Bovei 2025 Review: Everything You Need to Know

Executive Summary

This bovei review gives you a complete look at Bovei Financial Limited, a forex broker that has caught attention in the trading world for worrying reasons. Our research shows that Bovei has several red flags that traders should think about carefully before using their services.

Bovei says it offers forex, indices, and commodities trading to retail traders who want foreign exchange and investment opportunities. But the broker has serious trust problems, with many reports pointing to possible fraud and questionable regulatory status. User trust is very low, with an average rating of 2 out of 10 based on 11 reviews, showing that most clients are unhappy.

The broker's regulatory status looks fake even though they claim Australian registration, and many scam reports have appeared on review websites. These problems, plus poor customer service and lack of clear trading conditions, make Bovei a high-risk choice for traders looking for reliable forex services.

Important Disclaimers

This review uses public information and user feedback collected from different sources as of 2024. Since Bovei claims registration in Australia, traders should know that different regulatory rules may apply depending on where they live. The broker's regulatory status is questionable, and potential clients should be very careful.

This assessment uses user stories, public records, and available documents. Because of the many negative reviews and scam claims, this evaluation puts user safety and honesty first over promotional content.

Rating Framework

Broker Overview

Bovei Financial Limited started in the forex trading world on May 24, 2024, saying it provides complete trading services. The company claims to offer forex, indices, and commodities trading mainly to retail traders who want access to international financial markets. Based on available information, Bovei works by providing online trading access to different financial tools.

The broker started recently, which raises concerns about its track record and experience in the competitive forex industry. Even though it has been operating for a short time, Bovei has already gotten significant negative attention from the trading community, with multiple platforms reporting possible fraud and questionable business practices.

This bovei review shows that the company's claimed Australian registration status is being questioned, with regulatory authorities and independent reviewers doubting these claims. The broker's quick start and following controversy suggest possible problems with its basic business operations and regulatory compliance.

The available asset classes include foreign exchange pairs, stock indices, and commodity instruments, though specific details about spreads, commissions, and trading conditions are clearly missing from public documents. This lack of transparency is a significant red flag for potential traders seeking clear information about trading costs and conditions.

Regulatory Status: Bovei claims registration in Australia, but multiple sources show serious doubts about whether this regulatory status is real. Independent checking of licensing information has been difficult, raising big concerns about the broker's legal standing.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not available in public documents, creating uncertainty about fund management procedures and potential problems in accessing trader funds.

Minimum Deposit Requirements: The broker has not shared minimum deposit requirements, which is a significant transparency problem and makes it hard for potential clients to assess accessibility and account opening procedures.

Promotional Offers: No specific bonus or promotional information has been made available, though this may actually be a positive thing given the questionable nature of the broker's overall operations.

Available Trading Assets: The platform offers access to forex currency pairs, stock indices, and commodity instruments, though the exact number of available instruments and specific market coverage remains unknown.

Cost Structure: Important information about spreads, commissions, and other trading costs is not available, making it impossible for traders to assess the true cost of trading with this bovei review subject.

Leverage Ratios: According to available information, retail traders can access leverage ratios ranging from 1:2 to 1:30, which seems to match standard regulatory requirements, though checking these claims remains problematic.

Platform Options: Specific trading platform information has not been shared, creating uncertainty about the technological infrastructure and tools available to traders.

Geographic Restrictions: Information about geographic limits and restricted areas is not available in public documents.

Customer Support Languages: The broker has not specified available customer support languages or communication channels.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Bovei show many concerns that significantly hurt the trading experience. The lack of clear information about account types, minimum deposit requirements, and specific account features creates uncertainty that experienced traders typically avoid. User feedback shows that clients are frustrated with the unclear basic account information.

The absence of detailed account specifications, including different account levels, special features, or Islamic account options, suggests either poor communication practices or intentional hiding of important trading conditions. This bovei review finds that potential clients cannot make informed decisions about account selection because of insufficient information sharing.

User stories consistently point out difficulties in understanding account terms and conditions, with many reporting unexpected fees and unclear trading requirements. The account opening process seems problematic, with several users reporting complications during registration and verification procedures.

The lack of specialized account options, such as professional or institutional accounts, limits the broker's appeal to diverse trading groups. Also, the absence of clear information about account protection measures, such as negative balance protection or separated client funds, raises serious concerns about trader safety and regulatory compliance.

Bovei's trading tools and resources represent one of the weakest parts of their service offering. The broker has failed to provide clear information about available trading platforms, analytical tools, or educational resources, which are considered essential parts of modern forex trading services.

User feedback shows significant dissatisfaction with the limited tools and resources available through the platform. Traders report difficulties accessing basic market analysis, economic calendars, or technical analysis tools that are standard offerings from reputable brokers. The absence of comprehensive charting capabilities and advanced order types further limits the platform's appeal to serious traders.

Educational resources appear almost non-existent, with no evidence of webinars, tutorials, or market analysis content that could benefit new or intermediate traders. This lack of educational support represents a significant disadvantage for traders seeking to improve their skills and market knowledge.

The platform's research and analysis capabilities remain unclear, with no mention of market insights, daily analysis, or expert commentary that traders typically expect from professional forex brokers. This deficiency significantly impacts the overall value proposition and trader development opportunities.

Customer Service and Support Analysis (2/10)

Customer service represents a critical weakness in Bovei's operations, with user feedback consistently highlighting poor response times, unhelpful support staff, and inadequate problem resolution capabilities. Multiple user reports show significant delays in receiving responses to inquiries and complaints.

The available customer support channels remain unclear, with no comprehensive information about contact methods, operating hours, or multilingual support options. This lack of transparency about support accessibility creates additional barriers for traders seeking assistance with their accounts or trading activities.

User stories frequently mention difficulties in reaching customer service representatives and receiving satisfactory solutions to account-related issues. Many clients report feeling abandoned when encountering problems with their trading accounts or experiencing technical difficulties with the platform.

The quality of support interactions appears consistently poor, with users reporting unprofessional communication, lack of product knowledge among support staff, and inadequate follow-up on reported issues. These service deficiencies contribute significantly to the overall negative user experience and low trust ratings.

Trading Experience Analysis (3/10)

The trading experience with Bovei presents mixed signals, with some technical aspects showing promise while overall user satisfaction remains poor. The platform claims trading speeds of 0ms, which, if accurate, would represent competitive execution times. However, this isolated positive metric is overshadowed by numerous other concerns.

User feedback about platform stability and reliability shows significant inconsistencies, with many traders reporting technical issues, connection problems, and unexpected platform downtime. These technical difficulties directly impact trading performance and user confidence in the platform's reliability.

The absence of detailed information about order execution policies, slippage rates, and market depth creates uncertainty about actual trading conditions. This bovei review finds that traders cannot adequately assess the true quality of trade execution without transparent disclosure of these critical metrics.

Mobile trading capabilities and cross-device synchronization remain unclear, limiting the platform's appeal to modern traders who require flexible access to their accounts. The lack of advanced trading features and customization options further reduces the platform's competitiveness in the current market environment.

Trust and Safety Analysis (1/10)

Trust and safety represent the most critical concerns in this Bovei evaluation, with multiple serious red flags indicating potential fraudulent activities. The broker's questionable regulatory status, combined with numerous scam allegations across various review platforms, creates an extremely high-risk environment for potential traders.

The claimed Australian regulation appears fake, with independent verification efforts failing to confirm legitimate licensing status. This regulatory uncertainty raises serious questions about client fund protection, dispute resolution mechanisms, and overall operational legitimacy.

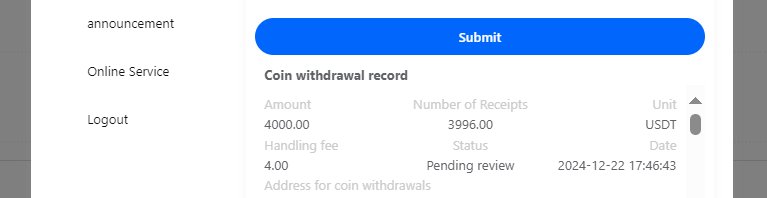

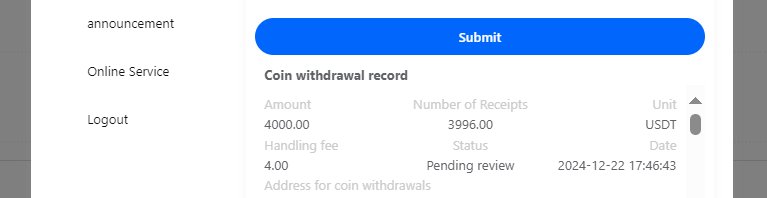

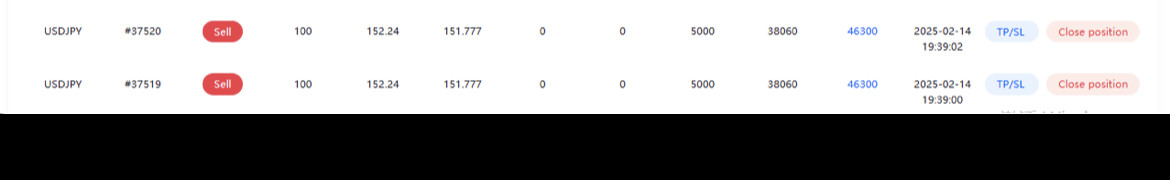

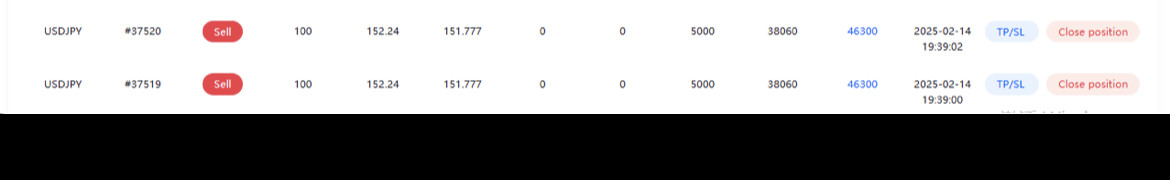

Multiple fraud allegations and negative user experiences suggest systematic issues with the broker's business practices. These concerns include difficulties with fund withdrawals, unexpected account closures, and lack of transparency in business operations.

The absence of clear information about client fund separation, insurance protection, or regulatory oversight creates additional safety concerns. Without proper regulatory supervision and fund protection measures, traders face significant risks to their invested capital and personal information security.

User Experience Analysis (2/10)

Overall user satisfaction with Bovei remains critically low, with an average rating of 2 out of 10 based on available user feedback. The predominance of negative reviews and user complaints indicates systematic issues with the broker's service delivery and customer relationship management.

Interface design and platform usability information remains limited, though user feedback suggests significant room for improvement in user experience design. Many traders report confusion with platform navigation and difficulty accessing essential trading functions and account information.

The registration and account verification processes appear problematic, with multiple users reporting delays, complications, and unclear requirements during account setup. These initial negative experiences often set the tone for ongoing customer relationships and contribute to overall dissatisfaction.

Common user complaints center around transparency issues, poor customer service, technical problems, and concerns about fund security. The consistency of these negative experiences across multiple review platforms suggests underlying operational and management issues that significantly impact user satisfaction and platform reliability.

Conclusion

This comprehensive bovei review reveals significant concerns about Bovei Financial Limited's operations, regulatory status, and overall trustworthiness as a forex broker. The combination of questionable regulatory claims, numerous fraud allegations, poor user feedback, and lack of transparency creates an extremely high-risk environment for potential traders.

The broker's critical weaknesses across all evaluated dimensions, particularly in trust and safety, make it unsuitable for recommendation to retail traders seeking reliable forex services. The absence of clear regulatory oversight, combined with consistent negative user experiences, suggests that traders should seek alternative brokers with established track records and verified regulatory compliance.

For traders interested in forex and investment opportunities, numerous well-regulated and established brokers offer superior services, better protection, and more transparent operations. The risks associated with Bovei significantly outweigh any potential benefits, making it advisable to avoid this broker entirely.