Is BOVEI PRO safe?

Pros

Cons

Is Bovei Safe or Scam?

Introduction

Bovei Financial Limited, operating through its platform Bovei FX, has emerged as a player in the forex market since its inception in 2024. Positioned as a multi-asset broker, Bovei claims to offer a diverse range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. However, the increasing number of fraudulent brokers in the financial sector necessitates that traders exercise caution and conduct thorough evaluations before engaging with any broker. This article aims to objectively assess Bovei's legitimacy by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a comprehensive review of various online sources, user testimonials, and regulatory information.

Regulation and Legitimacy

Regulation is a critical factor in determining the legitimacy of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and the protection of client funds. In the case of Bovei, the broker claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States and the Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000273101708 | United States | Verified |

| ASIC | 001309549 | Australia | Verified |

While Bovei is listed under these regulatory bodies, it is important to note that FinCEN primarily oversees anti-money laundering regulations and does not provide the same level of investor protection as other regulatory agencies. Additionally, Bovei's ASIC license is limited to providing financial product advice and does not cover retail client trading, raising concerns about the broker's ability to operate legally in the forex market. The lack of a robust regulatory framework may pose risks to traders, as unregulated or poorly regulated brokers can engage in questionable practices without accountability.

Company Background Investigation

Bovei Financial Limited was established in 2024, with its headquarters purportedly located in the United Kingdom. However, the broker's ownership structure remains unclear, and there is limited information available regarding its management team. A transparent company structure is essential for building trust with clients, as it indicates accountability and reliability.

Moreover, Bovei's website lacks detailed information about its history, key personnel, and operational practices, which further diminishes its credibility. Transparency is a hallmark of reputable brokers, and Bovei's failure to disclose essential information raises red flags. A lack of clear communication regarding the company's background can lead potential clients to question its integrity and reliability.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Bovei claims to provide competitive spreads and a tiered commission structure, but specific details about these conditions are not readily available on its website.

| Fee Type | Bovei FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | $0.01 - $0.005 per share |

| Overnight Interest Range | Not disclosed | 0.5% - 3% |

The absence of clear information regarding spreads, commissions, and overnight interest raises concerns about potential hidden fees that could affect traders' bottom lines. Additionally, the minimum deposit requirement of $500 may deter some traders, particularly beginners who prefer to start with smaller amounts. The lack of transparency in fee structures is often associated with less reputable brokers, further contributing to the skepticism surrounding Bovei.

Client Fund Security

The security of client funds is paramount when choosing a forex broker. Bovei claims to implement measures such as segregated accounts for client funds, which is a standard practice among legitimate brokers. However, the broker's website does not provide detailed information about its policies regarding investor compensation or negative balance protection.

Historically, Bovei has not faced any significant controversies regarding fund security, but the absence of clear information on its policies raises concerns. Traders should be wary of brokers that do not explicitly outline their fund protection measures, as this lack of transparency can indicate potential risks.

Customer Experience and Complaints

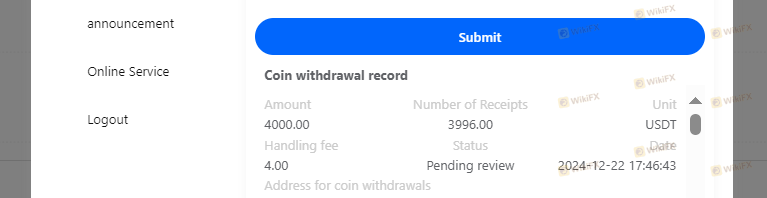

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Bovei Financial Limited reveal a mixed bag of experiences, with some users praising the platform's features while others report significant issues. Common complaints include difficulties withdrawing funds, lack of responsive customer support, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

| High-Pressure Sales Tactics | High | Poor |

Several users have reported losing substantial amounts of money and experiencing unresponsive customer service when attempting to resolve issues. These patterns of complaints are characteristic of less reputable brokers, leading many to advise caution when dealing with Bovei.

Platform and Trade Execution

The trading platform is a crucial aspect of a broker's offering, as it directly impacts the trading experience. Bovei provides a proprietary trading platform that is designed for both desktop and mobile users. However, there have been reports of platform instability, including slow loading times and execution delays.

Additionally, users have expressed concerns about slippage and order rejections, which can significantly impact trading outcomes. The absence of a well-established platform, such as MetaTrader 4 or 5, raises questions about the broker's commitment to providing a reliable trading environment.

Risk Assessment

Engaging with Bovei Financial Limited presents several risks that potential clients should consider. The following risk assessment summarizes the key concerns associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited regulatory oversight and potential legal issues. |

| Fund Security | Medium | Lack of transparency regarding fund protection measures. |

| Customer Support | High | Numerous complaints regarding unresponsive customer service. |

| Platform Reliability | Medium | Reports of platform instability and execution issues. |

To mitigate these risks, traders should conduct thorough research before opening an account, consider starting with a small deposit, and remain vigilant regarding any unusual activity on their accounts.

Conclusion and Recommendations

In conclusion, Bovei Financial Limited exhibits several concerning traits that may indicate it is not a trustworthy broker. The lack of robust regulatory oversight, limited transparency regarding fees and company background, and numerous customer complaints raise significant red flags. While some users report positive experiences, the overall sentiment leans towards caution.

For traders considering Bovei, it is crucial to weigh the potential risks against the benefits. If you prioritize safety and reliability, it may be wise to explore alternative brokers with a proven track record, strong regulatory oversight, and positive customer feedback. Some reputable alternatives include brokers like IG, OANDA, and Forex.com, which offer comprehensive trading services and robust client protections. Ultimately, conducting thorough research and exercising caution is essential in the ever-evolving world of forex trading.

Is BOVEI PRO a scam, or is it legit?

The latest exposure and evaluation content of BOVEI PRO brokers.

BOVEI PRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOVEI PRO latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.