Is WORLDCOIN safe?

Pros

Cons

Is Worldcoin Safe or Scam?

Introduction

Worldcoin is a cryptocurrency project co-founded by Sam Altman, the CEO of OpenAI, aimed at creating a unique digital identity verification system through biometric data, particularly iris scans. By establishing a "proof of personhood," Worldcoin intends to differentiate real individuals from bots in an increasingly digital and AI-driven world. However, the project's ambitious goals have raised significant concerns among traders and regulators alike, prompting the need for a careful evaluation of whether Worldcoin is safe or a potential scam.

In the volatile landscape of cryptocurrency and forex trading, traders must exercise due diligence when assessing brokers and platforms. The potential for fraud, mismanagement, and regulatory non-compliance necessitates a thorough investigation into the legitimacy of any trading entity. This article employs a comprehensive assessment framework, utilizing data from various reputable sources, regulatory disclosures, and user experiences to evaluate the safety and reliability of Worldcoin.

Regulation and Legitimacy

The regulatory landscape for Worldcoin is a critical factor in determining its safety. As of now, Worldcoin operates without oversight from any major financial regulator, which raises red flags about its legitimacy. The absence of regulation means that there are no stringent checks in place to protect users, making it essential to scrutinize its operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight can be alarming for potential users, as it opens the door for potential misuse of funds and data. Regulatory bodies often impose strict requirements on licensed entities, including capital adequacy, transparency, and consumer protection measures. Without such oversight, Worldcoins security measures and operational integrity come into question. The project's management has stated that it adheres to data protection regulations such as GDPR; however, the lack of independent verification makes these claims difficult to substantiate.

Company Background Investigation

Worldcoin was founded in 2019, with the vision of creating a decentralized identity and financial network. The project has attracted significant attention and investment, including backing from prominent figures in Silicon Valley. However, the ownership structure remains somewhat opaque, with many stakeholders involved, which complicates accountability.

The management team includes individuals with diverse backgrounds in technology and finance. While Sam Altmans reputation lends credibility to the project, the lack of transparency regarding the entire leadership team raises questions about their collective experience and capability to navigate the complexities of biometric data handling and cryptocurrency management.

Furthermore, the information disclosed by Worldcoin regarding its operational practices is limited. Transparency in operations is crucial for building trust among users, and the current level of disclosure does not inspire confidence. Without comprehensive information on the company's structure and decision-making processes, potential users are left in the dark, increasing the risk associated with engaging with Worldcoin.

Trading Conditions Analysis

Worldcoin's trading conditions are another area of concern. The platform claims to offer competitive fees; however, the absence of clear and comprehensive information on its fee structure makes it difficult for users to understand the actual costs involved.

| Fee Type | Worldcoin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.1-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-3% |

The lack of transparency regarding spreads and commissions could lead to unexpected costs for traders. Additionally, if Worldcoin employs hidden fees or unusual commission structures, users may face significant financial risks. Traders should be cautious and ensure they fully understand any costs associated with trading on this platform.

Customer Funds Security

When evaluating the safety of a trading platform, customer funds security is paramount. Worldcoin claims to implement several security measures, including fund segregation and encryption of biometric data. However, the effectiveness of these measures is unverified due to the absence of regulatory oversight.

The project has faced scrutiny regarding its data collection practices, particularly concerning the handling of sensitive biometric information. Concerns have been raised about the potential for data breaches and unauthorized access to user information. Historical incidents of data theft and misuse in the tech industry further exacerbate these concerns, leading to skepticism regarding Worldcoins ability to safeguard user data.

Without robust investor protection mechanisms in place, such as insurance against loss or fraud, users may be at significant risk. The lack of a clear track record regarding funds security raises questions about whether Worldcoin is safe for traders looking to invest their money.

Customer Experience and Complaints

User feedback on Worldcoin has been mixed, with some praising its innovative approach and others expressing concerns about its practices. Common complaints include issues with customer service responsiveness and transparency regarding how user data is utilized.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Data Privacy Concerns | High | Unclear |

| Customer Service Issues | Medium | Slow Response |

| Technical Glitches | Low | Addressed |

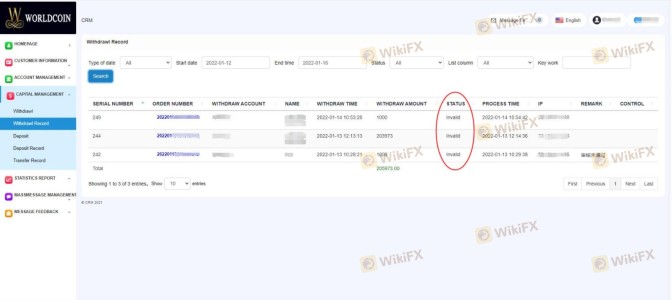

For instance, several users have reported difficulties in accessing their accounts and retrieving funds, leading to frustration and distrust. The company's response to these complaints has been criticized as inadequate, further diminishing user confidence in the platform.

Platform and Execution

Worldcoin's trading platform performance is crucial for a satisfactory user experience. However, reports suggest that users have encountered issues with order execution quality, including slippage and failed transactions. These problems can significantly impact trading outcomes and raise suspicions of potential manipulation.

The platform's stability and user interface design are also critical factors. A seamless and intuitive interface is essential for traders, especially those new to the market. However, if the platform is prone to crashes or delays, it could lead to missed trading opportunities and financial losses.

Risk Assessment

Engaging with Worldcoin presents several risks that potential users should consider. The lack of regulation, transparency issues, and concerns regarding data privacy all contribute to an elevated risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance Risk | High | No oversight from financial regulators. |

| Data Privacy Risk | High | Concerns over biometric data handling. |

| Financial Risk | Medium | Lack of transparency in fee structures. |

To mitigate these risks, users should conduct thorough research, remain vigilant about their personal data, and consider diversifying their investments across more established platforms.

Conclusion and Recommendations

In conclusion, while Worldcoin presents an innovative approach to digital identity verification, significant concerns regarding its regulatory status, data privacy, and overall transparency raise alarms about its safety. The absence of oversight and clear operational practices suggests that traders should exercise caution when considering engagement with this platform.

For traders seeking alternatives, it is advisable to explore more established and regulated platforms that prioritize user security and transparency. Platforms with proven track records and solid regulatory backing may provide a safer trading environment.

Ultimately, the question of "Is Worldcoin safe?" remains unanswered for now, as the project's future will depend heavily on its ability to address these pressing concerns and build trust within the trading community.

Is WORLDCOIN a scam, or is it legit?

The latest exposure and evaluation content of WORLDCOIN brokers.

WORLDCOIN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WORLDCOIN latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.