Btceth 2025 Review: Everything You Need to Know

Executive Summary

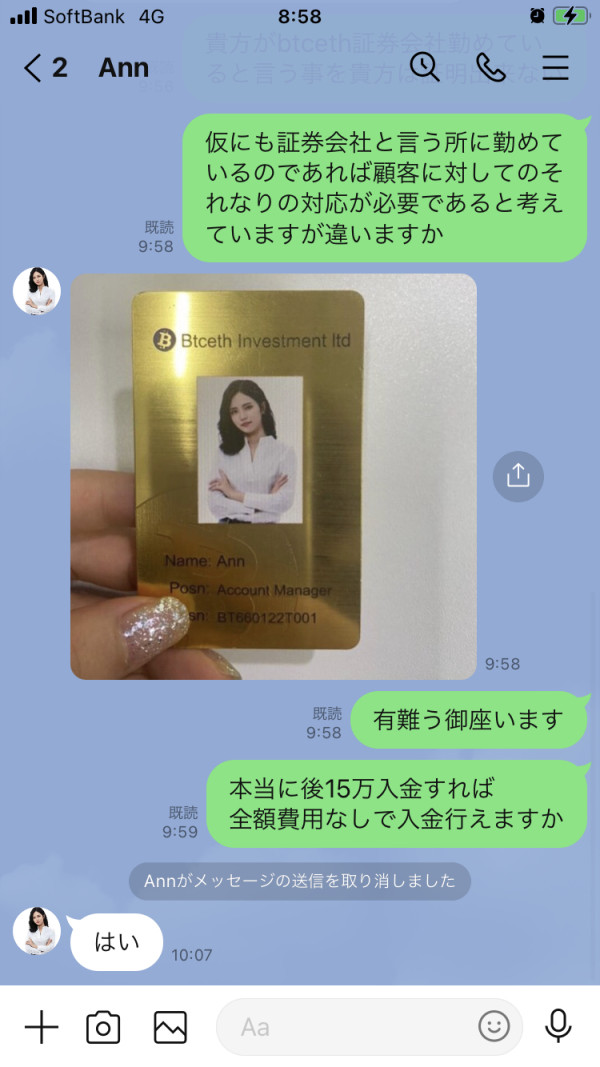

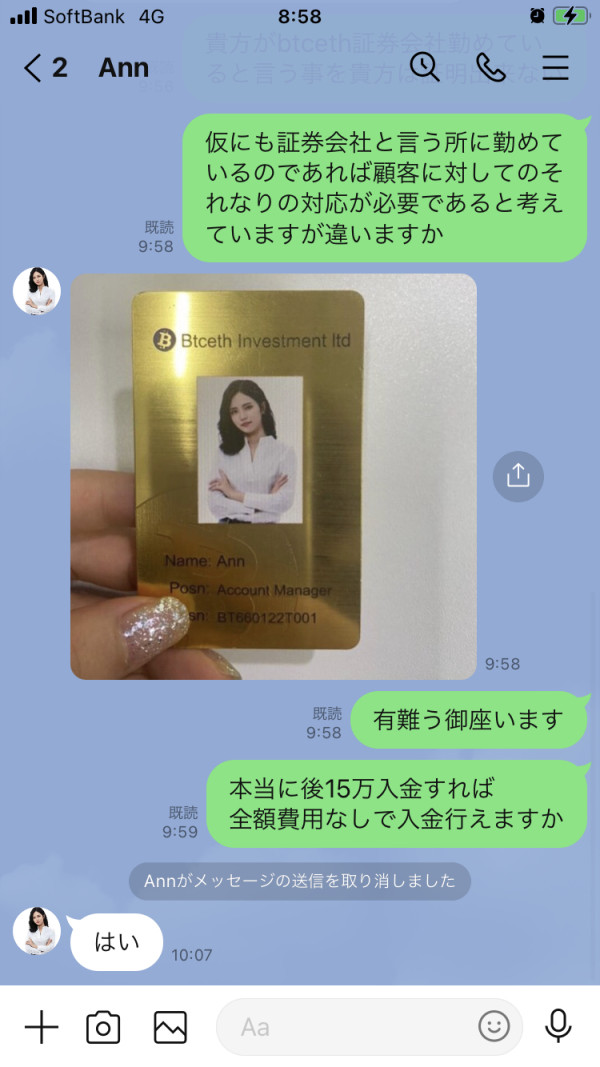

This Btceth review gives you a complete look at a cryptocurrency trading platform that works with well-known exchanges like Bitfinex and Kraken. Btceth says it helps people trade digital assets, especially Bitcoin and Ethereum. But we found big gaps in information about rules, trading details, and what services they really offer.

The platform looks good because it works with trusted crypto exchanges. Bitfinex calls itself "the world's leading digital asset exchange." Kraken says it's "the crypto platform for smarter investing." This setup means they use other companies' systems instead of building their own trading tools.

They seem to target people who already know something about crypto trading. These traders want to buy and sell major digital coins through established exchanges. Our review stays neutral because we couldn't find key details about rules, account terms, customer service, and clear fee information that traders need to make smart choices.

Important Notice

This review uses public information and user feedback. Crypto trading has big risks, and rules change a lot between different countries. The information here reflects what we knew on the review date and might change later.

We suggest doing your own research and talking to financial advisors before investing. Check your local rules before using any crypto trading service since regulations differ everywhere.

Rating Framework

Broker Overview

Btceth works in the crypto trading world by giving access to digital asset exchanges. The company doesn't share details about when it started or its background. They seem to help people trade crypto through partnerships with big platforms instead of running like a regular forex broker with their own systems.

The company uses the technology and trading volume of major crypto exchanges. Bitfinex, one of their partner platforms, says it's a global leader in digital asset trading with advanced features and strong security. Kraken focuses on safe crypto trading with rules compliance in many countries, serving both regular people and professional traders.

The main focus stays on Bitcoin and Ethereum trading. These are the two biggest cryptocurrencies by market value. This narrow approach targets mainstream digital assets instead of offering lots of smaller coins.

We couldn't find clear information about what rules govern Btceth's work. This creates a big information gap for this Btceth review.

Regulatory Status: We couldn't find specific details about which countries regulate them or what compliance rules they follow. This creates uncertainty about oversight and how they protect investors.

Deposit and Withdrawal Methods: They don't clearly explain payment options and how to move money. Working with major exchanges probably means standard crypto deposit and withdrawal options.

Minimum Deposit Requirements: They don't specify how much money you need to start. This might mean flexible account opening or different requirements based on which trading platforms you choose.

Promotional Offers: We didn't see any bonus programs, welcome deals, or loyalty rewards mentioned. They either don't have these programs or don't share much about their marketing.

Tradeable Assets: The service focuses mainly on Bitcoin and Ethereum. These are the most established cryptocurrencies with lots of trading volume and business adoption.

Cost Structure: They don't provide detailed fee schedules, spread information, or commission rates. This makes it hard to know the real cost of trading through their platform. This is a big transparency problem in our Btceth review.

Leverage Options: They don't specify margin trading abilities or leverage amounts. Access through platforms like Bitfinex suggests you might be able to use leveraged products.

Platform Selection: Working with Bitfinex and Kraken gives access to professional trading interfaces. These have advanced charts, order types, and market analysis tools.

Geographic Restrictions: They don't clearly outline which areas have limitations or restrictions.

Customer Service Languages: We couldn't find information about multilingual support options.

Detailed Rating Analysis

Account Conditions Analysis

Looking at account conditions for this Btceth review hits big limits because there's not enough public information. Regular forex brokers usually offer multiple account levels with different features, minimum deposits, and service types. But Btceth's specific account setup stays unclear from what we can access.

Standard crypto trading services often give different access levels based on verification needs and trading amounts. Without detailed papers about Btceth's account opening steps, verification needs, or service levels, potential users can't properly judge if the platform fits their specific needs. The missing information about minimum deposit requirements creates uncertainty for future traders planning their first investments.

We also don't know about special account features like business access, premium support levels, or Islamic-compliant trading options. This limits our ability to judge if the platform works for different trader needs. Account funding and withdrawal steps probably follow industry standards through the partner exchanges, but we lack specific papers about processing times, fees, or supported currencies.

This information gap represents a big concern for traders who want transparent and efficient fund management abilities.

Looking at trading tools and resources shows limited specific information about Btceth's own offerings beyond access to established exchange platforms. Working with Bitfinex and Kraken suggests access to professional trading interfaces, but we don't know how much Btceth adds extra analytical tools, research resources, or educational materials. Professional crypto trading typically needs advanced charting abilities, technical analysis tools, and market research resources.

The partner exchanges provide comprehensive trading interfaces, but Btceth's role in improving or adding to these tools isn't clearly documented in available materials. Educational resources play a crucial role in crypto trading success, especially for newcomers to digital asset markets. The missing information about tutorials, market analysis, or trading guides represents a missed opportunity for comprehensive service evaluation.

We don't know about automated trading support, including API access, algorithmic trading tools, or copy trading features. These abilities are increasingly important for sophisticated crypto traders seeking to implement advanced strategies or automated portfolio management systems.

Customer Service and Support Analysis

Customer service evaluation faces big limitations because there's no detailed information about support channels, response times, and service quality standards. Professional trading platforms typically offer multiple contact methods including live chat, email support, and telephone help, but Btceth's specific customer service framework remains undocumented. Response time expectations and service level agreements are crucial factors for active traders who may need immediate help during volatile market conditions.

The lack of published service standards or customer service commitments creates uncertainty about the level of support traders can expect when facing technical issues or account-related questions. We don't know about multilingual support abilities, which could limit accessibility for international users seeking help in their native languages. Given the global nature of crypto markets, comprehensive language support often distinguishes professional services from basic trading access providers.

Available hours of customer service operation and regional support coverage remain unclear from accessible materials. These factors significantly impact user experience, especially for traders operating across different time zones or needing help during extended market hours common in crypto trading environments.

Trading Experience Analysis

Looking at trading experience through this Btceth review encounters challenges due to limited specific performance data and user experience metrics. Access to established exchanges like Bitfinex and Kraken suggests professional-grade trading abilities, but the unique value and user interface improvements provided by Btceth remain unclear. Platform stability and execution speed are critical factors in crypto trading, where price volatility can create significant slippage risks.

The missing specific performance metrics, uptime statistics, or execution quality data makes it difficult to assess the reliability of trading operations through the platform. Mobile trading abilities have become essential in modern crypto markets, where price movements occur continuously across global time zones. The availability and functionality of mobile applications or responsive web interfaces were not detailed in accessible documentation.

This represents a significant information gap for traders prioritizing mobile accessibility. Order execution quality, including fill rates, slippage statistics, and order type availability, requires detailed analysis that is not possible with current information limitations. These factors directly impact trading profitability and user satisfaction, making their absence particularly notable in comprehensive platform evaluation.

Trust and Security Analysis

Trust assessment reveals significant information gaps regarding regulatory compliance, security measures, and operational transparency. The missing clearly documented regulatory oversight creates uncertainty about investor protection mechanisms and dispute resolution procedures available to platform users. Security measures protecting user funds and personal information were not specifically detailed, though association with established exchanges suggests adherence to industry security standards.

However, the specific role of Btceth in fund custody, security implementation, and risk management remains unclear from available documentation. Corporate transparency, including company registration details, management team information, and operational history, was not provided in accessible materials. This lack of transparency contrasts with industry best practices that emphasize clear corporate disclosure and regulatory compliance documentation.

Third-party audits, security certifications, and regulatory approvals that typically validate crypto service providers were not mentioned in available information. These credentials serve as important trust indicators for users evaluating platform reliability and regulatory compliance standards.

User Experience Analysis

User experience evaluation encounters big limitations due to the missing detailed interface descriptions, user feedback compilation, and satisfaction metrics. The overall user journey, from account registration through active trading, lacks comprehensive documentation in accessible materials. Interface design quality and ease of use represent crucial factors in trading platform selection, especially for users transitioning from traditional financial markets to crypto trading.

The specific user interface elements, navigation structure, and feature accessibility provided by Btceth remain undocumented in available sources. Registration and verification procedures, while likely following standard crypto exchange protocols, lack specific documentation regarding required documentation, processing timeframes, and verification level requirements. These procedural details significantly impact initial user experience and platform accessibility.

User feedback analysis and satisfaction surveys that typically inform comprehensive platform evaluations were not available for inclusion in this review. The missing documented user experiences, common complaints, or satisfaction metrics limits the depth of user experience assessment possible within current information constraints.

Conclusion

This Btceth review concludes with a neutral assessment based on limited available information about the crypto trading service. The platform's association with established exchanges like Bitfinex and Kraken suggests access to professional trading infrastructure, but significant information gaps regarding regulatory compliance, detailed trading conditions, and comprehensive service offerings prevent a more definitive evaluation. The service appears most suitable for experienced crypto traders who understand the risks associated with digital asset trading and can navigate platforms with limited disclosed information.

The focus on Bitcoin and Ethereum trading provides access to the most established crypto markets, though the missing detailed cost structures and service terms requires cautious consideration. The primary advantages include access to reputable exchange platforms and focus on major cryptocurrencies, while significant disadvantages center on limited transparency regarding regulatory status, fees, and comprehensive service offerings. Potential users should conduct thorough independent research and consider alternative platforms with more comprehensive disclosure before making trading decisions.