Dumbll 2025 Review: Everything You Need to Know

Dumbll has garnered significant attention in the forex trading community, but not necessarily for the right reasons. The reviews indicate a troubling trend of user complaints regarding withdrawal issues and lack of regulatory oversight, painting a concerning picture for potential investors. Notably, many users have reported difficulties in accessing their funds, raising red flags about the broker's reliability.

Note: It's crucial to recognize that the operations of Dumbll may differ across regions, with various entities involved. This complexity can impact the experiences of users and the regulatory frameworks that apply to them.

Rating Overview

How We Score Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data gathered from multiple reputable sources.

Broker Overview

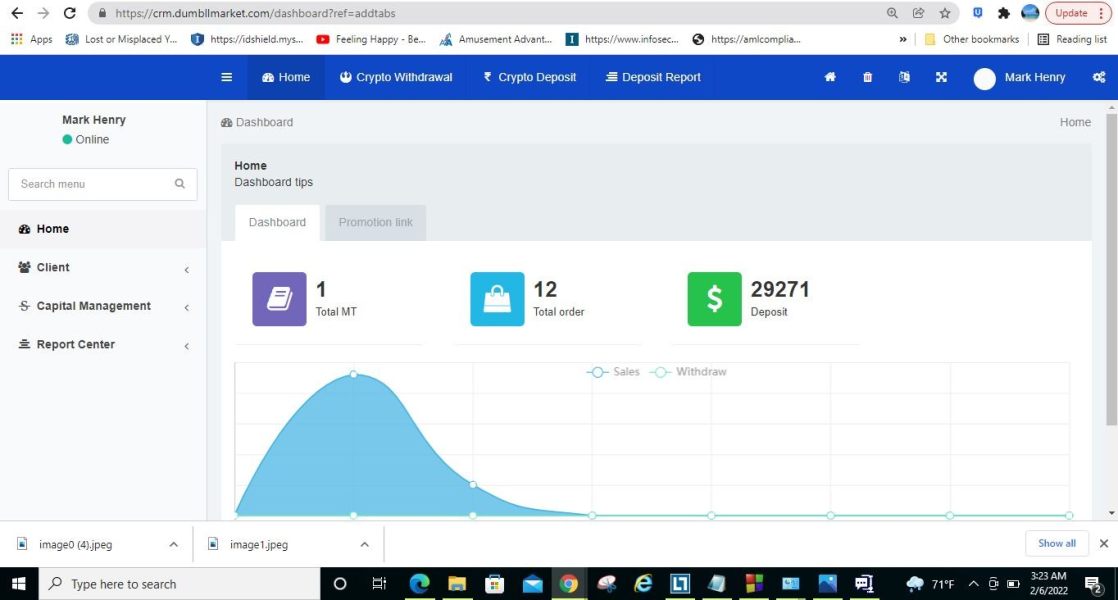

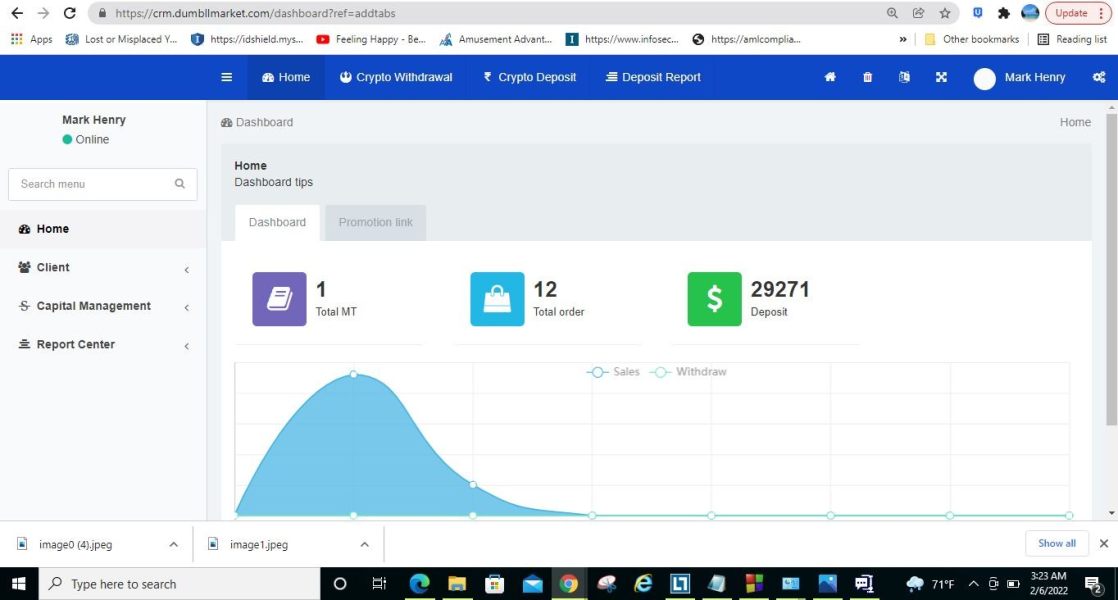

Dumbll, also known as Dumbll Market, operates as a forex and CFD broker, primarily focusing on forex trading and cryptocurrencies. While the exact year of establishment is unclear, user reviews indicate that it has been operational for at least a couple of years, with a significant presence online. The broker utilizes the MetaTrader 5 platform, which is popular among traders for its advanced features and user-friendly interface. However, it lacks a clear regulatory framework, which is a significant concern for potential investors.

Detailed Analysis

Regulatory Environment

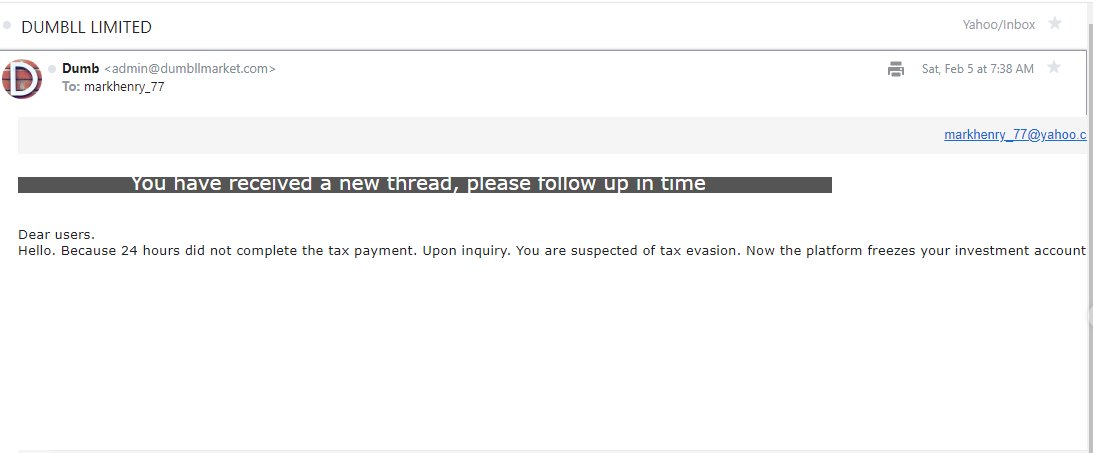

Dumbll is not regulated by any major financial authority, which is a significant drawback. According to sources, it has been flagged as operating illegally in certain regions, including Canada, where it is not authorized to collect funds or taxes from clients. This lack of oversight raises serious concerns about the safety of client funds and the overall integrity of the broker.

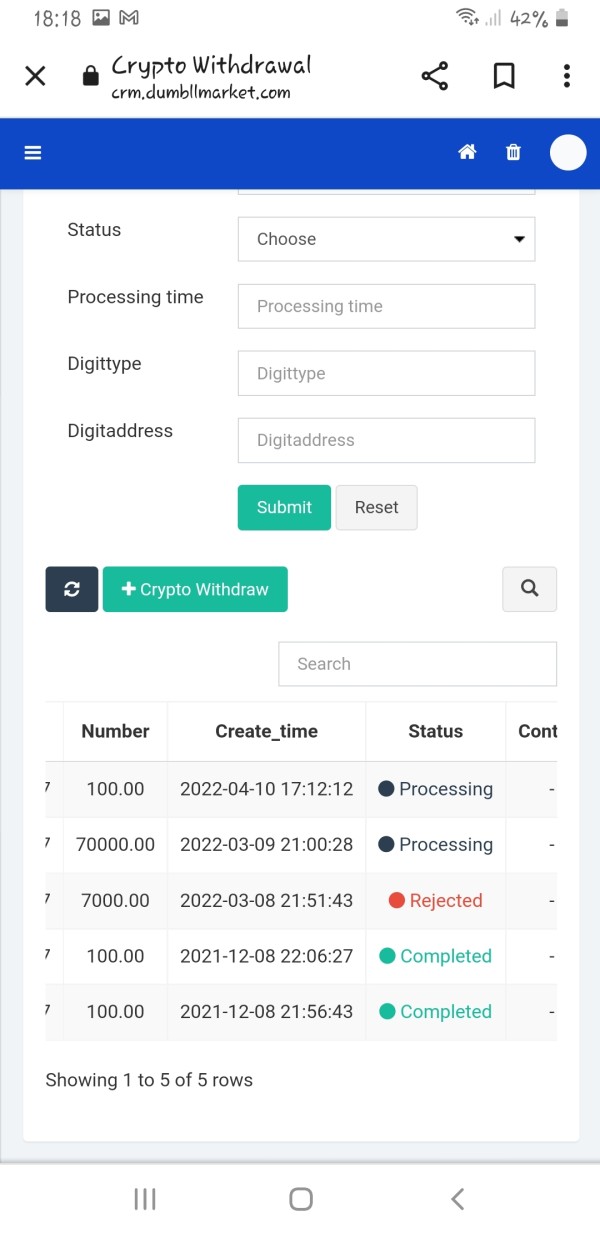

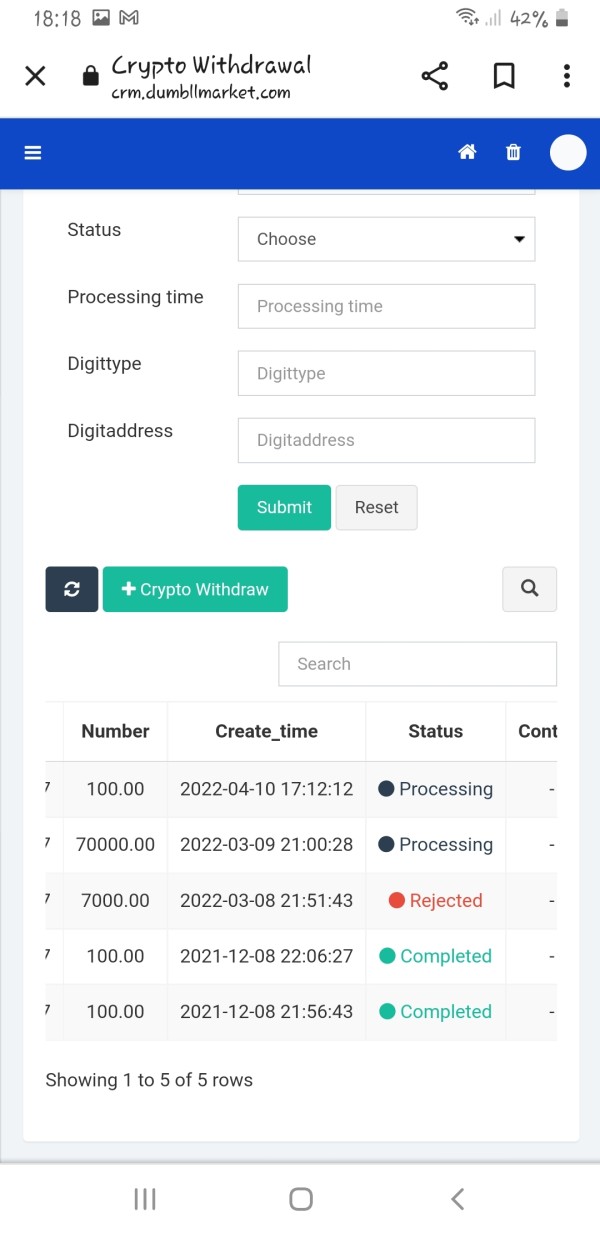

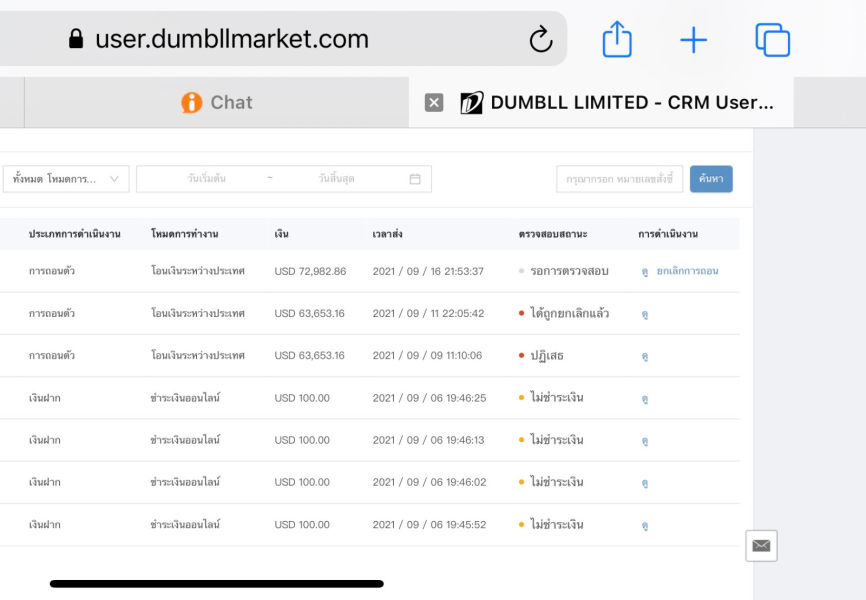

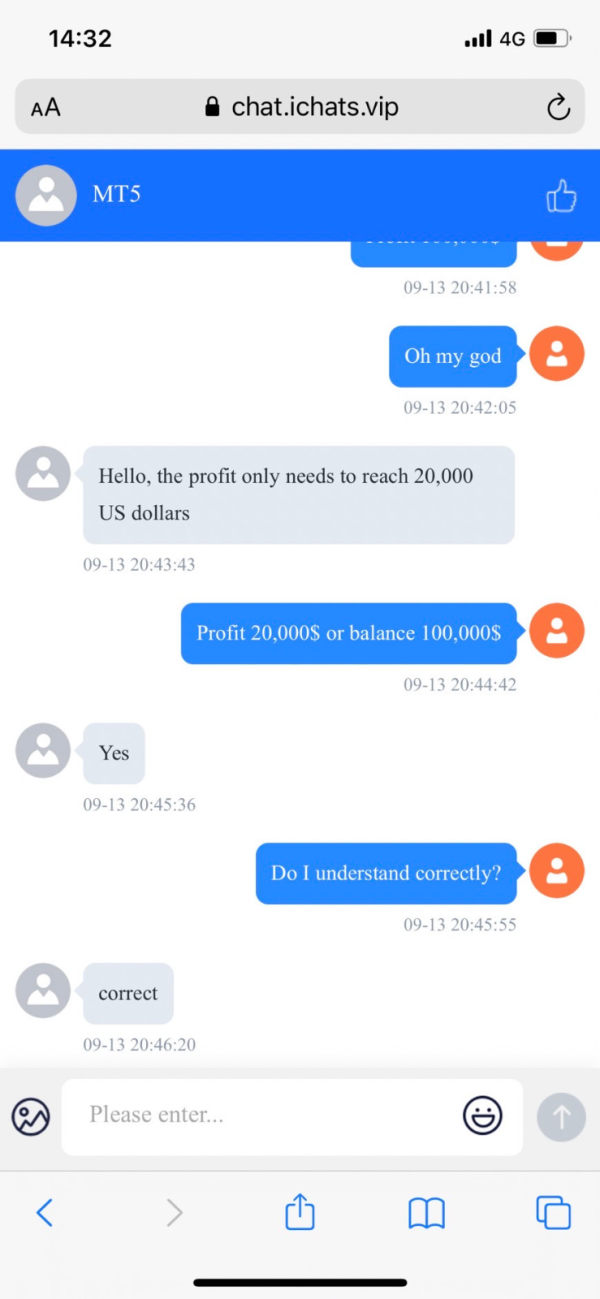

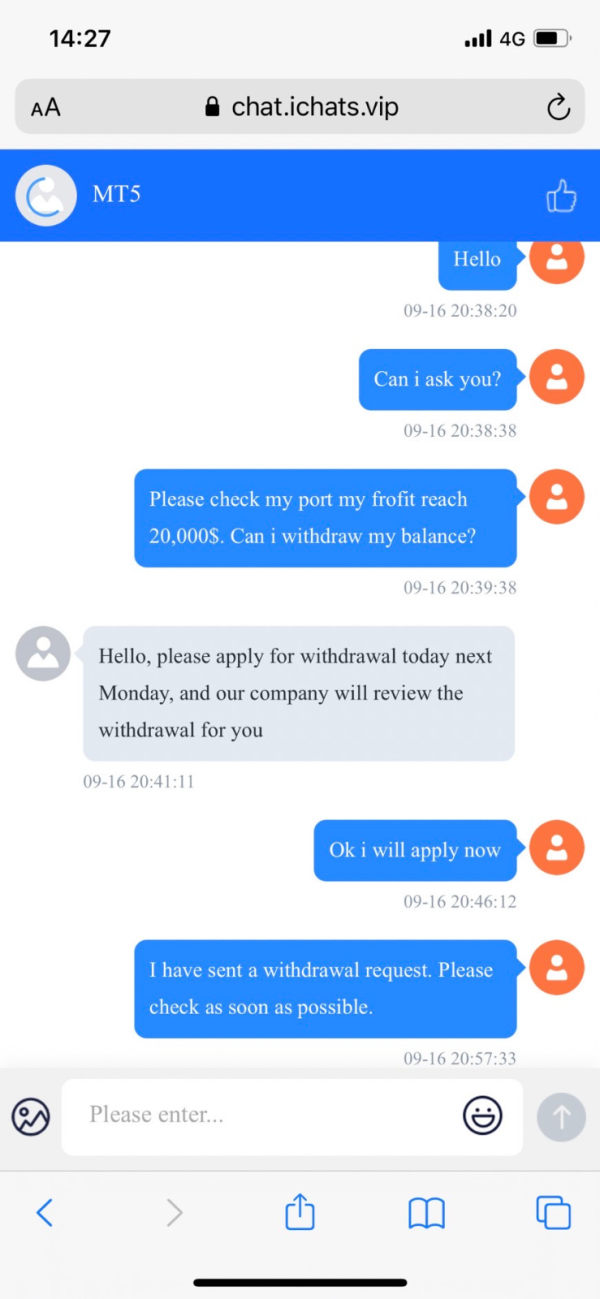

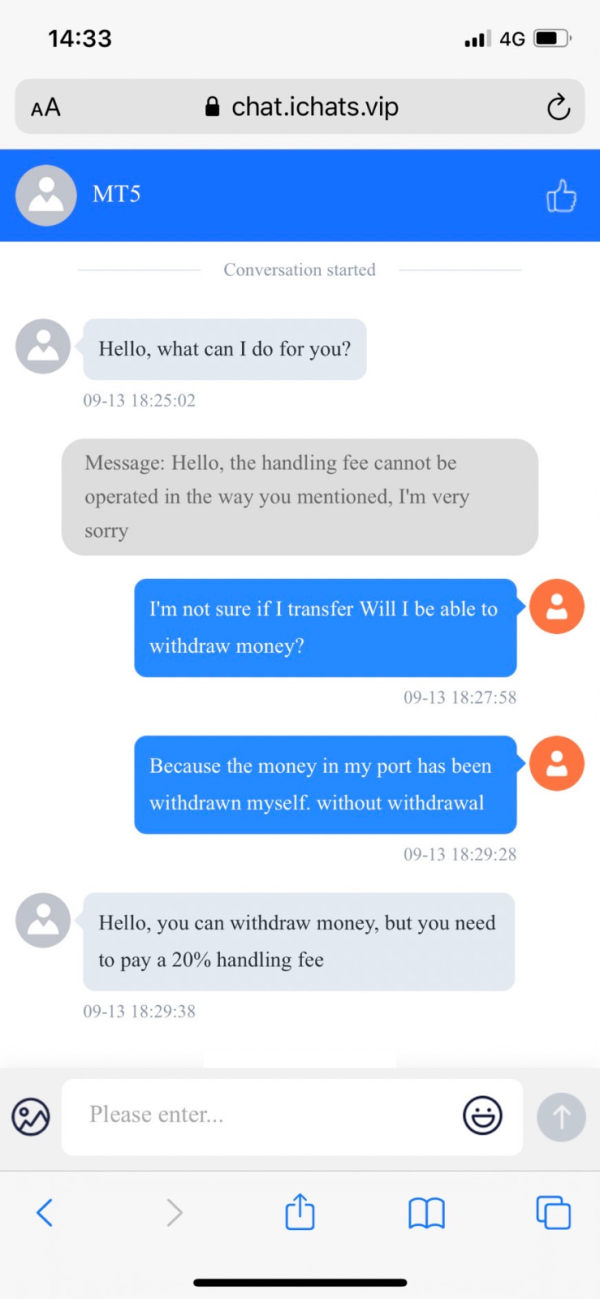

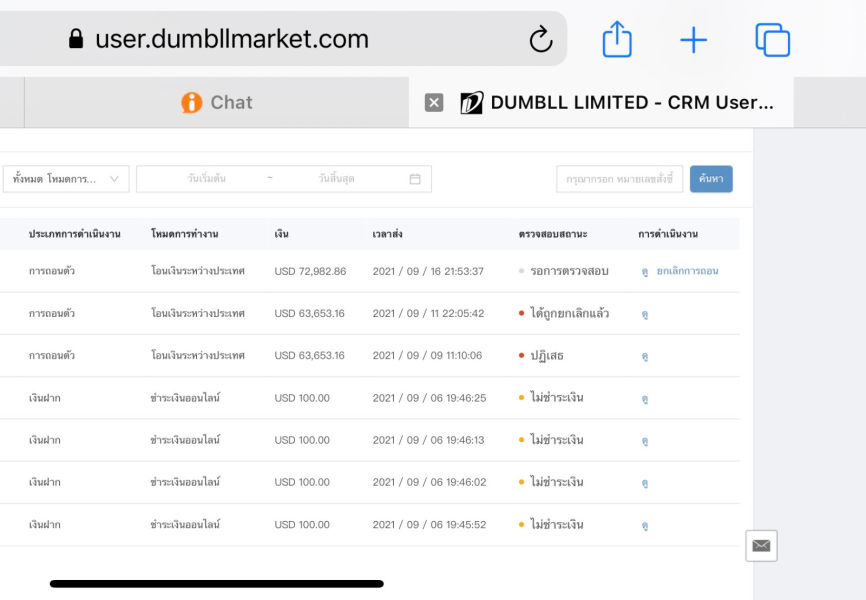

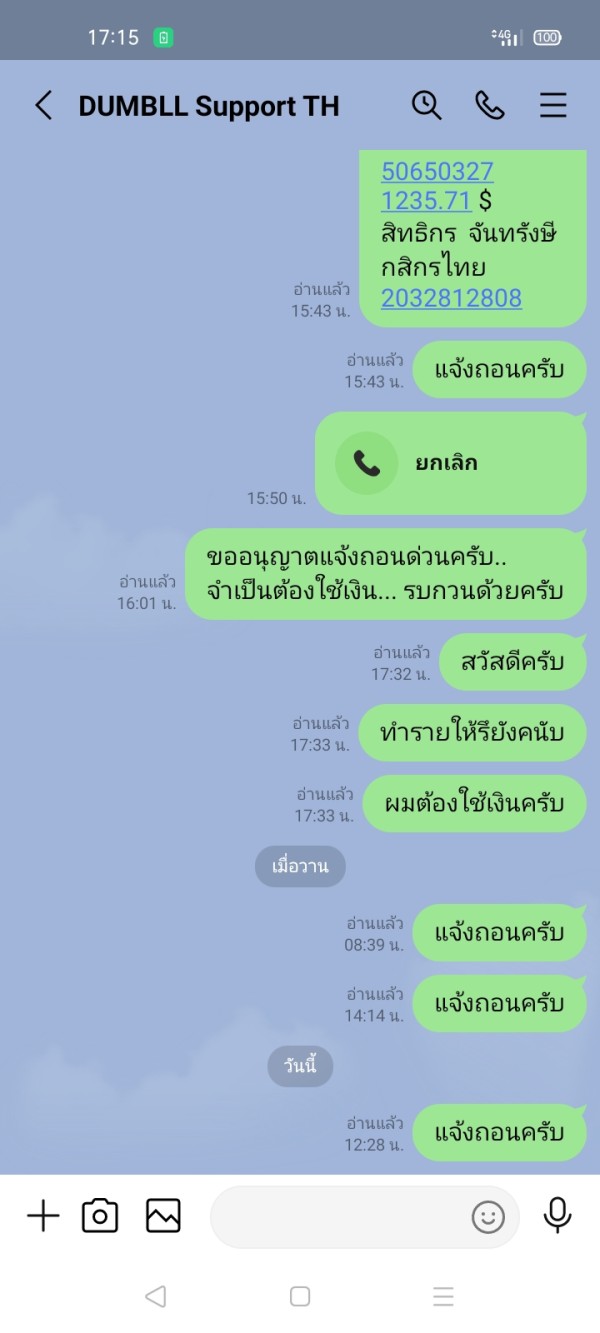

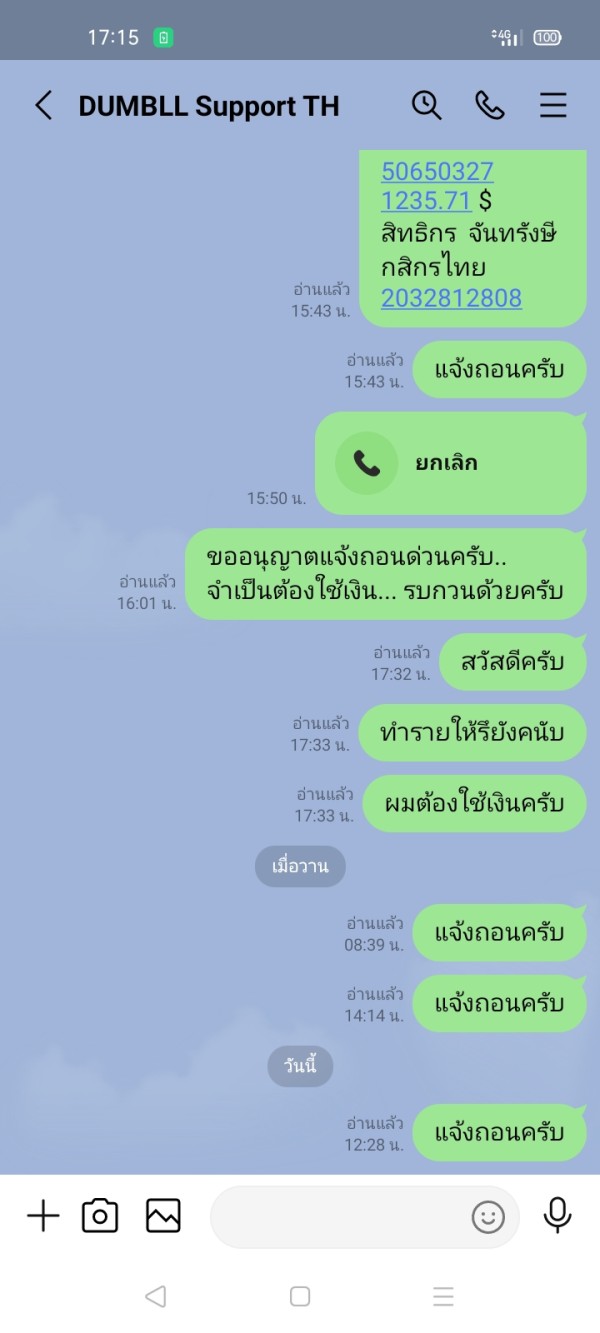

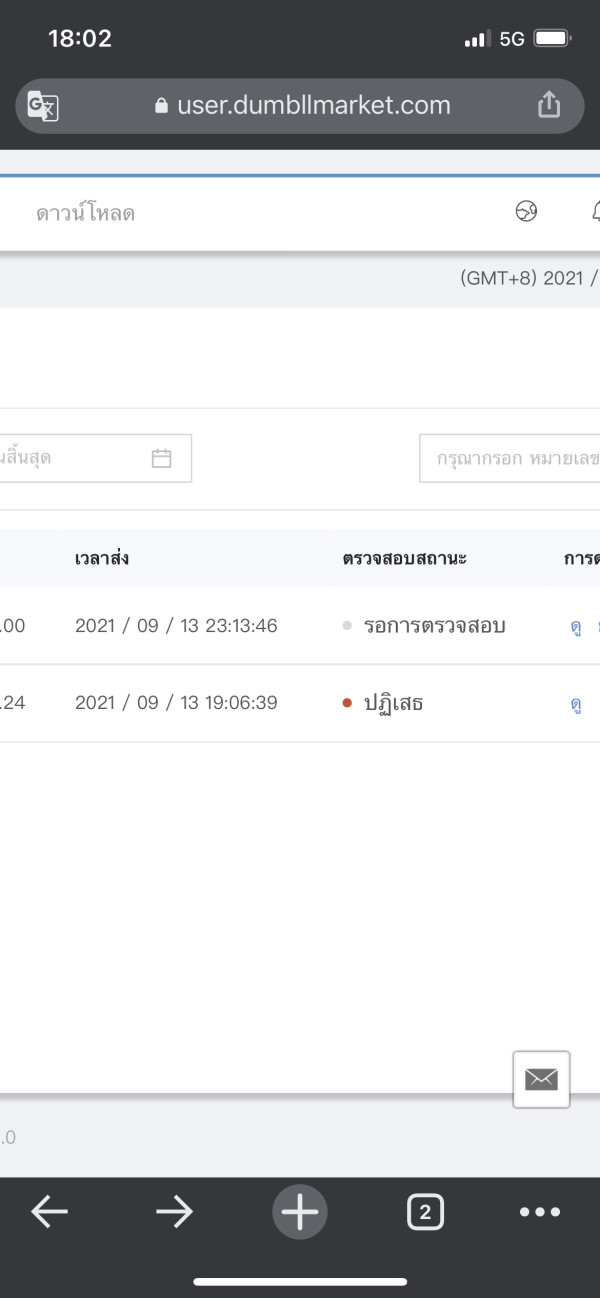

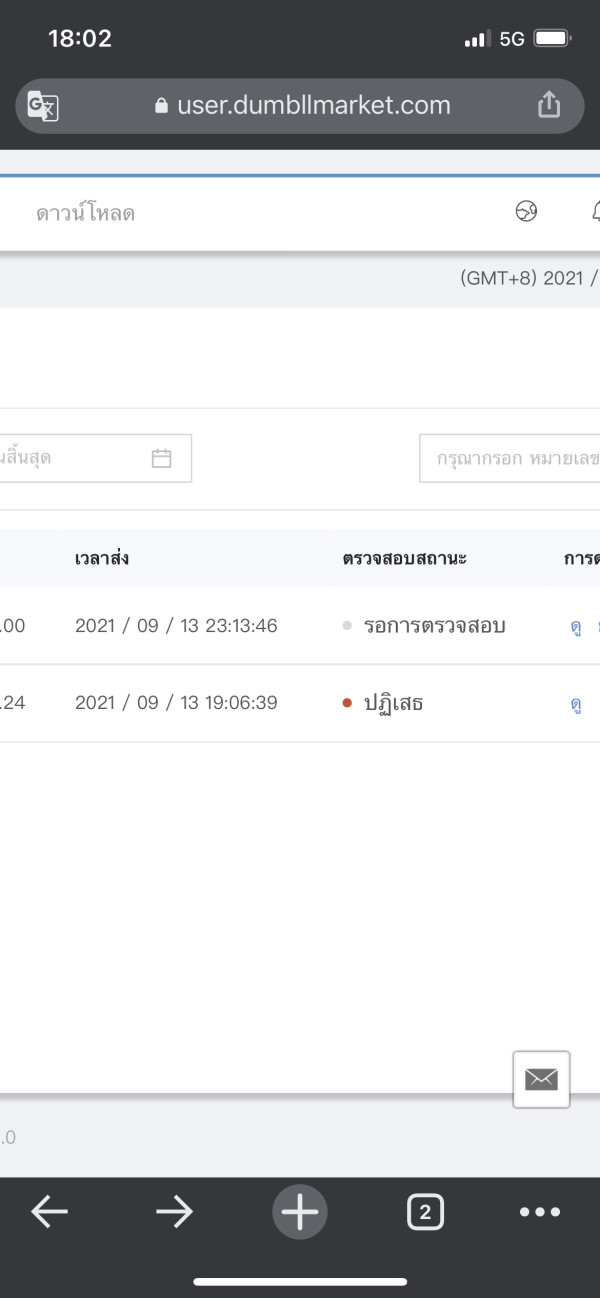

Deposit and Withdrawal Options

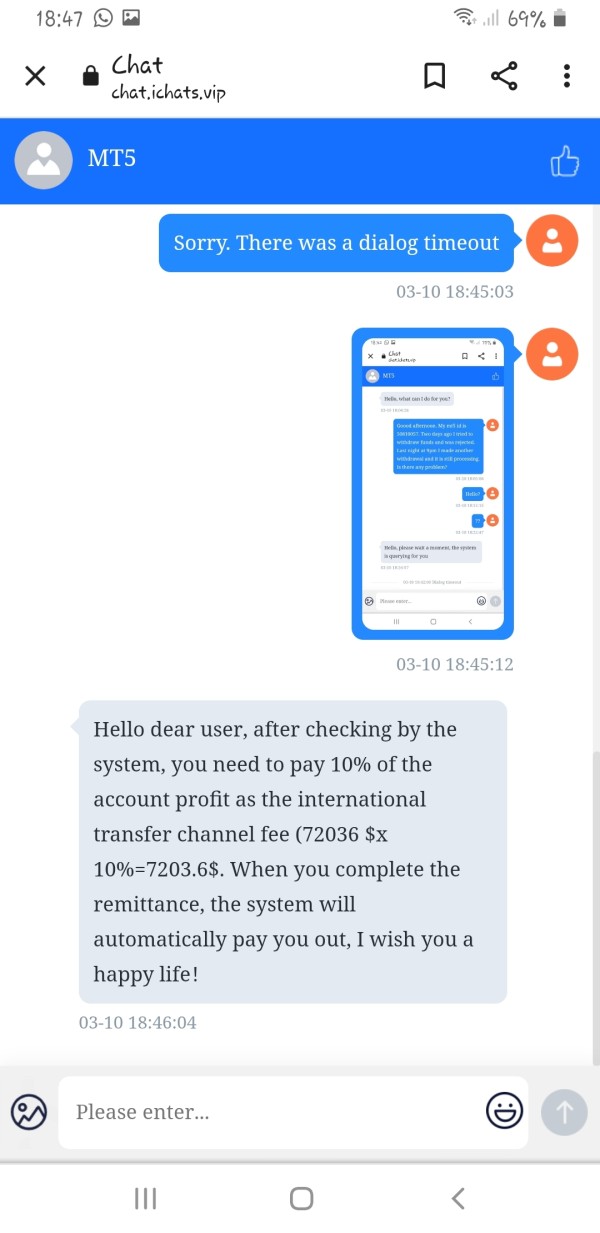

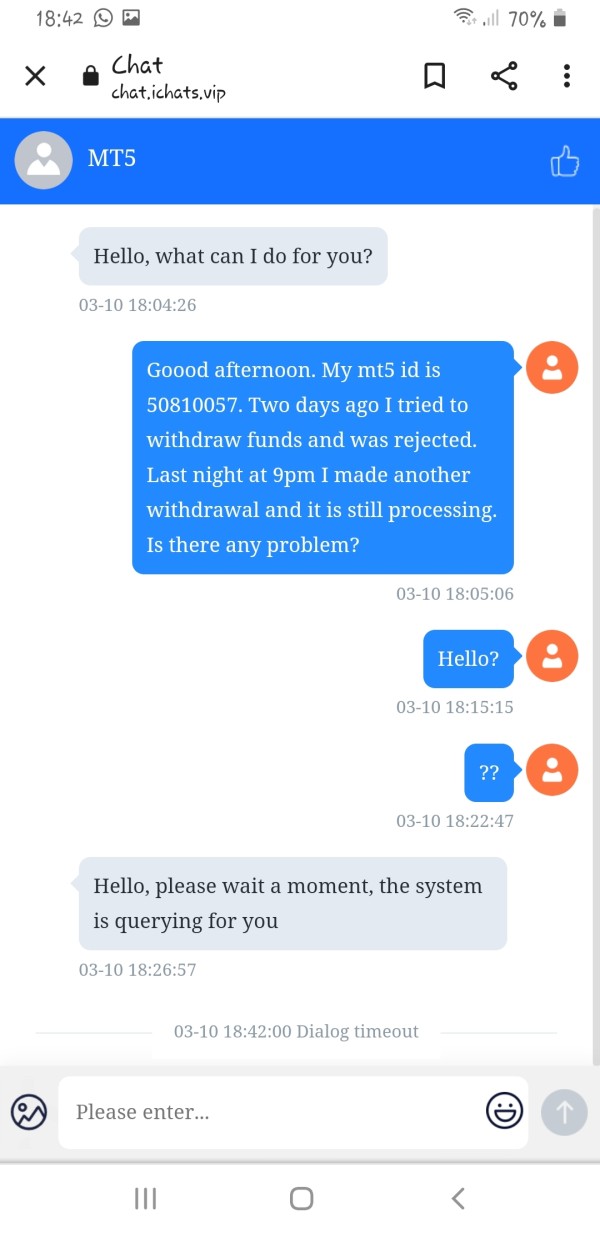

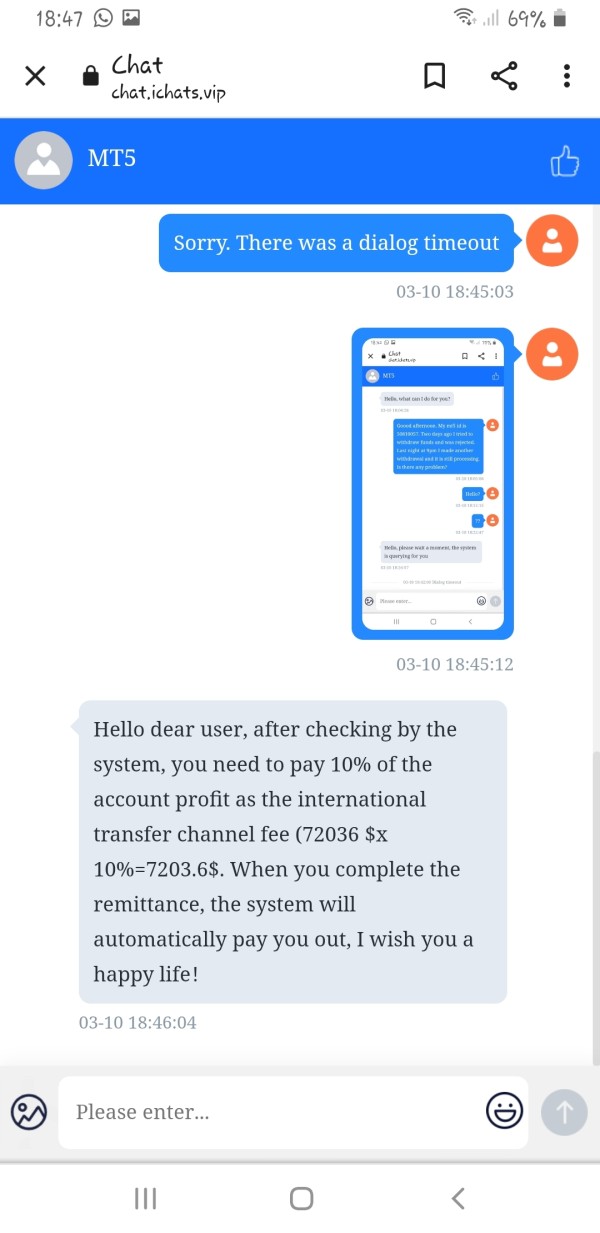

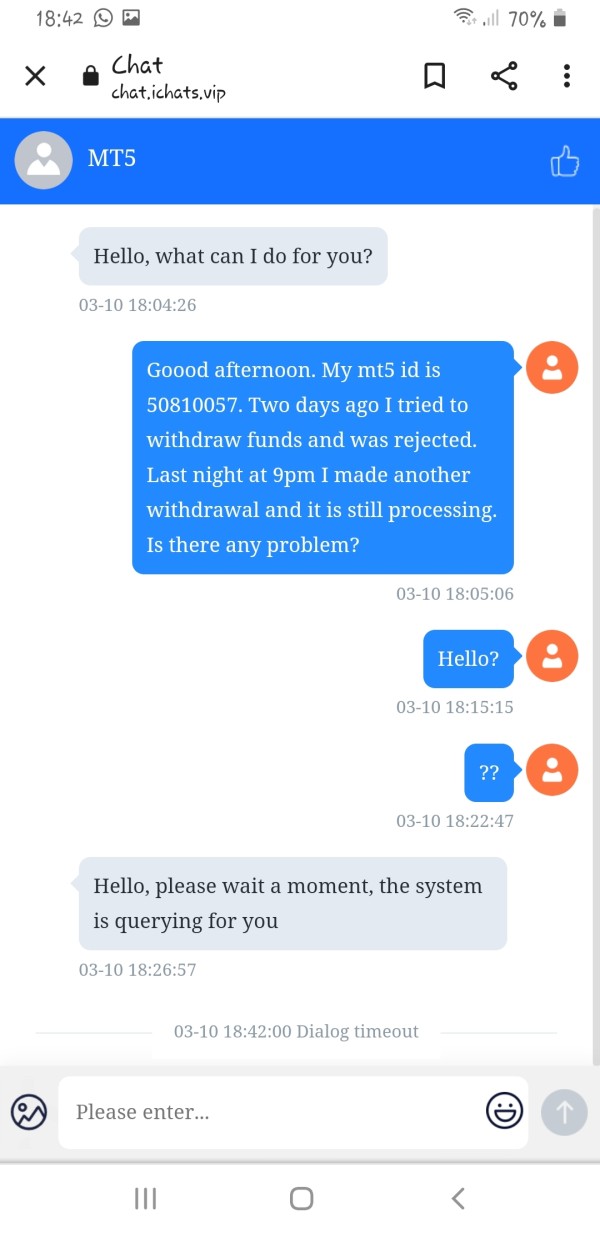

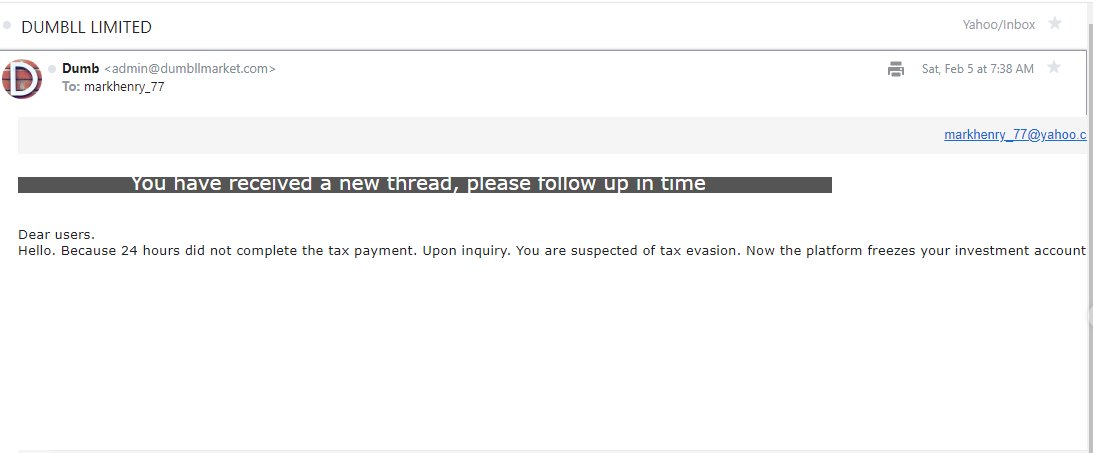

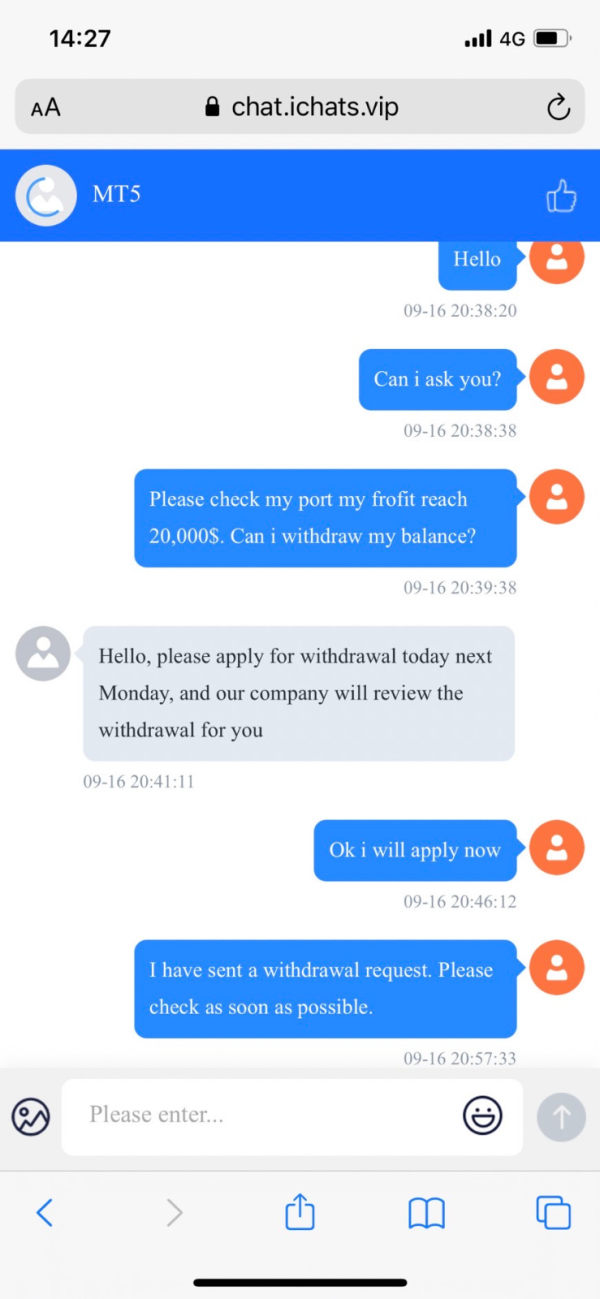

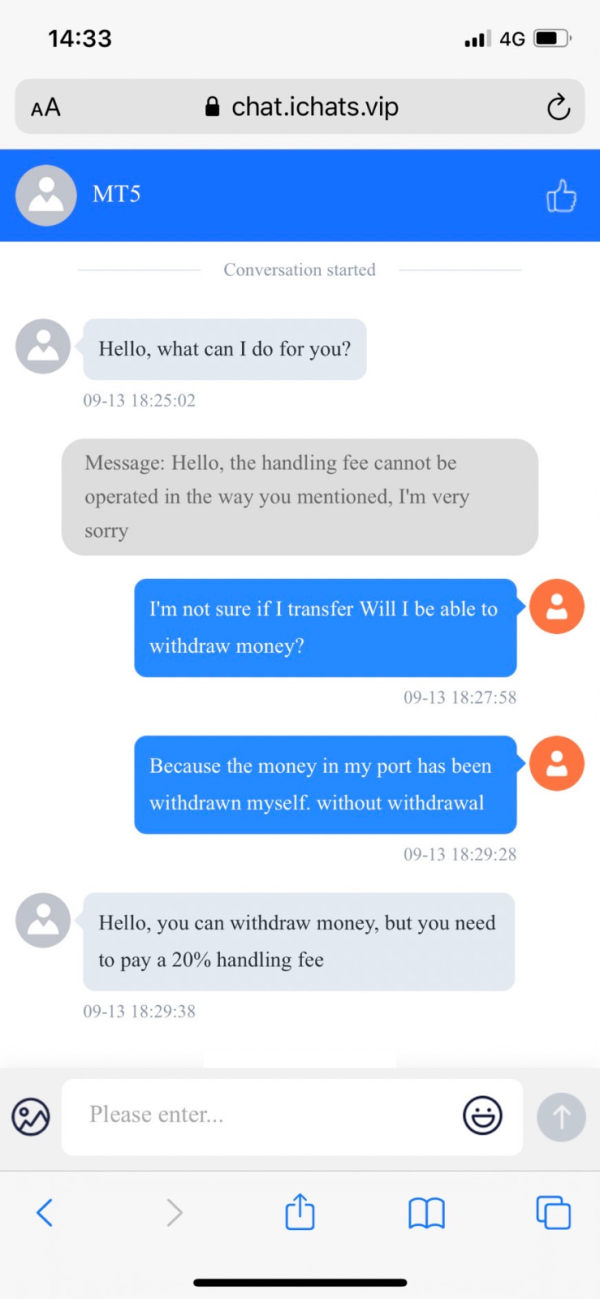

Dumbll offers a limited range of deposit and withdrawal methods, primarily focusing on bank transfers and credit cards. However, numerous user complaints highlight issues with fund withdrawals, with many claiming that their requests were either denied or subjected to unreasonable fees. For example, one user reported being asked to pay additional taxes and fees after attempting to withdraw, which is a common theme in negative reviews regarding this broker.

Minimum Deposit

The minimum deposit requirement is not explicitly stated on the broker's website, which can be a red flag for potential investors. Many brokers typically require an initial deposit ranging from $100 to $500, but without clear guidelines, users might find themselves in a precarious situation.

Dumbll does not appear to offer any significant bonuses or promotions, which is not uncommon for unregulated brokers. This absence of incentives may indicate a lack of competitive offerings compared to more reputable brokers that often provide bonuses to attract new clients.

Tradable Asset Classes

The broker claims to offer a variety of tradable assets, including over 60 currency pairs, commodities, and cryptocurrencies. However, the actual availability of these assets can vary, and the lack of transparency regarding the specifics of these offerings is concerning.

Cost Structure

Dumbll advertises a commission-free trading environment with spreads starting as low as 0.0 pips. However, many users have reported hidden fees and unexpected charges, particularly when trying to withdraw funds. This discrepancy between advertised costs and actual user experiences is a critical factor to consider.

Leverage

The broker offers a maximum leverage of up to 1:500, which can be appealing to seasoned traders looking for high-risk opportunities. However, this high leverage comes with its own set of risks, particularly for inexperienced traders who may not fully understand the implications of leveraged trading.

Dumbll exclusively utilizes the MetaTrader 5 platform, which is generally well-regarded in the trading community. However, the lack of alternative platforms may limit options for traders who prefer different interfaces or functionalities.

Restricted Regions

Dumbll has been flagged for operating in regions where it does not have the necessary licenses, particularly in Canada. This restriction could lead to legal ramifications for both the broker and its clients, making it imperative for potential users to conduct thorough research before engaging with this broker.

Available Customer Support Languages

Customer support appears to be a significant weakness for Dumbll. Users have reported a lack of responsiveness and difficulty in reaching customer service representatives. Many complaints highlight that inquiries often go unanswered, leading to frustration among clients seeking assistance.

Repeated Rating Overview

Detailed Breakdown

- Account Conditions: The absence of clear minimum deposit requirements and a lack of transparency raises concerns about the broker's account conditions.

- Tools and Resources: While the MT5 platform is a strong point, the limited educational resources and market analysis tools available to users detract from the overall offering.

- Customer Service: The overwhelming feedback regarding poor customer service is a significant red flag, with many users reporting unresponsive support channels.

- Trading Experience: Users have expressed dissatisfaction with their trading experiences, primarily due to withdrawal issues and hidden fees.

- Trustworthiness: The lack of regulation and numerous complaints about fund withdrawals severely impact the broker's trustworthiness.

- User Experience: Overall user experience is marred by negative feedback regarding transparency and service quality.

In conclusion, the Dumbll review suggests that potential investors should exercise extreme caution. The combination of regulatory concerns, withdrawal issues, and poor customer service indicates that this broker may not be a reliable choice for forex trading. Always conduct thorough research and consider more reputable alternatives before committing your funds.