Is FTX safe?

Business

License

Is FTX Safe or a Scam?

Introduction

FTX, a name that once resonated with promise in the forex and cryptocurrency markets, has become synonymous with controversy and caution. Established in 2019, FTX quickly positioned itself as a significant player in the trading arena, offering a wide array of financial instruments, including cryptocurrencies, forex, and derivatives. However, the collapse of FTX in late 2022 raised critical questions about its legitimacy and safety. For traders, evaluating the credibility of forex brokers like FTX is paramount, as the risks associated with unregulated platforms can lead to significant financial losses. This article aims to provide an objective analysis of FTX's safety, utilizing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, client experiences, and risk assessments.

Regulation and Legitimacy

The regulatory landscape is crucial for determining the safety of any forex broker. A regulated broker is typically subject to stringent oversight, ensuring that it operates within the law and adheres to best practices. In the case of FTX, the situation is alarming. The broker has been identified as unregulated, lacking valid licenses from any recognized financial authority. The absence of regulation exposes traders to heightened risks, as there are no safeguards in place to protect their investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of oversight from reputable bodies such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) raises significant red flags. Traders should be particularly wary of platforms that operate without regulatory scrutiny, as this often indicates a lack of accountability and transparency. FTX's claims of being regulated in various jurisdictions have been thoroughly debunked, highlighting the importance of verifying a broker's regulatory status before engaging in trading activities.

Company Background Investigation

FTX was founded by Sam Bankman-Fried and Gary Wang, quickly gaining traction due to its innovative trading products and user-friendly interface. However, the company's meteoric rise was marred by allegations of mismanagement and fraudulent activities. The ownership structure of FTX has come under scrutiny, particularly following the revelations of its financial practices, which included the misappropriation of customer funds.

The management team, while initially perceived as capable, has faced significant criticism for their handling of the company's operations. The lack of transparency regarding the company's financial health and operational practices has further eroded trust among investors and traders. The absence of a clear and accountable governance structure raises concerns about the company's commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. FTX's fee structure and trading policies have been a point of contention among users. Reports indicate that the broker has employed various fees that are not standard in the industry, leading to confusion and dissatisfaction among traders.

| Fee Type | FTX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low |

The high spreads associated with major currency pairs are particularly concerning, as they can significantly impact trading profitability. Moreover, the lack of transparency in the commission structure raises questions about the broker's overall fairness and reliability. Traders must be cautious of brokers that impose unexpected fees, as these can erode potential profits and lead to unfavorable trading experiences.

Client Fund Safety

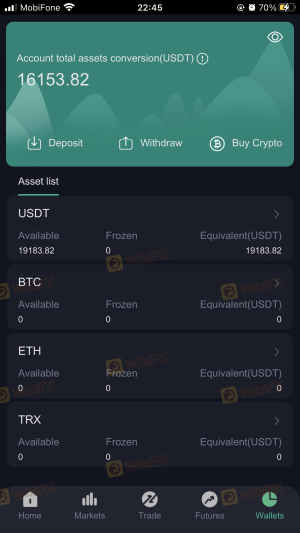

The safety of client funds is a paramount concern for any trader. FTX's practices regarding fund security have been questioned, particularly in light of the company's financial collapse. The absence of clear policies on fund segregation, investor protection, and negative balance protection puts traders at risk.

Historically, FTX has faced allegations of mishandling client funds, with reports of difficulties in withdrawing money from accounts. Such incidents underscore the importance of ensuring that a broker has robust security measures in place to protect client assets. Without these safeguards, traders may find themselves at risk of losing their investments without recourse.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability. In the case of FTX, numerous complaints have surfaced, highlighting issues such as withdrawal difficulties, unresponsive customer support, and a lack of transparency in operations.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Slow |

Many users have reported feeling trapped due to the inability to access their funds, exacerbating frustrations with the company's customer service. The pattern of complaints suggests a systemic issue within FTX regarding client relations and operational transparency. Traders considering FTX should be aware of these challenges and the potential impact on their trading experience.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. FTX's platform has been described as user-friendly, but concerns about execution quality, slippage, and order rejections have been raised. Traders have reported instances of significant slippage during volatile market conditions, which can lead to unexpected losses.

The absence of clear evidence regarding the platform's integrity raises concerns about potential manipulation or unfair practices. Traders must remain vigilant and consider the implications of using a platform that may not prioritize fair execution standards.

Risk Assessment

Engaging with FTX presents various risks that traders must consider. The unregulated nature of the broker, combined with its questionable operational practices, creates a high-risk environment for users.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities |

| Fund Safety Risk | High | Potential loss of client funds |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers that offer greater transparency and security. Prioritizing platforms with a solid regulatory framework can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, FTX's operational history and the circumstances surrounding its collapse paint a troubling picture for potential traders. The lack of regulation, high fees, and numerous customer complaints suggest that FTX may not be a safe choice for trading. Traders should exercise extreme caution and consider the significant risks involved with engaging in trading activities on this platform.

For those seeking reliable alternatives, brokers with robust regulatory oversight and transparent practices are recommended. Prioritizing safety and compliance is crucial for protecting investments in the volatile world of forex trading. In light of the evidence presented, it is clear that FTX is not safe, and traders should be wary of engaging with this broker.

Is FTX a scam, or is it legit?

The latest exposure and evaluation content of FTX brokers.

FTX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTX latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.