dutch prime 2025 Year Review: Everything You Need to Know

Abstract

Dutch Prime started in 2020. This relatively young forex broker has regulation from the NFA . The broker offers many trading products, from forex currency pairs to CFDs on stocks, indices, and precious metals. This makes it a useful platform for different asset types. Key features include spreads as low as 0 and leverage up to 1:400. These features appeal to investors who like high-risk, high-reward trading. The broker's performance gets a neutral rating. Mixed user feedback shows both benefits of tight spreads and high leverage, plus some gaps in transparency and customer support. This dutch prime review uses official information and user reviews to create a complete evaluation for potential clients who want strong trading conditions while noting areas that need improvement.

Important Considerations

Dutch Prime operates under different rules depending on the region. This means different laws and regulations may apply when you open an account. This review analyzes official information and user feedback carefully. Dutch Prime has NFA regulation, but traders in the United States and other regions need to know local financial laws and compliance requirements before trading. Some account details like deposit and withdrawal methods, minimum deposit amounts, and bonus programs are not clearly shown in the official summary. Investors should do their own research. The evaluation method here combines number data with user feedback to show a balanced view of Dutch Prime's performance.

Rating Framework

Broker Overview

Dutch Prime was founded in 2020. The company has its headquarters in Kuala Lumpur, Malaysia, with a strong focus on CFD trading services. Since it started, the broker has served clients worldwide by offering a platform that supports trading in different asset types. Dutch Prime positions itself as an online trading service provider. The company emphasizes technology and easy access over traditional banking relationships. The company has gotten attention for its competitive trading conditions—specifically, its low spreads and high leverage offerings—but certain details about account minimums and commission structures remain unclear. This dutch prime review shows that while the firm presents itself as modern and innovative, there are areas where more transparency could improve its market reputation.

The broker's trading platform uses MetaTrader 4, available on both Windows and mobile devices. This platform is widely known for its stability, many technical tools, and support for automated trading systems. This makes it suitable for both new and experienced traders. Along with forex, Dutch Prime offers trading in stocks, indices through CFD contracts, gold, and silver. This gives investors diversification opportunities within a single platform. The NFA provides primary regulatory oversight, which adds trust and credibility despite limited disclosure on specific account details and operational details. As noted in this dutch prime review, the broker's innovative offerings are attractive, but more clarity in certain operational areas would benefit potential users.

Regulatory Region:

Dutch Prime is regulated by the NFA. This ensures that its trading operations follow strict compliance requirements and industry standards. This regulatory oversight provides an additional safety net for traders and reinforces the broker's commitment to fairness and security.

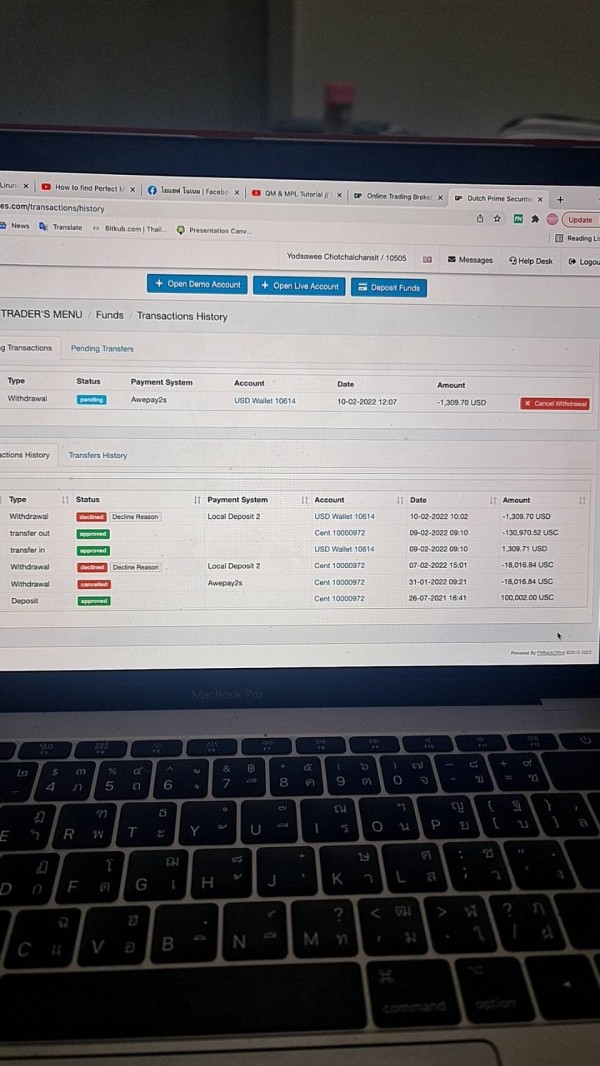

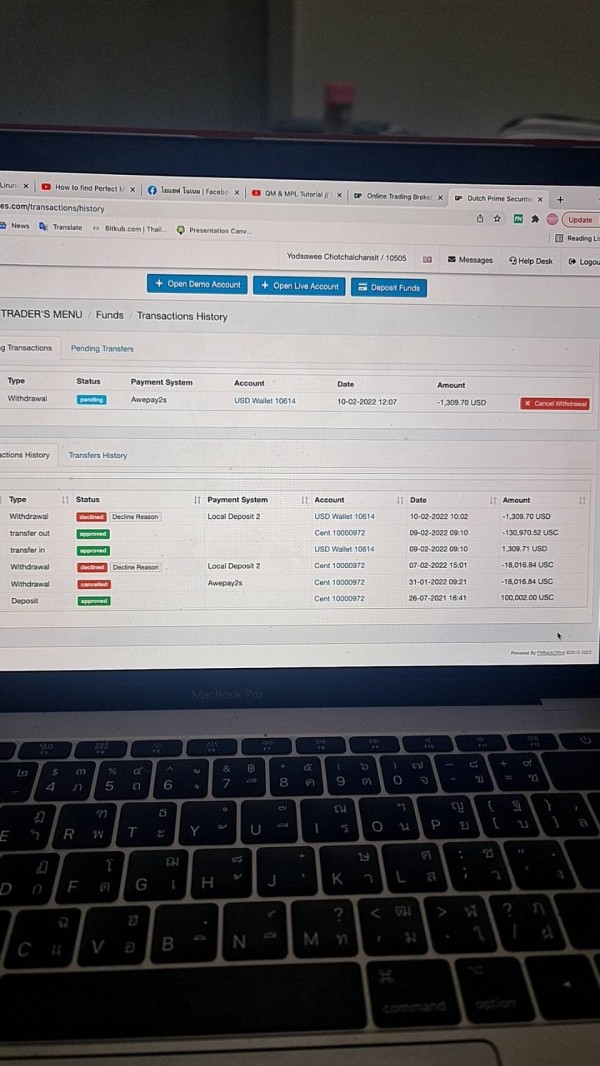

Deposit and Withdrawal Methods:

Information about specific deposit and withdrawal methods is not provided in the official summary. Prospective users should know that such details need to be clarified.

Minimum Deposit Requirement:

Specific information on the minimum deposit requirement is not mentioned in the available data.

Bonuses and Promotions:

Details about any bonus or promotional offers have not been disclosed in the official material.

Tradable Assets:

Clients of Dutch Prime can access many trading instruments. These include major and minor forex currency pairs, stocks, index CFDs, and precious metals like gold and silver. This selection supports both diversified trading strategies and risk management.

Cost Structure:

The broker presents competitive spreads that can be as low as 0. However, commission details are notably absent. This gap in transparency may influence traders assessing overall transaction costs.

Leverage Ratio:

Dutch Prime offers high leverage of up to 1:400. This appeals particularly to traders looking for significant market exposure with relatively low capital investment.

Platform Choice:

The chosen trading platform is MetaTrader 4. This platform is known for its user-friendly interface and advanced trading functions. This platform works well for both casual and professional traders.

Regional Restrictions:

Information about any geographical or regional restrictions on trading is not provided in the official summary.

Customer Support Languages:

Details about the languages available for customer support have not been explicitly provided.

This detailed section of the dutch prime review highlights both the strengths and the information gaps that prospective traders must consider when evaluating Dutch Prime as a trading partner.

Detailed Rating Analysis

1. Account Conditions Analysis

Dutch Prime's account conditions receive a score of 6 out of 10. The broker offers attractive trading features such as zero spreads and a high leverage ratio, but the account setup details remain unclear. Important parameters such as the minimum deposit requirement, commission structures, and the variety of account types available are not clearly outlined in the available documentation. The lack of detail about the account opening process and any special account features—like Islamic accounts—limits the transparency needed for fully informed decisions. User feedback has been mixed, with only a few positive remarks on account flexibility. Many users noted that additional information would greatly improve their trading experience. Compared to more established brokers where account conditions are thoroughly detailed, Dutch Prime still has room for improvement. This dutch prime review shows the need for the broker to provide clearer and more complete details to build greater trust and confidence among its potential clients. Better transparency would help traders understand the potential costs and requirements associated with their accounts, leading to a more satisfying and informed trading experience.

Tools and resources at Dutch Prime have earned a score of 7 out of 10. The broker provides access to the industry-standard MetaTrader 4 platform. This platform is known for its strong technical analysis tools, custom indicators, and automated trading capabilities. Traders can also diversify their portfolios by using a broad selection of tradable assets including forex pairs, stocks, indices, and precious metals. The review shows that while the trading platform itself works very well, additional research and analysis tools, as well as educational resources, are notably lacking. This gap is particularly clear among traders who want a complete set of tools for market analysis and ongoing education. Some users have expressed a desire for more detailed market research, advanced charting software, and timely economic updates to support their strategies. Despite these shortcomings, the overall trading infrastructure remains competent. The use of MT4 provides a familiar and well-developed environment for most traders. In this dutch prime review, it becomes clear that while the basic tools are in place, improving the educational and analytical resources could significantly boost the overall user satisfaction and effectiveness of the trading experience.

3. Customer Service and Support Analysis

Customer service and support for Dutch Prime receive a moderate score of 6 out of 10. The available data shows that the broker's customer support has received mixed feedback from users. Only a handful of comments highlight neutral experiences with service responsiveness and support quality. Specific aspects such as the variety of customer service channels, the responsiveness of support staff, and the availability of multi-language support are either poorly detailed or altogether absent. Users have reported that while the broker does offer customer service, there is not enough detail about service hours, response times, and complete support solutions for troubleshooting complex issues. This lack of clarity can create uncertainty, especially for newer traders who might expect a stronger onboarding and ongoing support system. Without clear evidence of a dedicated response team or detailed resolution case studies, the service experience remains less than optimal compared to competitors known for their proactive and multi-channel support systems. The insights from this dutch prime review emphasize that improving customer service transparency and providing more accessible support resources would likely enhance overall user confidence and satisfaction.

4. Trading Experience Analysis

The trading experience offered by Dutch Prime scores 7 out of 10. The broker's appealing features, such as spreads as low as 0 and leverage ratios reaching up to 1:400, contribute significantly to a positive trading environment. Users have noted that order execution tends to be efficient, with responsive platform performance, particularly on the MetaTrader 4 interface. The intuitive nature of MT4, combined with its complete suite of technical tools, makes executing trades and conducting market analysis relatively straightforward. Some users have raised concerns about limited information on the mobile version's performance and overall platform stability during extreme market conditions. While the low spreads and direct market access are definite strengths, a lack of detailed information on other transactional aspects prevents a full assessment of the overall cost efficiency. Despite these issues, the broker continues to maintain a stable trading environment supported by user testimonials that highlight liquidity and clear execution quality. Overall, this dutch prime review indicates that while the core trading experience is sound, more consistency in operational transparency and mobile platform performance would strengthen its market standing.

5. Trustworthiness Analysis

Dutch Prime's trustworthiness is rated 7 out of 10. The most significant factor supporting its reputation is its regulatory oversight by the NFA. This regulation imposes strict compliance standards to ensure trader protection and operational integrity. This regulatory backing provides comfort to potential clients, confirming that the broker operates under established financial guidelines. The relatively recent establishment of the company in 2020 means that there is still a limited historical record for assessing its long-term stability and reliability. User feedback includes both positive notes about regulatory legitimacy and negative comments highlighting instances of exposure and uncertainty in issue resolution. While regulatory compliance adds a layer of security, certain safety measures such as details on fund segregation or additional third-party audits are not clearly outlined. This mixed picture leads to an overall moderate trust score. The dutch prime review shows that while regulatory credentials are a strong point, enhanced transparency about operational processes and proactive communication during negative incidents would further improve trader confidence and strengthen the broker's trustworthiness.

6. User Experience Analysis

User experience at Dutch Prime is rated 5 out of 10. This reflects a mostly neutral sentiment among its clients. The platform is generally functional and hosts a familiar interface in the form of MetaTrader 4. Many traders appreciate this platform for its reliability and extensive features. User feedback suggests that the overall interface design lacks innovation, and the registration and account verification processes remain vague and cumbersome. Aspects such as ease of navigation, clarity of fee structures, and straightforward fund management features have been flagged as areas needing improvement. The limited disclosure about deposit/withdrawal procedures and support channels further hurts the overall experience. In many user reports, frustrations were recorded over delayed responses and insufficient clarity in transaction details. Others noted that the learning curve remained steeper than expected. This dutch prime review combines these insights, indicating that while the core trading tools are in place, significant improvements in user interface design and customer journey transparency are needed to elevate overall satisfaction.

Conclusion

Dutch Prime presents itself as a modern forex broker with promising features such as zero spreads and high leverage. This makes it an attractive option for high-risk investors seeking diverse trading instruments. The overall performance remains neutral due to notable shortcomings in transparency, particularly regarding account conditions, cost structures, and customer support. While the regulatory credentials under the NFA provide a measure of trustworthiness, the lack of detailed operational information requires prospective clients to exercise additional due diligence. This dutch prime review concludes that Dutch Prime may be best suited for traders prepared to navigate potential uncertainties and who prioritize aggressive trading conditions over a fully transparent service framework.