Xlence 2025 Review: Everything You Need to Know

Summary

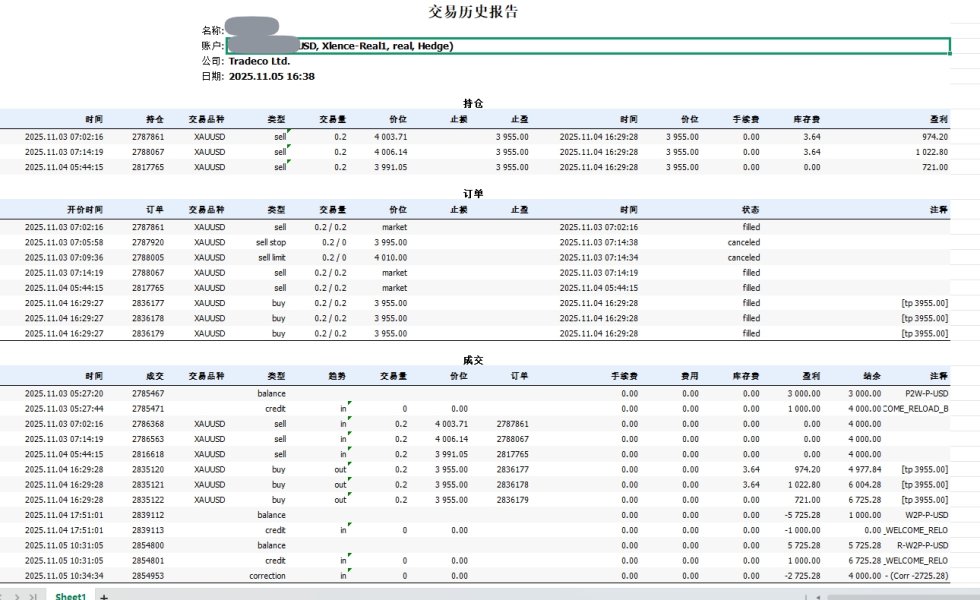

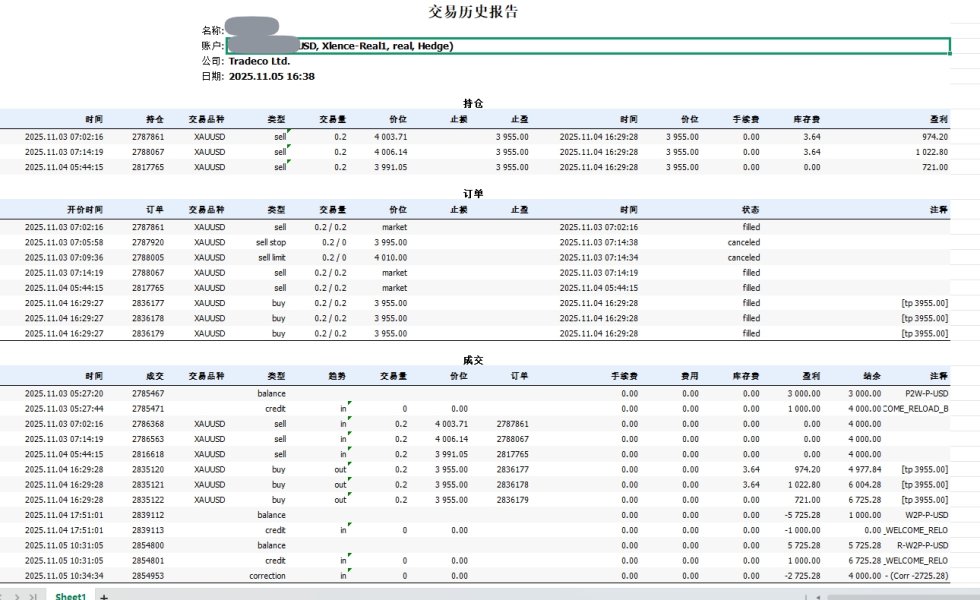

This comprehensive Xlence review examines a newly established forex broker that has generated significant attention in the trading community. However, this attention is not always for positive reasons. Xlence operates under Tradeco Limited and is registered in Seychelles, presenting itself as a modern online broker offering low spreads and flexible leverage options to retail traders. The company has positioned itself prominently in the industry by participating as a diamond sponsor in major 2025 trading exhibitions. This signals ambitious growth plans.

However, our analysis reveals concerning patterns in customer feedback and operational transparency that potential clients should carefully consider. While Xlence offers multiple tradeable assets and claims to provide advanced trading platforms, user experiences paint a troubling picture. They report withdrawal difficulties and customer service issues. The broker's lack of clear regulatory information and mounting negative reviews have led some industry observers to flag it as a potential concern for traders.

The platform appears to target small to medium-sized traders who prioritize low trading costs and platform functionality. Nevertheless, the growing number of complaints regarding withdrawal rejections and poor customer support response times suggests that cost savings may come at the expense of reliability and trustworthiness. This review provides an in-depth examination of all aspects of Xlence's services to help traders make informed decisions.

Important Notice

Traders should be aware that Xlence operates from Seychelles through Tradeco Limited. However, specific regulatory authority and license numbers are not clearly disclosed in available public information. This lack of regulatory transparency means clients in different regions may face varying levels of legal protection and recourse options. The regulatory framework in Seychelles may differ significantly from major financial centers. This could potentially affect dispute resolution and fund protection mechanisms.

This review is based on publicly available information and user feedback collected from various sources. Due to limited official disclosure from the company, there may be information asymmetries that could affect the completeness of this assessment. Prospective clients are strongly advised to conduct their own due diligence and verify all information directly with the broker before making any financial commitments.

Rating Framework

Broker Overview

Xlence emerged in 2024 as a new player in the competitive online forex and CFD brokerage space. The company operates under Tradeco Limited, with its registration based in Seychelles, a jurisdiction known for its business-friendly regulatory environment but also for less stringent financial oversight compared to major financial centers. The broker positions itself as a modern trading solution, emphasizing flexible trading conditions and competitive pricing structures to attract retail traders seeking alternatives to established brokers.

The company's business model centers on providing online forex and CFD trading services with an emphasis on low spreads and flexible leverage options. Xlence has made notable efforts to establish its market presence, including high-profile sponsorships of major trading exhibitions in 2025. This suggests significant marketing investment and growth ambitions. However, the broker's rapid market entry and aggressive marketing approach have been overshadowed by mounting customer complaints and transparency concerns.

According to available information, Xlence offers trading across multiple asset classes through what it describes as advanced trading platforms. The broker targets primarily small to medium-sized traders who are sensitive to trading costs and seek competitive spreads and leverage options. However, specific details about regulatory oversight, licensing authorities, and comprehensive platform specifications remain notably absent from public information. This raises questions about operational transparency and regulatory compliance that potential clients should carefully consider.

Regulatory Status: Xlence is registered in Seychelles under Tradeco Limited. However, specific regulatory authority oversight and license numbers are not clearly disclosed in available public information. This lack of regulatory transparency represents a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Available information does not provide specific details about supported deposit and withdrawal methods, processing times, or associated fees. This lack of transparency regarding payment processes has been highlighted in user complaints about withdrawal difficulties.

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available public information. This makes it difficult for potential clients to assess entry barriers and account accessibility.

Bonuses and Promotions: Specific details about bonus programs, promotional offers, or incentive structures are not mentioned in available sources. This suggests either a lack of such programs or insufficient marketing transparency.

Tradeable Assets: Xlence offers forex and CFD trading across multiple asset classes. However, specific instruments, market coverage, and trading conditions for different asset types are not comprehensively detailed in available information.

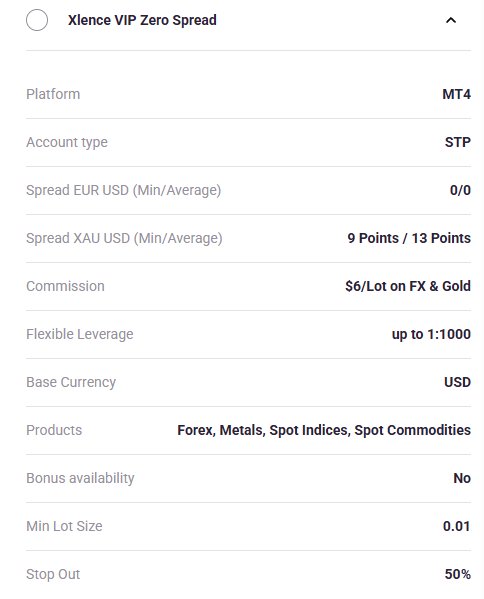

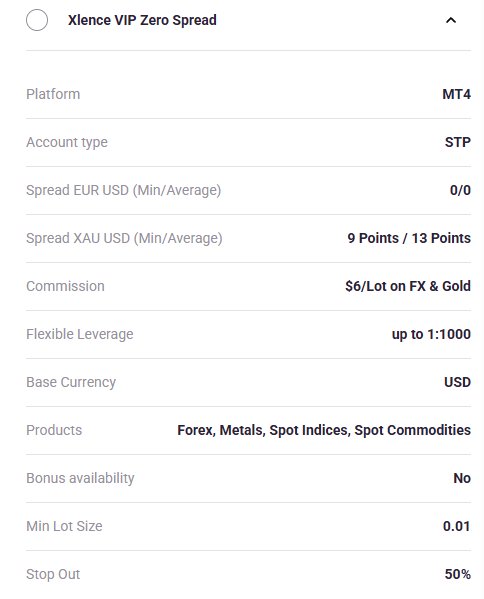

Cost Structure: While the broker advertises low spreads as a key selling point, specific spread ranges, commission structures, overnight financing rates, and other trading costs are not clearly specified. This lack of pricing transparency makes it difficult to assess true trading costs.

Leverage Options: The company mentions flexible leverage options but does not specify maximum leverage ratios for different asset classes or client categories. This information is crucial for risk assessment.

Trading Platforms: Xlence claims to provide advanced trading platforms but does not specify whether these are proprietary solutions, third-party platforms like MetaTrader, or web-based systems. Platform features and capabilities remain largely undisclosed.

Geographic Restrictions: Available information does not specify which countries or regions are restricted from accessing Xlence's services. This creates uncertainty about service availability.

Customer Support Languages: The languages supported by customer service are not specified in available information. This could impact communication effectiveness for international clients.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Xlence present several areas of concern that significantly impact our Xlence review assessment. The broker has failed to provide transparent information about account types, minimum deposit requirements, or specific terms and conditions governing different account tiers. This lack of transparency makes it extremely difficult for potential clients to understand what they're signing up for or to compare offerings with other brokers in the market.

User feedback consistently highlights issues with account management, particularly regarding withdrawal processes. Multiple users report that withdrawal requests have been declined internally without clear explanations, even when account details and verification status remained unchanged. This pattern suggests potential problems with the broker's operational procedures or liquidity management.

The account opening process, while reportedly straightforward according to some user experiences, lacks the comprehensive verification and documentation standards typically associated with regulated brokers. This simplified approach, while potentially appealing to some traders, raises questions about compliance with anti-money laundering and know-your-customer requirements.

Compared to established brokers in the market, Xlence's account conditions suffer from a significant transparency deficit. Most reputable brokers provide detailed information about account types, minimum deposits, and terms of service, allowing clients to make informed decisions. The absence of such clarity in Xlence's offering represents a substantial disadvantage for potential clients seeking reliable trading partnerships.

Xlence's trading tools and resources receive a moderate rating based on the limited information available about their offerings. The broker claims to provide advanced trading platforms and multiple asset classes, suggesting some investment in trading infrastructure. However, the lack of specific details about available tools, analytical resources, and platform capabilities makes it difficult to assess the true quality and comprehensiveness of their offerings.

The absence of detailed information about research and analysis resources is particularly concerning for traders who rely on fundamental and technical analysis to inform their trading decisions. Most established brokers provide economic calendars, market analysis, research reports, and educational content to support their clients' trading activities. The apparent lack of such resources, or at least their poor documentation, represents a significant gap in service provision.

Educational resources, which are crucial for developing traders and maintaining client engagement, are not specifically mentioned in available information. This absence suggests either a lack of educational support or insufficient marketing of such resources. In today's competitive brokerage environment, comprehensive educational offerings are often considered essential for client retention and development.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not specifically addressed in available information. This represents another potential gap in service provision, particularly as automated trading becomes increasingly popular among retail traders seeking to systematize their trading approaches.

Customer Service and Support Analysis (3/10)

Customer service represents one of the most problematic aspects of Xlence's operations based on available user feedback. Multiple users report significant delays in customer service response times, with some indicating that their inquiries go unanswered for extended periods. This poor responsiveness is particularly concerning when dealing with financial services where timely support can be crucial for resolving trading or account issues.

The quality of service provided when customers do receive responses appears to be inadequate based on user experiences. Many complaints center around unresolved withdrawal issues, with customers reporting that their concerns are not properly addressed or that promised resolutions fail to materialize. This pattern suggests either insufficient training of customer service staff or systemic issues with the broker's operational procedures.

Available information does not specify the customer service channels available to clients, such as live chat, email support, or telephone assistance. The lack of clear communication about support availability and operating hours creates additional uncertainty for potential clients who may need assistance outside standard business hours or prefer specific communication methods.

Multilingual support capabilities are not documented in available information, which could pose significant challenges for international clients who may not be comfortable communicating in English. In today's global trading environment, comprehensive language support is often considered essential for effective customer service delivery.

Trading Experience Analysis (5/10)

The trading experience offered by Xlence receives a mixed assessment in this Xlence review, with advertised benefits offset by concerning user feedback. While the broker promotes low spreads as a key selling point, user experiences suggest that the actual trading environment may not live up to these marketing claims. Reports of execution problems and concerns about platform stability raise questions about the quality of the trading infrastructure.

User feedback indicates potential issues with order execution quality, including possible slippage and requoting situations that can negatively impact trading performance. These execution problems are particularly concerning for active traders who require reliable and fast order processing to implement their trading strategies effectively.

The stability and speed of trading platforms have been questioned by users, with some expressing concerns about platform performance during active trading periods. Platform reliability is crucial for traders, particularly those employing short-term strategies or trading during high-volatility market conditions where system failures can result in significant financial losses.

Mobile trading experience, which is increasingly important for modern traders who need to monitor and manage positions while away from their computers, is not specifically addressed in available information. The absence of clear information about mobile platform capabilities represents a potential gap in service provision for traders who require flexible access to their accounts.

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of Xlence's operations, earning the lowest rating in our Xlence review. The broker has been flagged as "suspected fraud" by industry observers, which represents a severe red flag for potential clients considering their services. This designation, combined with mounting negative user feedback, creates substantial concerns about the broker's operational integrity.

The lack of clear regulatory oversight is a fundamental trust issue. While Xlence claims registration in Seychelles through Tradeco Limited, specific regulatory authority supervision and license numbers are not transparently disclosed. This regulatory opacity makes it difficult for clients to understand their legal protections or recourse options in case of disputes.

Company transparency is severely lacking, with insufficient information available about management, operational procedures, or corporate governance. Reputable brokers typically provide comprehensive information about their leadership team, regulatory compliance, and operational standards. The absence of such transparency raises questions about the company's commitment to open and accountable business practices.

The handling of negative events, particularly user complaints about withdrawal issues, appears to be inadequate based on available feedback. Users report that their concerns are not properly addressed or resolved, suggesting either insufficient complaint resolution procedures or unwillingness to address legitimate customer concerns. This pattern of unresolved issues further undermines trust in the broker's operational integrity.

User Experience Analysis (4/10)

Overall user satisfaction with Xlence appears to be significantly below industry standards based on available feedback and reviews. The predominance of negative reviews and complaints suggests that the broker is failing to meet basic client expectations for reliable service delivery. This poor satisfaction level is particularly concerning given that user experience is often a key differentiator in the competitive brokerage industry.

While specific information about interface design and usability is not detailed in available sources, user feedback suggests that operational issues overshadow any potential platform advantages. The registration and verification process is reportedly straightforward, which may be one of the few positive aspects of the user experience, though this simplicity may also raise questions about compliance standards.

Fund operation experience represents the most significant user experience problem, with withdrawal delays and rejections being the most frequently cited complaints. These issues directly impact users' ability to access their funds, which is fundamental to any financial service provider. The pattern of withdrawal problems suggests systemic operational issues that significantly degrade the overall user experience.

Common user complaints consistently center around withdrawal difficulties, poor customer service responsiveness, and lack of transparency about operational procedures. These complaints indicate fundamental service delivery problems that affect core aspects of the trading relationship between broker and client.

Conclusion

This comprehensive Xlence review reveals a broker that, despite some potentially attractive features like advertised low spreads and flexible leverage, faces significant challenges that raise serious concerns about its suitability for most traders. While Xlence has attempted to establish itself as a modern trading solution with competitive pricing, the mounting evidence of operational problems and transparency issues suggests that potential cost savings may come at an unacceptable risk to fund security and service reliability.

The broker may theoretically appeal to small to medium-sized traders seeking low-cost trading solutions and flexible leverage options. However, the substantial risks associated with withdrawal difficulties, poor customer service, and regulatory opacity make it difficult to recommend Xlence to any trader category, regardless of their experience level or trading requirements.

The main advantages cited for Xlence include competitive spreads and multi-asset trading capabilities, along with what appears to be a simplified account opening process. However, these potential benefits are significantly outweighed by substantial disadvantages including withdrawal problems, lack of regulatory transparency, poor customer service quality, and an overall pattern of user dissatisfaction that raises serious questions about operational integrity and long-term viability.