Brunsdon 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Brunsdon is a forex broker operating from Saint Vincent and the Grenadines, presenting a daunting choice for its potential clients. This unregulated broker offers a wide spectrum of trading instruments via the MT4 platform. However, it comes with serious caveats including a lack of regulatory oversight and numerous complaints about fund withdrawals, making it a risky option—especially for inexperienced traders. Experienced investors seeking diverse trading options and willing to navigate higher risks might find some appeal in Brunsdons offerings. Nevertheless, the trade-offs between cost and safety cannot be ignored. High trader risks and negative user experiences underscore the critical need for caution when contemplating this broker.

⚠️ Important Risk Advisory & Verification Steps

- Lack of Regulation: Brunsdon operates without valid regulations, which poses significant risks to traders regarding fund safety and recourse.

- Withdrawal Issues: Numerous customer complaints detail difficulties in withdrawing funds, signaling potential threats to capital safety.

- Self-Verification Steps:

- Check the brokers regulatory status through recognized financial authority websites.

- Review user feedback on credible financial forums and broker review sites.

- Look for updates or warnings about the broker in financial regulatory bodies.

It is essential for all investors to weigh these risks carefully before proceeding with Brunsdon.

Broker Review Ratings

Company Background and Positioning

Brunsdon was founded approximately 5 to 10 years ago in Saint Vincent and the Grenadines. It operates as an unregulated broker, which is noteworthy primarily due to its claimed list of diverse trading instruments including precious metals, energy, stock indices, and agricultural products. However, without regulatory oversight and in light of a revoked FCA license, its market positioning raises questions about its longevity and operational credibility.

Core Business Overview

Brunsdons offerings span various asset classes such as precious metals, energy, and agricultural products, accessed through the popular MT4 trading platform known for its user-friendly features and charting capabilities. The broker claims to provide floating spreads and does not charge commissions, making it potentially attractive for cost-sensitive traders. However, the absence of a transparent regulatory framework should raise red flags for prospective clients.

Quick-Look Details

6. In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of valid regulatory oversight is a significant factor undermining Brunsdons trustworthiness. Various regulatory bodies have publicly indicated that the broker operates without necessary licenses. Furthermore, multiple user experiences highlight severe withdrawals issues, indicating a significant trust deficit in the integrity of its operations.

Regulatory Information Conflicts:

There are inconsistencies surrounding Brunsdon‘s regulatory claims. Despite its assertions that it operates under certain licensing, users have noted that FCA licenses have been revoked, highlighting the lack of dependable oversight. This suggests an environment where traders’ funds are more vulnerable.

User Self-Verification Guide:

Research Brunsdon on the Financial Conduct Authority (FCA) or Financial Services Authority (FSA) websites.

Check for any updates or warnings concerning Brunsdon on reputable financial regulatory websites.

Engage with established user forums detailing trader experiences and cautionary tales regarding withdrawal issues.

Industry Reputation and Summary:

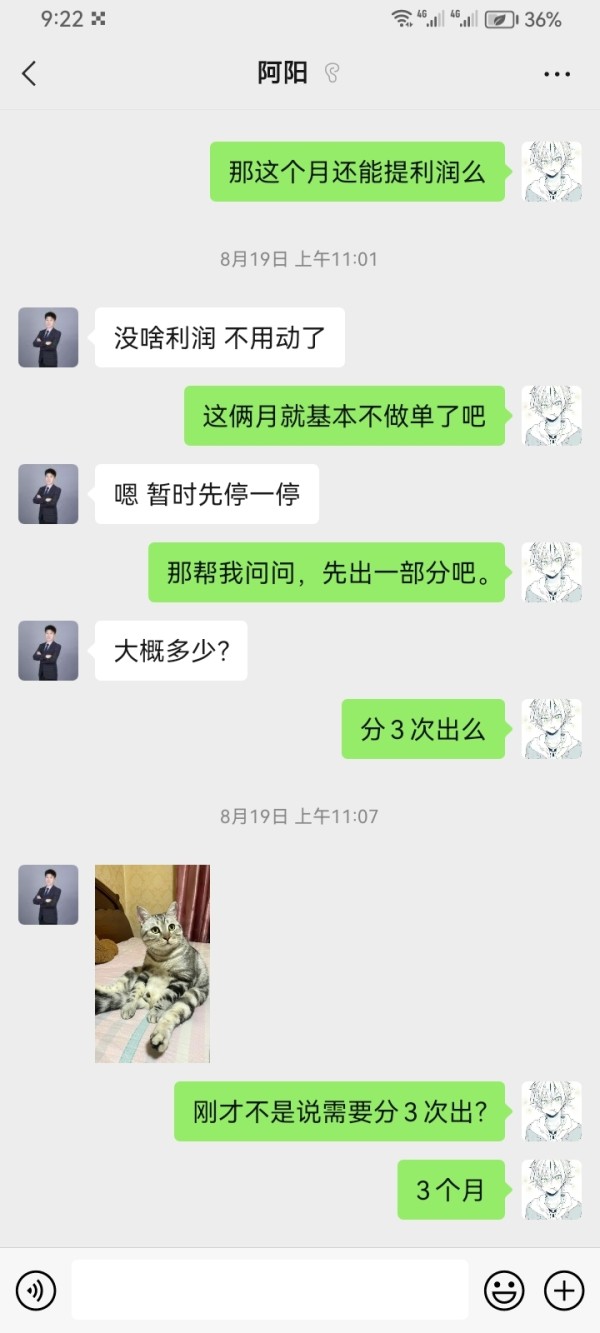

User feedback regarding Brunsdon often paints a troubling picture. One user shared,

"I asked for the principal withdrawal; the principal has been delayed for several months. Funds cannot be transferred out, and there are no corresponding communication channels or solutions."

These experiences reveal a troubling trend regarding funds and customer service, emphasizing the need for potential clients to approach Brunsdon with caution.

Trading Costs Analysis

Brunsdon presents a mixed bag regarding trading costs.

Advantages in Commissions:

The broker showcases competitive commissions with no stated trading fees, which can be appealing to frequent traders looking to minimize transaction costs associated with their trading strategies.

The "Traps" of Non-Trading Fees:

However, users have expressed concerns about hidden withdrawal fees and burdensome withdrawal processes. One user remarked,

"Withdrawals from the asset management account are currently not possible, and to withdraw my funds, I need to hand over any profits first—a process concerning."

Such comments underscore the potential for unanticipated costs that could undermine the low commission structure.

- Cost Structure Summary:

For traders focused on commission-based trading strategies, Brunsdon may seem attractive, yet the hidden costs and challenges related to withdrawing funds highlight significant trade-offs, especially for less experienced traders who might be unaware of these issues.

Brunsdon facilitates trading primarily through the MT4 platform, a globally recognized trading software known for its extensive tools and functionalities.

Platform Diversity:

MT4 is touted for its user-friendly design, supporting various trading styles which include scalping, day trading, and swing trading. Its charting tools and analytical resources are vital for proficient traders looking for depth in their trading tools.

Quality of Tools and Resources:

Despite the benefits of the MT4 platform, reviews about the educational resources and support tools fall short of expectations. Users have indicated a lack of comprehensive training or guidance, making it less beginner-friendly.

Platform Experience Summary:

User feedback often commends the customizable features of MT4; however, one trader mentioned,

"While MT4 is robust, navigating the withdrawal process feels cumbersome and negatively affects the trading experience."

Such insights spotlight the need for potential users to weigh platform strengths against operational challenges.

User Experience Analysis

User experience on Brunsdons platform is mixed, showcasing the duality of advanced trading tools versus reported systemic issues.

Ease of Use:

Many users appreciate the straightforward functionalities of MT4, allowing for ease of tracking and executing trades.

User Interactions:

Yet, as expressed in several user reviews, interactions with customer support have been subpar, often characterized by unresponsiveness and limited communication avenues. One review stated that accessing support "feels like an uphill battle," a sentiment evidently shared by numerous clientele.

Overall Summary:

While the platform shows promise regarding trading capabilities, the urgency around its deficient customer service experiences raises critical concerns for users.

Customer Support Analysis

The customer support dimension represents one of Brunsdon's weakest areas.

Contact Channels:

Users express frustration regarding limited avenues for assistance, which hampers their ability to obtain prompt resolutions concerning trading issues or withdrawal requests.

Customer Service Quality:

Many reviews cite that when reaching out for support, responses are delayed or they receive insufficient guidance. This has led to increased stress, especially related to the ongoing difficulties surrounding fund withdrawals.

Overall Support Summary:

The portrayal of Brunsdon's customer support, coupled with the serious withdrawal grievances presented by users, tends to undermine overall confidence in the broker's operational integrity.

Account Conditions Analysis

Brunsdon offers a flexible account setup conducive to various trading styles.

General Account Requirements:

The broker does not define a minimum deposit requirement or withdrawal amount, potentially attracting novice traders who may not have substantial capital to start.

Account Flexibility:

However, the lack of institutional regulations around these accounts often translates into hesitancy from more experienced traders. One trader indicated,

"Entering with no deposit limit sounds appealing, but unknown conditions tied to withdrawals make it risky."

- Overall Summary:

Despite the operational flexibility, the lack of clear conditions on account use eventually leads to notable skepticism surrounding the safety of funds and operational practices.

Final Thoughts

The comprehensive review of Brunsdon paints a complex picture. While the broker presents appealing trading opportunities, potential traders must navigate considerable risks arising from a lack of regulatory oversight and troubling user experiences. Experienced investors might find how these factors align with their trading goals, but beginners would be wise to approach with caution. Thus, Brunsdon remains a brokerage fraught with potential pitfalls cloaked in the guise of opportunity.