Regarding the legitimacy of bgc forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is bgc safe?

Pros

Cons

Is bgc markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

BGC Brokers L.P

Effective Date:

2006-11-16Email Address of Licensed Institution:

#compliancebgcuk@bgcg.com, donatella.seidner@bgcg.comSharing Status:

No SharingWebsite of Licensed Institution:

www.bgcg.comExpiration Time:

--Address of Licensed Institution:

5 Churchill Place London E14 5RD UNITED KINGDOMPhone Number of Licensed Institution:

+442078947000Licensed Institution Certified Documents:

Is BGC A Scam?

Introduction

BGC, officially known as BGC Partners, Inc., is a global brokerage and financial technology company that has established a significant presence in the foreign exchange (FX) market. With its headquarters in New York and London, BGC specializes in providing a wide range of financial services, including brokerage for fixed income securities, foreign exchange, equities, and commodities. However, the financial services industry is fraught with risks, and traders must exercise caution when selecting brokers. This article aims to evaluate whether BGC is a legitimate broker or a potential scam by analyzing its regulatory status, company background, trading conditions, customer safety measures, client feedback, and overall risk profile. The assessment is based on a thorough review of recent online sources, regulatory filings, and customer reviews.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. BGC operates under the oversight of the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its stringent regulatory requirements. This regulatory framework aims to ensure that financial markets operate fairly and transparently, protecting the interests of consumers.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 454814 | United Kingdom | Verified |

The FCA's involvement provides a level of assurance to traders, as it enforces compliance with industry standards. However, it is worth noting that BGC has been flagged for operating as a "suspicious clone" by some sources, indicating that there may be unauthorized entities using its name to mislead potential clients. This highlights the importance of verifying the legitimacy of the broker you are dealing with and ensuring that you are using the correct website and contact information.

In terms of historical compliance, BGC has maintained a relatively clean record, with no significant regulatory sanctions reported against it. However, the presence of clone operations raises concerns and necessitates a careful evaluation of the broker's claims. Traders should always verify the licensing status and ensure that they are dealing with the legitimate entity.

Company Background Investigation

BGC was founded in 2004 as a spin-off from Cantor Fitzgerald, a well-known financial services firm. Over the years, BGC has expanded its operations through various acquisitions and investments, positioning itself as a leading player in the global brokerage market. The company specializes in providing a wide array of financial products and services, catering primarily to institutional clients.

The management team at BGC is led by Howard Lutnick, who has extensive experience in the financial services industry. Under his leadership, the company has made significant investments in technology, totaling over $1.7 billion since its inception. This focus on technology positions BGC as a competitive player in an increasingly digital financial landscape.

BGC's commitment to transparency is evident in its operations; the company regularly publishes financial reports and engages with stakeholders through various communication channels. However, while BGC has a solid reputation, the presence of clone brokers using its name can create confusion among potential clients, emphasizing the need for due diligence when selecting a broker.

Trading Conditions Analysis

BGC offers a variety of trading conditions, but it is essential to analyze its fee structure and overall trading environment. The broker's pricing model includes spreads, commissions, and overnight financing costs, which can significantly impact a trader's profitability.

| Fee Type | BGC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1-3 pips | 1-2 pips |

| Commission Model | Negotiable | Fixed/Variable |

| Overnight Interest Range | Varies | Varies |

BGCs spreads are competitive, particularly for major currency pairs. However, the requirement for negotiation can be a drawback for smaller traders, as it may lead to a lack of transparency in pricing. Additionally, traders should be cautious of any unusual fees that may be hidden in the fine print, as these can erode profits and affect overall trading performance.

The broker's commission structure is also negotiable, which may benefit high-volume traders but could be a disadvantage for retail traders who prefer a more straightforward fee structure. Overall, while BGC provides a comprehensive range of trading conditions, the complexity of its pricing model may deter some traders.

Customer Fund Safety

The safety of client funds is paramount when evaluating a broker. BGC takes several measures to ensure the security of its clients' funds, including segregating client accounts from company funds. This practice is essential in protecting clients in the event of financial difficulties faced by the broker.

BGC is also subject to the FCA's requirements for investor protection, which includes maintaining a minimum capital requirement and adhering to strict operational standards. However, it is important to note that while BGC is regulated, the presence of clone operations raises concerns about the safety of funds if clients inadvertently engage with unauthorized entities.

In terms of negative balance protection, BGC offers measures to prevent clients from losing more than their initial investment. This is a critical feature that can help mitigate risks for traders, especially in the highly volatile FX market. Nevertheless, potential clients should conduct thorough research and ensure they are dealing with the legitimate BGC entity to safeguard their investments.

Customer Experience and Complaints

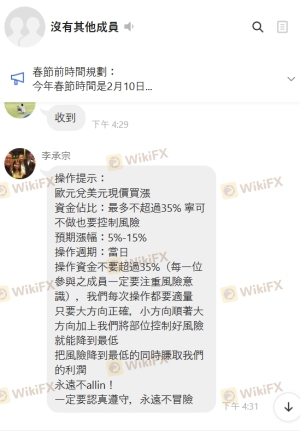

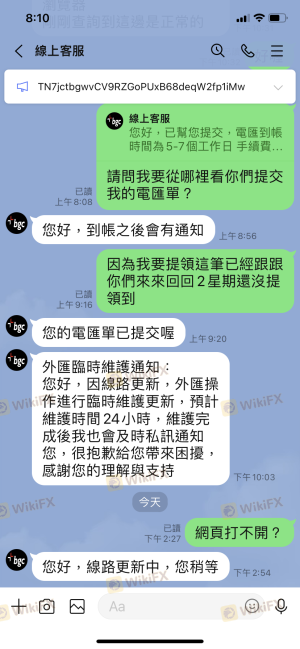

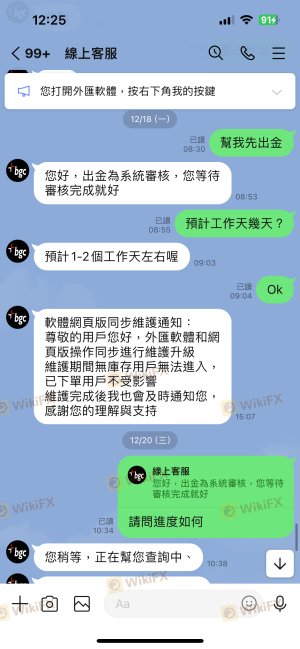

Customer feedback is a vital indicator of a broker's reliability and service quality. BGC has received mixed reviews from clients, with some praising its trading platform and customer service, while others have raised concerns about withdrawal processes and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Customer Support | Medium | Inconsistent |

| High Pressure Sales Tactics | High | No clear policy |

Common complaints include delays in processing withdrawals, with some clients reporting difficulties in accessing their funds. This issue can be particularly concerning for traders who prioritize liquidity and timely access to their investments. Additionally, high-pressure sales tactics have been reported, which can create an uncomfortable trading environment.

A few typical cases highlight these issues. For instance, one user reported a significant delay in withdrawing funds, with customer support providing vague responses and no clear resolution. Another client expressed frustration over being pressured to deposit more funds, raising red flags about the broker's sales practices.

Platform and Execution

The performance of a trading platform is crucial for successful trading. BGC offers a proprietary trading platform known for its advanced features and user-friendly interface. The platform supports various trading instruments and provides real-time market data, which is essential for making informed trading decisions.

However, some users have reported issues with order execution, including slippage and rejected orders. These problems can significantly impact trading outcomes, particularly for high-frequency traders who rely on quick execution. While BGC's platform is generally well-regarded, any signs of potential manipulation or execution issues should be closely monitored.

Risk Assessment

Using BGC as a broker presents several risks that traders should consider. The presence of clone brokers poses a significant threat, as clients may inadvertently engage with unauthorized entities.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Potential for clone operations |

| Execution Risk | Medium | Possible slippage and rejected orders |

| Customer Service Risk | Medium | Inconsistent support response |

To mitigate these risks, traders should verify the broker's regulatory status and ensure they are using the official website. Additionally, maintaining a diversified trading portfolio and setting strict risk management parameters can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while BGC appears to be a legitimate broker with a solid regulatory framework and a diverse range of financial products, there are notable concerns that potential clients should be aware of. The presence of clone operations, mixed customer feedback, and issues with withdrawal processes raise red flags that warrant caution.

For traders considering BGC, it is essential to conduct thorough research and ensure they are engaging with the legitimate entity. Additionally, those who prioritize a straightforward fee structure and reliable customer service may want to explore alternative brokers known for their transparency and client-centric practices.

If you are looking for reliable alternatives, consider brokers such as IG, OANDA, or Saxo Bank, which have established reputations for regulatory compliance and customer service excellence. Ultimately, informed decision-making and due diligence are key to navigating the complexities of the forex market successfully.

Is bgc a scam, or is it legit?

The latest exposure and evaluation content of bgc brokers.

bgc Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bgc latest industry rating score is 6.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.