IMAX Review 1

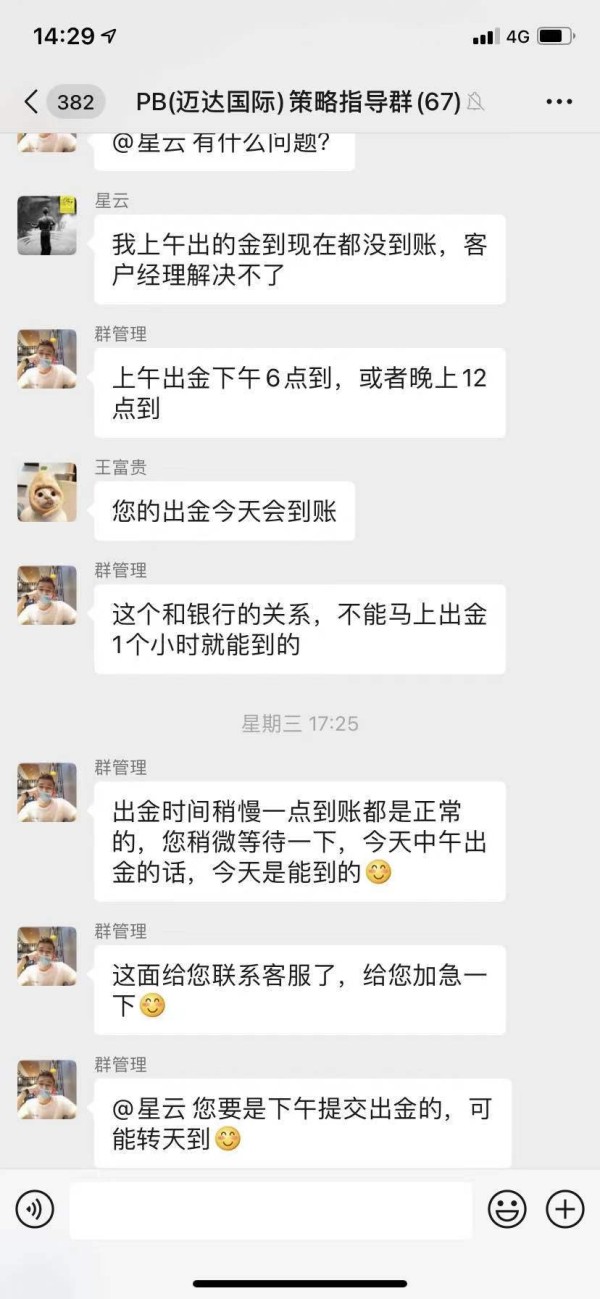

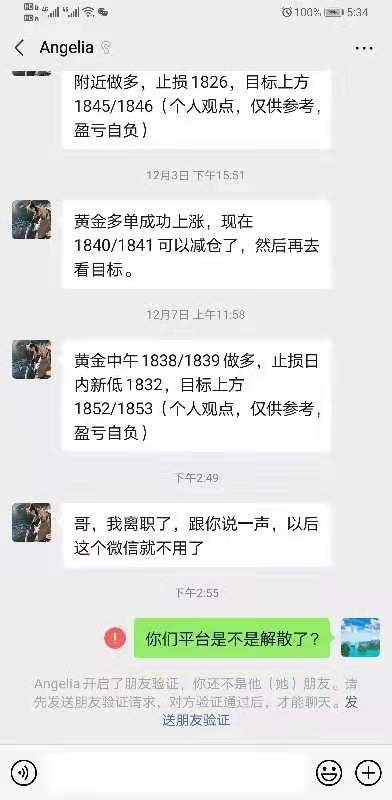

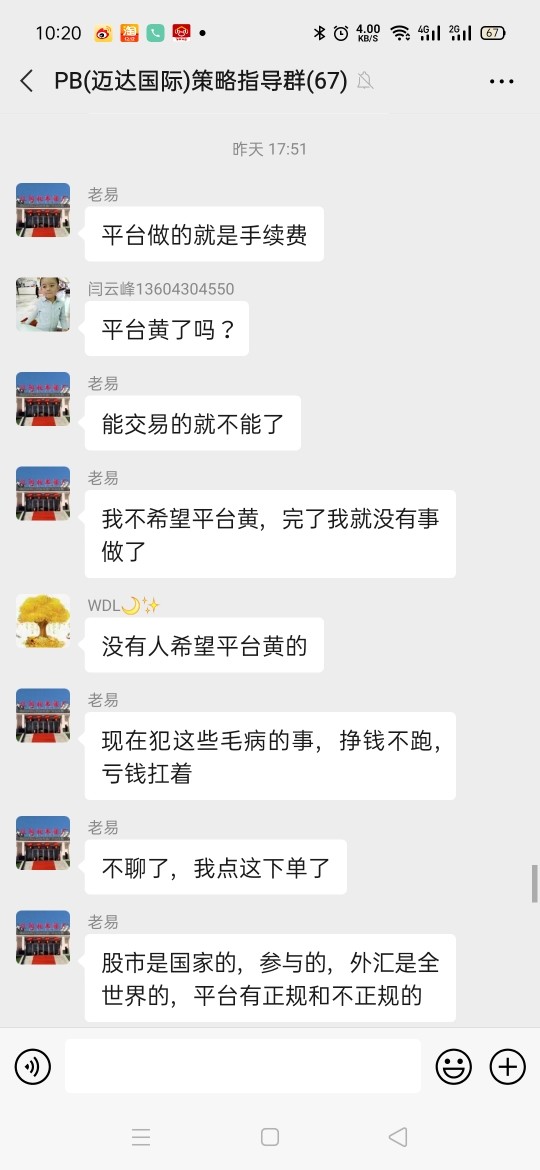

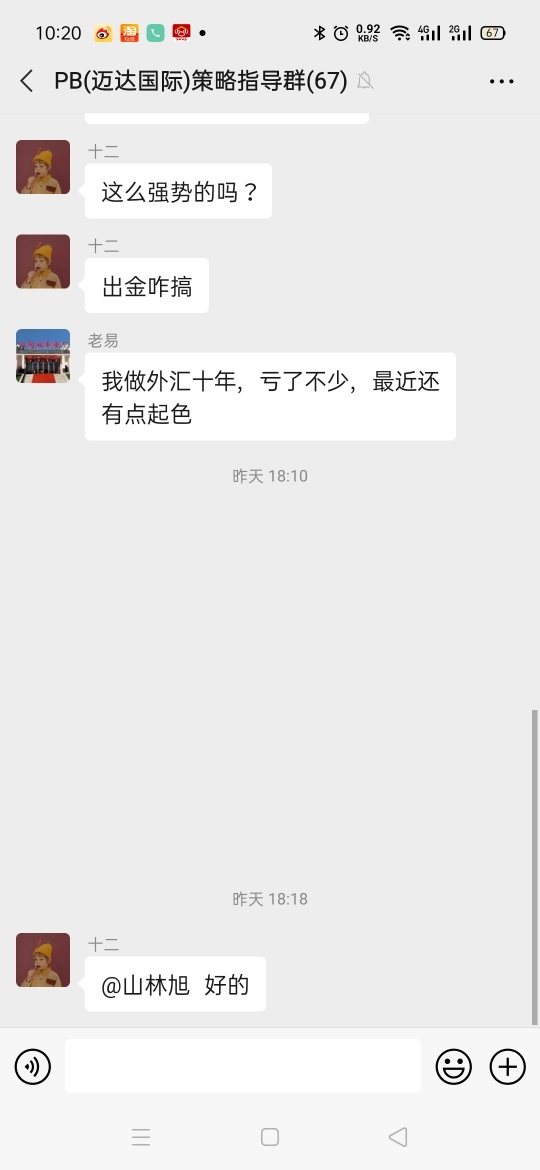

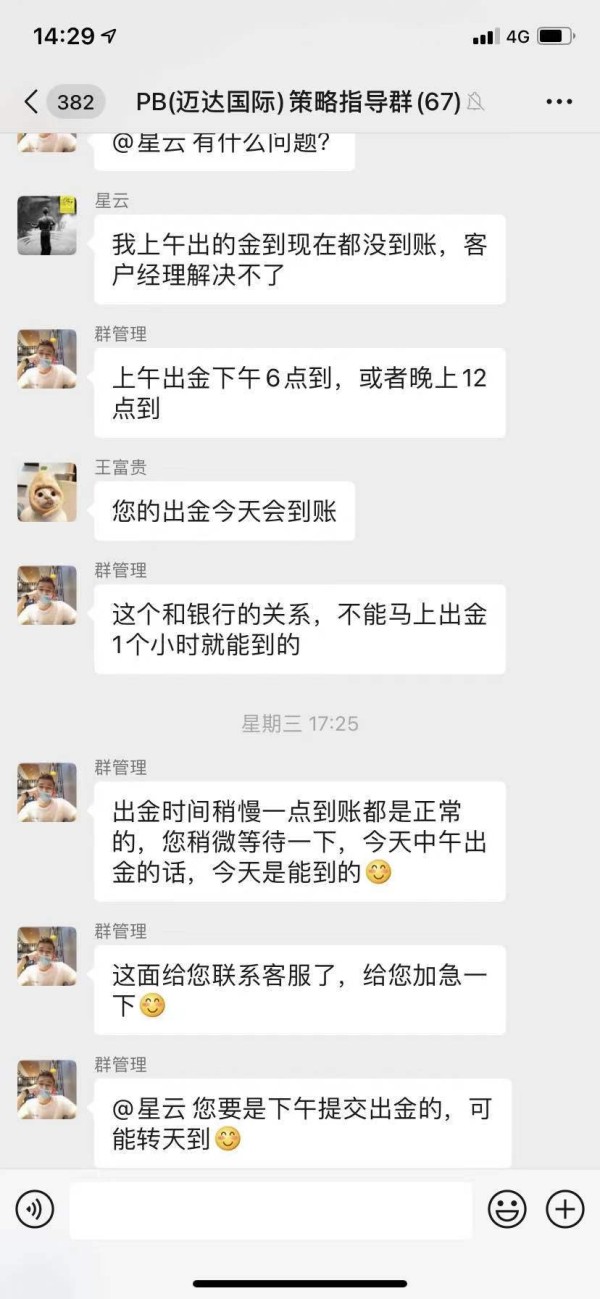

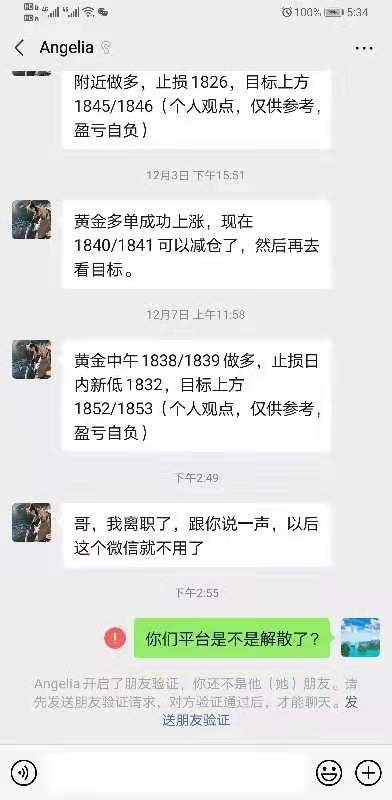

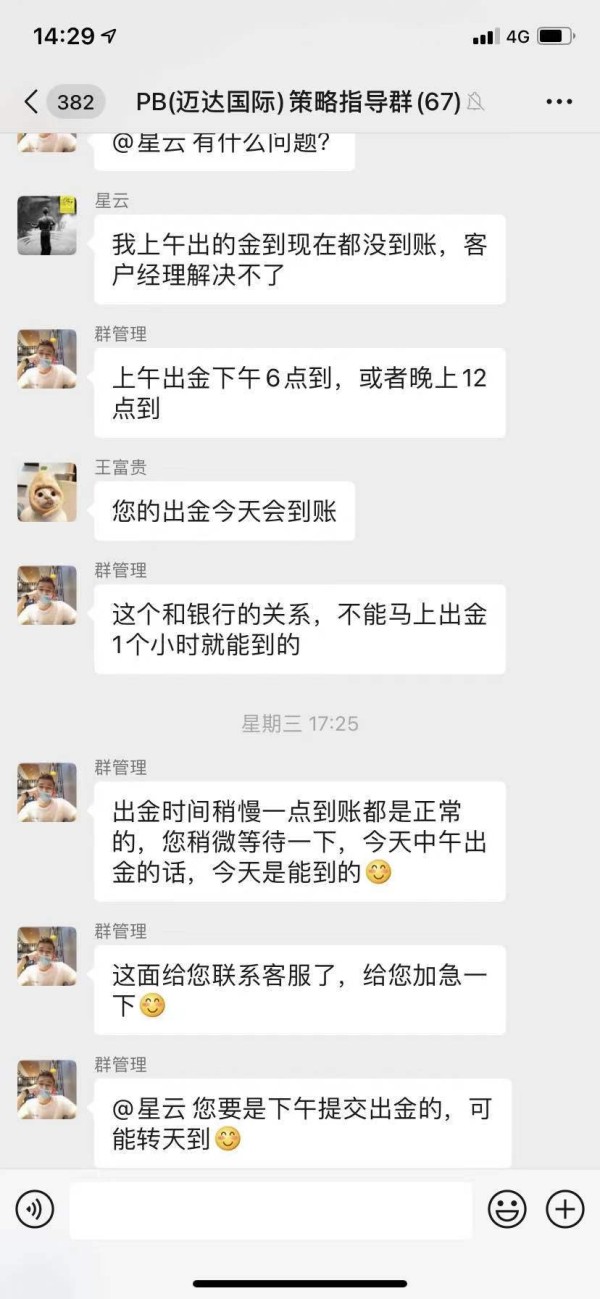

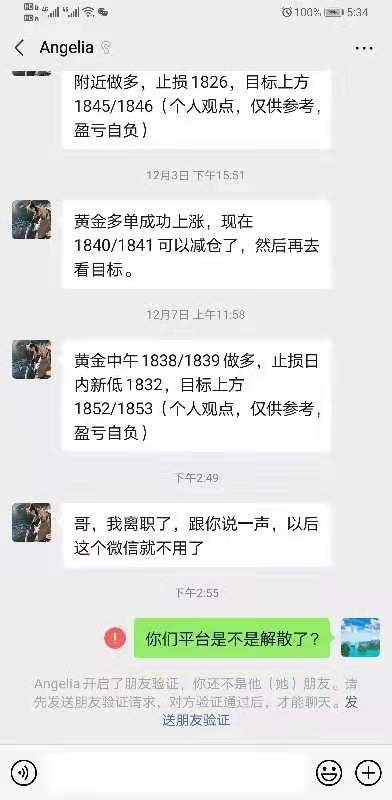

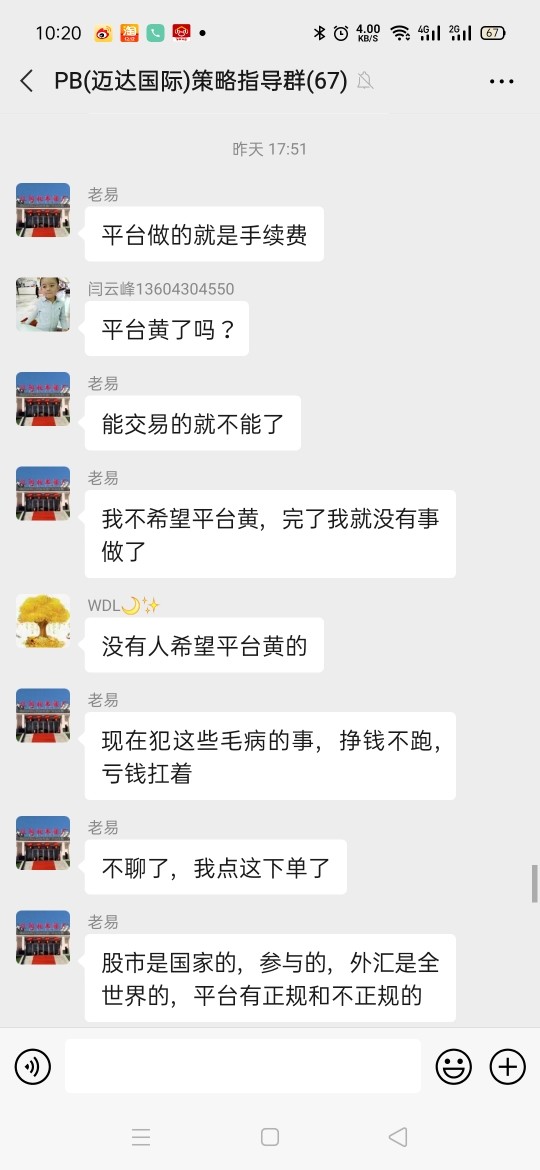

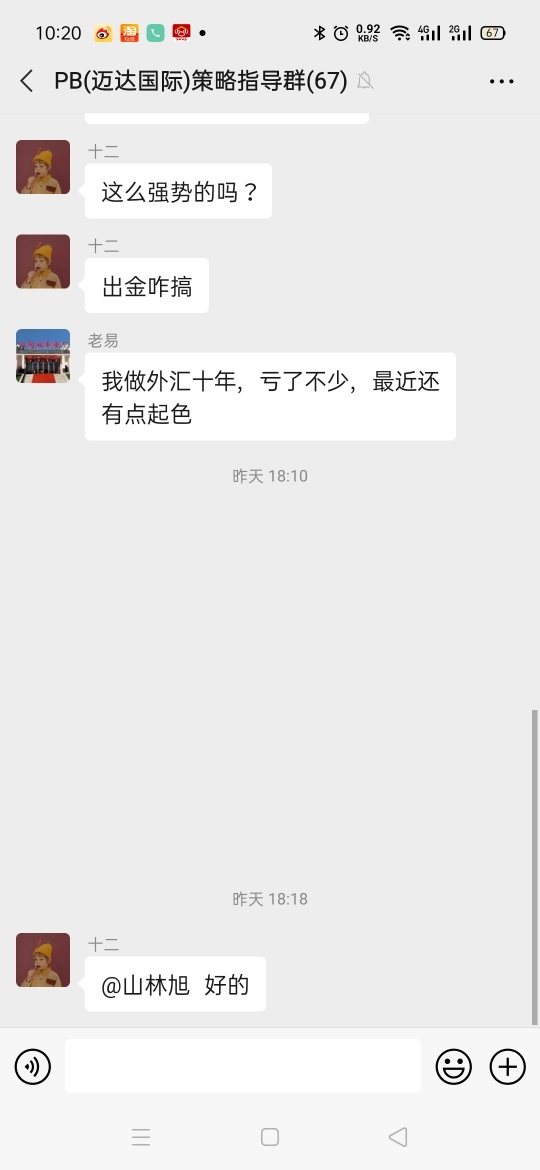

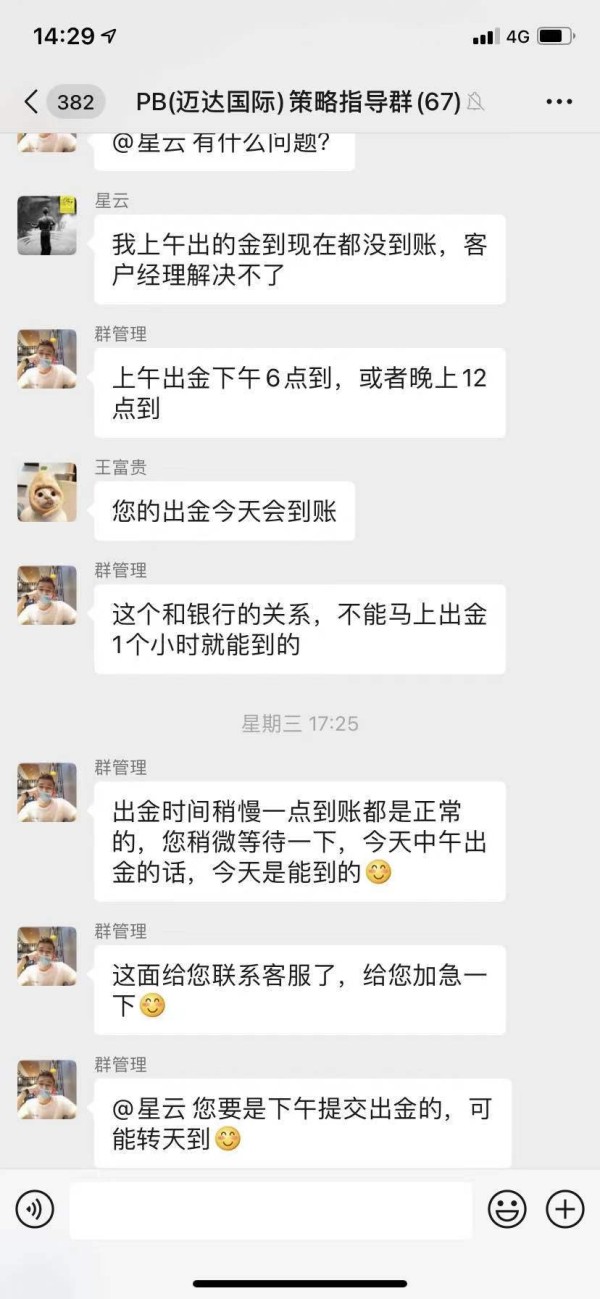

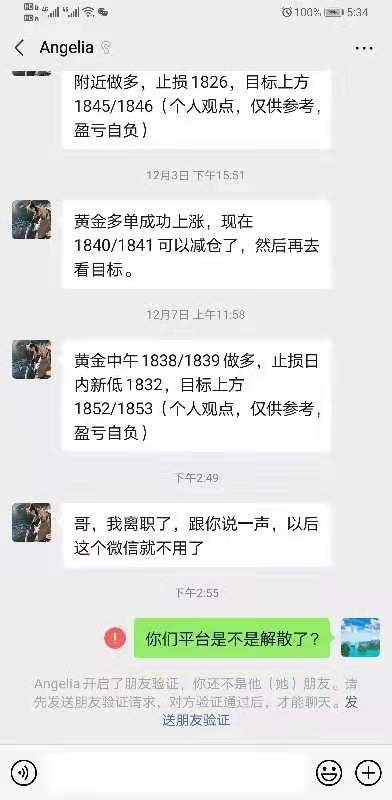

There has been no one talking in the strategy group chat since this Monday. And the withdrawal can’t arrive. All the teachers and superiors are out of contact

IMAX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

There has been no one talking in the strategy group chat since this Monday. And the withdrawal can’t arrive. All the teachers and superiors are out of contact

This comprehensive imax review examines IMAX LIMITED, an unregulated forex broker that presents significant concerns for potential traders. IMAX LIMITED is registered in the United States but operates without proper regulatory oversight, which raises substantial red flags for investor protection. The broker appears to target traders interested in options trading, potentially leveraging the brand recognition associated with IMAX cinema technology to attract users.

While the company's US registration might initially appear reassuring, the lack of regulatory authorization from recognized financial authorities creates considerable risk for traders. The broker's positioning in the market seems to capitalize on name recognition. It's important to note that this entity appears unrelated to the well-known IMAX cinema technology company. Traders considering this platform should exercise extreme caution due to the absence of regulatory protection and limited transparency regarding operational practices.

The evaluation of this broker reveals significant information gaps across multiple critical areas, including account conditions, trading tools, customer support, and overall user experience. These gaps further compound the concerns about its legitimacy and reliability.

Regional Entity Differences: It's crucial to understand that IMAX-related entities may operate under different regulatory frameworks across various jurisdictions. The IMAX LIMITED entity discussed in this review is specifically registered in the United States but lacks proper regulatory authorization. Traders should carefully verify the regulatory status of any broker they consider, as regulatory protection varies significantly between regions.

Review Methodology: This imax review is based on currently available information from official sources and regulatory databases. However, due to the limited transparency and regulatory status of IMAX LIMITED, some information may be incomplete or unavailable. Traders should conduct additional due diligence before making any investment decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Specific information not available in current sources |

| Tools and Resources | N/A/10 | Detailed platform information not disclosed |

| Customer Service | N/A/10 | Support infrastructure details not available |

| Trading Experience | N/A/10 | Platform performance data not provided |

| Trust and Reliability | 2/10 | Unregulated status with no official authorization |

| User Experience | N/A/10 | User feedback and interface details not available |

IMAX LIMITED presents itself as a forex and options trading platform. Specific details about its establishment date remain undisclosed in available sources. The company operates under US registration but notably lacks authorization from recognized financial regulatory bodies. This regulatory gap represents a significant concern for potential traders seeking secure and compliant trading environments.

The broker's business model appears to focus on forex and options trading services. Comprehensive details about its operational structure, trading infrastructure, and service offerings are not readily available through official channels. The limited transparency regarding fundamental business operations raises questions about the company's commitment to regulatory compliance and trader protection.

According to regulatory databases, IMAX LIMITED is classified as an unauthorized company, which means it operates without proper oversight from financial authorities. This status significantly impacts the level of protection available to traders and suggests that the platform may not meet standard industry requirements for client fund security, operational transparency, and regulatory compliance that legitimate brokers typically maintain.

Regulatory Status: IMAX LIMITED operates as an unregulated entity registered in the United States but lacks authorization from recognized financial regulatory bodies. This absence of proper oversight creates substantial risks for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in current available sources. This raises concerns about operational transparency.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit thresholds or account funding requirements through official channels. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: Details regarding bonus structures, promotional campaigns, or incentive programs are not available in current documentation. This suggests limited marketing transparency.

Available Assets: Based on available information, the platform appears to offer forex and options trading. Comprehensive asset lists, market coverage, and trading instrument details remain undisclosed.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not available through official sources. This is concerning for cost-conscious traders seeking transparent pricing.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. This leaves traders without crucial risk management information.

Platform Options: Trading platform specifications, software providers, and technological infrastructure details are not disclosed in current sources.

Geographic Restrictions: Information about service availability across different jurisdictions and potential trading restrictions is not clearly outlined.

Customer Support Languages: Available support languages and communication channels are not specified in current documentation.

This imax review highlights significant information gaps that potential traders should consider when evaluating this broker option.

The evaluation of IMAX LIMITED's account conditions faces substantial challenges due to limited available information from official sources. Without access to comprehensive details about account types, minimum deposit requirements, and special features, it becomes impossible to provide a meaningful assessment of the broker's account offerings.

Legitimate forex brokers typically provide detailed information about various account tiers. Each tier is designed to meet different trader needs and experience levels. These usually include basic accounts for beginners, advanced accounts for experienced traders, and sometimes VIP accounts for high-volume traders. However, IMAX LIMITED has not disclosed such information through official channels.

The absence of clear account opening procedures, verification requirements, and account management features raises significant concerns about the broker's transparency and commitment to regulatory compliance. Professional brokers typically offer specialized account types, including Islamic accounts for traders requiring Sharia-compliant trading conditions, but no such information is available for this entity.

Furthermore, without detailed information about account conditions, potential traders cannot assess whether the broker's offerings align with their trading needs, risk tolerance, or investment objectives. This lack of transparency is particularly concerning given the broker's unregulated status and suggests that traders should exercise extreme caution when considering this platform for their trading activities.

The unavailability of basic account information in this imax review underscores the importance of choosing regulated brokers that maintain transparency in their service offerings.

The assessment of trading tools and resources offered by IMAX LIMITED is severely hampered by the lack of publicly available information about the broker's technological infrastructure and analytical offerings. Professional forex brokers typically provide comprehensive suites of trading tools, including advanced charting software, technical indicators, economic calendars, and market analysis resources.

Standard industry practice includes offering multiple chart types, timeframes, and technical analysis tools that enable traders to make informed decisions. Additionally, reputable brokers often provide educational resources such as webinars, trading guides, and market commentary to support trader development. However, no such information is available regarding IMAX LIMITED's offerings.

The absence of details about automated trading support, expert advisors, or algorithmic trading capabilities further limits the ability to assess the broker's technological sophistication. Modern trading platforms typically integrate with popular trading software and provide APIs for custom tool development, but IMAX LIMITED has not disclosed such capabilities.

Research and analysis resources are crucial for successful trading, including real-time market data, fundamental analysis, and expert commentary. The lack of information about these essential services raises questions about the broker's commitment to providing professional trading environments. Without access to quality research tools and educational materials, traders may find themselves at a significant disadvantage in the markets.

The information gaps identified in this evaluation suggest that potential traders should seek more transparent and well-documented alternatives for their trading needs.

Evaluating IMAX LIMITED's customer service capabilities proves challenging due to the absence of detailed information about support infrastructure, response times, and service quality measures. Professional forex brokers typically maintain multiple communication channels, including live chat, email support, and telephone assistance, with clearly defined operating hours and response time commitments.

Industry-standard customer support includes multilingual assistance to serve global trader bases. Support teams are trained to handle various inquiries ranging from technical platform issues to account management concerns. However, IMAX LIMITED has not provided information about available support channels, languages offered, or service availability schedules.

The quality of customer service often reflects a broker's commitment to client satisfaction and operational professionalism. Legitimate brokers typically maintain detailed FAQ sections, comprehensive help documentation, and dedicated account managers for different client tiers. The absence of such information raises concerns about the level of support traders might expect.

Response time is crucial in forex trading, where market conditions can change rapidly and traders may require immediate assistance. Professional brokers usually guarantee response times for different communication channels and maintain 24/5 or 24/7 support during market hours. Without clear service level commitments from IMAX LIMITED, traders cannot assess whether their support needs would be adequately met.

The lack of transparency regarding customer service capabilities represents another significant concern for potential traders considering this platform, particularly given the unregulated nature of the broker's operations.

The analysis of trading experience with IMAX LIMITED faces significant limitations due to insufficient information about platform performance, execution quality, and overall trading environment. Professional brokers typically provide detailed specifications about their trading infrastructure, including server locations, execution speeds, and platform stability metrics.

Order execution quality is fundamental to successful trading, with legitimate brokers offering transparent information about average execution speeds, slippage rates, and order fill statistics. The absence of such data from IMAX LIMITED makes it impossible to assess whether traders would receive competitive execution conditions or encounter significant delays and requotes during trading.

Platform stability and reliability are crucial factors that directly impact trading success. Professional trading platforms undergo rigorous testing and maintain high uptime percentages, with redundant systems to prevent service interruptions. However, no information is available about IMAX LIMITED's technological infrastructure or reliability measures.

Mobile trading capabilities have become essential in modern forex trading, allowing traders to monitor positions and execute trades from anywhere. The lack of information about mobile platform availability, features, and performance represents another significant gap in assessing the broker's technological offerings.

The trading environment encompasses factors such as market depth, liquidity provision, and price feed quality. Without detailed information about these critical aspects, potential traders cannot evaluate whether IMAX LIMITED provides competitive trading conditions. This imax review emphasizes the importance of platform transparency when selecting a trading partner.

The trust and reliability assessment of IMAX LIMITED reveals significant concerns primarily stemming from its unregulated status and lack of proper financial oversight. The broker operates without authorization from recognized regulatory bodies, which fundamentally undermines trader protection and fund security measures that regulated brokers must maintain.

Regulatory compliance serves as the foundation of trust in the forex industry. Legitimate brokers subject themselves to strict oversight, regular audits, and client fund protection requirements. IMAX LIMITED's classification as an unauthorized entity means it operates outside these protective frameworks, exposing traders to substantial risks including potential fund loss without legal recourse.

Transparency is another critical component of trustworthiness, with professional brokers providing detailed company information, regulatory documentation, and clear terms of service. The limited availability of such information from IMAX LIMITED raises questions about the company's commitment to operational transparency and client protection.

Fund security measures typically include segregated client accounts, deposit protection schemes, and regular financial reporting to regulatory authorities. Without regulatory oversight, there are no guarantees that IMAX LIMITED maintains such protective measures, creating significant risks for client funds and trading capital.

The absence of verifiable track record, industry recognition, or third-party validation further compounds trust concerns. Legitimate brokers typically maintain transparent operational histories and receive recognition from industry organizations, none of which appears to be available for IMAX LIMITED.

Assessing the user experience offered by IMAX LIMITED proves extremely difficult due to the scarcity of available user feedback, platform documentation, and operational transparency. Professional brokers typically maintain active user communities, detailed platform guides, and transparent user satisfaction metrics that enable comprehensive experience evaluation.

User interface design and platform usability are crucial factors that determine trading efficiency and user satisfaction. Modern trading platforms emphasize intuitive navigation, customizable layouts, and responsive design across devices. However, without access to platform demonstrations or user testimonials, it's impossible to evaluate IMAX LIMITED's interface quality or usability standards.

The registration and verification process significantly impacts initial user experience, with professional brokers maintaining streamlined onboarding procedures while ensuring regulatory compliance. The lack of detailed information about account opening requirements, verification timelines, and documentation needs makes it difficult for potential traders to understand what to expect.

Funding operations, including deposits and withdrawals, directly affect user satisfaction and platform usability. Legitimate brokers provide clear information about processing times, available payment methods, and associated fees. The absence of such details from IMAX LIMITED creates uncertainty about the practical aspects of account management.

Common user concerns typically include platform stability, customer support responsiveness, and withdrawal processing efficiency. Without access to user feedback or independent reviews, potential traders cannot benefit from the experiences of existing users to make informed decisions about platform suitability.

This comprehensive imax review reveals significant concerns about IMAX LIMITED as a trading platform option. The broker's unregulated status, combined with substantial information gaps across critical operational areas, makes it unsuitable for most traders seeking secure and transparent trading environments. The lack of regulatory oversight fundamentally undermines trader protection and creates unnecessary risks for trading capital.

While the broker may appear to target traders interested in options trading, the absence of proper authorization, transparent operational information, and verifiable track record suggests that traders would be better served by choosing regulated alternatives. The significant information gaps identified throughout this evaluation indicate a lack of transparency that is inconsistent with professional broker standards.

For traders prioritizing security, transparency, and regulatory protection, IMAX LIMITED presents more risks than potential benefits. The combination of unregulated status and limited operational transparency creates an environment where trader interests may not be adequately protected, making this platform unsuitable for serious trading activities.

FX Broker Capital Trading Markets Review