detailed.

Cost Structure: Specific information about spreads, commissions, and fee structures is not available in current source materials. This prevents accurate cost assessment for potential clients.

Leverage Options: Details about maximum leverage ratios and margin requirements are not specified in available documentation from review sources.

Platform Options: The specific trading platforms offered by ProfitFX are not detailed in accessible source materials. This creates uncertainty about technological capabilities and user interface quality.

This profitfx review highlights significant information gaps. Potential clients should consider these when evaluating this broker's services.

The account conditions offered by ProfitFX receive a below-average rating. This is due to limited transparency and insufficient publicly available information. WikiBit and other review platforms indicate that specific details about account types, their distinctive features, and associated benefits are not clearly documented. They are also not readily accessible to potential clients.

The absence of clear information regarding minimum deposit requirements creates uncertainty for traders. These traders are attempting to assess entry-level accessibility. This lack of transparency extends to account tier structures, special features, and any premium account benefits that might be available to higher-volume traders.

Account opening procedures and verification processes are not detailed in available source materials. This makes it difficult to evaluate the convenience and efficiency of the onboarding experience. The broker's unregulated status further complicates account security assessments. Standard industry protections may not apply.

User feedback regarding account conditions is not specifically documented in available sources. This prevents comprehensive evaluation of client satisfaction with account-related services. This profitfx review emphasizes that potential clients should request detailed account information directly from the broker before making commitments.

ProfitFX's tools and resources receive a moderate rating. This is based on its stated focus on educational support and development opportunities for traders. According to TheForexReview and other sources, the broker emphasizes providing educational resources. However, specific details about the quality and comprehensiveness of these materials are not extensively documented.

The availability of demo accounts represents a positive feature. It allows potential clients to test trading conditions and platform functionality without financial risk. This educational approach aligns with the broker's stated mission to support developing traders. However, the actual quality and depth of educational content require further investigation.

Trading tools and analytical resources beyond basic educational materials are not specifically detailed in available source materials. The absence of information about advanced charting capabilities, market analysis tools, or automated trading support limits the assessment of the broker's technological offerings.

Research resources, market commentary, and analytical support services are not comprehensively documented. This makes it difficult to evaluate the broker's commitment to providing ongoing trading support beyond initial educational materials.

Customer service and support capabilities at ProfitFX receive a below-average rating. This is due to limited information about service channels, response times, and overall support quality. Available review sources do not provide specific details about customer service accessibility or effectiveness.

The broker's support infrastructure is not clearly documented in accessible source materials. This includes available communication channels such as live chat, email support, or telephone assistance. This lack of transparency about support availability creates uncertainty for potential clients regarding assistance accessibility.

Response times and service quality metrics are not reported in available user feedback or review sources. This prevents accurate assessment of support effectiveness. The absence of documented customer service hours and multilingual support capabilities further complicates evaluation efforts.

Problem resolution procedures and escalation processes are not detailed in available information. This raises questions about the broker's ability to handle client concerns effectively. Without regulatory oversight, dispute resolution mechanisms may lack standard industry protections.

The trading experience at ProfitFX receives a below-average rating. This is primarily due to insufficient information about platform performance, execution quality, and overall trading conditions. Available sources do not provide specific user feedback regarding platform stability, order execution speed, or trading environment quality.

Platform functionality and feature completeness cannot be accurately assessed based on available documentation. The absence of detailed information about trading platform options, mobile accessibility, and advanced trading features limits evaluation of the overall trading experience.

Order execution quality cannot be documented in available source materials. This includes fill rates, slippage characteristics, and execution speed. These factors significantly impact trading performance but remain unclear for potential ProfitFX clients.

Mobile trading capabilities and cross-device synchronization features are not specifically addressed in accessible review sources. Given the importance of mobile trading in contemporary forex markets, this information gap represents a significant evaluation limitation.

Market conditions cannot be properly assessed without specific data from user experiences or independent testing. This includes spread competitiveness and liquidity access. This profitfx review notes that trading experience evaluation requires additional research and direct broker contact.

ProfitFX's trust factor receives a poor rating. This is primarily due to its unregulated status, which significantly undermines credibility and safety assurance. According to WikiBit and other review platforms, the broker operates without oversight from recognized financial regulatory authorities. This eliminates standard industry protections.

The absence of regulatory supervision means that client fund segregation, operational transparency, and dispute resolution mechanisms may not meet industry standards. This regulatory gap creates substantial risk for potential clients. Recovery options in case of operational issues may be severely limited.

Company transparency regarding management structure, financial reporting, and operational procedures is not evident in available source materials. The lack of publicly accessible corporate information further reduces confidence in the broker's operational integrity.

Industry recognition, awards, or positive endorsements from reputable financial organizations are not documented in available sources. The broker's reputation within the professional trading community appears limited. There is insufficient evidence of positive industry standing.

Third-party evaluations and independent assessments of the broker's operational practices are not comprehensively available. This makes it difficult to verify claims about service quality and operational reliability.

User experience at ProfitFX receives a below-average rating. This is due to limited documented user feedback and insufficient information about interface design and operational convenience. Available review sources do not provide comprehensive user satisfaction data or detailed experience reports.

Interface design quality, navigation ease, and overall platform usability are not specifically evaluated in accessible source materials. The absence of user interface screenshots or detailed platform reviews limits assessment of the visual and functional aspects of the trading environment.

Registration and account verification processes are not detailed in available documentation. This makes it difficult to evaluate onboarding convenience and efficiency. New client experiences and setup procedures remain unclear based on current source materials.

Funding and withdrawal experiences are not documented in available user feedback. This includes processing times and convenience factors. These operational aspects significantly impact overall user satisfaction but lack sufficient evaluation data.

Common user complaints and recurring issues are not systematically documented in available review sources. This prevents identification of potential problem areas or service limitations that might affect client satisfaction.

This comprehensive profitfx review reveals a broker with significant limitations. These primarily stem from its unregulated status and limited transparency. While ProfitFX offers educational resources and demo account access, the absence of regulatory oversight creates substantial concerns about fund security and operational reliability.

The broker may be suitable for traders specifically seeking educational support and development opportunities. This is particularly true for those comfortable with higher risk tolerance. However, the lack of comprehensive information about trading conditions, costs, and platform capabilities makes thorough evaluation challenging.

Major advantages include educational focus and demo account availability. Significant disadvantages encompass regulatory absence, limited transparency, and insufficient documented user feedback. Potential clients should exercise extreme caution and conduct additional due diligence before engaging with this broker's services.

FX Broker Capital Trading Markets Review