Founded approximately 2 to 5 years ago and registered in China, Future-X operates without adequate regulatory oversight. This status places it among multiple trading platforms that often fail to provide necessary security protections for client funds. Despite claims of offering diverse trading opportunities, this broker's operational legitimacy remains undetermined due to accessibility issues with its website.

Future-X claims to facilitate trading across various asset classes, including futures and options. However, concrete data regarding the extent of these offerings and any supposed affiliations with regulatory bodies is lacking. The broker's primary operational base appears to be nonexistent, highlighting a troubling trend in online brokerage where transparency is critical and often absent.

Future-X lacks any legitimate regulatory oversight, which poses a significant risk to traders. The absence of a valid license indicates that user funds may not be safeguarded, leading to an environment prone to fraudulent practices.

- Visit official regulatory body websites to check for licensing.

- Look for reports or reviews from other traders on platforms like WikiFX.

- Search for user testimonials to get an estimate of the platform's reliability.

Industry Reputation and Summary

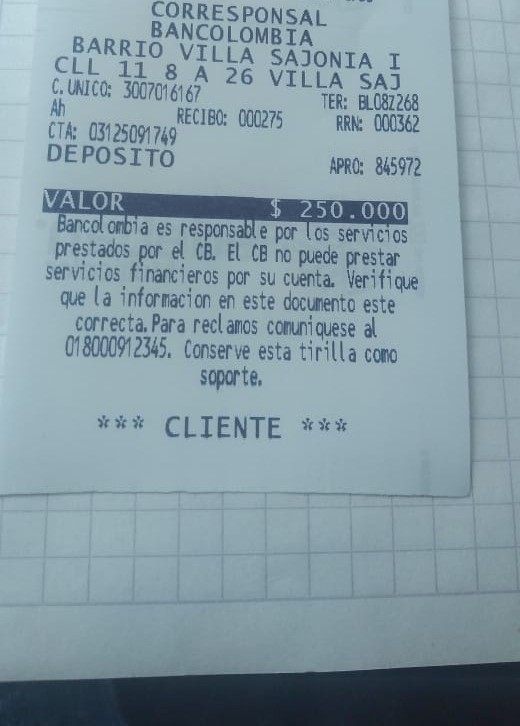

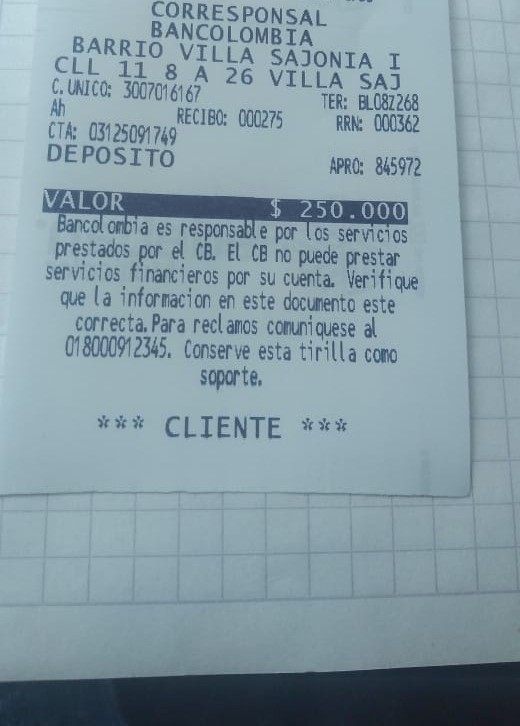

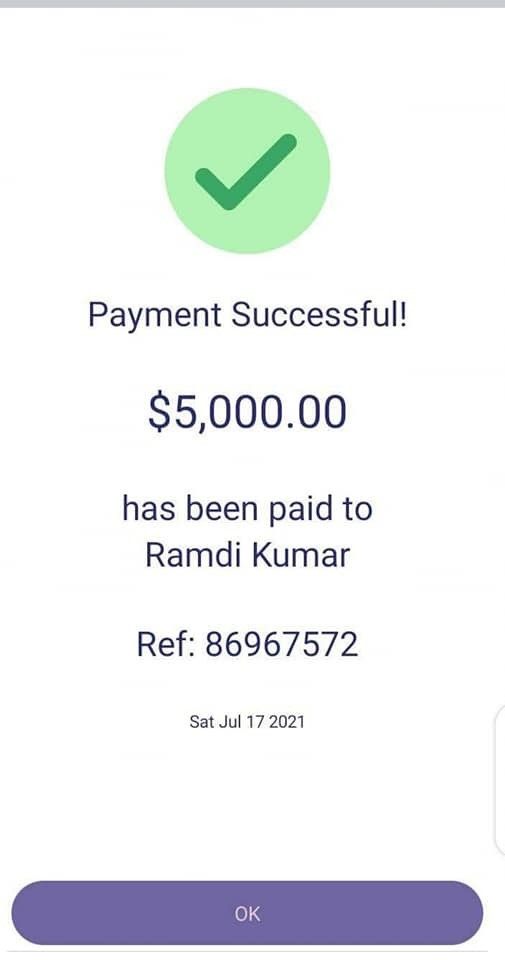

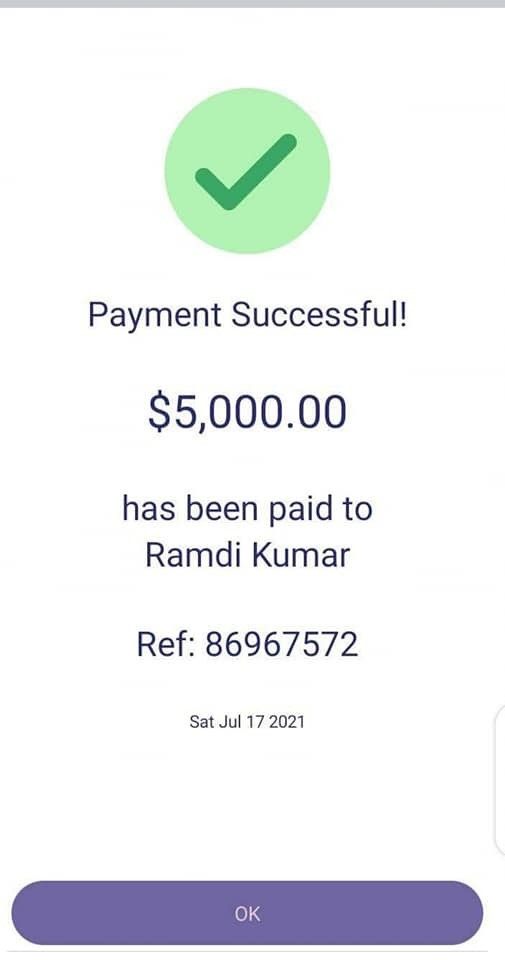

User feedback on Future-X is predominantly negative. Reports from platforms like WikiFX highlight issues such as funds being held after withdrawal requests and inaccessible accounts.

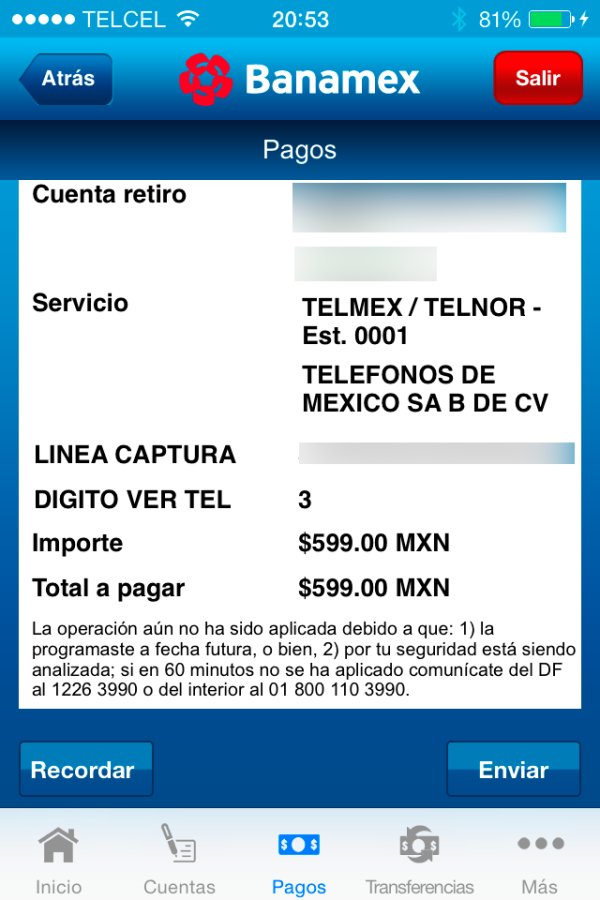

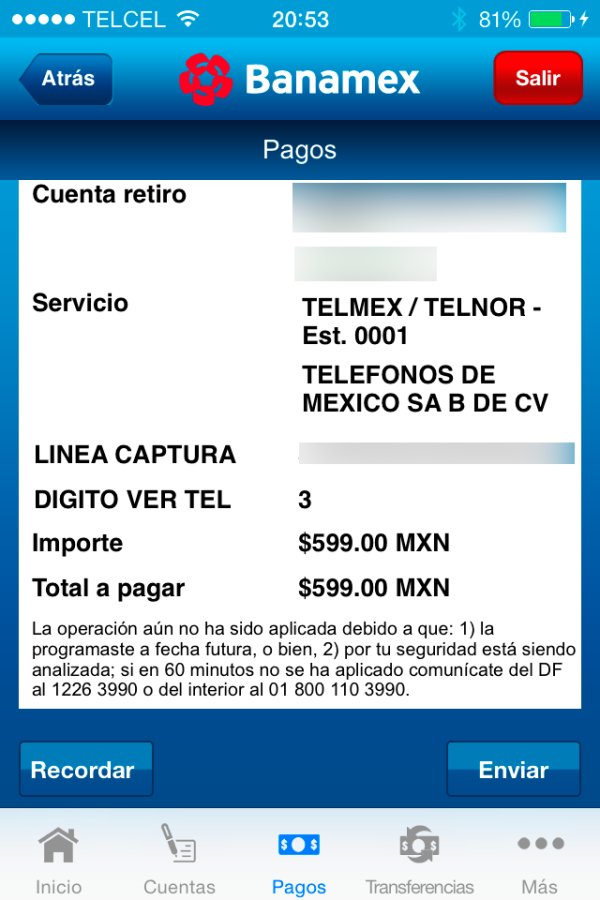

"They promised over 100% profits within one month but I was unable to validate my account after depositing $599." — User Riza Berk Caglayan

Trading Costs Analysis

Advantages in Commissions

Future-X advertises a low commission structure, which could be appealing to high-frequency traders. Commissions reportedly start low, theoretically providing access to greater trading potential.

The "Traps" of Non-Trading Fees

Many complaints arise from unexpected costs, especially concerning withdrawal fees. Users report fees as high as $30 per withdrawal, creating a substantial burden on traders looking to access their own funds.

"They took $1200 from my wallet, which was all my profits." — User Benjamin

Cost Structure Summary

While the platform appears enticing with low trading costs, these fees can quickly undermine profitability, especially when considering the difficulty associated with withdrawing funds.

Platform Diversity

Future-X claims to offer a variety of trading platforms, including MetaTrader 5 (MT5). However, in practice, the availability of diverse tools appears limited, which may restrict the trading capabilities for professionals.

Quality of Tools and Resources

Feedback indicates that the platform lacks robust analytical tools and educational content, which are critical for traders seeking detailed insights into market conditions.

Platform Experience Summary

Overall user feedback is mixed, with many stating the platform is not user-friendly and difficult to navigate, particularly highlighting the frustrations associated with account verification and operational efficacy.

"I've been unable to validate my account after depositing." — User testimonial

*(Continue similar detailed analysis for User Experience, Customer Support, and Account Conditions...) *

User Experience Analysis

- Accessibility and Layout (120-150 words): User experiences indicate that navigating Future-X is cumbersome, reporting frequent issues such as downtime and failures to execute trades.

- Feedback on Overall Satisfaction (100-120 words): General series of critiques, with most users voicing frustration about cumbersome interfaces and delayed responses.

Customer Support Analysis

- Support Functions Available (120-150 words): Limited to email inquiries, often resulting in protracted delays.

- User Complaints (100-120 words): Majority of user experiences indicate that email support rarely resolves urgent issues.

Account Conditions Analysis

- Minimum Requirements (100-120 words): Users are required to maintain a minimum account balance for optimal trading conditions.

- Transaction Limitations (120-150 words): Specific transaction limits exist that can inhibit trading flexibility, particularly for those aiming for higher-volume trades.

Conclusion

Future-X presents a challenging future for potential traders, offering more risks than benefits. The broker's unregulated status, coupled with persistent issues related to accessibility and negative user reviews, positions it as a risky venture. Prospective traders must weigh their options carefully and consider regulated alternatives that offer a safer, more reliable trading environment.

In summary, for those considering Future-X, thorough due diligence is critical. Awareness of the operational risks linked to unregulated brokers cannot be understated, as these factors pose potential threats to both investments and overall investor wellbeing.