Is PT FINTECH safe?

Business

License

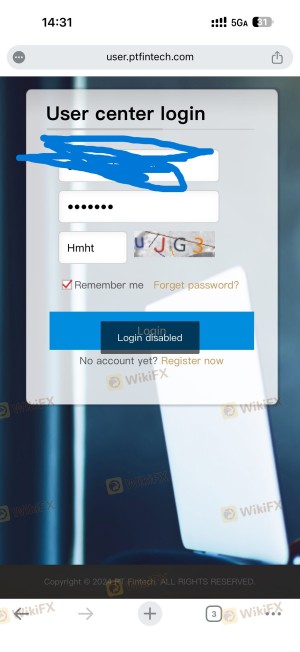

Is PT Fintech Safe or Scam?

Introduction

PT Fintech is a relatively new entrant in the forex trading market, operating as an online trading platform that claims to offer a variety of financial instruments, including forex, indices, precious metals, energy commodities, and cryptocurrencies. As the forex market continues to grow, traders are increasingly drawn to platforms like PT Fintech, which promise high leverage and low minimum deposits. However, with the rise of online trading, the risks associated with unregulated brokers have also escalated, prompting traders to exercise caution. This article aims to objectively assess whether PT Fintech is a safe trading option or a potential scam, utilizing a combination of narrative analysis and structured information based on the latest reviews and reports.

Regulation and Legitimacy

One of the most critical factors in evaluating the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect clients. Unfortunately, PT Fintech currently operates without any valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that PT Fintech is not held accountable by any financial authority, leading to a higher risk of fraudulent activities. Without regulatory oversight, traders have little recourse in the event of disputes or issues with withdrawals. This absence of regulation is a major red flag and calls into question the broker's commitment to fair trading practices. Moreover, the company's operational history is short, further complicating the evaluation of its legitimacy.

Company Background Investigation

PT Fintech, registered under the name Po Tai Bullion (Hong Kong) Limited, was established in 2024 and is based in China. The company claims to provide a user-friendly trading experience, but its short history raises questions about its stability and reliability. The management team behind PT Fintech has not been extensively documented, and the lack of transparency regarding its ownership structure is concerning.

The company's website provides limited information about its operations, which hampers the ability of potential clients to conduct thorough due diligence. Transparency is crucial in the financial industry, and PT Fintech's vague disclosures make it difficult for traders to assess the broker's trustworthiness. The absence of a clear history and ownership details further complicates the evaluation of whether PT Fintech is safe or a scam.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is essential to analyze the fee structure and trading costs. PT Fintech advertises a minimum deposit of just $10 and leverage of up to 1:500, which may seem attractive to new traders. However, the lack of clarity regarding fees and commissions can lead to unexpected costs that may not be immediately apparent.

| Fee Type | PT Fintech | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.0 pips | 1.5-2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of a clear commission structure is particularly concerning, as traders may find themselves facing hidden fees that could significantly impact their profitability. Additionally, the lack of information on overnight interest rates raises questions about the overall cost of trading with PT Fintech. Without transparent trading conditions, traders are left to navigate potential pitfalls, making it difficult to determine whether PT Fintech is safe.

Client Fund Security

The safety of client funds is paramount in any trading environment. PT Fintech has not provided any detailed information regarding its fund security measures, such as whether client funds are held in segregated accounts or if there are any investor protection schemes in place.

The absence of such protections increases the risk of losing funds, particularly in the event of insolvency or fraudulent activities. Furthermore, the lack of historical data regarding any past security incidents or controversies raises further concerns about the broker's commitment to safeguarding client assets. The overall lack of transparency regarding fund security measures makes it challenging to assess whether PT Fintech is a safe choice for traders.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall trading experience with PT Fintech. Reviews from users indicate a mixed bag of experiences, with several complaints highlighting issues related to withdrawal delays and poor customer support. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Account Manipulation | High | No resolution |

For instance, some users have reported being unable to withdraw their funds after multiple requests, leading to frustration and distrust in the platform. The slow response from customer support has only exacerbated these issues, leaving traders feeling unsupported. Such complaints suggest that PT Fintech may not prioritize customer service, raising further doubts about whether it is a trustworthy broker.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a smooth trading experience. PT Fintech utilizes the popular MetaTrader 4 (MT4) platform, which is known for its advanced features and user-friendly interface. However, user experiences regarding execution quality and stability have been inconsistent.

Traders have reported issues such as slippage and order rejections, which can significantly impact trading outcomes. Furthermore, there are concerns about potential platform manipulation, as some users have experienced sudden changes in spreads and execution during volatile market conditions. These issues raise questions about the overall integrity of PT Fintech's trading environment, making it imperative for traders to weigh the risks carefully.

Risk Assessment

Using PT Fintech comes with a range of risks that traders should be aware of. The absence of regulation, unclear fee structures, and poor customer support are all significant risk factors that could lead to financial losses.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | Medium | Lack of transparency in fees and commissions. |

| Operational Risk | High | Reports of withdrawal issues and customer complaints. |

To mitigate these risks, traders should consider starting with a demo account to test the platform before committing real funds. Additionally, it is advisable to limit the amount of capital invested initially and to remain vigilant regarding any unusual activities on the account.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about whether PT Fintech is safe or a scam. The lack of regulatory oversight, unclear trading conditions, and numerous customer complaints indicate that traders should exercise caution when considering this broker. While PT Fintech offers attractive trading conditions such as low minimum deposits and high leverage, these factors are overshadowed by the potential risks involved.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, which provide greater assurances regarding fund safety and trading practices. Overall, while PT Fintech may appeal to some traders, the associated risks suggest that it may be prudent to explore other, more established options in the forex market.

Is PT FINTECH a scam, or is it legit?

The latest exposure and evaluation content of PT FINTECH brokers.

PT FINTECH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PT FINTECH latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.