DBG Markets Review 2025: Everything You Need to Know

Summary

DBG Markets is a forex broker that started in 2007. It offers trading services across many global markets. According to AsiaForexMentor, this dbg markets review shows a broker with mixed user experiences and moderate market positioning. The company has offices in Australia, South Africa, Seychelles, and Vanuatu. It operates under different rules including ASIC and FSCA oversight.

The broker offers leverage up to 1:500 and supports many asset types including forex, precious metals, stocks, indices, and commodities. However, ForexPeaceArmy reports show that while DBG Markets provides real trading services, some users worry about service quality. They suggest there may be better choices in the market.

DBG Markets targets traders who want high-leverage opportunities in forex and precious metals trading. The minimum deposit is $100 USD, making it accessible to retail traders. The broker uses STP (Straight Through Processing) and ECN (Electronic Communication Network) models. However, user feedback shows mixed experiences with execution quality and customer satisfaction.

Important Notice

DBG Markets operates through multiple regional entities across different areas. Each area has different rules and standards. According to Trader Magazine, the broker's services and user experiences may differ a lot depending on the region and local entity that handles clients.

This review is based on public information and user feedback from various industry sources including ForexPeaceArmy and AsiaForexMentor. Market conditions, rule changes, and broker policies may change over time. This could affect how accurate this assessment stays.

Rating Framework

Broker Overview

DBG Markets started in the forex industry in 2007. It positions itself as a multi-area broker with offices in Australia, South Africa, Seychelles, and Vanuatu. According to AsiaForexMentor's analysis, the company built its business around providing access to global financial markets through both STP and ECN execution models. However, specific details about their liquidity providers remain limited in available documentation.

The broker's regulatory framework includes multiple oversight bodies. ForexPeaceArmy confirms registrations under ASIC (Australian Securities and Investments Commission), FSCA (Financial Sector Conduct Authority), SFSA (Seychelles Financial Services Authority), and VFSC (Vanuatu Financial Services Commission). This multi-regulatory approach suggests an attempt to serve diverse global markets while staying compliant across different areas.

DBG Markets offers trading access to forex currency pairs, precious metals, individual stocks, major indices, and various commodities. However, this dbg markets review notes that specific information about trading platforms, spreads, and commission structures is notably missing from readily available documentation. This may show limited transparency in their service offerings compared to industry standards.

Regulatory Areas: DBG Markets operates under multiple regulatory frameworks including ASIC in Australia, FSCA in South Africa, SFSA in Seychelles, and VFSC in Vanuatu. This provides regulatory coverage across different global markets.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This represents a potential transparency concern for prospective clients.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100 USD. This positions it as accessible to retail traders and beginners in the forex market.

Bonus and Promotional Offers: Available documentation does not specify current bonus programs or promotional offerings. This suggests either limited promotional activities or insufficient public disclosure of such programs.

Tradeable Assets: The platform supports trading in foreign exchange currency pairs, precious metals including gold and silver, individual stock securities, major global indices, and various commodity markets.

Cost Structure: ForexPeaceArmy reports show that specific information about spreads, commissions, and other trading costs is not readily available in public documentation. This may concern cost-conscious traders seeking transparency.

Leverage Ratios: Maximum leverage of 1:500 is available. However, specific leverage offerings may vary by asset class and regulatory area.

Platform Options: Available documentation does not specify which trading platforms are offered. This represents a significant information gap for this dbg markets review.

Geographic Restrictions: Specific information about geographic trading restrictions is not detailed in available sources.

Customer Service Languages: Available documentation does not specify supported languages for customer service operations.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

DBG Markets' account conditions present a mixed picture for potential traders. The $100 minimum deposit requirement positions the broker well for retail traders and newcomers to forex trading, according to AsiaForexMentor's assessment. This relatively low barrier makes the broker accessible to a broad range of market participants.

However, this dbg markets review reveals significant information gaps about account types and their specific features. Available documentation does not detail whether the broker offers various account tiers, Islamic accounts for Sharia-compliant trading, or other special account features that are standard among established brokers.

The account opening process and verification requirements are not clearly outlined in available sources. This may create uncertainty for prospective clients. ForexPeaceArmy user feedback suggests that while the basic account setup is straightforward, some traders have experienced delays or complications during the verification process.

The maximum leverage of 1:500 provides substantial trading power, though this high leverage also increases risk significantly. The absence of detailed information about margin requirements, stop-out levels, and other risk management parameters represents a notable transparency concern. This impacts the overall account conditions rating.

The tools and resources offering at DBG Markets appears limited based on available information. This dbg markets review finds that specific details about trading tools, analytical resources, and educational materials are notably absent from public documentation. This suggests either limited offerings or poor communication of available resources.

Trader Magazine reports show that the broker does not prominently feature advanced trading tools, market analysis, or research resources that are typically expected from established forex brokers. This lack of comprehensive tool availability may hurt traders who rely on in-depth analysis and automated trading capabilities.

Educational resources, including webinars, tutorials, and market commentary, are not detailed in available sources. This absence is particularly concerning for retail traders who often depend on broker-provided education to develop their trading skills. They need this education to understand the market better.

The lack of information about automated trading support, API access, or third-party tool integration further limits the appeal for more sophisticated traders. User feedback suggests that traders seeking comprehensive analytical tools and resources may find better options with other brokers in the market.

Customer Service and Support Analysis (Score: 7/10)

Customer service represents one of DBG Markets' stronger aspects according to user feedback compiled by AsiaForexMentor. Multiple user reports show that the broker provides responsive customer support with generally satisfactory resolution times for common inquiries and issues.

The quality of customer service interactions receives positive mentions in user reviews. Support staff are described as knowledgeable and helpful in addressing trading-related questions. However, specific information about available contact channels, support hours, and response time guarantees is not detailed in available documentation.

ForexPeaceArmy user feedback suggests that while basic support needs are adequately addressed, more complex technical issues or account problems may experience longer resolution times. The absence of detailed information about multilingual support capabilities may limit accessibility for international traders.

The lack of comprehensive self-service resources, including detailed FAQs, video tutorials, and troubleshooting guides, means that clients may need to rely more heavily on direct support contact. This could potentially create bottlenecks during peak periods.

Trading Experience Analysis (Score: 6/10)

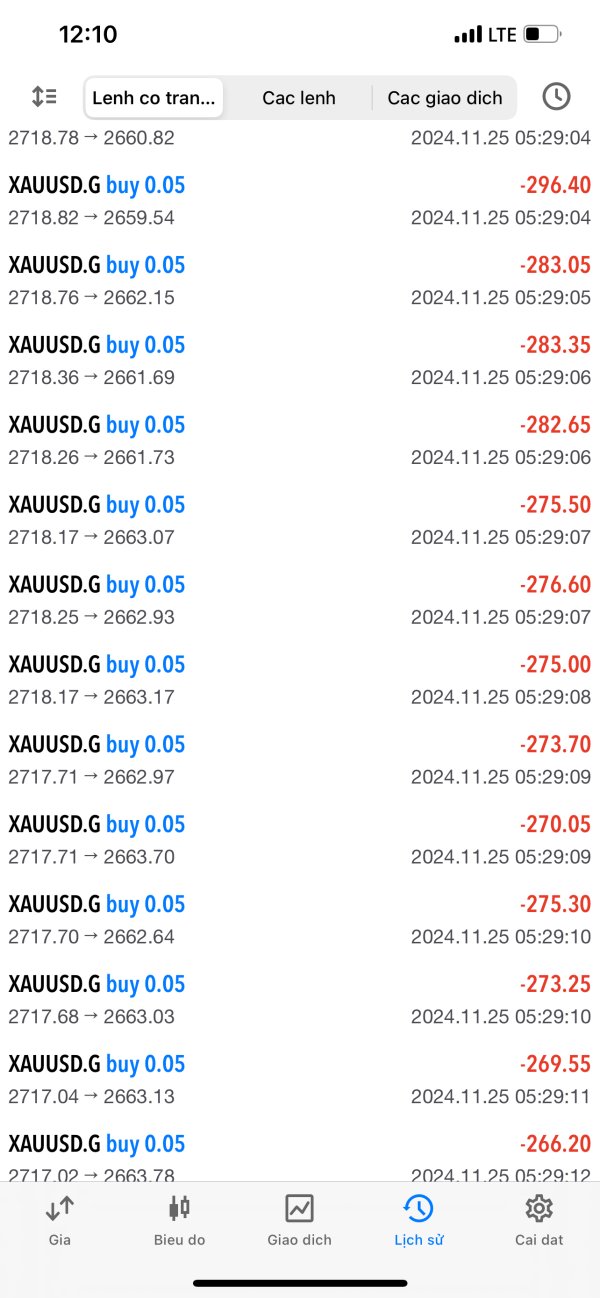

The trading experience at DBG Markets receives mixed reviews from users, according to ForexPeaceArmy reports. While some traders report satisfactory execution speeds and order processing, the absence of detailed information about trading platforms creates uncertainty about the overall trading environment quality.

User feedback shows that execution times are generally acceptable for standard market conditions. However, specific data about slippage rates, requote frequency, and execution quality during volatile market periods is not available. This lack of transparency makes it difficult to assess the broker's performance during challenging trading conditions.

The variety of tradeable assets including forex, precious metals, stocks, indices, and commodities provides decent diversification opportunities. However, without detailed information about available trading platforms, charting capabilities, and order types, traders cannot fully evaluate whether the trading environment meets their specific needs.

This dbg markets review notes that mobile trading capabilities and platform stability are not well-documented. This is increasingly important for modern traders who require reliable access across multiple devices and consistent platform performance.

Trust and Reliability Analysis (Score: 7/10)

DBG Markets' trust profile benefits from its multi-area regulatory oversight, with registrations under ASIC, FSCA, SFSA, and VFSC providing a foundation of regulatory compliance. AsiaForexMentor confirms that these regulatory registrations can be verified through appropriate regulatory databases. This supports the broker's legitimacy.

However, specific information about client fund protection measures, segregated accounts, and insurance coverage is not detailed in available documentation. This lack of transparency about fund safety measures may concern security-conscious traders who prioritize capital protection.

The company's operational history since 2007 suggests reasonable market longevity. However, available sources do not provide information about any significant regulatory actions, awards, or industry recognition that might further establish credibility.

ForexPeaceArmy user feedback includes some concerns about withdrawal processes and account management, though these appear to be isolated incidents rather than systematic issues. The absence of detailed financial reporting or third-party audits limits transparency about the company's financial stability.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with DBG Markets appears mixed, with AsiaForexMentor reporting that some traders express disappointment with their experience and suggest seeking alternative brokers. This feedback shows that while the broker provides legitimate services, the overall user experience may not meet contemporary market expectations.

Interface design and platform usability information is not available in current documentation. This makes it difficult to assess the quality of user interaction with the broker's systems. The absence of detailed onboarding process descriptions and account management features suggests potential gaps in user experience design.

Trader Magazine reports show that registration and verification processes may involve delays or complications that frustrate new users. The lack of comprehensive self-service capabilities and limited transparency about various service aspects contribute to user experience challenges.

Common user complaints center around limited communication about service features, unclear cost structures, and insufficient trading tools and resources. This dbg markets review suggests that while DBG Markets may suit traders with basic needs, those seeking comprehensive service and advanced features may find better options elsewhere in the market.

Conclusion

DBG Markets presents a mixed proposition in the forex brokerage landscape, offering legitimate trading services with regulatory oversight across multiple areas, yet falling short of contemporary market standards in several key areas. The broker's strengths include accessible minimum deposit requirements, high leverage availability up to 1:500, and generally responsive customer service according to user feedback.

However, significant transparency gaps about trading platforms, cost structures, and available tools limit its appeal to informed traders. The broker appears most suitable for basic forex and precious metals trading for users who prioritize high leverage and don't require comprehensive analytical tools or advanced platform features.

The main advantages include multi-area regulatory compliance and reasonable customer support quality, while notable disadvantages include limited transparency, insufficient trading resources, and mixed user experience feedback. Prospective traders should carefully consider these factors against their specific trading requirements and expectations.