Is Premium safe?

Pros

Cons

Is Premium Brokers A Scam?

Introduction

Premium Brokers positions itself as an international brokerage firm offering multi-asset trading solutions to clients in the foreign exchange market. However, the rise of unregulated brokers and the prevalence of scams in the financial sector necessitate that traders exercise caution when selecting a brokerage. Evaluating a broker's legitimacy and safety is paramount to protect one's investments and ensure a secure trading environment. This article aims to provide an objective assessment of Premium Brokers based on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis draws on various sources, including regulatory warnings, user reviews, and expert evaluations, to deliver a comprehensive overview of whether Premium is safe for trading.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. Premium Brokers operates under a license from the Marshall Islands, a jurisdiction known for its lax regulatory environment. This raises significant concerns regarding investor protection and the broker's adherence to international standards. Below is a summary of the core regulatory information for Premium Brokers:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Not Verified |

The lack of credible regulation is alarming, especially since the broker has been blacklisted by the Spanish regulator CNMV. This warning indicates that Premium Brokers is not authorized to provide investment services, including foreign currency transactions. The absence of oversight from reputable regulatory bodies such as the FCA in the UK or ASIC in Australia further exacerbates concerns about the broker's operational integrity. Historically, brokers without robust regulatory frameworks have been associated with higher risks, making it imperative for traders to thoroughly investigate before engaging with such firms.

Company Background Investigation

Premium Brokers is owned and operated by Premium Solutions Ltd, which is registered in the Marshall Islands. However, a search through various company registrars reveals a lack of verifiable information regarding the companys legitimacy. The opacity surrounding the ownership structure and management team raises red flags about the broker's transparency. Effective communication and accountability are essential for any financial institution, yet Premium Brokers has not provided sufficient information about its management or operational practices.

The management team‘s background is crucial in assessing the broker’s reliability. Unfortunately, there is no publicly available information regarding the qualifications or experience of the individuals behind Premium Brokers. This lack of transparency can leave potential investors vulnerable, as it becomes challenging to ascertain the broker's credibility. Furthermore, the company's failure to disclose essential operational details contributes to the perception that Premium is not safe for trading.

Trading Conditions Analysis

When evaluating a broker, it is essential to understand their trading conditions, including fees and spreads. Premium Brokers claims to offer competitive trading conditions, yet the specifics are often vague and not clearly outlined. The following table summarizes the core trading costs associated with Premium Brokers:

| Cost Type | Premium Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3.0% |

The lack of detailed information regarding spreads and commissions is concerning. Traders may encounter hidden fees that could significantly affect their profitability. Moreover, the absence of a clear commission model raises questions about the broker's transparency and fairness in pricing. Such practices can often lead to unexpected costs, making it difficult for traders to manage their expenses effectively. Therefore, it is crucial for potential clients to recognize that Premium is not safe without fully understanding the associated trading costs.

Customer Funds Safety

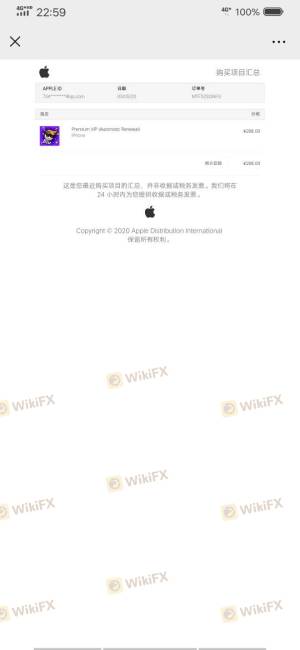

The safety of customer funds is a primary concern for any trader. Premium Brokers has not provided adequate information regarding its fund security measures, which is a significant drawback. The lack of segregation of client funds from the companys operational funds raises serious concerns about the safety of deposits. In addition, there is no indication that the broker participates in any investor compensation schemes that would provide a safety net in the event of insolvency.

Historical complaints about withdrawal issues further highlight the risks associated with trading with Premium Brokers. Many users have reported difficulties in accessing their funds, suggesting potential mismanagement of client accounts. Such incidents not only undermine trust but also indicate that Premium is not safe for traders looking to protect their investments. Without robust security measures and transparent policies, clients are left exposed to significant risks.

Customer Experience and Complaints

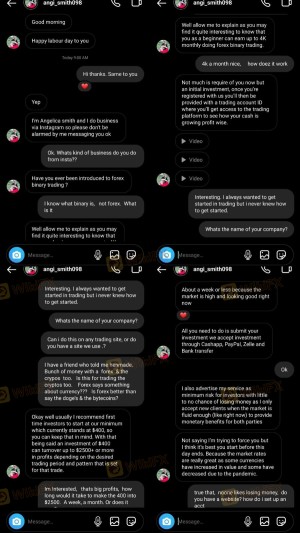

Customer feedback provides valuable insights into a broker's operational practices and reliability. Reviews of Premium Brokers reveal a pattern of negative experiences, particularly concerning withdrawal requests and customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

One notable case involves a trader who reported being unable to withdraw their funds after multiple requests, leading to frustration and financial loss. The company's unresponsive customer support exacerbated the situation, leaving the trader feeling helpless. Such experiences underscore the importance of choosing a broker with a proven track record of addressing customer concerns effectively. Overall, the feedback indicates that Premium is not safe for traders who value responsive and reliable customer service.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for ensuring a smooth trading experience. Premium Brokers offers a trading platform that claims to provide real-time quotes and advanced trading capabilities. However, user feedback suggests issues with platform stability, order execution quality, and potential slippage.

Many users have reported experiencing delays in order execution and instances of slippage during volatile market conditions. Such issues can significantly impact trading outcomes and raise concerns about the broker's operational integrity. If traders frequently encounter execution problems, it may indicate that Premium is not safe for reliable trading activities. The potential for platform manipulation or unfair practices further complicates the situation, making it essential for traders to consider alternative options.

Risk Assessment

Using Premium Brokers comes with inherent risks that traders must carefully evaluate. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about legality and accountability. |

| Fund Security Risk | High | Lack of segregation and investor protection mechanisms. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

| Execution Risk | High | Delays and slippage during trading can lead to financial losses. |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider using brokers with established regulatory oversight. Additionally, maintaining a diversified trading portfolio can help reduce exposure to any single broker's shortcomings. Ultimately, understanding the risks involved is crucial for making informed trading decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Premium is not safe for trading. The lack of credible regulation, transparency regarding company operations, and numerous customer complaints point to significant risks associated with this broker. Traders should be cautious and consider alternative options that offer robust regulatory oversight and a proven track record of client satisfaction.

For traders seeking reliable alternatives, it is recommended to explore brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers typically provide comprehensive investor protections and a transparent trading environment, ensuring a safer trading experience. Always prioritize due diligence before engaging with any brokerage to safeguard your investments effectively.

Is Premium a scam, or is it legit?

The latest exposure and evaluation content of Premium brokers.

Premium Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Premium latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.