Is ApexMarkets safe?

Pros

Cons

Is Apex Markets A Scam?

Introduction

Apex Markets is an online trading platform that positions itself as a global broker in the forex market, offering a range of trading instruments including forex, cryptocurrencies, commodities, and stocks. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. In this article, we will investigate Apex Markets' regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a trustworthy trading platform or a potential scam. Our analysis is based on a comprehensive review of multiple online sources, user feedback, and regulatory information.

Regulation and Legitimacy

Apex Markets operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. Regulation is a critical aspect of the financial industry, as it ensures that brokers adhere to certain standards, providing oversight and protection for traders. The absence of regulation can expose traders to higher risks and potential fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory license means that Apex Markets does not have to comply with any legal requirements regarding fund safety, transparency, or fair trading practices. This raises red flags about the broker's operations, as traders have no legal recourse should any issues arise, such as withdrawal problems or fraudulent activities. Furthermore, the company's registration in Saint Vincent and the Grenadines—a jurisdiction known for its lax regulatory environment—adds to the skepticism surrounding its legitimacy.

Company Background Investigation

Apex Markets is owned by Apex Capital Markets LLC, which is registered in Saint Vincent and the Grenadines. However, there is limited information available regarding the company's history, ownership structure, and management team. The lack of transparency about the individuals behind the company is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

The absence of a clear organizational structure and the anonymity of its owners may indicate potential risks for traders. Additionally, the company has not provided any substantial information about its operational history or compliance with financial regulations, further casting doubt on its credibility. Without a transparent background, potential clients may find it challenging to trust Apex Markets with their funds.

Trading Conditions Analysis

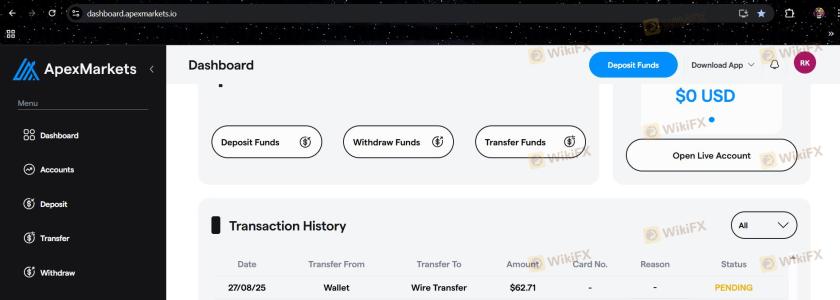

Apex Markets claims to offer competitive trading conditions, including high leverage and low spreads. However, the absence of a demo account raises concerns about the broker's transparency and the quality of its trading conditions. Traders are often encouraged to test a broker's platform and conditions through a demo account before committing real funds.

| Fee Type | Apex Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 2.0 pips |

| Commission Model | $3 per lot | $5 - $10 per lot |

| Overnight Interest Range | Not specified | 0.5% - 1.5% |

While the broker advertises spreads starting from 0.0 pips, the actual trading conditions may vary significantly based on market conditions and account types. The commission structure appears competitive; however, the lack of clarity regarding overnight interest rates and additional fees raises concerns about hidden costs that could affect overall profitability.

Traders should be cautious and thoroughly review all costs associated with trading on Apex Markets to avoid unexpected charges that could diminish their returns.

Customer Fund Safety

The safety of customer funds is a paramount concern when evaluating a broker. Apex Markets does not provide sufficient information regarding its fund protection measures. The absence of segregated accounts, investor protection schemes, and negative balance protection policies is alarming.

Traders should be aware that without proper fund segregation, their deposits may be at risk in the event of the broker's insolvency. Furthermore, the lack of investor compensation schemes means that traders have no safety net to recover their funds if Apex Markets were to go bankrupt. Historical complaints and reports from users indicate that withdrawal issues have been a common problem, which raises further alarm regarding the safety of funds held with this broker.

Customer Experience and Complaints

Customer feedback regarding Apex Markets has been predominantly negative, with numerous complaints about withdrawal difficulties and poor customer service. Many users report experiencing long delays in processing withdrawals, with some claiming that their requests were ignored altogether.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency | High | Non-existent |

For instance, one user reported waiting for months to withdraw their funds, only to be met with excuses and delays from the support team. Another common complaint involves the lack of transparency regarding fees and trading conditions, leading to frustration and distrust among clients.

These patterns of complaints suggest systemic issues within the company, indicating that potential clients should approach Apex Markets with caution.

Platform and Execution

Apex Markets offers the MetaTrader 5 (MT5) trading platform, which is known for its advanced features and user-friendly interface. However, user experiences regarding platform performance have been mixed. Reports of slippage, order rejections, and execution delays are concerning, as these factors can significantly impact trading outcomes.

The potential for platform manipulation is another issue that traders should consider. While the MT5 platform itself is reputable, the lack of regulatory oversight raises questions about the integrity of the trading environment provided by Apex Markets. Traders should be vigilant and monitor their execution quality closely.

Risk Assessment

Engaging with Apex Markets carries several risks, primarily due to its unregulated status and negative customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety Risk | High | Lack of fund protection measures puts traders' capital at risk. |

| Withdrawal Risk | High | Many users report difficulties in withdrawing funds. |

| Customer Service Risk | Medium | Slow response times and poor support experiences reported. |

To mitigate these risks, potential traders should conduct thorough research and consider using regulated brokers with a proven track record. Establishing a clear understanding of the potential pitfalls associated with unregulated brokers like Apex Markets is essential for protecting ones investment.

Conclusion and Recommendations

In conclusion, the investigation into Apex Markets reveals significant concerns regarding its legitimacy and safety as a trading platform. The lack of regulatory oversight, negative customer experiences, and transparency issues suggest that traders should exercise extreme caution when considering this broker.

For those seeking a reliable trading experience, it is advisable to explore alternative brokers that are well-regulated and have positive user feedback. Options such as brokers regulated by the FCA, ASIC, or CySEC may provide a safer and more trustworthy trading environment.

Ultimately, while Apex Markets may offer attractive trading conditions on the surface, the underlying risks associated with its operations make it a broker to avoid for serious traders.

Is ApexMarkets a scam, or is it legit?

The latest exposure and evaluation content of ApexMarkets brokers.

ApexMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ApexMarkets latest industry rating score is 2.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.