Regarding the legitimacy of dbinvesting forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is dbinvesting safe?

Pros

Cons

Is dbinvesting markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

DB Invest LIMITED

Effective Date:

--Email Address of Licensed Institution:

compliance@dbinvesting.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.dbinvesting.comExpiration Time:

--Address of Licensed Institution:

Abis Centre, Office 15, Avenue D’Arhoa, Providence Industrial EstatePhone Number of Licensed Institution:

+248 4373561Licensed Institution Certified Documents:

Is DB Investing A Scam?

Introduction

DB Investing, a forex broker founded in 2018, operates out of Seychelles and positions itself as a multi-asset trading platform offering a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies. With the allure of high leverage and low minimum deposits, it has attracted many traders seeking to maximize their investment potential. However, the forex market is fraught with risks, and not all brokers are created equal. Therefore, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to provide an objective assessment of DB Investing by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

The regulation of a broker is a pivotal factor in determining its legitimacy and safety. DB Investing is regulated by the Seychelles Financial Services Authority (FSA), which is considered a tier-3 regulator. While this means that the broker operates under some level of oversight, it does not provide the same level of investor protection as top-tier regulators like the UK‘s FCA or Australia’s ASIC.

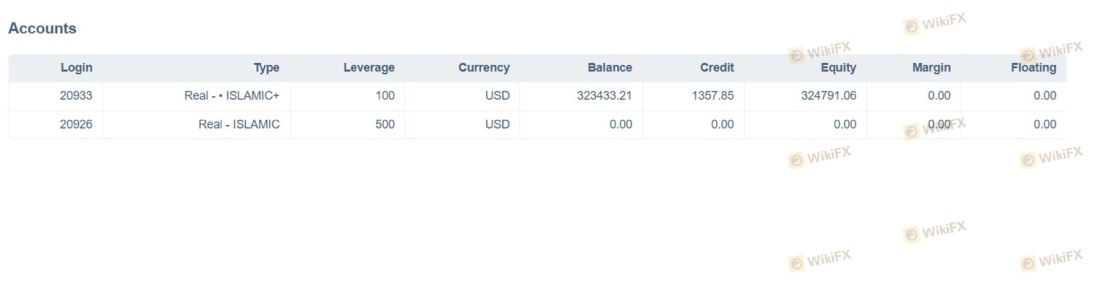

| Regulatory Body | License Number | Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 053 | Seychelles | Verified |

The Seychelles FSA has a reputation for being lenient, which raises concerns about the robustness of its regulatory framework. Unlike stricter jurisdictions, brokers regulated in Seychelles are not required to maintain client funds in segregated accounts, nor do they have to participate in compensation schemes for clients in case of insolvency. This lack of stringent oversight may expose traders to higher risks, especially if the broker engages in unethical practices.

Historically, DB Investing has faced scrutiny due to its offshore regulatory status and the general perception that brokers operating in such jurisdictions may not prioritize client protection. Traders should be cautious and consider whether they are comfortable with the risks associated with trading through a broker regulated by a less stringent authority.

Company Background Investigation

DB Investing, operating under the name DB Invest Limited, has its headquarters in Seychelles and has expanded its presence to other regions, including Cyprus and Dubai. The company claims to have a team of experienced professionals with a decade of experience in the forex and securities brokerage industry. However, detailed information about its ownership structure and management team is scarce, which raises questions about the company's transparency.

The management teams background is essential in assessing the broker's reliability. A well-qualified team with a solid track record in financial services can inspire confidence among traders. However, without accessible information on the team members' qualifications and previous experiences, potential clients may find it challenging to gauge the broker's credibility.

Furthermore, the company's commitment to transparency is questionable, as it does not provide comprehensive information regarding its operations, financial health, or any potential conflicts of interest. This lack of transparency can be a red flag for potential investors, indicating that the broker may not be fully forthcoming about its practices.

Trading Conditions Analysis

DB Investing offers a competitive trading environment with various account types and trading instruments. However, the overall fee structure and trading conditions require careful scrutiny. The broker provides access to multiple trading platforms, including the widely-used MetaTrader 5 (MT5) and its proprietary Sirix platform.

The fee structure is a critical aspect of the trading experience. DB Investing claims to offer low spreads and no commission on certain account types, but traders should be aware of the potential for hidden fees.

| Fee Type | DB Investing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads at DB Investing start from 1.3 pips for major currency pairs, which is above the industry average. This could significantly impact profitability, especially for high-frequency traders. Additionally, the brokers commission structure may include hidden fees that are not immediately apparent. For instance, if a trader engages in promotional offers, they may face stringent turnover requirements before being able to withdraw funds, effectively locking their capital.

Traders should also be cautious about the leverage offered by DB Investing, which can go up to 1:1000. While high leverage can amplify profits, it also increases the risk of significant losses, making it essential for traders to understand their risk tolerance before engaging with such a broker.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. DB Investing claims to implement various measures to protect client funds, including holding them in segregated accounts and providing negative balance protection. However, the effectiveness of these measures is contingent upon the regulatory environment in which the broker operates.

The lack of a robust compensation scheme in Seychelles means that clients may not have recourse to recover their funds in the event of broker insolvency. Historically, there have been reports of withdrawal issues and other financial disputes associated with DB Investing, which raises concerns about the actual safety of client funds.

Traders should be vigilant and ensure that they fully understand the broker's policies regarding fund security and withdrawal processes. Any historical issues related to fund safety or withdrawal disputes should be thoroughly investigated before deciding to engage with the broker.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability and service quality. Reviews of DB Investing reveal a mix of experiences, with some users reporting satisfactory service while others highlight significant issues, particularly regarding fund withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Manipulation | Medium | Unclear policies |

| Customer Support Quality | Medium | Inconsistent |

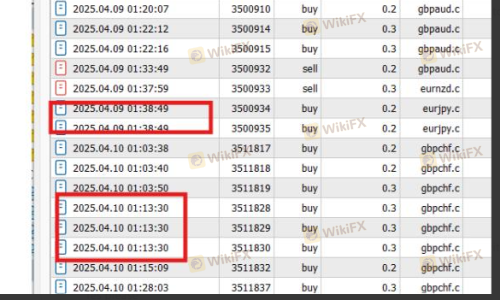

Common complaints include difficulties in withdrawing funds, with several users alleging that the broker imposes unreasonable conditions for withdrawals. Additionally, there are reports of account manipulation, where traders felt their accounts were being unfairly managed. The responses from the company have been mixed, with some users noting slow and unhelpful customer support.

For instance, one user reported that after making a profit, they encountered unexpected withdrawal fees and conditions that were not disclosed upfront. Such experiences can deter potential clients and raise alarms about the broker's operational integrity.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. DB Investing offers both MT5 and Sirix platforms, with MT5 being the more robust option favored by experienced traders. User reviews indicate that the MT5 platform is generally well-received, offering advanced charting tools and analytical capabilities.

However, there have been reports of execution delays and slippage, particularly during volatile market conditions. Such issues can significantly impact trading outcomes, especially for strategies that rely on precise execution. Traders should be aware of these potential pitfalls and consider whether they can tolerate the associated risks.

Additionally, any indications of platform manipulation, such as frequent rejections of orders or unexplained changes in trade execution, should be taken seriously. Traders must remain vigilant and monitor their trading performance closely.

Risk Assessment

Engaging with DB Investing presents several risks that traders should consider before opening an account. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Financial Risk | High | High leverage and potential hidden fees. |

| Operational Risk | Medium | Reports of withdrawal issues and customer complaints. |

| Platform Risk | Medium | Potential execution delays and slippage. |

To mitigate these risks, traders should conduct thorough due diligence, limit their exposure to high-leverage trading, and remain informed about the broker's operational practices. It is advisable to start with a demo account to familiarize oneself with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, while DB Investing is a regulated broker, the quality of its regulation, combined with historical complaints and issues surrounding fund withdrawals, raises significant concerns. The broker operates under a lenient regulatory authority, which may not provide adequate protection for traders. Additionally, the mixed customer feedback suggests that potential clients should approach this broker with caution.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternatives regulated by more stringent authorities, such as the FCA or ASIC. Brokers like AxiTrader, Pepperstone, or IG Group are examples of firms with robust regulatory oversight and a solid reputation in the industry.

Ultimately, the decision to engage with DB Investing should be made after careful consideration of the associated risks and a thorough evaluation of alternative options.

Is dbinvesting a scam, or is it legit?

The latest exposure and evaluation content of dbinvesting brokers.

dbinvesting Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

dbinvesting latest industry rating score is 2.14, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.14 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.