Is Btceth safe?

Pros

Cons

Is Btceth A Scam?

Introduction

Btceth, a relatively new player in the forex market, positions itself as a broker offering various trading instruments, including cryptocurrencies, forex, and CFDs. As the cryptocurrency landscape continues to evolve, traders are increasingly drawn to platforms like Btceth for their potential to generate profits. However, the rapid growth of the forex and cryptocurrency markets has also led to an influx of unregulated and potentially fraudulent brokers. Therefore, it is essential for traders to carefully evaluate the credibility and safety of any trading platform before investing their hard-earned money. This article employs a comprehensive framework to assess Btceth's legitimacy, focusing on regulatory compliance, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of a trading platform. Regulation serves as a form of consumer protection, ensuring that brokers adhere to strict guidelines and standards. Btceth's regulatory status is particularly concerning. According to available information, Btceth operates under an unauthorized status with the NFA, which raises significant red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0539113 | United States | Unauthorized |

The lack of oversight from a reputable regulatory body such as the FCA, ASIC, or SEC means that Btceth is not subject to the stringent requirements that protect investors. Moreover, the absence of a functional website adds to the skepticism surrounding the broker's operations. Without proper regulatory oversight, traders are left vulnerable to potential scams and fraudulent activities. This lack of regulatory compliance significantly diminishes the broker's credibility, making it essential for traders to exercise caution when considering Btceth as a trading platform.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its trustworthiness. Btceth, formally known as Btceth Investment Ltd, claims to be headquartered in the United Kingdom. However, details about its history, ownership structure, and management team are scarce. The lack of transparency raises concerns about the broker's accountability and operational integrity.

Furthermore, the absence of information regarding the management team's experience and qualifications is alarming. A well-established broker typically provides information about its leadership, showcasing their expertise in financial markets. Without this information, potential investors may question the broker's ability to navigate the complexities of the forex and cryptocurrency markets effectively. The overall opacity surrounding Btceth's operations serves as a warning sign for traders considering this platform for their investment needs.

Trading Conditions Analysis

An essential aspect of any trading platform is its fee structure and trading conditions. Btceth's trading conditions appear to be less favorable compared to industry standards. The broker imposes a minimum deposit requirement of $1,000, which can be a significant barrier for novice traders or those with limited capital.

| Fee Type | Btceth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 25 pips | 1-3 pips |

| Commission Model | Zero Commission | Varies (0.1% - 0.5%) |

| Overnight Interest Range | Not Disclosed | Varies (0.5% - 2%) |

The spread for major currency pairs starting at 25 pips is considerably higher than the industry average, which typically ranges from 1 to 3 pips. This discrepancy indicates that traders using Btceth may incur higher trading costs, which can erode their profit margins. Additionally, the lack of transparency regarding overnight interest rates raises further concerns about the broker's fee structure. Traders should be wary of any platform that does not clearly disclose its fees, as hidden costs can lead to unexpected losses.

Customer Funds Security

The security of customer funds is paramount when selecting a trading platform. Btceth's lack of regulatory oversight raises significant concerns about the safety of investors' funds. The broker's website does not provide any information regarding fund segregation, investor protection schemes, or negative balance protection policies.

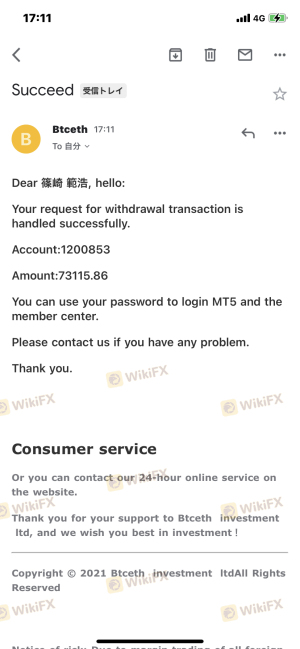

In regulated environments, brokers are typically required to maintain segregated accounts for client funds, ensuring that these funds are kept separate from the company's operational funds. This practice protects investors in the event of the broker's insolvency. However, Btceth's unauthorized status with the NFA suggests that such protective measures may not be in place. Additionally, any historical issues related to fund safety or withdrawal problems further exacerbate concerns regarding the broker's reliability. Traders should prioritize platforms that offer robust security measures and transparent information about fund protection.

Customer Experience and Complaints

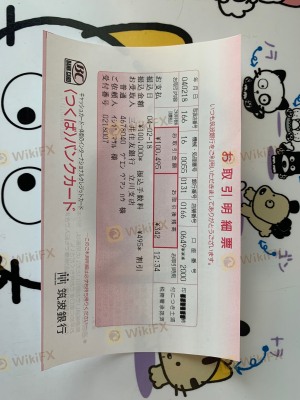

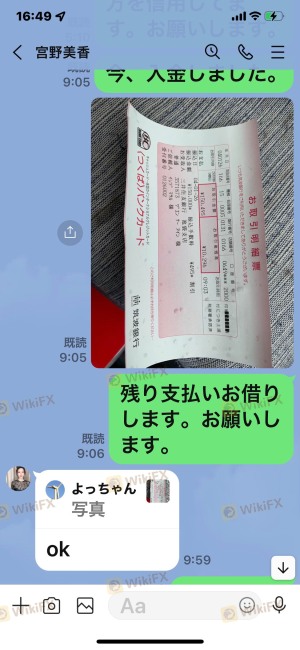

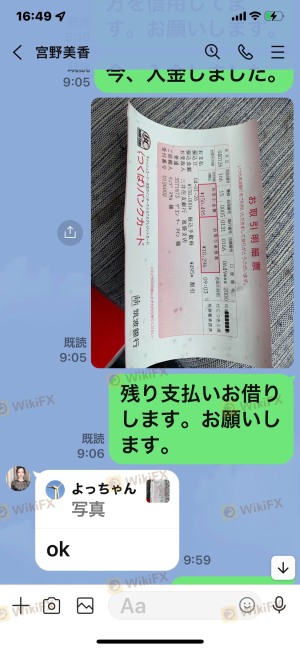

Analyzing customer feedback is crucial for understanding the overall user experience on a trading platform. Btceth has garnered a number of negative reviews and complaints from users, raising questions about its reliability. Common complaints include withdrawal issues, lack of customer support, and difficulties in accessing funds.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency | High | Nonexistent |

The severity of these complaints indicates that many users have faced significant challenges while using Btceth. The company's slow response to customer inquiries further compounds the issue, leaving traders feeling unsupported and frustrated. A lack of transparency in operations only adds to the dissatisfaction among users. Potential investors should approach Btceth with caution, as a pattern of unresolved complaints can be indicative of deeper systemic issues within the brokerage.

Platform and Execution

The quality of the trading platform and execution speed are critical factors for traders. Btceth claims to offer a user-friendly trading platform; however, the lack of access to its website raises concerns about its reliability. Traders expect a stable and efficient platform that allows for seamless execution of trades.

Additionally, any indications of slippage or order rejections can significantly impact a trader's experience. Unfortunately, there is insufficient data on Btceth's execution quality, making it difficult to gauge its performance accurately. Traders should be cautious of platforms that do not provide clear information about their execution policies or show evidence of platform manipulation.

Risk Assessment

Using Btceth carries several risks that traders should consider before engaging with the platform. The broker's unauthorized status, high minimum deposit, and negative customer feedback are significant risk factors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight, increasing risk of fraud. |

| Fund Security | High | Lack of information on fund protection measures. |

| Customer Support | Medium | Poor response to complaints and user issues. |

Given these risks, it is crucial for traders to weigh their options carefully. Engaging with an unregulated broker like Btceth can lead to significant financial losses, especially for inexperienced traders. It is advisable to consider alternative, regulated brokers that prioritize security and transparency.

Conclusion and Recommendations

After a thorough evaluation of Btceth, it is clear that the broker presents several red flags that warrant caution. The lack of regulatory oversight, high trading costs, and negative customer feedback indicate that Btceth may not be a safe option for traders.

For those considering trading in the forex or cryptocurrency markets, it is advisable to seek out reputable, regulated brokers that offer transparent trading conditions and robust customer support. Alternatives such as Coinbase, Binance, and eToro provide safer environments for trading, with established regulatory frameworks and positive user experiences. In summary, potential investors should exercise extreme caution when dealing with Btceth and prioritize platforms that demonstrate a commitment to security and customer satisfaction.

Is Btceth a scam, or is it legit?

The latest exposure and evaluation content of Btceth brokers.

Btceth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Btceth latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.