Is EXFINANCES safe?

Business

License

Is Exfinances Safe or a Scam?

Introduction

Exfinances is a forex broker that has emerged in the crowded online trading landscape, catering to traders seeking opportunities in the foreign exchange market. However, as the financial sector continues to attract both legitimate businesses and scams, it is crucial for traders to exercise caution when selecting a broker. The reputation and reliability of a broker can significantly impact a trader's experience and financial security. This article aims to investigate whether Exfinances is a safe platform or a potential scam. To do so, we will analyze various aspects of the broker, including its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its safety and legitimacy. Exfinances claims to operate under the jurisdiction of the United Kingdom; however, it lacks any valid regulatory licenses from recognized financial authorities. This absence of regulation raises significant concerns about the broker's credibility and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The importance of regulatory oversight cannot be overstated. Regulated brokers are required to adhere to strict standards that protect traders, such as maintaining segregated accounts for client funds and providing transparent information about fees and trading conditions. The lack of regulation at Exfinances suggests that it may not be subject to the same level of scrutiny, leaving traders vulnerable to potential misconduct. Furthermore, the absence of a regulatory history raises questions about the broker's compliance with financial laws and regulations.

Company Background Investigation

Exfinances is operated by Finex Group Ltd., but detailed information about its company history, ownership structure, and management team is limited. This lack of transparency is concerning, as traders typically benefit from knowing the backgrounds of the firms with which they are engaging. A thorough investigation into the management team reveals that there is little to no publicly available information regarding their qualifications or experience in the financial industry.

The opacity surrounding Exfinances and its parent company raises red flags about its legitimacy. A reputable broker should provide comprehensive information about its history, ownership, and management team, fostering trust among its clients. Given the unclear background of Exfinances, potential traders should be wary of engaging with this broker.

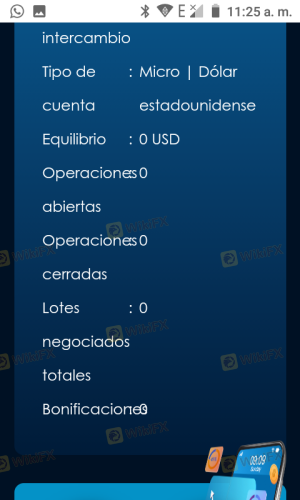

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions and fee structure is essential. Exfinances offers a variety of trading options, but the specifics regarding spreads, commissions, and other fees are not transparently disclosed. This lack of clarity can lead to unexpected costs for traders, making it challenging to assess the overall trading environment.

| Fee Type | Exfinances | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The absence of clear fee structures can be a significant disadvantage for traders, as it complicates their ability to calculate potential profits and losses accurately. Furthermore, if Exfinances implements hidden fees or unusual charges, traders may find themselves at a financial disadvantage.

Client Fund Security

The security of client funds is paramount in the forex trading industry. Exfinances claims to implement various safety measures, but the lack of regulatory oversight raises concerns about the effectiveness of these measures. Without proper regulation, there are no guarantees that client funds are kept in segregated accounts or that investor protection mechanisms are in place.

The absence of negative balance protection policies also poses risks for traders. In volatile markets, traders can incur losses that exceed their initial deposits, leaving them liable for the deficit. This situation can lead to severe financial repercussions for traders who engage with unregulated brokers like Exfinances.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. A review of online forums and trading communities reveals a mix of experiences with Exfinances. While some users report satisfactory trading experiences, others highlight issues related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | Poor |

The common themes in complaints suggest that Exfinances may struggle with customer service and transparency. Traders should be cautious, as unresolved complaints can indicate broader operational issues within the broker.

Platform and Execution

The trading platform's performance is another critical aspect of a broker's reliability. Exfinances provides a trading platform, but details regarding its stability, execution speed, and user experience remain unclear. Traders have reported varying experiences regarding order execution quality, with some mentioning slippage and rejected orders during volatile market conditions.

A reliable trading platform should ensure quick and accurate order execution, minimizing the chances of slippage or manipulation. The lack of detailed information about Exfinances' platform raises questions about its reliability and effectiveness in providing a seamless trading experience.

Risk Assessment

Using Exfinances as a trading platform presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of segregation and protection |

| Customer Service Risk | Medium | Poor response to complaints |

Given the high-risk levels associated with Exfinances, traders should tread carefully. Engaging with an unregulated broker can lead to significant financial losses and challenges in recovering funds.

Conclusion and Recommendations

Based on the investigation into Exfinances, it is evident that the broker presents several red flags that suggest it may not be a safe trading option. The lack of regulation, transparency issues, and mixed customer feedback raise concerns about its legitimacy. Therefore, traders are advised to approach Exfinances with caution.

For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of customer satisfaction. Always prioritize safety and transparency when selecting a forex broker to ensure a secure trading experience. In summary, is Exfinances safe? The evidence suggests that it may be prudent to avoid this broker.

Is EXFINANCES a scam, or is it legit?

The latest exposure and evaluation content of EXFINANCES brokers.

EXFINANCES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EXFINANCES latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.