Protrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive protrade review examines a forex broker that has established itself as a competitive player in the online trading space. However, it has notable transparency concerns that traders should know about. Protrade positions itself as the world's fourth-largest listed stock and CFD broker, with Protrade Network boasting over 8 years of experience in the financial markets. The broker has built a substantial presence in India. There, it serves as a thematic investment platform used by more than 40 banks and brokers.

According to Trustpilot reviews, Protrade Tools & Fixings has garnered 426 customer reviews. Users consistently highlight the broker's strong price competitiveness as a standout feature. However, this protrade review reveals significant gaps in regulatory transparency and mixed user feedback that potential traders should carefully consider. The broker primarily attracts traders seeking low-cost trading solutions and diversified investment instruments. Though concerns about trust and regulatory oversight may deter more conservative investors.

While Protrade demonstrates strength in pricing competitiveness and offers various online trading tools, the lack of comprehensive regulatory information presents challenges. Scattered user experiences also create problems for those prioritizing security and transparency in their broker selection process.

Important Notice

Regional Entity Differences: Protrade's operations may vary significantly across different jurisdictions and regions. Users should exercise caution when selecting the appropriate trading platform and ensure they are dealing with the correct regional entity that serves their location. Different Protrade entities may offer varying services, regulatory protections, and terms of service.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and official company communications. The assessment has not involved actual trading experience with the platform. Readers should conduct their own due diligence and consider seeking independent financial advice before making any trading decisions. Information accuracy may vary based on the timing of data collection and regional differences in service offerings.

Overall Rating Framework

Broker Overview

Protrade Network, established in 2015, has evolved into a significant player in the global trading landscape over its 8+ years of operation. The company positions itself as the world's fourth-largest listed stock and CFD broker. It focuses primarily on providing online trading and investment services through its thematic investment platform. This protrade review reveals that the broker has particularly strong market penetration in India, where it serves as the backbone trading platform for over 40 banks and brokers. This demonstrates its institutional credibility in that specific market.

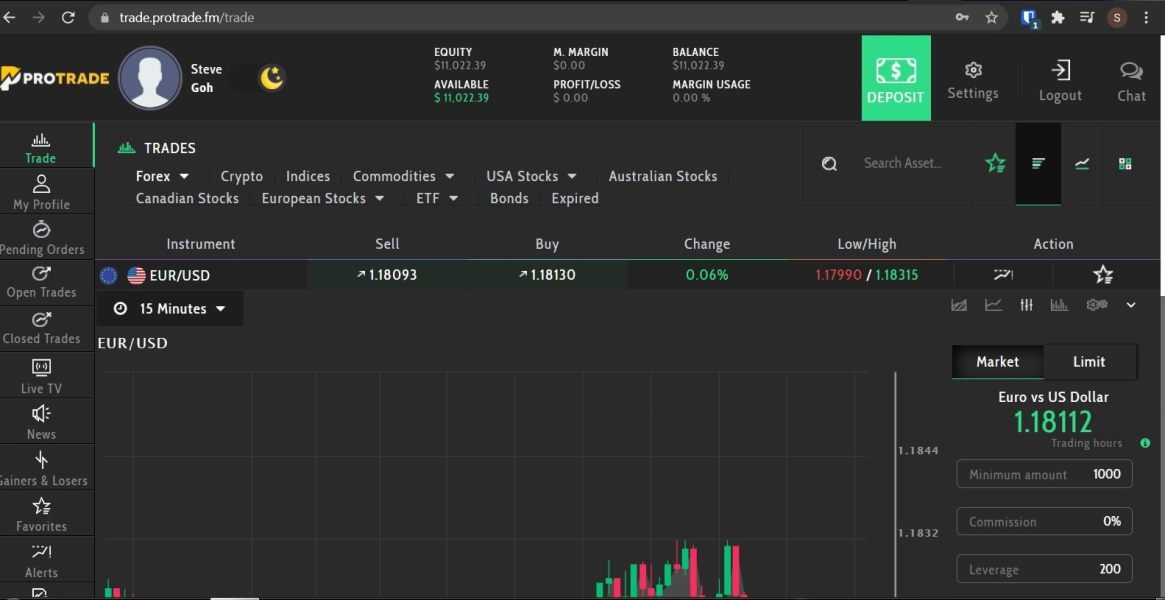

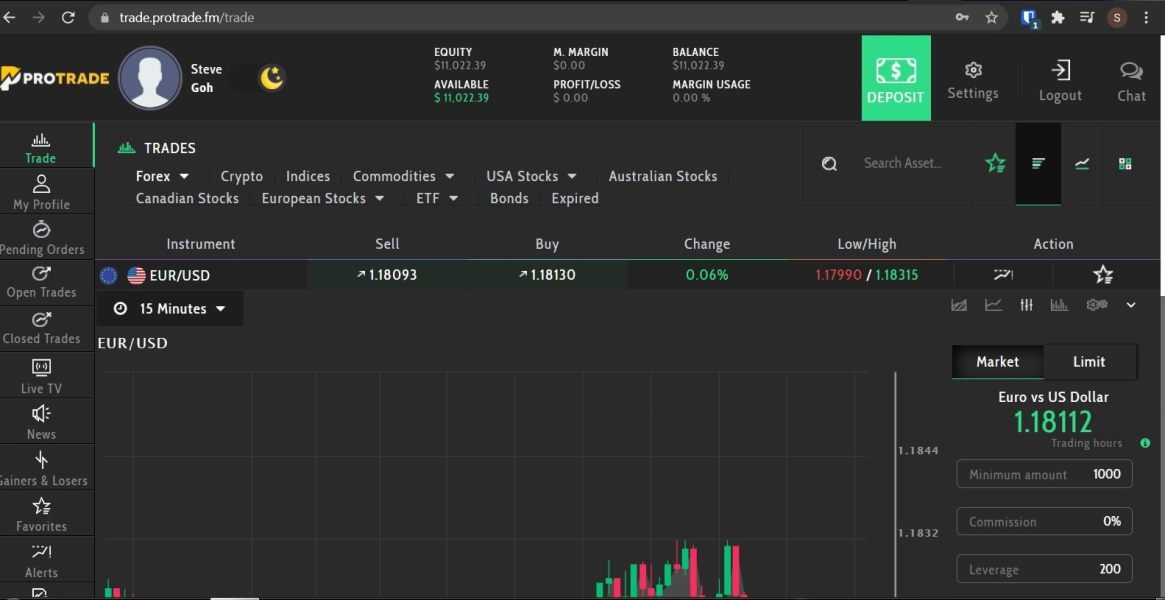

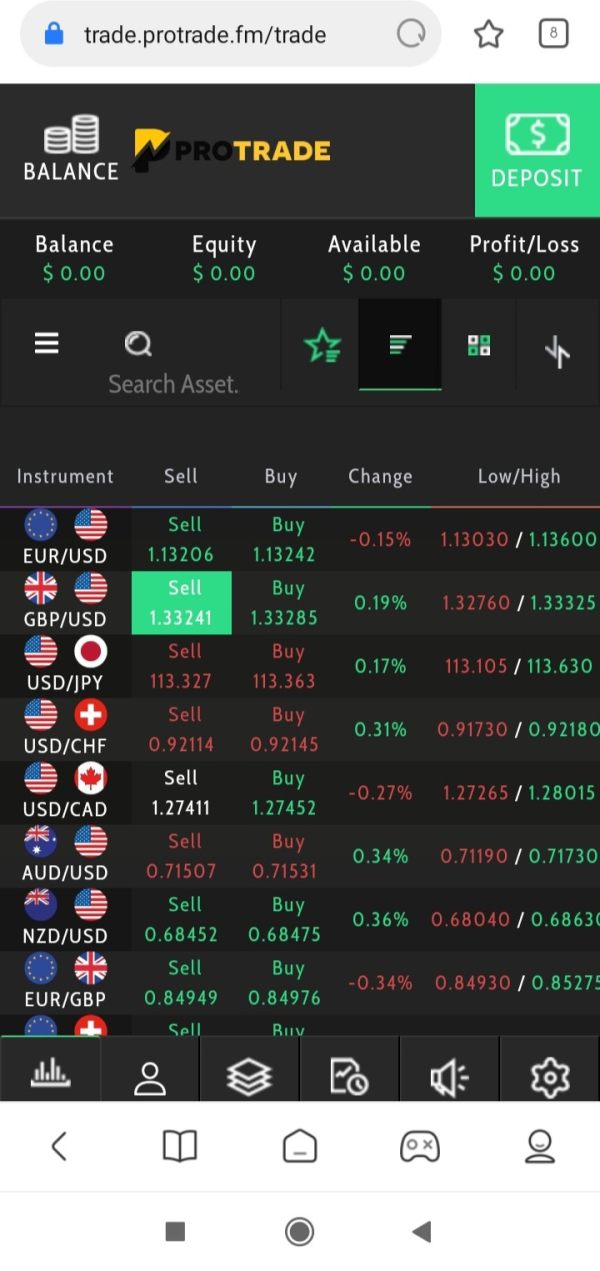

The broker's business model centers around providing comprehensive online trading solutions. However, specific details about platform types such as MetaTrader 4 or MetaTrader 5 integration remain unclear from available sources. Protrade primarily focuses on forex and CFD trading instruments, catering to both retail and institutional clients seeking diversified investment opportunities. The company's emphasis on thematic investing suggests a more sophisticated approach to market exposure. It potentially offers sector-specific or strategy-focused trading options.

However, this protrade review must note significant transparency gaps regarding regulatory oversight. Available information does not clearly identify specific regulatory authorities overseeing Protrade's operations. This represents a considerable concern for potential users prioritizing regulatory protection and compliance standards in their broker selection process.

Regulatory Status: Available information does not specify the regulatory authorities overseeing Protrade's operations. This represents a significant transparency gap that potential users should carefully consider before engaging with the platform.

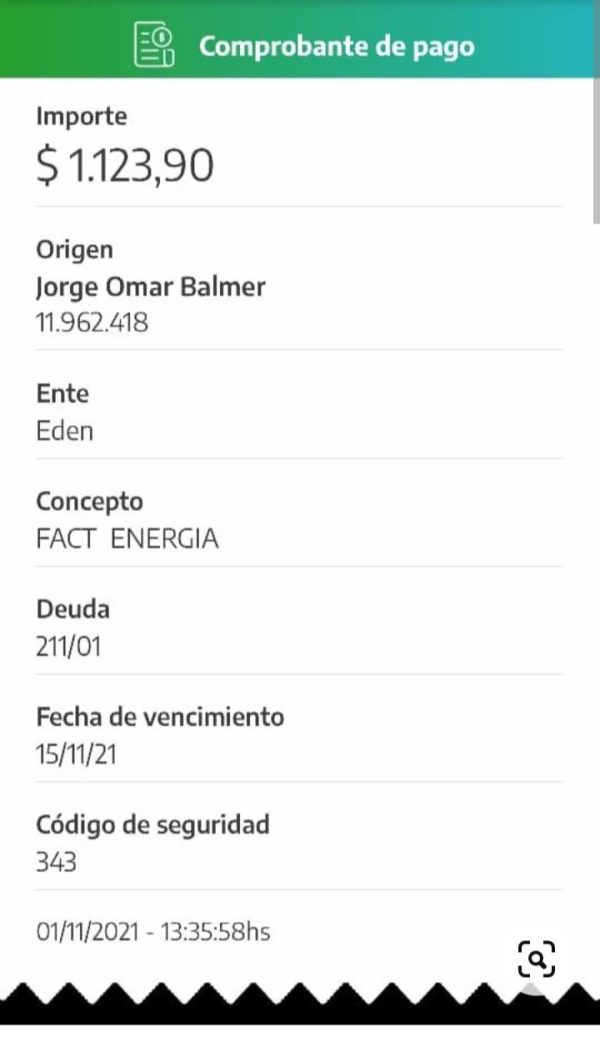

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in available sources. This requires direct inquiry with the broker for comprehensive payment method details.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This necessitates direct contact with Protrade for current account opening requirements and funding thresholds.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available sources. However, traders should inquire directly about any available incentives or welcome packages.

Available Trading Assets: Protrade primarily offers forex and CFD trading instruments, positioning itself as a multi-asset trading solution. However, comprehensive asset lists and specific instrument details require further investigation through direct broker contact.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not readily available in current sources. This represents another area where potential users must seek direct clarification from the broker regarding trading costs and any additional charges.

Leverage Ratios: Available documentation does not specify the leverage ratios offered by Protrade. This is crucial information for traders planning their risk management strategies and position sizing approaches.

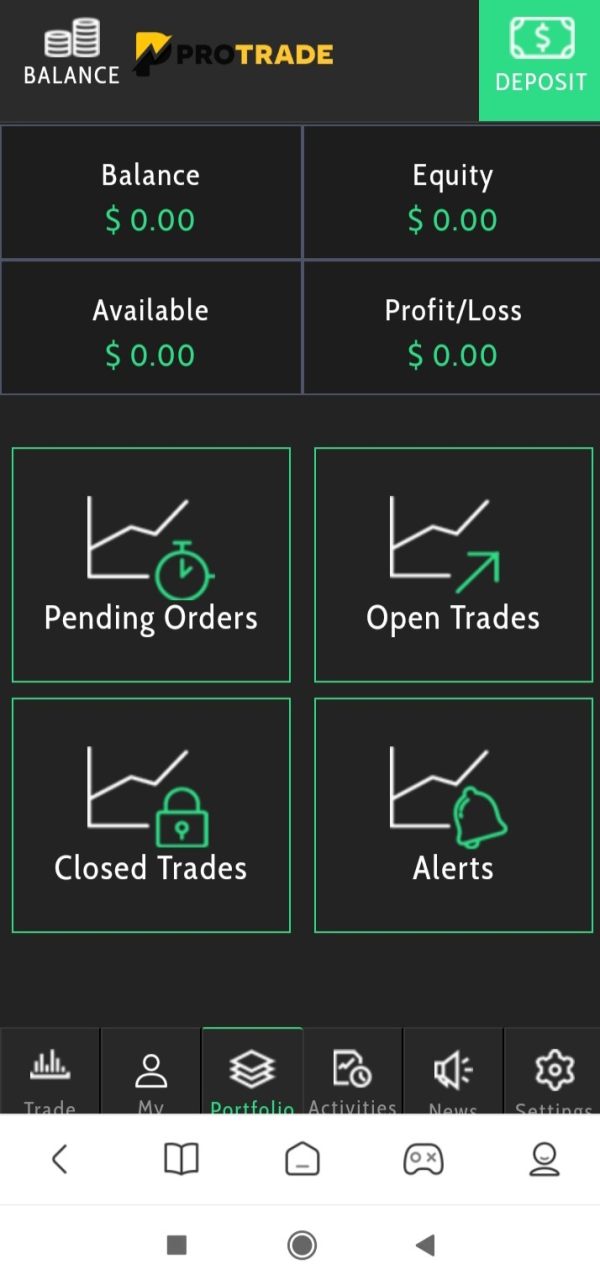

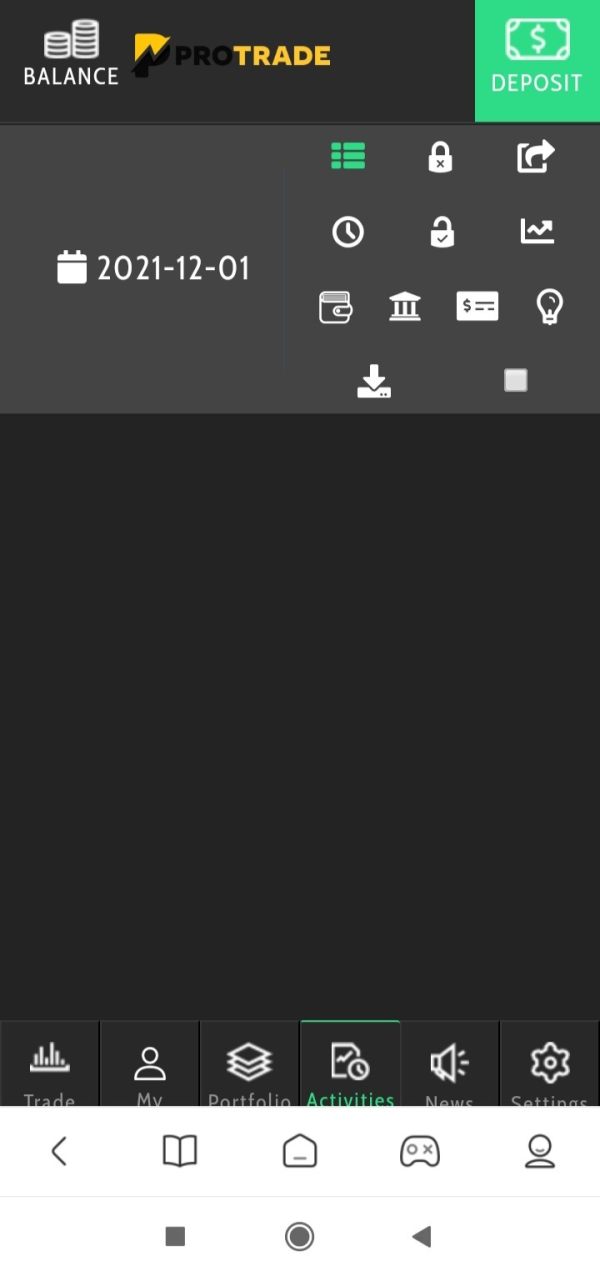

Platform Options: While Protrade offers online trading platforms, specific technical details about platform types, features, and compatibility are not comprehensively detailed in available sources.

Geographic Restrictions: Specific regional limitations and service availability restrictions are not clearly outlined in available documentation. However, the broker's strong presence in India suggests focused regional operations.

Customer Support Languages: Available information does not specify the range of languages supported by Protrade's customer service team. This requires direct inquiry for multilingual support capabilities.

This protrade review emphasizes the need for potential users to conduct thorough due diligence and direct communication with the broker to obtain comprehensive details about these critical service aspects.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

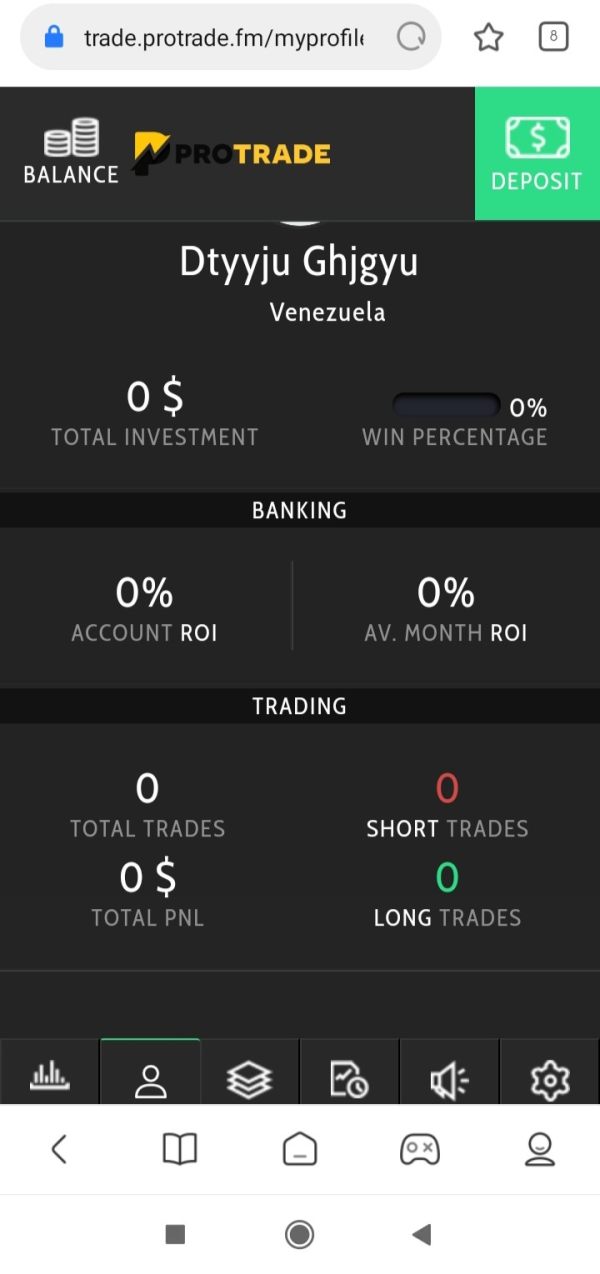

The account conditions evaluation for Protrade reveals significant information gaps that impact the overall assessment. Available sources do not provide comprehensive details about the variety of account types offered, their specific features, or the differentiation between various account tiers. This lack of transparency makes it challenging for potential traders to understand what account options might best suit their trading style and capital requirements.

Minimum deposit requirements remain unspecified in available documentation. This is particularly concerning for traders seeking to understand the financial commitment required to begin trading with Protrade. The absence of clear account opening procedures and verification processes in publicly available information suggests that prospective users must rely on direct contact with the broker for these fundamental details.

The lack of information regarding special account features, such as VIP accounts, Islamic accounts, or professional trader classifications, further limits the ability to assess how well Protrade accommodates diverse trading needs. User feedback specifically addressing account conditions is notably sparse in available sources. This makes it difficult to gauge real-world satisfaction with account-related services.

This protrade review must emphasize that the limited transparency regarding account conditions represents a significant drawback for traders. These traders prioritize clear, upfront information about account structures and requirements before committing to a trading relationship.

Protrade demonstrates stronger performance in the tools and resources category, with user feedback indicating generally positive experiences with the broker's trading tools and platform functionality. The company's positioning as a versatile multi-asset trading solution suggests a comprehensive approach to providing traders with necessary market access tools. However, specific technical details about tool quality and variety remain limited in available sources.

The broker's emphasis on thematic investment platforms indicates a sophisticated approach to market analysis and investment strategy development. This potentially offers traders unique perspectives on market opportunities. However, detailed information about research and analysis resources, including market reports, economic calendars, or technical analysis tools, is not readily available in current documentation.

Educational resource availability remains unclear from available sources. This is an important consideration for traders seeking to develop their skills and market knowledge through broker-provided learning materials. Similarly, information about automated trading support, including Expert Advisor compatibility or algorithmic trading capabilities, is not comprehensively detailed.

User feedback suggests that traders generally find Protrade's tools competitive and functional, with particular emphasis on the price competitiveness aspect. The positive user sentiment regarding tool quality contributes significantly to this category's higher rating. However, more detailed technical specifications would strengthen the overall assessment.

Customer Service and Support Analysis (6/10)

Customer service evaluation reveals mixed user experiences that contribute to a moderate rating in this category. Available user feedback indicates variability in service quality. This suggests that support experiences may depend on factors such as inquiry complexity, timing, or the specific support channels utilized by users.

Specific information about customer service channels, including phone support, live chat availability, or email response systems, is not comprehensively detailed in available sources. This lack of clarity about contact methods and availability represents a transparency concern for traders who prioritize accessible customer support in their broker selection process.

Response time information is notably absent from available documentation. This makes it difficult to assess how quickly users can expect resolution of their inquiries or technical issues. The absence of detailed service level agreements or support hour information further complicates the evaluation of customer service accessibility.

Multilingual support capabilities remain unclear, which is particularly relevant for Protrade's international user base. Given the broker's strong presence in India and positioning as a global trading solution, clarity about language support would be valuable for potential international users. The mixed user feedback suggests room for improvement in service consistency and quality assurance.

Trading Experience Analysis (6/10)

The trading experience evaluation is constrained by limited specific feedback about platform stability, execution speed, and overall trading environment quality. Available sources do not provide detailed user testimonials about platform performance during various market conditions or peak trading hours. These are crucial factors for active traders.

Order execution quality information is notably absent from available documentation. This makes it difficult to assess how effectively Protrade processes trades and whether users experience slippage or execution delays during normal and volatile market conditions. This represents a significant information gap for traders prioritizing execution reliability.

Platform functionality details, including charting capabilities, order types, and trading tools integration, are not comprehensively outlined in available sources. The lack of specific technical performance data, such as uptime statistics or execution speed benchmarks, further limits the ability to thoroughly assess the trading experience quality.

Mobile trading experience information is similarly limited, despite the increasing importance of mobile platform functionality for modern traders. User feedback specifically addressing trading experience aspects is sparse in available sources. This requires this protrade review to note the need for more comprehensive user testimonials about actual trading performance and platform reliability.

Trust and Security Analysis (4/10)

The trust and security evaluation reveals the most concerning aspects of Protrade's service offering, primarily due to the absence of clear regulatory information and the presence of negative user feedback mentioning fraudulent experiences. The lack of specific regulatory authority oversight represents a fundamental concern for traders prioritizing regulatory protection and compliance standards.

Available sources do not detail specific fund security measures, such as segregated account policies, investor compensation schemes, or deposit protection programs. This absence of security information is particularly troubling for traders seeking assurance about fund safety and regulatory recourse in case of disputes or operational issues.

Company transparency concerns are amplified by the limited availability of comprehensive operational details, regulatory compliance information, and clear corporate structure documentation. The presence of user reviews mentioning fraudulent experiences, while not necessarily indicative of widespread issues, raises additional concerns about risk management and user protection.

Industry reputation assessment is complicated by the mixed nature of available feedback and the absence of third-party regulatory ratings or industry certifications. The lack of clear regulatory validation and the presence of negative user experiences contribute significantly to the lower rating in this critical category. This suggests potential users should exercise enhanced caution and due diligence.

User Experience Analysis (5/10)

Overall user satisfaction appears mixed based on available feedback, with experiences ranging from positive comments about price competitiveness to concerning reports about fraudulent activities. This diversity in user feedback suggests that experiences may vary significantly depending on individual circumstances and usage patterns.

Interface design and usability information is not comprehensively available in current sources. This makes it difficult to assess how user-friendly Protrade's platforms are for traders of different experience levels. The absence of detailed user interface reviews or usability assessments represents a gap in understanding the practical aspects of using Protrade's services.

Registration and verification process details are not clearly outlined in available documentation. This is important information for potential users seeking to understand the onboarding experience and time requirements for account activation.

Fund operation experiences, including deposit and withdrawal processes, are not well-documented in available user feedback. However, some negative reviews suggest potential issues in this area. The presence of users reporting problematic experiences indicates areas where Protrade may need to improve operational transparency and user communication.

Based on available feedback, Protrade appears most suitable for cost-conscious traders willing to accept higher risk levels in exchange for competitive pricing. However, users prioritizing regulatory protection and service consistency may want to consider alternative options.

Conclusion

This comprehensive protrade review reveals a broker with notable strengths in price competitiveness and trading tool functionality, but significant concerns regarding regulatory transparency and trust factors. Protrade's positioning as a major CFD broker with substantial institutional presence in India demonstrates operational scale. Yet the absence of clear regulatory oversight information represents a fundamental concern for risk-conscious traders.

The broker appears most suitable for experienced traders who prioritize cost-effectiveness and are comfortable with higher risk tolerance levels, particularly those seeking exposure to thematic investment strategies. However, traders prioritizing regulatory protection, comprehensive customer service, and operational transparency may find better alternatives in the current market.

Key Advantages: Strong price competitiveness, established market presence, and positive user feedback regarding trading tools and platform functionality.

Primary Concerns: Lack of regulatory transparency, mixed user experiences including fraud reports, and limited availability of comprehensive service information.

Potential users should conduct thorough due diligence and consider their risk tolerance carefully before engaging with Protrade's services.