Rate 2025 Review: Everything You Need to Know

In this comprehensive review of Rate, we explore the strengths and weaknesses of this brokerage, focusing on user experiences, expert opinions, and key features. Overall, Rate appears to offer a fast and user-friendly service, but it faces criticism regarding customer satisfaction and higher-than-average fees.

Note: It is important to consider that different entities operate under the name "Rate" across various regions, which may influence user experiences and regulatory standards. This review aims to provide a fair and accurate assessment based on a variety of sources.

Rating Overview

How We Rate Brokers: Our ratings are based on a combination of user feedback, expert analyses, and factual data regarding the brokerage's offerings.

Broker Overview

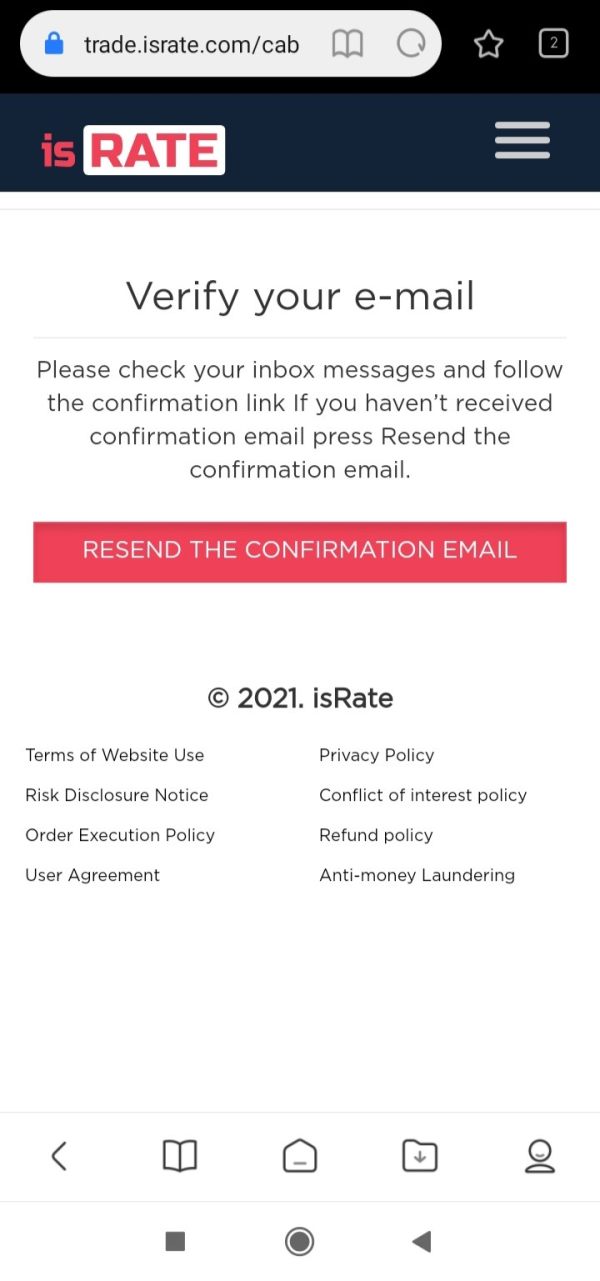

Rate, which was previously known as Guaranteed Rate, was established in 2000 and has grown to become a prominent player in the mortgage lending space. While primarily recognized for its mortgage products, Rate also provides a digital platform for trading various assets. The brokerage supports popular trading platforms such as MT4 and MT5, providing users with access to a wide array of asset classes, including stocks, ETFs, and cryptocurrencies. However, it is worth noting that Rate operates under different regulatory frameworks depending on the region, which can affect user experiences.

Detailed Analysis

Regulatory Regions

Rate operates in multiple jurisdictions, but it is crucial to verify the regulatory body overseeing your specific entity. The presence of a top-tier regulator enhances trust and provides a safety net for users. According to BrokerChooser, Rate is not regulated by any top-tier financial authorities, which raises concerns about its operational practices.

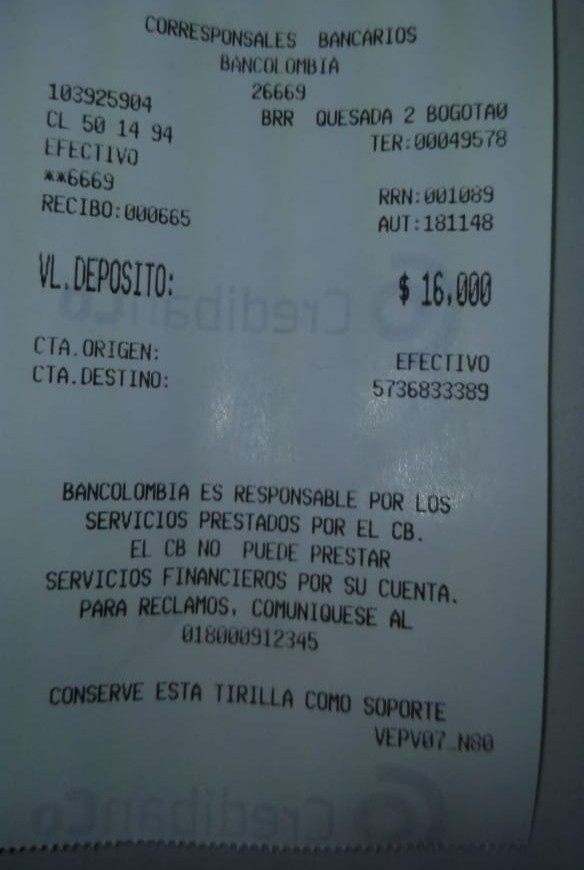

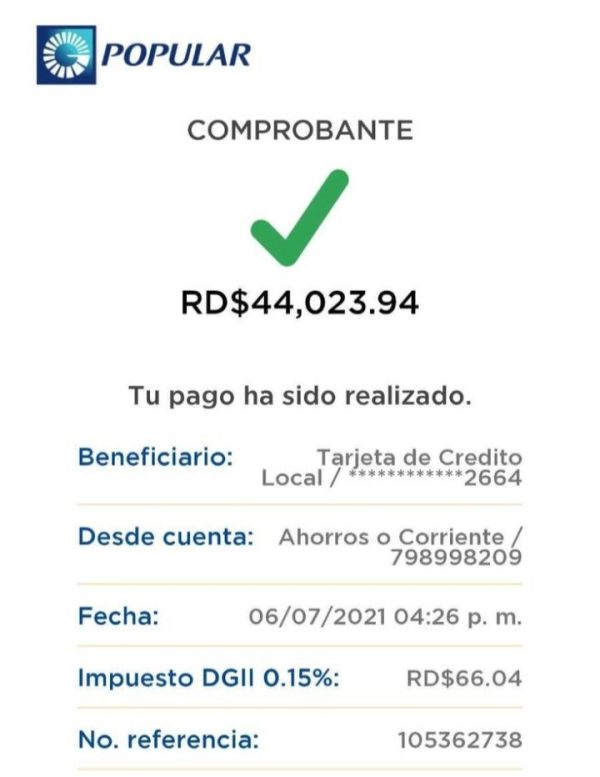

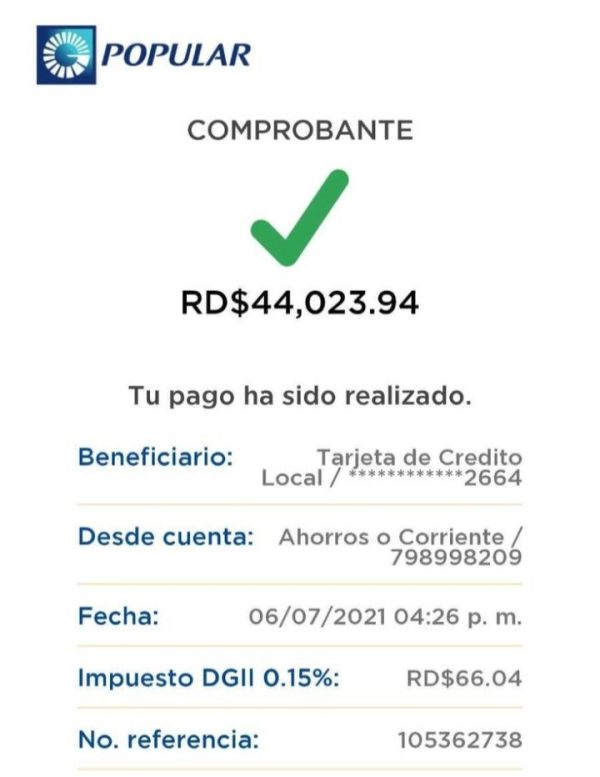

Deposit/Withdrawal Currencies and Cryptocurrencies

Rate supports standard fiat currencies for deposits and withdrawals, including USD and EUR. However, the availability of cryptocurrencies for transactions may vary by region. Users should confirm the specifics with their local Rate entity.

Minimum Deposit

The minimum deposit required to open an account with Rate is competitive, generally hovering around $500. This makes it accessible for new traders looking to enter the market.

Rate occasionally offers promotions and bonuses, which can be attractive for new users. However, the specifics of these offers may differ based on the regulatory jurisdiction.

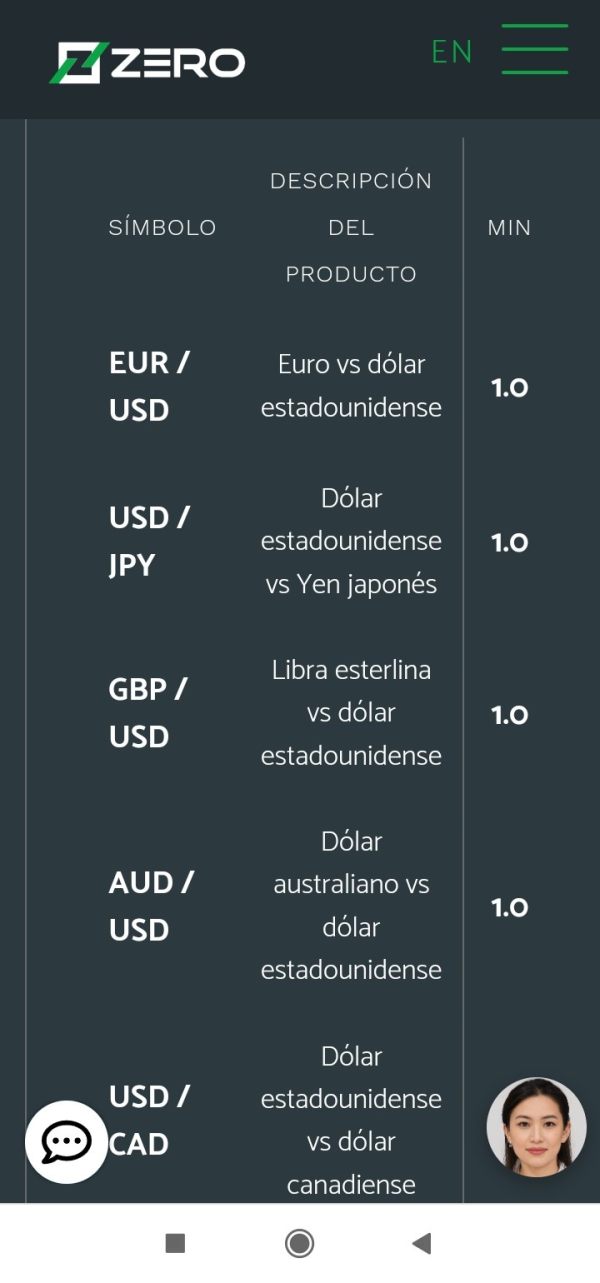

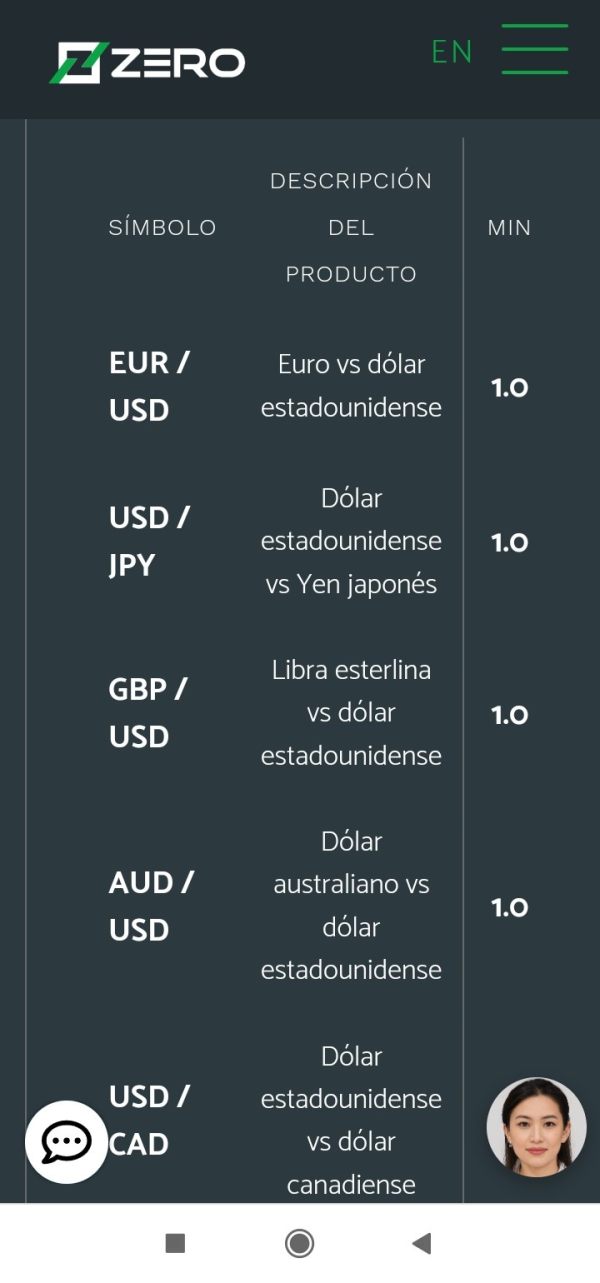

Tradable Asset Classes

Rate provides access to a diverse range of asset classes, including stocks, ETFs, and cryptocurrencies. This variety allows users to build a well-rounded portfolio. However, some users have reported limitations on certain asset classes depending on their region.

Costs (Spreads, Fees, Commissions)

One of the significant drawbacks noted in the Rate review is the higher-than-average fees associated with trading. Users have expressed concerns about the cost structure, which may eat into their trading profits. According to Investopedia, the average spread for trading with Rate is higher than many of its competitors, making it less cost-effective for frequent traders.

Leverage

Rate offers leverage options that can enhance trading potential. However, the specific leverage ratios available depend on the asset class and regulatory requirements.

Rate supports popular trading platforms like MT4 and MT5, which provide users with advanced charting tools and trading functionalities. These platforms are favored by many traders for their user-friendly interfaces and robust features.

Restricted Regions

Certain regions may face restrictions when attempting to access Rates services. Users are advised to check the availability of services in their area to avoid any inconveniences.

Available Customer Service Languages

Customer service is a critical aspect of any brokerage experience. Rate offers support in multiple languages, but user reviews indicate that response times can be slow, and the quality of service may vary. Many users have reported challenges in reaching customer support, which can be frustrating.

Rating Recap

Detailed Breakdown

-

Account Conditions: Rate offers a competitive minimum deposit, making it accessible to new traders. However, the lack of regulatory oversight in certain regions raises questions about the safety of funds.

Tools and Resources: The brokerage provides advanced trading platforms like MT4 and MT5, which are well-regarded in the trading community for their features and user experience.

Customer Service and Support: Customer service has received mixed reviews, with some users reporting slow response times and difficulties in reaching support representatives.

Trading Setup (Experience): While the trading experience is generally user-friendly, the higher fees associated with trading can deter cost-conscious users.

Trustworthiness: The absence of regulation from top-tier financial authorities is a significant concern, as it may expose users to higher risks.

User Experience: Users have reported a generally positive experience, but the issues with customer service can detract from overall satisfaction.

Additional Features: Rate offers a diverse range of asset classes, but the specifics of promotions and bonuses can vary by region, which may affect user experiences.

In conclusion, while Rate presents a solid option for users seeking a user-friendly trading experience with a variety of asset classes, potential clients should be cautious due to the higher fees and lack of regulatory oversight in certain areas. Always conduct thorough research and consider your trading needs before proceeding.