Is BRUNSDON safe?

Pros

Cons

Is Brunsdon Safe or Scam?

Introduction

Brunsdon is a forex broker that has been gaining attention in the trading community for its services and offerings. As the forex market continues to expand, traders must remain vigilant in evaluating the credibility and safety of brokers like Brunsdon. With numerous reports of scams and fraudulent activities in the industry, it is essential for traders to conduct thorough research before committing their funds. This article will investigate whether Brunsdon is a safe option for traders or if there are potential red flags that warrant caution. Our analysis will be based on a review of regulatory compliance, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect traders' interests. Brunsdon operates under the supervision of the St. Vincent and the Grenadines Financial Services Authority (SVG FSA), which is known for its less stringent regulatory framework compared to other jurisdictions. Below is a summary of Brunsdon's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG Financial Services Authority | 24014 | St. Vincent and the Grenadines | Authorized |

While Brunsdon is authorized by the SVG FSA, the quality of regulation is a concern. The SVG FSA is often categorized as a low-tier regulator, which may not provide the same level of investor protection as top-tier regulators such as the FCA (UK) or ASIC (Australia). This raises questions about Brunsdon's compliance history and the extent to which it protects its clients. Traders should be cautious when dealing with brokers regulated by less reputable authorities, as they may face challenges in recovering funds in case of disputes.

Company Background Investigation

Brunsdon has a relatively brief history compared to more established brokers. Founded in 2017, it has been positioned as a provider of forex and CFD trading services. The ownership structure of Brunsdon is not extensively documented, which can be a red flag for potential investors. Transparency is crucial in the financial services industry, and a lack of information about the company's management team and operational history can lead to skepticism.

The management team at Brunsdon should ideally have a track record of experience in the financial industry. However, there is limited publicly available information regarding their professional backgrounds. This lack of transparency can hinder traders' confidence in the broker's ability to manage their investments effectively. Overall, the companys limited history and opaque ownership structure may contribute to concerns regarding its reliability.

Trading Conditions Analysis

When evaluating whether Brunsdon is safe, traders must consider the broker's trading conditions, including fees and spreads. Brunsdon claims to offer competitive trading costs, but it is essential to examine these claims critically. Below is a comparison of Brunsdon's core trading costs against industry averages:

| Cost Type | Brunsdon | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 0.5% | 0.3% |

While Brunsdon offers a spread of 1.5 pips on major currency pairs, which is slightly higher than the industry average, the variable commission model could lead to unexpected costs for traders. Additionally, the overnight interest rate of 0.5% raises concerns, as it is higher than the average, potentially impacting long-term trading strategies. Traders should carefully review the fee structure to avoid any surprises that could erode their profits.

Customer Fund Safety

The safety of customer funds is paramount when assessing whether Brunsdon is safe. Brunsdon claims to implement measures to protect client funds, including segregating client accounts from corporate funds. However, the effectiveness of these measures is not well documented. The absence of robust investor protection mechanisms, such as negative balance protection, raises further concerns. Traders need to be aware of the potential risks associated with trading with Brunsdon, especially in volatile market conditions.

Moreover, there have been no significant historical incidents reported regarding fund security issues at Brunsdon. However, the lack of transparency regarding their financial practices and safety measures can lead to uncertainty among potential clients. It is crucial for traders to prioritize brokers with established safety protocols and clear policies regarding fund protection.

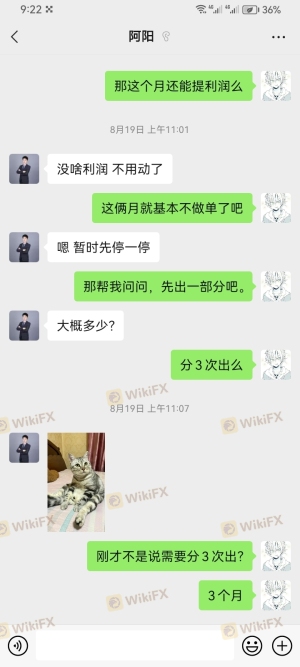

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user experiences with Brunsdon reveals a mix of positive and negative reviews. Many users appreciate the user-friendly trading platform and responsive customer service. However, common complaints include withdrawal delays and unclear fee structures. Below is a summary of the primary complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Fee Transparency Issues | Medium | Vague explanations |

One notable case involved a trader who experienced significant delays in withdrawing their funds, leading to frustration and dissatisfaction. The company's response was deemed inadequate, with many users reporting a lack of communication regarding their withdrawal requests. Such complaints can raise red flags about the broker's operational efficiency and commitment to customer satisfaction.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for traders. Brunsdon offers a standard trading platform that is generally well-received for its user-friendly interface. However, there have been reports of slippage and execution delays during high-volatility periods. Traders should be cautious of these potential issues, as they can impact trading outcomes significantly.

Additionally, there are no substantial indications of platform manipulation or unethical practices reported by users. However, the presence of slippage and execution issues could indicate underlying operational inefficiencies that traders should consider before engaging with Brunsdon.

Risk Assessment

Using Brunsdon comes with a range of risks that traders should be aware of. Below is a risk assessment summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under a low-tier regulator |

| Financial Transparency | Medium | Limited information available |

| Withdrawal Issues | High | History of delays reported |

To mitigate these risks, traders are advised to start with a small investment, conduct regular monitoring of their accounts, and maintain open communication with the broker. It's also wise to familiarize oneself with the broker's terms and conditions to avoid unexpected issues.

Conclusion and Recommendations

In conclusion, the investigation into whether Brunsdon is safe reveals a mixed picture. While the broker is authorized by the SVG FSA, the regulatory quality is a concern, and there are several red flags regarding transparency, customer fund safety, and withdrawal processes. Traders should exercise caution and consider the potential risks associated with this broker.

For those looking for safer alternatives, it may be beneficial to explore brokers regulated by top-tier authorities such as the FCA or ASIC, which offer stronger investor protections and clearer operational transparency. Ultimately, conducting thorough research and staying informed will empower traders to make educated decisions in the forex market.

Is BRUNSDON a scam, or is it legit?

The latest exposure and evaluation content of BRUNSDON brokers.

BRUNSDON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BRUNSDON latest industry rating score is 2.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.