PT Fintech 2025 Review: Everything You Need to Know

Executive Summary

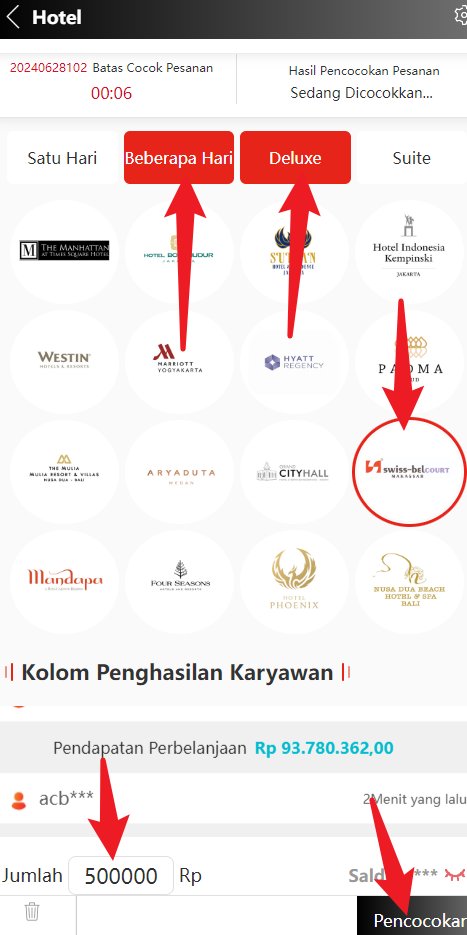

PT Fintech is a new forex broker that started in 2024. The company operates without regulatory oversight while offering diverse trading instruments and platforms suitable for traders with low risk tolerance. This pt fintech review reveals that the broker positions itself as an accessible entry point into forex trading. The minimum deposit requirement is just $10 and the broker supports the widely recognized MT4 trading platform.

The broker primarily targets beginners and small-scale traders seeking low-barrier investment opportunities. PT Fintech provides access to multiple asset classes including forex pairs, precious metals, index CFDs, energy CFDs, and cryptocurrency CFDs. However, as an unregulated entity based in China, potential clients should carefully consider the associated risks before committing funds. The extremely low minimum deposit threshold makes trading accessible to virtually anyone interested in forex markets.

The MT4 platform support ensures traders have access to professional-grade trading tools and technical analysis capabilities. However, the lack of regulatory supervision represents a significant consideration for risk-conscious traders.

Important Notice

PT Fintech operates as an unregulated international forex broker. This may present varying legal and compliance risks across different jurisdictions. Traders should be aware that unregulated brokers typically offer fewer protections compared to their regulated counterparts, particularly regarding fund security and dispute resolution mechanisms.

This review is based on publicly available information and market feedback. Due to the broker's recent establishment and limited operational history, comprehensive user ratings and detailed client testimonials are not yet widely available. Potential clients are advised to conduct thorough due diligence before opening accounts.

Rating Framework

Broker Overview

PT Fintech emerged in 2024 as an international forex broker headquartered in China. The company focuses on providing comprehensive trading services for forex and other financial instruments to a global clientele. The company has positioned itself as a technology-driven broker, leveraging modern trading infrastructure to deliver competitive services to retail traders worldwide. Despite its recent establishment, PT Fintech demonstrates ambitions to capture market share in the competitive forex brokerage industry.

The broker's business model centers on providing accessible trading opportunities through reduced entry barriers and user-friendly platforms. While PT Fintech currently operates without regulatory oversight, the company appears committed to building a sustainable business by offering diverse trading instruments and maintaining competitive trading conditions. This pt fintech review indicates that the broker targets primarily novice traders and those seeking cost-effective trading solutions.

PT Fintech supports the MetaTrader 4 platform, one of the most widely adopted trading software solutions globally. This enables users to access sophisticated technical analysis tools and automated trading capabilities. The broker's asset portfolio encompasses forex currency pairs, precious metals, index CFDs, energy CFDs, and cryptocurrency CFDs, providing traders with diversification opportunities across multiple markets. However, clients should exercise caution given the absence of specific regulatory information and the inherent risks associated with unregulated brokers.

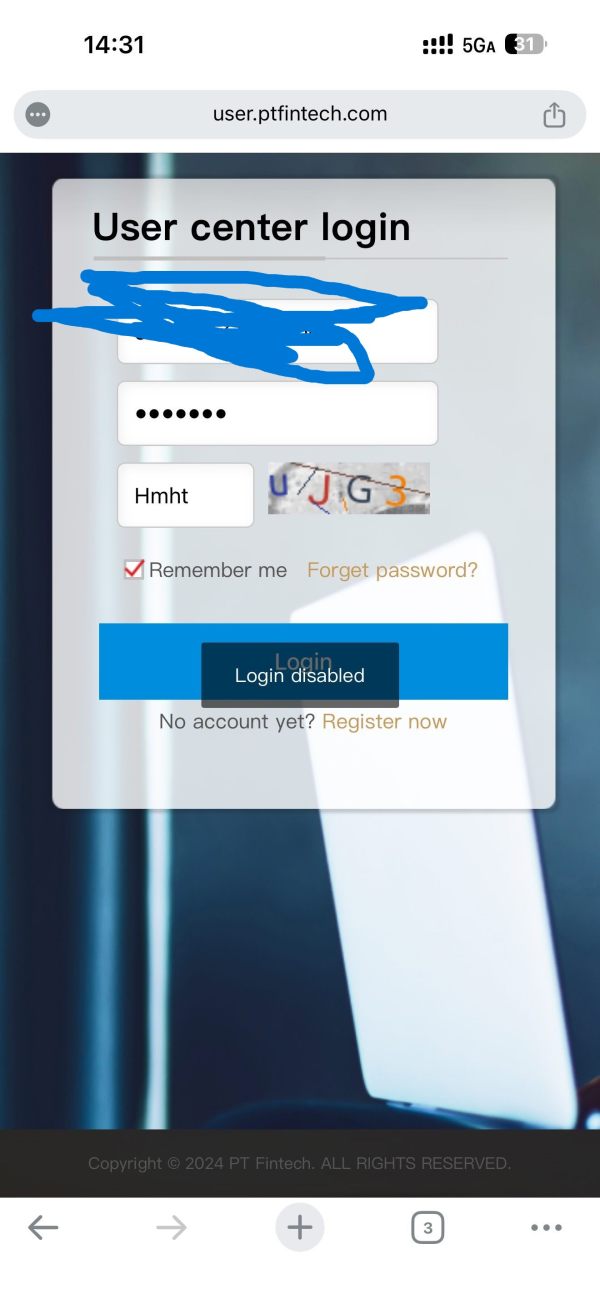

Regulatory Status: PT Fintech currently operates without regulatory supervision from recognized financial authorities. This presents potential compliance risks for clients in various jurisdictions.

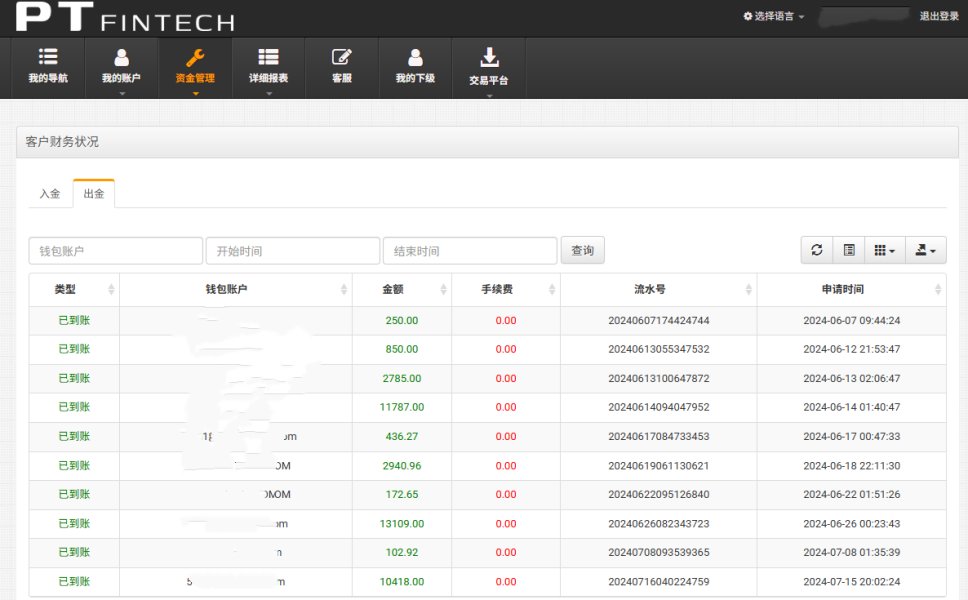

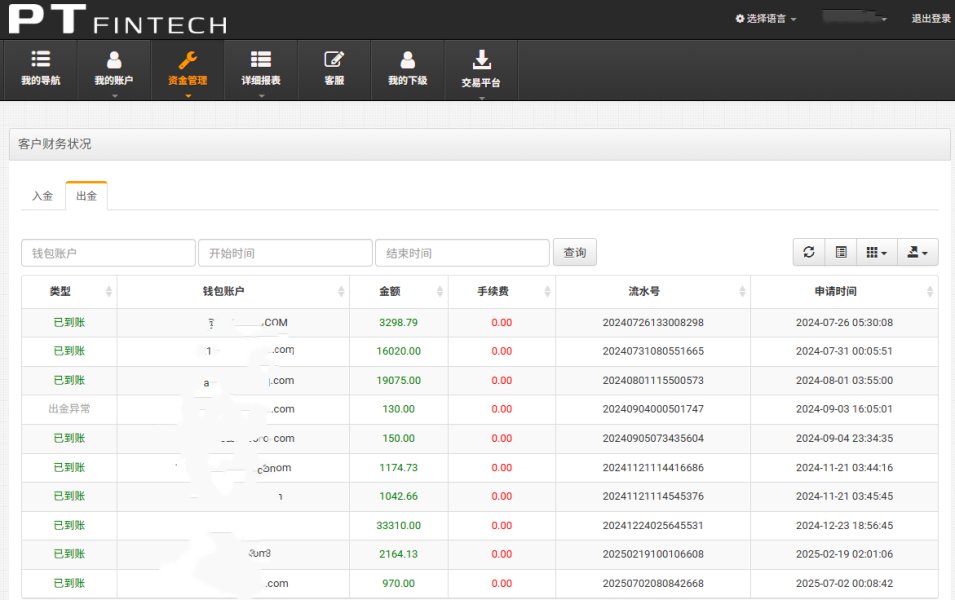

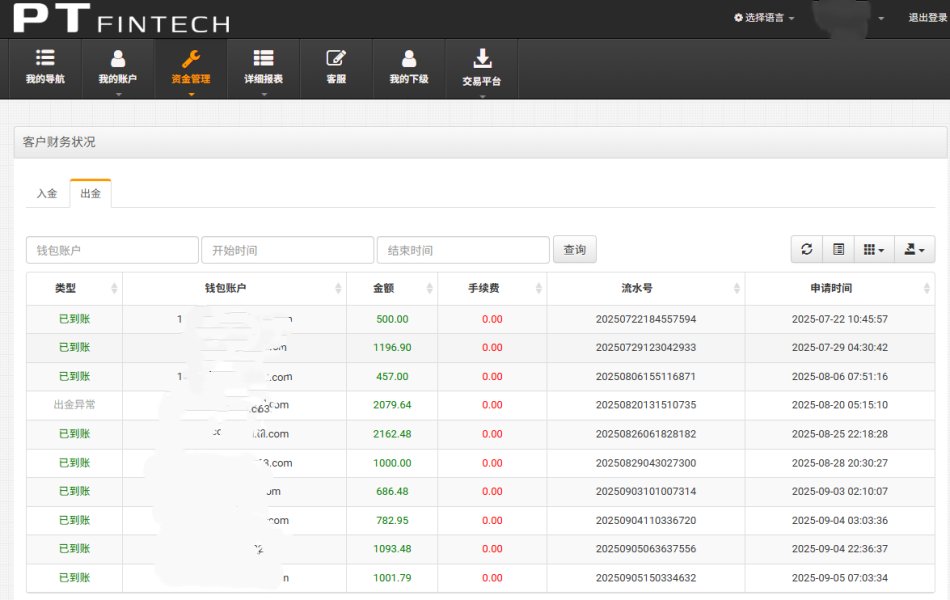

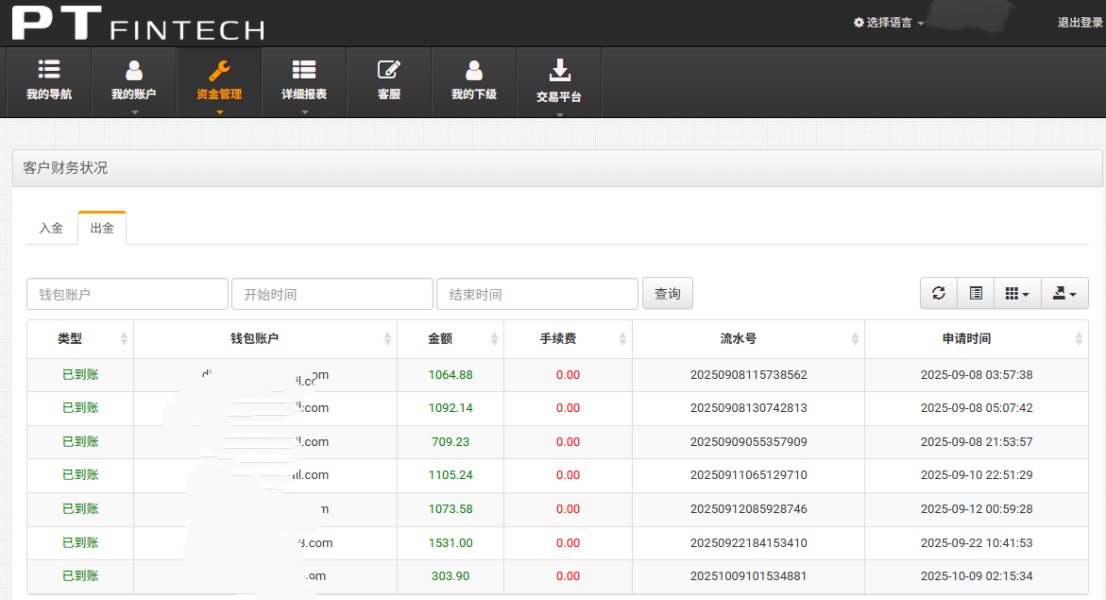

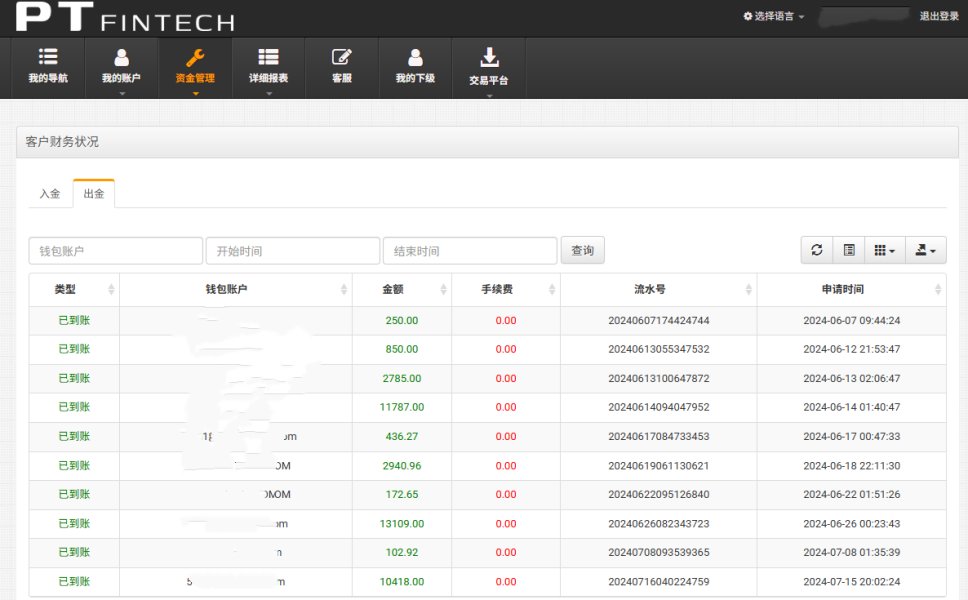

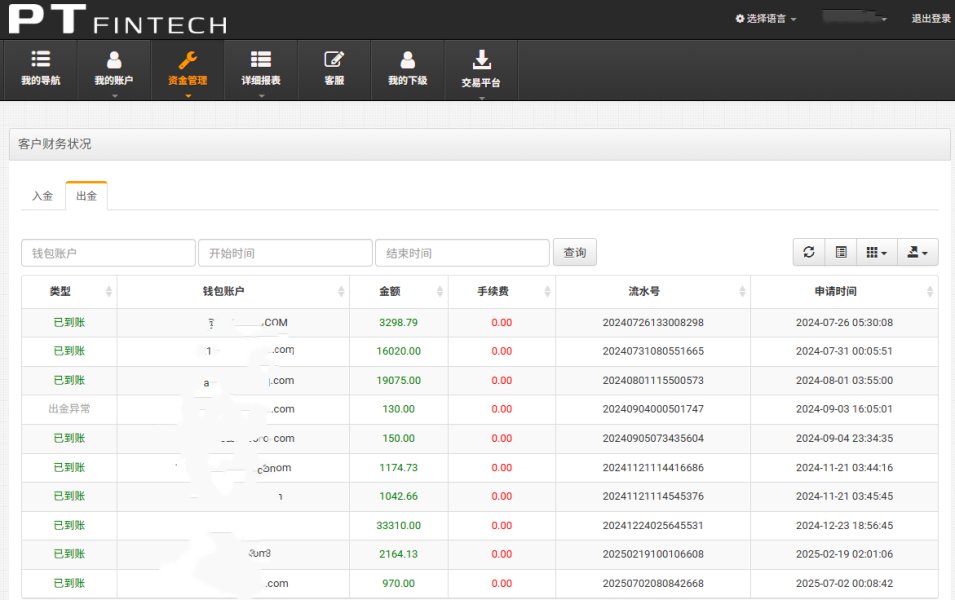

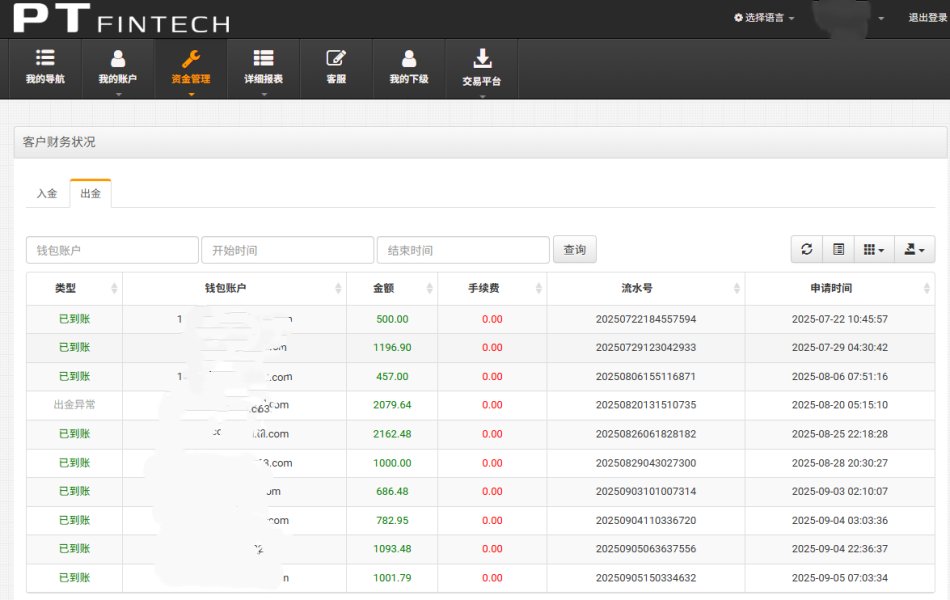

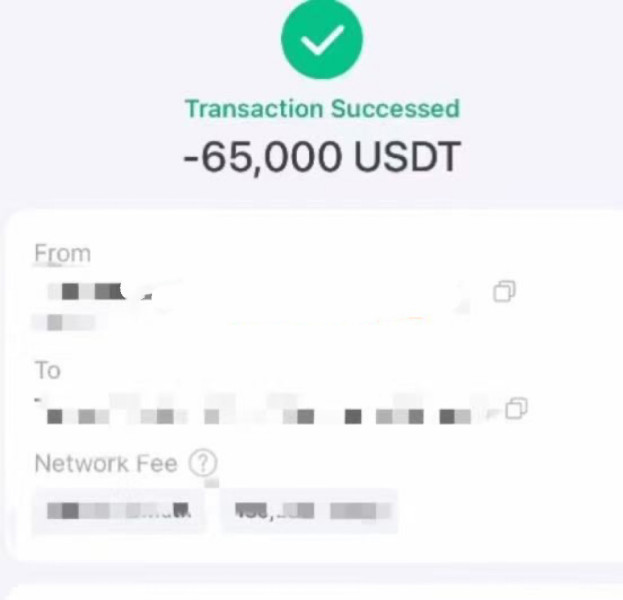

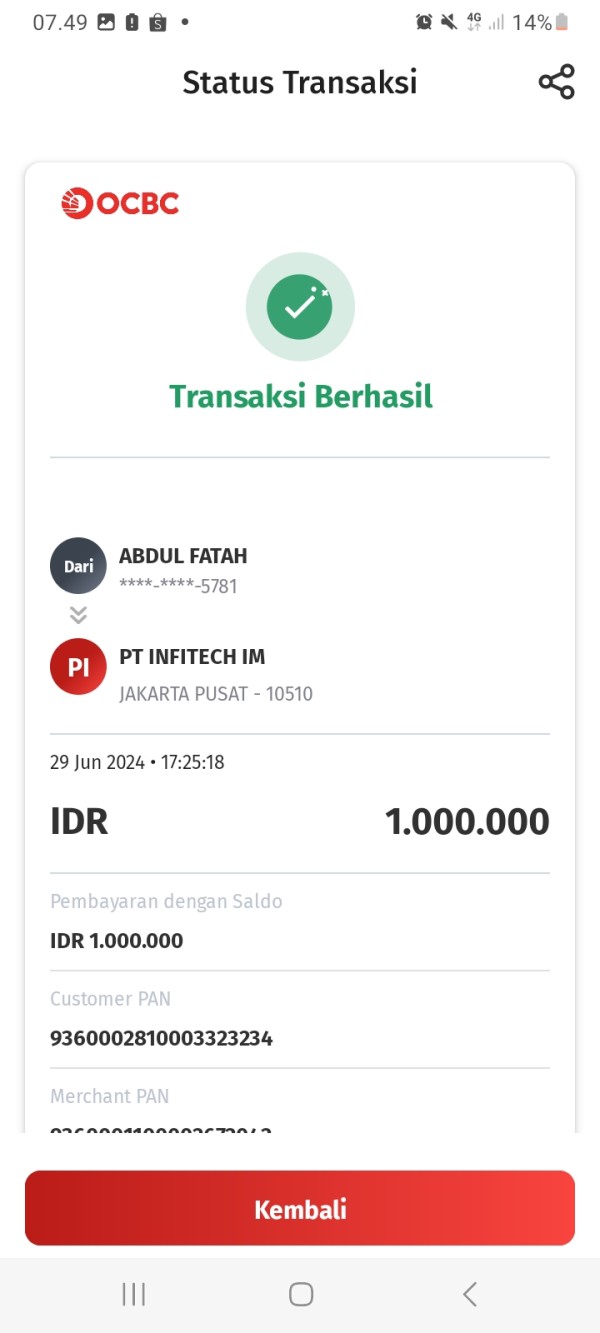

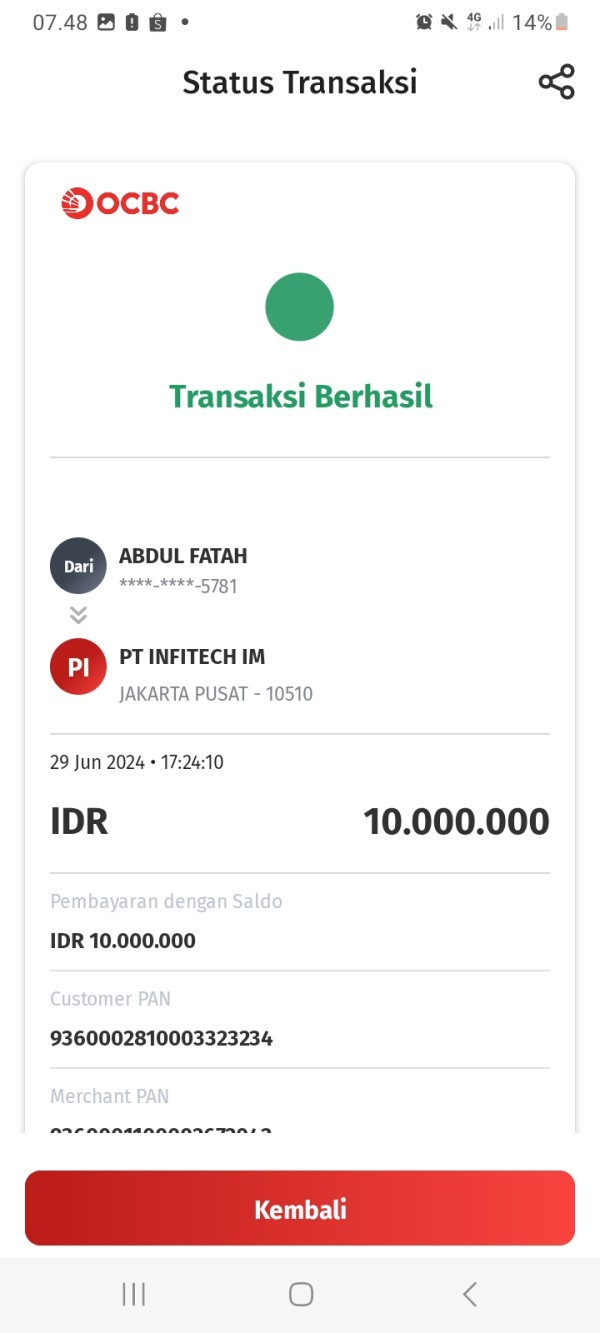

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. Potential clients need to contact the broker directly for clarification.

Minimum Deposit Requirements: The broker maintains an exceptionally low minimum deposit threshold of $10. This makes it highly accessible for beginning traders and those with limited initial capital.

Bonus and Promotions: No specific information about promotional offers or bonus programs is currently available in public sources.

Tradeable Assets: PT Fintech offers a comprehensive range of trading instruments including major and minor forex pairs, precious metals such as gold and silver, various index CFDs covering global markets, energy CFDs including oil and gas, and cryptocurrency CFDs for digital asset exposure.

Cost Structure: Detailed information regarding commission structures, spreads, and other trading costs is not specified in available materials. This requires direct inquiry with the broker for accurate pricing details.

Leverage Ratios: Specific leverage offerings are not mentioned in current information sources.

Platform Options: The broker provides access to the MetaTrader 4 platform. This ensures traders can utilize industry-standard trading tools and analytical capabilities.

Geographic Restrictions: Information regarding regional limitations or restricted territories is not specified in available sources.

Customer Service Languages: Details about supported languages for customer service are not provided in current materials.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

PT Fintech demonstrates strong performance in account accessibility with its remarkably low $10 minimum deposit requirement. This makes it one of the most accessible brokers for entry-level traders. This threshold effectively eliminates financial barriers that might prevent newcomers from entering the forex market, aligning with the broker's apparent strategy of targeting beginning traders and small-scale investors.

However, this pt fintech review notes that specific account types and their respective features are not detailed in available information. This potentially limits traders' ability to choose accounts that match their trading styles and experience levels. The absence of information about account tiers, premium features, or graduated benefits based on deposit levels represents a significant information gap.

The account opening process convenience and verification requirements remain unclear from available sources. This could impact the overall user experience. Additionally, without detailed information about account maintenance fees, inactivity charges, or other potential costs, traders cannot fully assess the true cost of maintaining accounts with PT Fintech.

PT Fintech's provision of the MetaTrader 4 platform represents a solid foundation for trading tools and resources. MT4 offers comprehensive charting capabilities, technical indicators, and automated trading support through Expert Advisors. This platform choice demonstrates the broker's commitment to providing professional-grade trading infrastructure that meets industry standards.

The broker's diverse asset portfolio spanning forex, precious metals, and various CFD instruments provides traders with substantial diversification opportunities. However, specific details about research resources, market analysis, educational materials, and proprietary trading tools are not emphasized in available information. This potentially limits traders' ability to make informed decisions and develop their trading skills.

The quality and quantity of analytical resources, daily market commentary, economic calendars, and educational content remain unclear from current sources. These supplementary resources are crucial for trader development and success, particularly for the beginner demographic that PT Fintech appears to target.

Customer Service and Support Analysis (5/10)

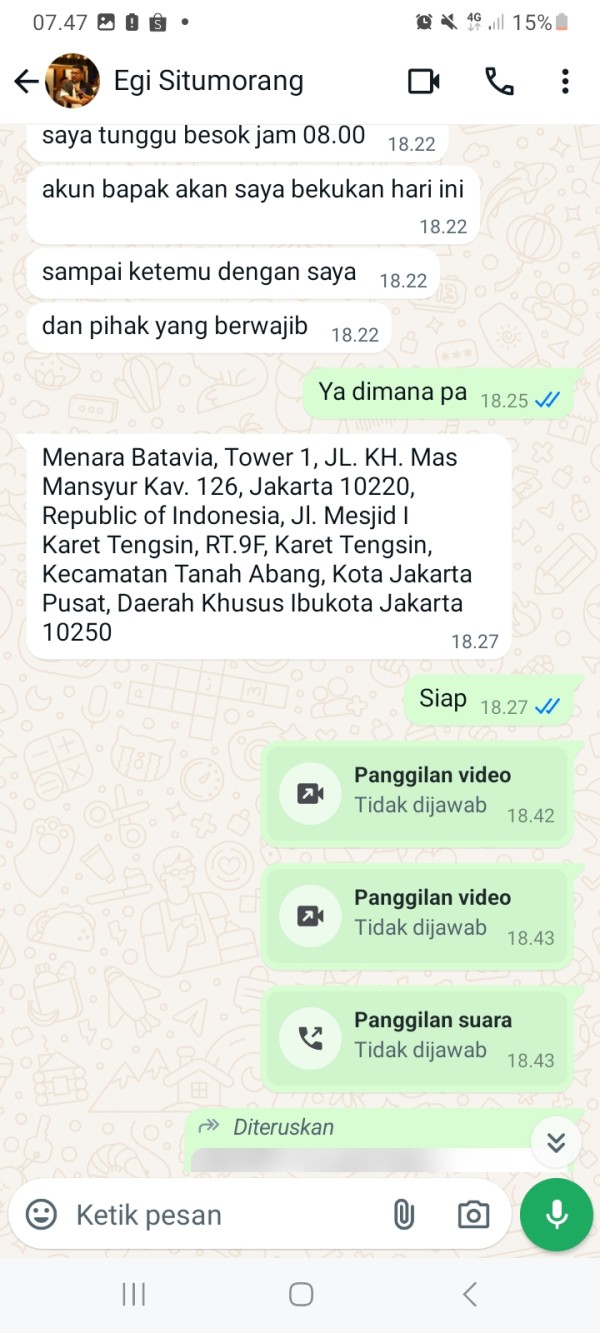

Customer service represents a significant area of uncertainty for PT Fintech. Detailed information about support channels, availability, and service quality is not provided in available sources. This lack of transparency regarding customer support infrastructure raises concerns about traders' ability to receive timely assistance when needed.

The absence of information about response times, multilingual support capabilities, and available communication channels makes it difficult for potential clients to assess whether the broker can meet their support needs. For international traders, particularly those in different time zones, comprehensive support coverage is essential for effective trading operations.

Without specific user feedback or documented customer service experiences, this pt fintech review cannot provide insights into problem resolution effectiveness or overall client satisfaction with support services. This information gap is particularly concerning for a broker targeting beginners who typically require more guidance and support.

Trading Experience Analysis (6/10)

The MetaTrader 4 platform foundation suggests that PT Fintech can provide a standard professional trading experience. Traders get access to advanced charting tools, multiple order types, and algorithmic trading capabilities. MT4's proven stability and widespread adoption indicate that traders should expect reliable platform performance under normal market conditions.

However, crucial aspects of the trading experience such as order execution quality, slippage rates, requote frequency, and server stability during volatile market periods are not documented in available sources. These factors significantly impact trading outcomes and overall satisfaction, particularly for active traders and scalpers who depend on precise execution.

Mobile trading capabilities and cross-device synchronization features, which are increasingly important for modern traders, are not specifically addressed in current information. The absence of user feedback regarding actual trading experiences makes it challenging to assess real-world platform performance and reliability.

Trust and Reliability Analysis (4/10)

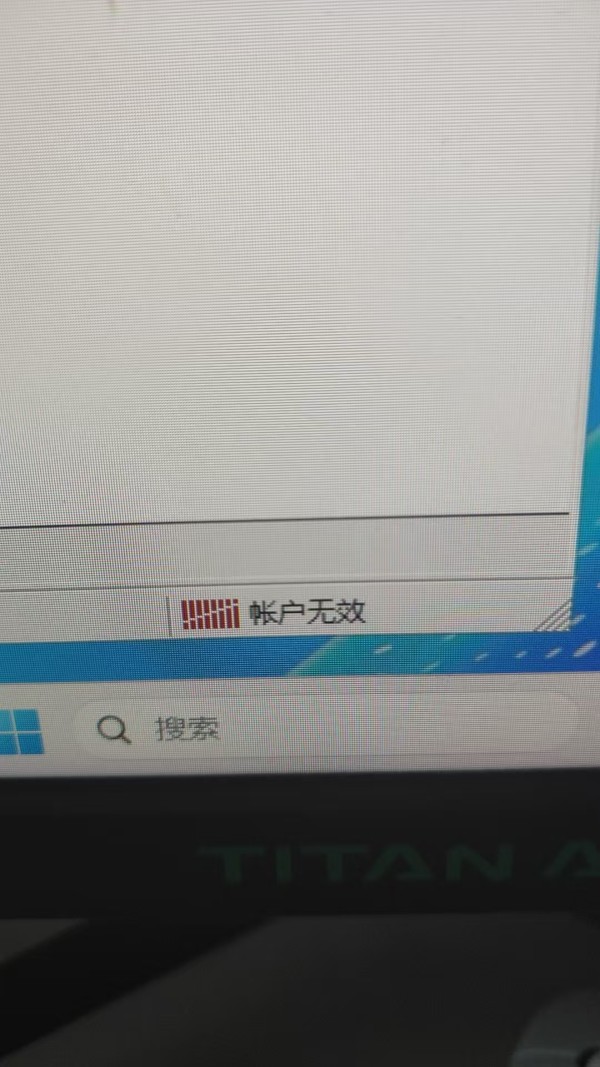

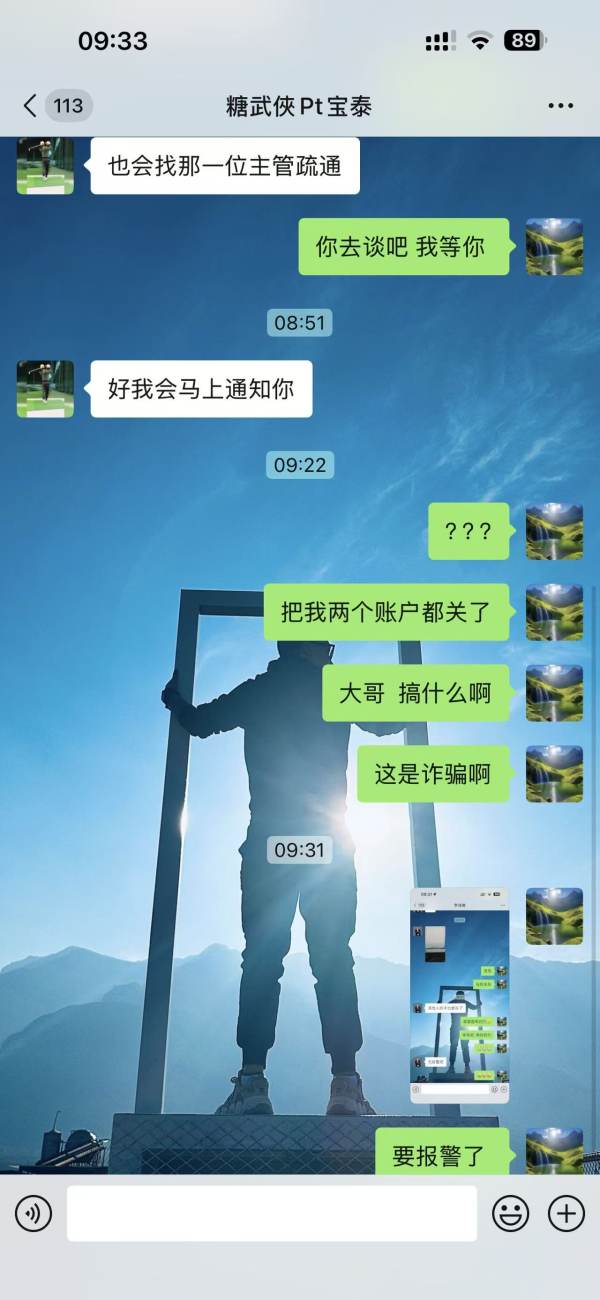

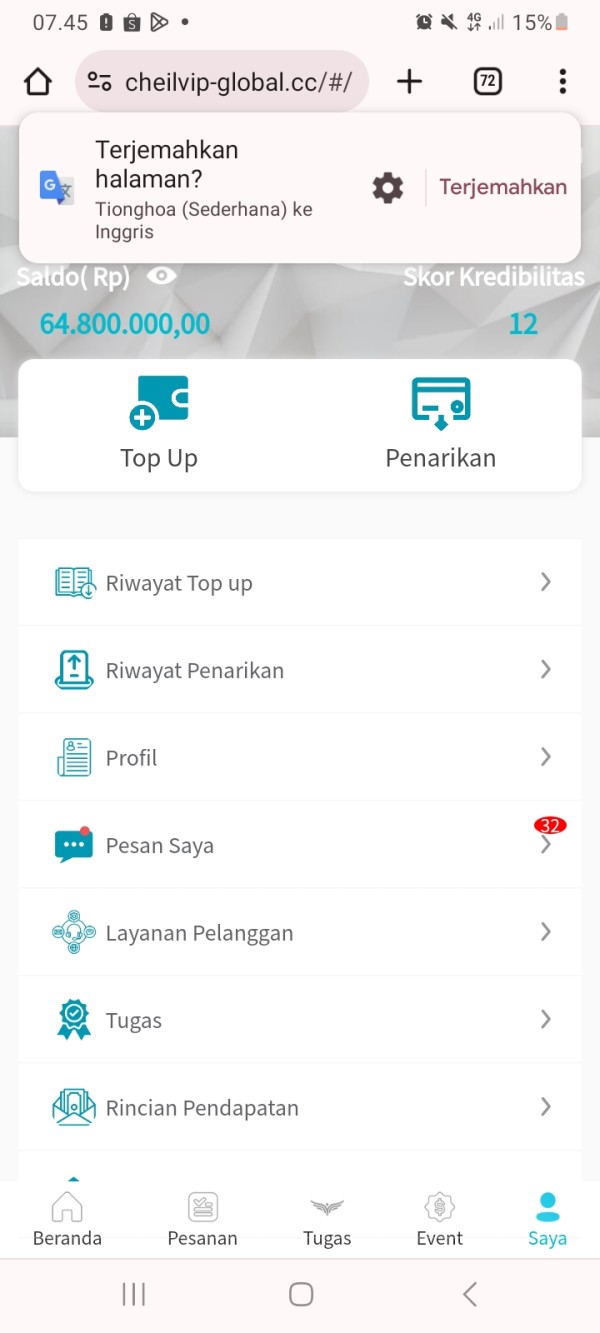

PT Fintech's unregulated status represents the most significant concern regarding trust and reliability. Operating without oversight from recognized financial regulatory authorities means clients lack the protections typically provided by regulatory frameworks. This includes segregated fund requirements, compensation schemes, and standardized dispute resolution procedures.

The absence of regulatory supervision raises questions about fund security measures, operational transparency, and adherence to industry best practices. Without regulatory oversight, traders must rely entirely on the broker's voluntary compliance with ethical business practices and financial safeguards.

The broker's recent establishment in 2024 means there is limited operational history to assess long-term reliability and stability. No information is available regarding third-party audits, financial reporting transparency, or involvement in industry organizations that might provide additional credibility indicators.

User Experience Analysis (5/10)

Overall user satisfaction assessment is challenging due to the limited availability of client feedback and testimonials. As a newly established broker, PT Fintech has not yet accumulated substantial user reviews that would provide insights into real-world client experiences and satisfaction levels.

Interface design quality, platform usability, and registration process efficiency are not detailed in available sources. This makes it difficult to evaluate the practical aspects of client onboarding and daily trading operations. These factors significantly impact user satisfaction, particularly for novice traders who may be less familiar with trading platforms.

The convenience and speed of deposit and withdrawal processes, which are critical components of user experience, lack detailed documentation. Without information about processing times, fees, and available payment methods, potential clients cannot fully assess the practical aspects of fund management with PT Fintech.

Conclusion

PT Fintech presents itself as an accessible entry point into forex trading with its exceptionally low $10 minimum deposit requirement and MetaTrader 4 platform support. The broker appears well-suited for beginners and traders seeking low-barrier access to diverse financial markets, including forex, precious metals, and various CFD instruments.

However, significant concerns arise from PT Fintech's unregulated status and the limited availability of detailed operational information. While the low deposit threshold and platform choice represent clear advantages, the absence of regulatory oversight and comprehensive user feedback requires potential clients to exercise considerable caution.

This pt fintech review concludes that while PT Fintech may offer opportunities for cost-conscious traders, the lack of regulatory protection and limited transparency regarding operational details make it suitable primarily for traders willing to accept higher risk levels in exchange for accessible trading conditions.