Northstar 2025 Review: Everything You Need to Know

Executive Summary

This northstar review gives a fair look at Northstar's money services. We found limited information about rules and trading details that the public can see. Northstar works in many business areas, and NorthStar Moving Company started in 1994 as one of its main parts.

The company shows mixed results. Employee recommendation rates change a lot across different parts of the business. Some Northstar companies keep workers fairly happy, but others have problems with rule-following groups.

The data shows Northstar Group has a 56% employee recommendation rate with an overall rating of 3. Other parts do better with 76% employee recommendations. But Northstar Brokers got an F rating from the Better Business Bureau and doesn't appear on major lending websites.

The main customers seem to be people who need small personal loans and short-term money help. These people especially need fast access to funds up to $3,000. However, users should be careful about high rates and fees that come with these services.

Important Disclaimers

Regional Entity Variations: This review covers multiple Northstar companies that work in different areas. Rule oversight and service quality may change a lot between these companies. The information shows a lack of complete rule data, which may show different rule systems across regions.

Review Methodology: This review uses user feedback, company background information, and public data. We couldn't find enough specific trading and rule information in available sources, so some parts need more checking.

Rating Framework

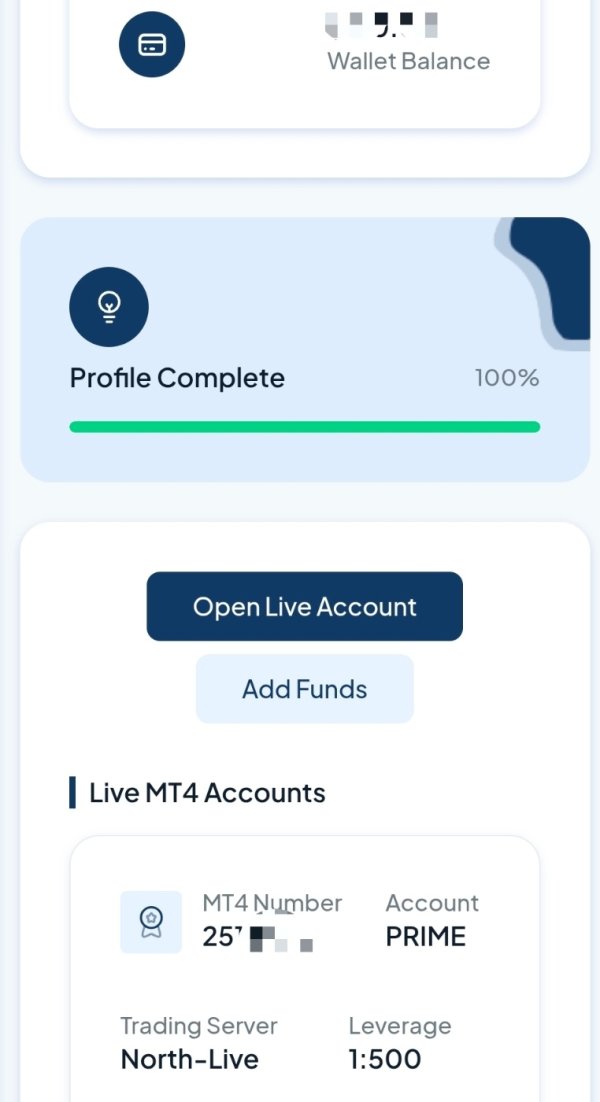

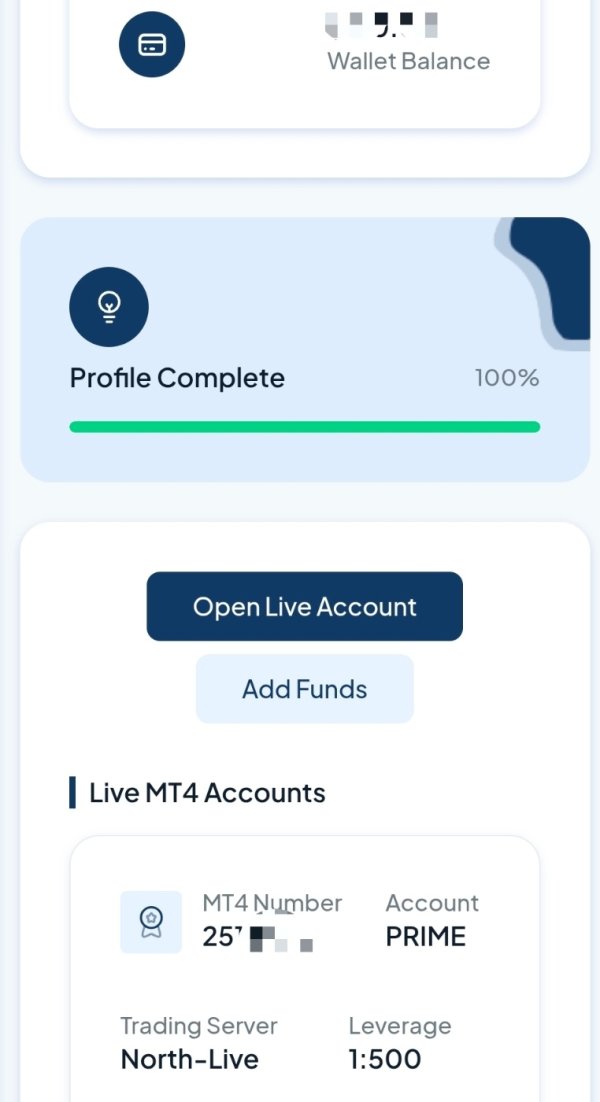

Broker Overview

Company Background and History

NorthStar Moving Company started in 1994. This means the company has over thirty years of experience in the service business. The company grew from its original moving services to include various money service offerings like personal loans and short-term financial help.

The company works through multiple parts that serve different market groups. NorthStar Moving keeps its main moving and relocation services, while Northstar Brokers focuses on personal lending. This spread-out approach shows the business grew beyond traditional moving services into money services, though how these parts work together needs more explanation.

Business Model and Service Structure

Northstar's money services part mainly works as a lending platform. It offers personal loans and short-term money solutions to individual borrowers. The business focuses on fast loan processing, with services that advertise quick access to funds up to $3,000.

However, this northstar review must note that Northstar Brokers Personal Loans isn't available on major comparison sites like Finder. This may limit access and openness for potential customers. The company focuses on quick turnaround times for loan applications and targets consumers who need immediate money help.

Available information suggests users should carefully think about the costs involved. Reports show possibly high rates and fees compared to traditional lending companies.

Regulatory Environment: Specific rule information is not detailed in available sources. This creates uncertainty about oversight and compliance systems that govern Northstar's money services operations.

Deposit and Withdrawal Methods: Available sources do not specify the payment processing methods or money transaction procedures that Northstar's lending services use.

Minimum Requirements: While loans up to $3,000 are mentioned, specific minimum borrowing amounts and eligibility criteria are not detailed in accessible documentation.

Promotional Offers: Current promotional programs or special offers are not outlined in the available information sources we reviewed.

Available Assets: The focus appears to be on personal lending products rather than traditional trading assets. However, specific product details are not fully documented.

Cost Structure: Reports show the presence of possibly high rates and fees. However, specific percentage rates and fee schedules are not detailed in available sources.

Leverage Options: Traditional leverage ratios do not apply to the personal lending model that Northstar's money services use.

Platform Technology: Specific information about digital platforms and technology infrastructure is not provided in available documentation.

Geographic Restrictions: Regional limitations and service availability are not clearly specified in accessible sources.

Customer Support Languages: Available language support options for customer service are not detailed in the reviewed materials.

This northstar review section highlights major information gaps that potential users should consider when looking at Northstar's services.

Detailed Rating Analysis

Account Conditions Analysis

The review of Northstar's account conditions faces big limitations because of insufficient specific information in available sources. Traditional account types that money service providers commonly offer are not clearly outlined in accessible documentation. This makes it hard to assess the variety and characteristics of available options.

The absence of detailed account opening procedures and minimum deposit requirements creates uncertainty for potential users. These users want to understand entry-level commitments. Available information suggests that Northstar Brokers focuses on personal lending rather than traditional account-based services.

This may explain the lack of conventional account structure details. However, this northstar review cannot provide definitive assessment of account features, special functionalities, or comparative advantages without access to comprehensive service documentation. The limited transparency about account conditions represents a significant consideration for potential users.

User feedback specifically addressing account setup experiences and ongoing account management is not available in reviewed sources. This prevents meaningful analysis of customer satisfaction with account-related services. This information gap requires direct inquiry with the company for users who need detailed account condition information.

Assessment of Northstar's tools and resources encounters substantial limitations because of the absence of detailed information about technology offerings and analytical resources in available sources. Traditional trading tools, research capabilities, and educational resources that users typically expect from money service providers are not documented in accessible materials.

This creates uncertainty about the company's technology infrastructure and client support capabilities. The lack of information about automated services, analytical tools, or educational programs suggests either minimal investment in these areas or insufficient public documentation of available resources. For a comprehensive service evaluation, this represents a significant information gap that potential users should address through direct company contact.

User feedback about tool effectiveness, resource quality, and educational material usefulness is not available in reviewed sources. Expert opinions on technology capabilities and resource adequacy are similarly absent from accessible documentation. This limits the ability to provide informed assessment of these critical service components.

Customer Service and Support Analysis

Evaluation of Northstar's customer service capabilities is limited by insufficient specific information about support channels, response times, and service quality metrics in available sources. Traditional customer service elements such as phone support, email assistance, live chat availability, and operating hours are not detailed in accessible documentation.

This creates uncertainty about the company's commitment to customer support and problem resolution capabilities. The absence of documented customer service protocols, multilingual support options, and escalation procedures represents a significant information gap for potential users. Without access to specific service level agreements or customer satisfaction metrics, this review cannot provide definitive assessment of support quality or reliability.

User testimonials about customer service experiences, problem resolution effectiveness, and overall satisfaction with support interactions are not available in reviewed sources. This prevents meaningful analysis of real-world customer service performance. It also limits the ability to provide informed recommendations about support expectations.

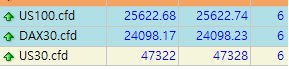

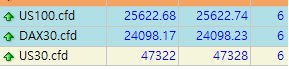

Trading Experience Analysis

Analysis of trading experience faces fundamental challenges because of Northstar's apparent focus on personal lending rather than traditional trading services. Available sources do not indicate platform stability metrics, order execution capabilities, or trading environment characteristics typically associated with money trading platforms.

This suggests that Northstar's services may not include traditional trading activities. The absence of information about platform performance, mobile application capabilities, and trading tools indicates either non-availability of these services or insufficient documentation of trading-related offerings. For users seeking traditional trading experiences, this northstar review cannot provide relevant assessment based on available information.

User feedback specifically addressing trading platform performance, execution quality, and overall trading satisfaction is not documented in accessible sources. Technical performance data, latency measurements, and platform reliability metrics are similarly absent. This prevents comprehensive evaluation of trading-related service quality.

Trust and Reliability Analysis

Assessment of Northstar's trustworthiness reveals concerning elements that potential users should carefully consider. According to available information, Northstar Brokers holds an F rating with the Better Business Bureau and lacks BBB accreditation.

This raises significant questions about business practices and customer satisfaction. This rating represents one of the lowest possible assessments from a major business evaluation organization. The absence of detailed regulatory information in available sources creates additional uncertainty about oversight and compliance frameworks governing Northstar's operations.

Without clear regulatory documentation, users cannot easily verify the company's adherence to industry standards and consumer protection requirements. Third-party evaluations and industry reputation assessments are limited in available sources, though the BBB rating provides a significant data point for trust evaluation. The combination of low BBB ratings and limited regulatory transparency suggests that potential users should exercise enhanced due diligence before engaging with Northstar's services.

User Experience Analysis

Evaluation of overall user experience encounters significant limitations because of insufficient specific user feedback and satisfaction metrics in available sources. Traditional user experience elements such as interface design, navigation ease, and overall service satisfaction cannot be comprehensively assessed without access to detailed user testimonials and experience reports.

The absence of documented user journey information, from initial registration through service completion, prevents meaningful analysis of customer experience quality. Without access to user satisfaction surveys, complaint resolution data, or positive experience testimonials, this review cannot provide definitive assessment of service quality from the user perspective. Available information suggests that Northstar's services target users seeking quick access to personal loans.

However, specific user demographics, satisfaction levels, and experience quality metrics are not detailed in accessible sources. This information gap represents a significant limitation for potential users seeking to understand expected service experiences.

Conclusion

Based on available information, this northstar review presents a neutral to cautious assessment of Northstar's money services. The evaluation reveals significant information gaps about regulatory oversight, specific service conditions, and comprehensive user feedback that limit the ability to provide definitive recommendations.

While the company demonstrates operational longevity through its 1994 establishment, concerns arise from the F rating with the Better Business Bureau and limited transparency in key operational areas. Northstar appears most suitable for users seeking quick access to small personal loans up to $3,000, particularly those prioritizing speed over comprehensive service features. However, potential users should carefully consider the reported high rates and fees, limited regulatory transparency, and absence from major comparison platforms when making service decisions.

The primary advantages include established operational history and focus on rapid loan processing. The significant disadvantages include limited regulatory information, concerning BBB ratings, and insufficient transparency about service conditions and user experiences.