OffsetFX 2025 Review: Everything You Need to Know

Executive Summary

This offsetfx review shows major concerns about the broker's legitimacy and regulatory status. OffsetFX has been flagged by the UK Financial Conduct Authority as potentially operating without proper authorization, which raises serious red flags for potential traders. The broker claims to offer MT4 and MT5 trading platforms and presents itself as a London-based operation. However, multiple sources indicate this entity may be operating as a scam.

The broker primarily targets retail forex traders seeking access to international markets. Our investigation reveals substantial risks that make it unsuitable for most investors. The FCA warning issued on March 12, 2024, specifically highlighted concerns about OffsetFX providing financial services without proper authorization in the UK.

The company falsely claims membership with The Financial Commission. No matching information could be verified in FinCom's database. Given the mounting evidence of regulatory violations and deceptive practices, we strongly advise traders to exercise extreme caution and consider alternative, properly regulated brokers for their trading activities.

Important Notice

Regional Entity Differences: Traders should be aware that OffsetFX's regulatory status varies significantly across different jurisdictions. The FCA warning specifically applies to UK operations, but similar concerns may extend to other regions including Canada, Australia, the United States, and Sweden where the broker allegedly operates.

Review Methodology: This evaluation is based on publicly available information, regulatory warnings, and user feedback compiled from multiple sources. Our assessment prioritizes trader safety and regulatory compliance above all other factors.

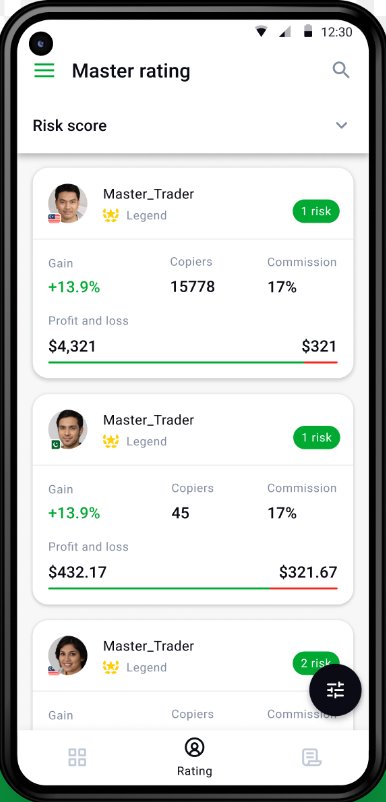

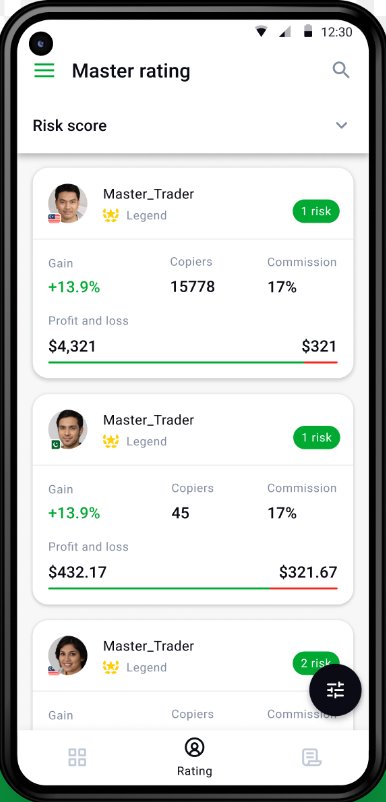

Rating Framework

Broker Overview

OffsetFX presents itself as a London-based forex broker. Specific founding details remain unclear in available documentation. The company claims to operate as a comprehensive trading service provider, targeting retail investors interested in forex markets across multiple international jurisdictions.

Serious questions about the company's legitimacy and operational transparency have emerged through regulatory investigations. The broker's business model appears to focus on attracting traders through claims of advanced platform access and competitive trading conditions. OffsetFX promotes itself as offering professional-grade trading infrastructure, though the reality of these claims has been called into question by regulatory authorities and user experiences.

OffsetFX provides access to MT4 and MT5 trading platforms. These are industry-standard tools used by legitimate brokers worldwide. The company claims to serve traders across multiple asset classes, though specific details about available instruments remain limited in publicly accessible documentation.

Most concerning is the broker's regulatory status. It operates under FCA oversight but has received official warnings for potentially unauthorized activities, fundamentally undermining its credibility in the financial services sector.

Regulatory Jurisdiction: OffsetFX claims regulation under the UK Financial Conduct Authority, but regulatory warnings suggest unauthorized operation.

Deposit and Withdrawal Methods: Specific information about payment methods and processing procedures is not detailed in available documentation.

Minimum Deposit Requirements: Minimum deposit thresholds and account funding requirements are not clearly specified in accessible materials.

Bonus and Promotions: Details regarding promotional offers, welcome bonuses, or trading incentives are not mentioned in available documentation.

Available Trading Assets: Specific information about tradeable instruments, asset categories, and market access is not comprehensively detailed in current materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not specified in available documentation. This raises transparency concerns.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not clearly outlined in accessible materials.

Platform Options: The broker offers MT4 and MT5 trading platforms. These are recognized industry standards for forex trading.

Geographic Restrictions: The service potentially involves traders from multiple countries including the UK, Canada, Australia, the United States, and Sweden. Specific restrictions are unclear.

Customer Support Languages: Information about multilingual support options is not detailed in available documentation.

This offsetfx review highlights significant information gaps. These gaps further underscore concerns about the broker's transparency and operational legitimacy.

Account Conditions Analysis

OffsetFX's account conditions present significant concerns due to lack of transparency and regulatory issues. Available documentation does not provide clear details about account types, tier structures, or specific features offered to different client categories.

This absence of fundamental information represents a major red flag for potential traders seeking to understand their trading environment. The minimum deposit requirements remain unspecified, making it impossible for traders to properly plan their initial investment or compare conditions with legitimate competitors. Account opening procedures and verification processes are not clearly outlined, which could indicate either poor operational standards or deliberate obfuscation of requirements.

No information is available regarding special account features such as Islamic accounts for Muslim traders, VIP tiers for high-volume clients, or demo accounts for practice trading. This lack of detailed account information, combined with the FCA warning about unauthorized operations, suggests that offsetfx review findings consistently point to inadequate service provision and potential regulatory violations that make account opening inadvisable for most traders.

OffsetFX claims to provide MT4 and MT5 trading platforms. These are legitimate and widely-used trading tools in the forex industry. These platforms offer comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

However, the availability of these standard platforms does not compensate for the broker's fundamental regulatory and transparency issues. Research and analysis resources appear to be limited or non-existent based on available information. Professional traders typically expect access to market commentary, economic calendars, fundamental analysis, and technical insights from their brokers.

The absence of detailed information about such resources suggests OffsetFX may not provide the comprehensive support tools that serious traders require. Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in available documentation. This gap is particularly concerning for newer traders who depend on broker-provided education to develop their skills safely.

The combination of platform availability with limited supporting resources creates an incomplete trading environment. This fails to meet modern broker standards.

Customer Service and Support Analysis

Customer service quality appears to be a significant weakness based on available user feedback and the overall operational concerns surrounding OffsetFX. The lack of detailed information about support channels, availability hours, and service protocols suggests inadequate customer support infrastructure that fails to meet industry standards.

Response times and service quality have received negative feedback from users. They report difficulties in reaching support representatives and obtaining satisfactory resolutions to their concerns. This pattern of poor customer service aligns with the broader regulatory concerns and suggests systemic operational deficiencies rather than isolated service issues.

Multilingual support capabilities remain unclear. This could present additional barriers for international traders seeking assistance in their native languages. The absence of clearly defined support procedures, combined with negative user experiences and regulatory warnings, indicates that customer service represents a critical failure point for this broker that potential clients should carefully consider before engaging with the platform.

Trading Experience Analysis

The trading experience with OffsetFX appears compromised by multiple factors that significantly impact user satisfaction and platform reliability. While the broker claims to offer MT4 and MT5 platforms, user feedback suggests that the actual trading environment may not meet professional standards expected from legitimate brokers.

Platform stability and execution quality concerns have been raised by users. Specific technical performance data is not available in current documentation. Order execution speeds, slippage rates, and platform uptime statistics are not transparently reported, making it difficult for traders to assess the actual quality of the trading infrastructure.

Mobile trading capabilities and cross-device synchronization features are not detailed in available materials. This potentially limits traders' ability to manage positions effectively across different devices. The lack of comprehensive trading environment information, combined with negative user feedback and regulatory concerns, suggests that the offsetfx review consistently reveals substandard trading conditions that fail to meet contemporary broker standards and trader expectations.

Trust and Security Analysis

Trust and security represent the most critical concerns in any OffsetFX evaluation. The FCA warning issued on March 12, 2024, explicitly states that the broker may be providing financial services without proper authorization in the UK, fundamentally undermining any claims of regulatory compliance and operational legitimacy.

The company's false claims about membership with The Financial Commission further demonstrate deceptive practices. These call into question all aspects of their operations. When a broker misrepresents regulatory affiliations, it indicates systemic dishonesty that extends beyond simple administrative errors to deliberate misrepresentation of credentials.

Fund security measures, segregation of client assets, and investor protection protocols are not clearly documented. This is particularly concerning given the regulatory warnings. Legitimate brokers typically provide detailed information about client fund protection, insurance coverage, and regulatory safeguards.

The absence of such transparency, combined with official regulatory warnings, creates an environment where trader funds face significant risk. Loss through unauthorized or fraudulent activities becomes a real possibility.

User Experience Analysis

Overall user satisfaction with OffsetFX appears to be predominantly negative based on available feedback and the broader context of regulatory concerns. Users report difficulties with various aspects of the service, though specific details about interface design, platform usability, and account management features are limited in available documentation.

The registration and account verification processes are not clearly outlined. This can create confusion and frustration for new users attempting to establish trading accounts. This lack of clear procedural information often indicates poor operational organization and inadequate customer onboarding procedures that fail to meet professional standards.

Common user complaints appear to center around service reliability, transparency issues, and concerns about fund security. The pattern of negative feedback aligns with regulatory warnings and suggests that user experience problems are symptomatic of broader operational deficiencies.

Traders seeking reliable, transparent, and professionally managed trading services would likely find OffsetFX's user experience inadequate compared to properly regulated alternatives.

Conclusion

This comprehensive offsetfx review reveals that OffsetFX poses significant risks to traders due to regulatory warnings, transparency issues, and operational concerns. These make it unsuitable for most investors. While the broker claims to offer standard trading platforms, the fundamental problems with authorization and regulatory compliance overshadow any potential technical advantages.

The combination of FCA warnings, false regulatory claims, and negative user feedback creates a risk profile that makes OffsetFX inappropriate for traders seeking secure, reliable, and professionally managed trading services. We strongly recommend that traders consider properly regulated alternatives that provide transparent operations, verified regulatory compliance, and comprehensive investor protections.