Is Atlantic safe?

Business

License

Is Atlantic Safe or Scam?

Introduction

Atlantic is a brokerage that has gained attention in the forex market, often marketed as a platform offering a variety of trading opportunities. However, with the proliferation of online trading platforms, it has become increasingly important for traders to carefully evaluate the legitimacy and safety of these brokers. Many traders have fallen victim to scams, leading to significant financial losses. Therefore, this article aims to provide an objective assessment of whether Atlantic is a safe trading option or a potential scam. Our investigation will utilize various sources, including regulatory databases, user reviews, and expert analyses, to evaluate Atlantic's safety profile comprehensively.

Regulation and Legitimacy

The regulatory status of a broker is critical in determining its credibility and the safety of traders' funds. Atlantic is not regulated by any top-tier financial authorities, which raises significant concerns about its legitimacy. Regulatory oversight is essential as it ensures that brokers adhere to strict standards, providing a layer of protection for investors. Without regulation, traders are at a higher risk of fraud and malpractice.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation from recognized authorities such as the FCA (UK), ASIC (Australia), or SEC (USA) indicates that Atlantic operates without the oversight that typically safeguards traders. This lack of regulatory framework can lead to unfair trading practices, including hidden fees and poor customer service. Furthermore, history has shown that unregulated brokers often engage in shady practices, making it imperative for traders to approach such platforms with caution. Thus, when assessing whether is Atlantic safe, the answer leans heavily towards skepticism.

Company Background Investigation

Atlantic's history and ownership structure are crucial in understanding its operational legitimacy. However, information regarding the company's background is sparse. Many unregulated brokers operate with minimal transparency, making it difficult for potential clients to ascertain their credibility. The management team behind Atlantic is often not disclosed, which is a red flag for potential investors. A lack of accountability and transparency in a broker's operations can lead to serious concerns about their intentions.

Moreover, the absence of a verifiable physical address or contact details can make it challenging for traders to seek recourse in the event of disputes. The anonymity surrounding Atlantic raises questions about its reliability and trustworthiness. In the forex market, where financial transactions are substantial, knowing who is behind the platform is vital. Therefore, the lack of clear information about Atlantic's management and operational history further supports the notion that traders should be cautious when considering this broker.

Trading Conditions Analysis

A broker's trading conditions, including fees and commissions, play a significant role in determining its attractiveness to traders. Atlantic claims to offer competitive spreads and various trading instruments, but the lack of transparency regarding its fee structure is concerning. Traders should be wary of any hidden charges that could erode their profits.

| Fee Type | Atlantic | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The absence of clear information on these key trading costs is a significant drawback. Traders often rely on transparent fee structures to make informed decisions. If a broker is not forthcoming about its fees, it could indicate a lack of integrity in its business practices. Therefore, when asking is Atlantic safe, the answer is further complicated by the ambiguity surrounding its trading conditions.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Atlantic's policies regarding fund segregation and investor protection are not clearly outlined, raising concerns about the security of traders' investments. A reputable broker typically segregates client funds from its operating capital, ensuring that traders' money is protected even in the event of the broker's insolvency.

Additionally, the lack of negative balance protection policies can expose traders to significant risks. Without these safeguards, traders could potentially lose more than their initial investment, leading to financial ruin. The absence of any historical incidents regarding fund safety is also a red flag. If a broker has a clean track record, it is usually a good sign; however, the lack of information about Atlantic's fund safety measures suggests that traders should proceed with caution.

Customer Experience and Complaints

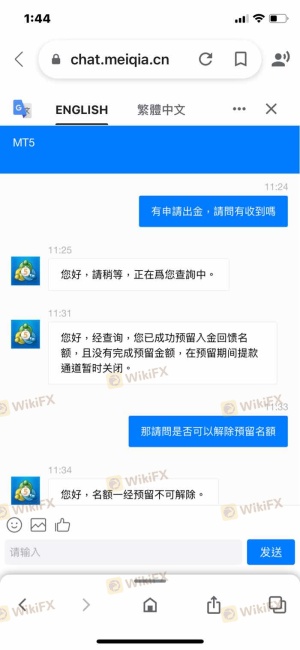

Customer feedback is a vital component in assessing a broker's reliability. Reviews and complaints about Atlantic indicate a pattern of dissatisfaction among users. Common complaints include difficulty in withdrawing funds, unresponsive customer service, and unclear communication regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

| Misleading Information | High | Poor |

For instance, several users have reported that their accounts were frozen without clear justification, making it impossible to access their funds. Such practices are indicative of a broker that may not have the best interests of its clients at heart. When evaluating whether is Atlantic safe, the negative customer experiences suggest that traders should be wary of engaging with this broker.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. Users have reported mixed experiences with Atlantic's platform, highlighting issues such as slow execution speeds and occasional downtime. These factors can significantly impact traders' ability to capitalize on market opportunities.

Moreover, there are allegations of slippage and order rejections, which can frustrate traders and lead to financial losses. A reliable broker should provide a stable platform with minimal disruptions. If traders are facing issues with execution, it raises concerns about the broker's overall reliability. Thus, when considering is Atlantic safe, the platform's performance and execution quality are critical elements to assess.

Risk Assessment

Using a broker like Atlantic comes with inherent risks. The lack of regulatory oversight, unclear trading conditions, and negative customer experiences contribute to a high-risk profile for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation |

| Fund Security | High | Lack of safeguards |

| Customer Satisfaction | Medium | Numerous complaints |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always verify a broker's regulatory status and read user reviews before opening an account.

- Start Small: If you decide to proceed with Atlantic, begin with a small investment to limit potential losses.

- Explore Alternatives: Look for brokers with strong regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Atlantic may not be a safe broker for forex trading. The lack of regulation, questionable trading conditions, and negative customer experiences raise significant red flags. Traders should exercise extreme caution when considering this broker.

For those seeking safer alternatives, consider brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC. These brokers typically offer better investor protection, transparent trading conditions, and a higher level of customer service. In summary, when evaluating whether is Atlantic safe, the overall assessment leans towards the conclusion that it is not a reliable option for traders.

Is Atlantic a scam, or is it legit?

The latest exposure and evaluation content of Atlantic brokers.

Atlantic Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atlantic latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.