BTSE 2025 Review: Everything You Need to Know

In this comprehensive review of BTSE, we delve into the strengths and weaknesses of this cryptocurrency exchange, highlighting key features and user experiences. Overall, BTSE has garnered a positive reputation for its user-friendly interface and robust trading options, but it faces challenges in customer support and regulatory compliance.

Note: It is essential to recognize that BTSE operates under different entities across regions, which may affect user experience and regulatory conditions. This review reflects a balanced approach to evaluating the platform based on various sources.

Ratings Overview

We assess brokers based on user feedback, expert opinions, and factual data from multiple sources.

Broker Overview

Founded in 2018, BTSE is a cryptocurrency exchange headquartered in the British Virgin Islands. It aims to bridge traditional finance and the crypto world, offering a platform for trading over 150 cryptocurrencies and various fiat currencies. The exchange provides a user-friendly platform with advanced trading tools, including futures contracts with leverage options up to 100x. However, BTSE is not regulated by major financial authorities, which raises concerns about its trustworthiness.

Detailed Section

Regulatory Regions

BTSE is not available to users in the United States, Canada, and several other countries, including North Korea and Iran. This limited accessibility may deter potential users who are situated in these regions. The lack of regulatory oversight can be a red flag for many traders seeking a secure trading environment.

Deposit/Withdrawal Currencies

BTSE supports deposits and withdrawals in multiple fiat currencies, including USD, EUR, GBP, and several others. Users can also transact in over 150 cryptocurrencies, which adds flexibility for traders. Notably, there are no deposit fees for cryptocurrency transactions, but withdrawal fees vary depending on the asset.

Minimum Deposit

One of the standout features of BTSE is the absence of a minimum deposit requirement for cryptocurrency transactions. This makes it accessible for new traders looking to enter the market without significant financial commitment. However, for fiat deposits, a minimum of $100 is required.

Currently, BTSE does not offer any promotional bonuses or incentives for new users, which could be a disadvantage compared to other exchanges that provide such benefits to attract new customers.

Tradable Asset Classes

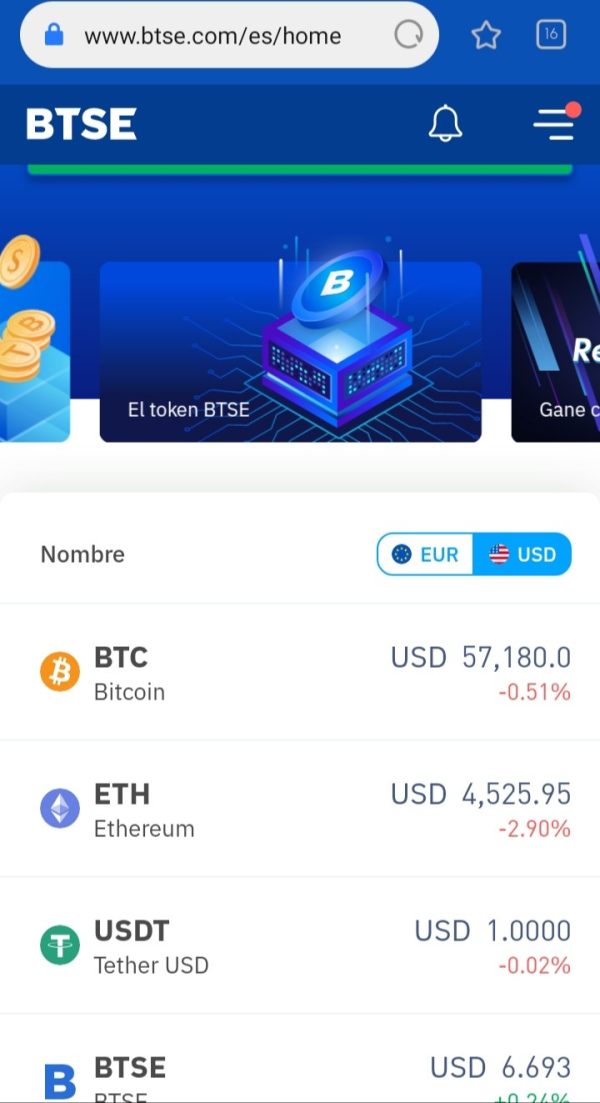

BTSE allows users to trade a wide variety of cryptocurrencies, including major assets like Bitcoin (BTC), Ethereum (ETH), and stablecoins like Tether (USDT). Furthermore, the platform offers futures trading, which is a significant draw for more experienced traders looking to leverage their positions.

Costs (Spreads, Fees, Commissions)

The trading fees on BTSE are competitive, with a tiered fee structure that rewards higher trading volumes. For spot trading, the maker fee is 0.2%, while the taker fee is also 0.2%. Futures trading fees are slightly lower, with discounts available for users holding BTSE tokens.

Leverage

BTSE offers leverage up to 100x on futures contracts, allowing traders to amplify their potential gains (and losses). This high leverage can be appealing to experienced traders but poses significant risks for novices.

BTSE operates its proprietary trading platform, which is accessible via web and mobile applications for both iOS and Android devices. The mobile app has received positive reviews for its intuitive design and functionality, allowing users to trade on the go.

Restricted Areas

As previously mentioned, BTSE is not accessible to users in the United States and several other countries due to regulatory restrictions. This limitation can significantly impact the platform's user base and overall trading volume.

Available Customer Service Languages

BTSE primarily provides customer support in English. However, users have reported that customer service options are somewhat limited, with no live chat available. Support is primarily conducted through email, and response times can vary, leading to frustration among users.

Ratings Revisited

Detailed Breakdown

-

Account Conditions: BTSE's lack of minimum deposit requirements for cryptocurrency trading is a significant advantage, making it accessible for new traders. However, the requirement for a $100 minimum deposit for fiat transactions may deter some users.

Tools and Resources: The platform offers advanced trading tools, including various order types and futures trading, catering to both novice and experienced traders. Educational resources help users navigate the trading landscape effectively.

Customer Service and Support: Users have reported that customer service is a weak point for BTSE. While the platform provides email support, the absence of live chat and slow response times can lead to dissatisfaction.

Trading Experience: BTSE's user-friendly interface and mobile app make trading easy, even for beginners. The platform's advanced trading features, such as leverage and automated trading options, enhance the overall trading experience.

Trustworthiness: The lack of regulation is a concern for many users. While BTSE has implemented security measures such as two-factor authentication and cold storage for user funds, the absence of oversight from major financial authorities may deter some traders.

User Experience: Overall, users appreciate the intuitive design of BTSE's platform, which simplifies the trading process. The mobile app has received positive feedback for its functionality and ease of use.

In conclusion, BTSE appears to be a solid option for cryptocurrency trading, especially for those interested in futures and leveraged trading. However, potential users should weigh the pros and cons, particularly regarding regulatory compliance and customer support, before committing to the platform.