thunder markets 2025 Review: Everything You Need to Know

1. Abstract

The following thunder markets review gives a balanced and neutral evaluation of the broker. It highlights both its strengths and potential problems, showing what traders need to know before making decisions. Thunder Markets was established in 2022 and is regulated by the SFSA. The company offers traders access to many different assets including forex, indices, stocks, precious metals, futures, and energy products. It features high leverage options up to 1:400 and supports multiple funding methods such as bank transfers, credit/debit cards, and e-wallets. Despite these attractive features, the broker's overall user trust remains low. This is shown by a TrustScore of 2.75 from one user review, and its account conditions and transparency need improvement. Thunder Markets appears to target active traders, scalpers, and even those new to the market. However, caution is advised due to the relatively high minimum deposit of $500 and the limited feedback available. As this thunder markets review outlines, while innovative trading conditions are on offer, prospective clients should perform due diligence before committing their funds.

2. Important Notices

Thunder Markets operates under the regulatory framework of the SFSA . This may differ from regulations in other jurisdictions, so traders should understand these differences before opening accounts. This review is based solely on publicly available information and user feedback and does not incorporate direct user experience. Differences between regional standards and regulatory practices should be considered when evaluating the broker's overall reliability. Due to the limited number of user experiences and the sparse details on account setup and other functions, some aspects of the service remain unclear. The methodology used here combines publicly available data along with reported user satisfaction levels. This might not wholly capture all operational details that traders experience in practice. Readers are advised to use this review as a starting point for further investigation into Thunder Markets' services.

3. Rating Framework

4. Broker Overview

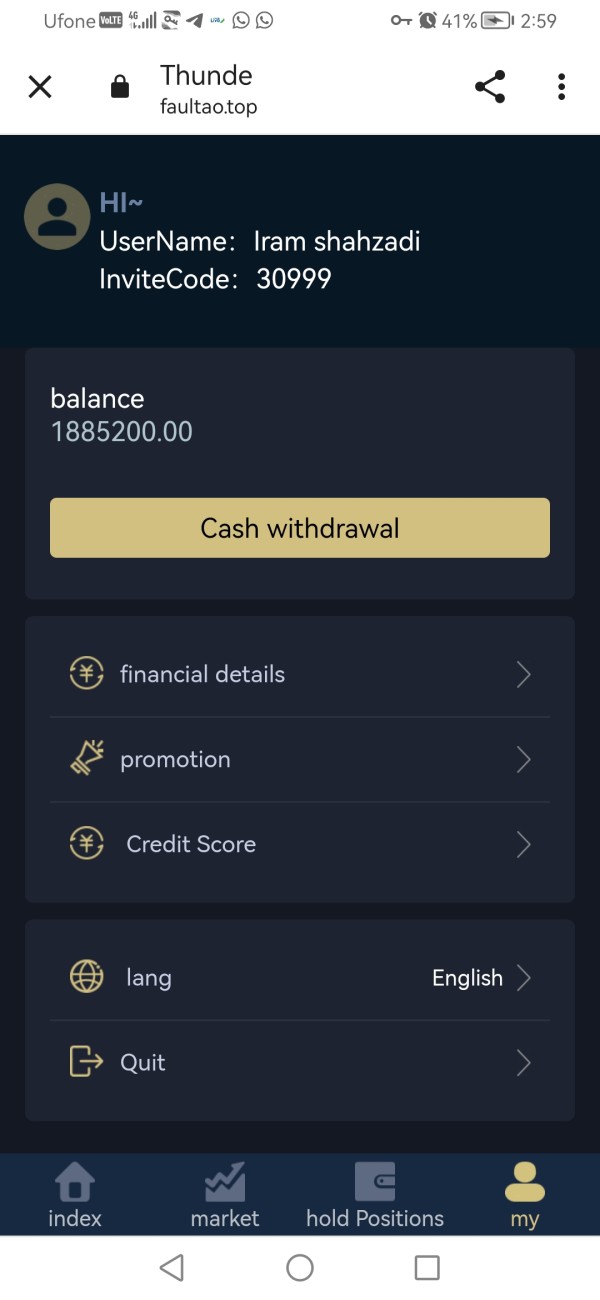

Thunder Markets was established in 2022 and is headquartered in Seychelles. The company positions itself as a provider of direct market access through an STP business model, which means trades go directly to the market without dealing desk interference. The broker has quickly gained attention for its robust high-leverage offering of up to 1:400. This appeals primarily to active traders and scalpers who want to maximize their market exposure with smaller capital requirements. Although the company's background is relatively new, its ambition to serve a wide array of traders is evident. By offering access to multiple asset classes, including forex, indices, stocks, precious metals, futures, and energies, Thunder Markets attempts to cater to diverse trading strategies. However, the limited user feedback reflected in a low TrustScore of 2.75 raises concerns regarding overall satisfaction and execution quality. This thunder markets review emphasizes that while innovative leverage and asset diversity are clear advantages, potential clients should approach with caution given the higher minimum deposit requirement and unclear account type differences.

Thunder Markets employs the renowned MetaTrader 4 trading platform for executing trades. This ensures familiarity among many retail traders who have used this platform with other brokers before. The platform supports a variety of technical indicators and automated trading systems, which enhance its appeal for both beginners and professionals. The regulatory oversight provided by the SFSA lends some degree of accountability to the broker's operations. However, the lack of detailed license information and comprehensive company transparency leaves many questions unanswered about their actual regulatory compliance. As this thunder markets review illustrates, while the broker's innovative offerings and direct market access model are promising, its operational and transparency issues must be carefully evaluated by discerning investors.

Thunder Markets is regulated by the SFSA. This means it adheres to a set of standards that might differ from other regulatory jurisdictions around the world. Notably, the precise license number is not specified, leaving some uncertainty about the full scope of regulatory oversight and what protections traders actually have.

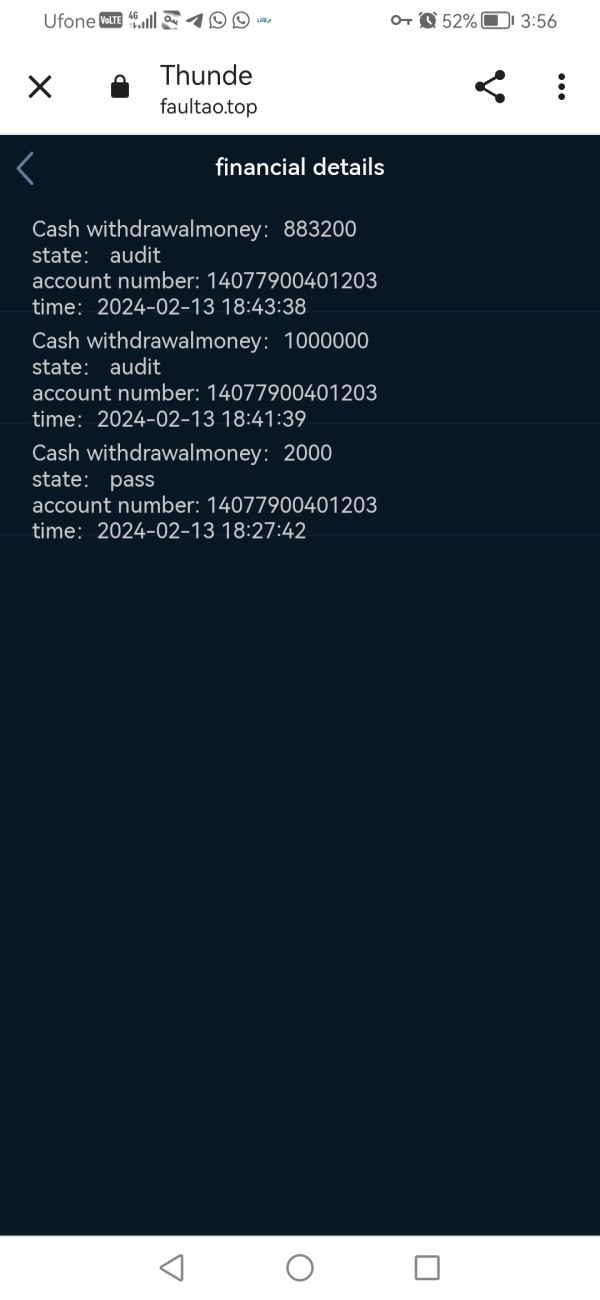

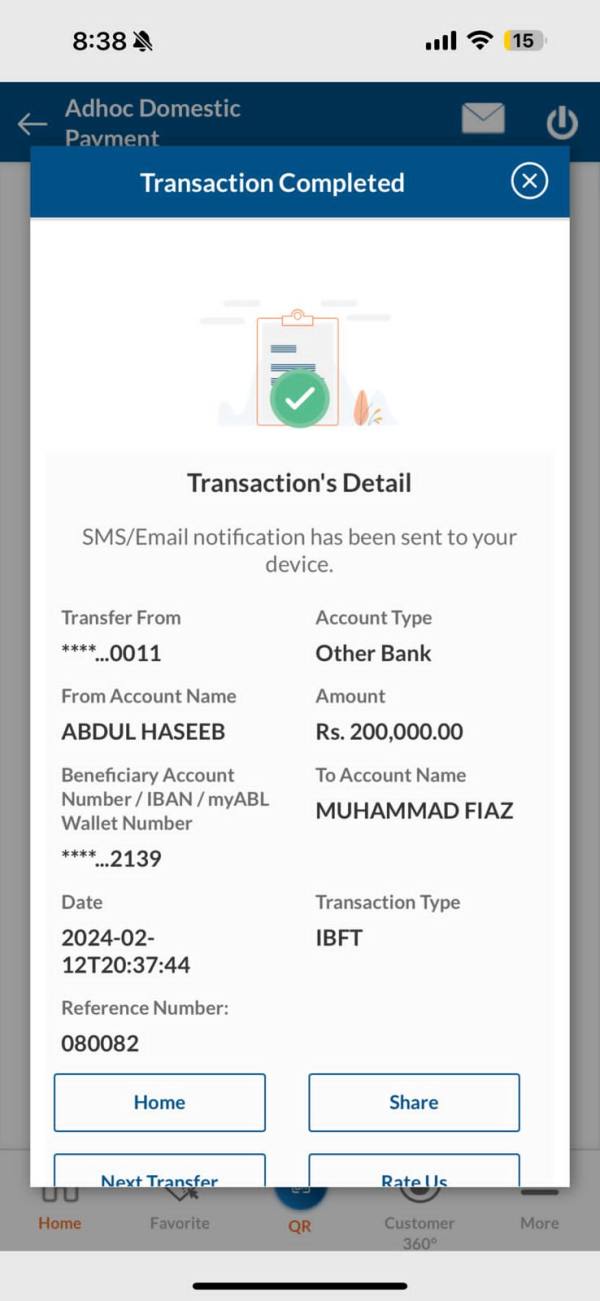

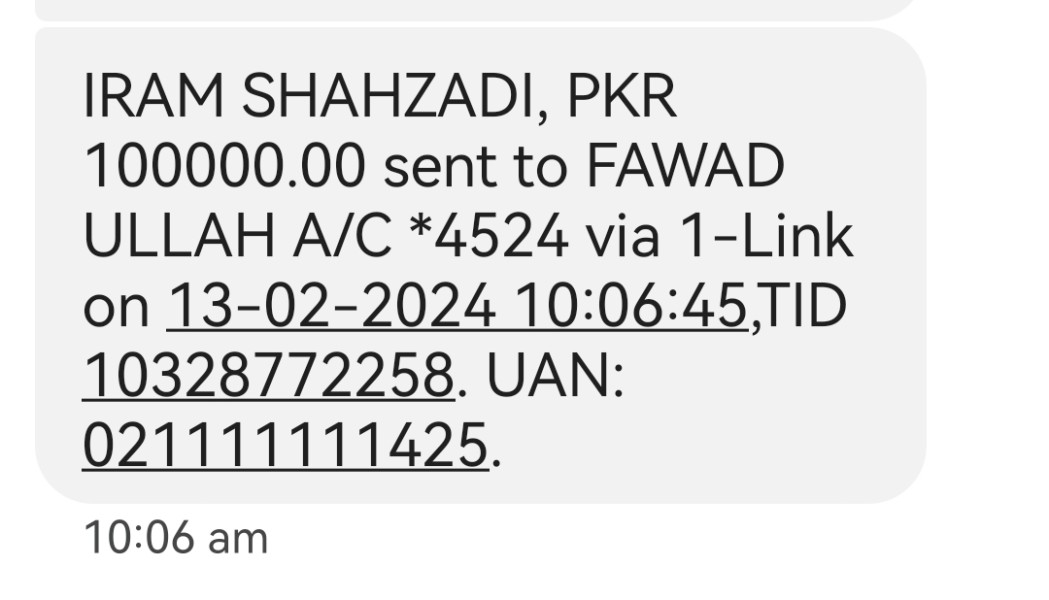

The broker supports a variety of deposit and withdrawal methods. These include bank transfers, credit and debit cards, and popular e-wallet solutions like Skrill and Neteller. This flexibility facilitates smoother transactions for an international clientele who may prefer different payment methods based on their location.

The minimum deposit required to open an account stands at $500. This may act as a moderate entry barrier for newer traders who want to start with smaller amounts. No detailed information on bonus promotions is provided, and there are no indications of any bonus or promotional offers at this time.

Thunder Markets offers a broad spectrum of tradable assets. These include forex, indices, stocks, precious metals, futures, and energy products like oil and gas. This wide selection allows traders to diversify their portfolios effectively and take advantage of different market conditions.

In terms of cost structure, traders will face variable spreads accompanied by a commission structure that begins at $0. This competitive pricing model is designed to appeal to cost-conscious traders, though actual costs may vary significantly based on market conditions and volatility. The leverage available goes as high as 1:400, which underscores the broker's potential for high-risk trading environments. This can be very attractive for experienced traders looking to maximize their exposure with limited capital.

The trading platform is MetaTrader 4, renowned for its stability and rich feature set. Although regional trading restrictions are not explicitly outlined, traders should verify compliance with their local regulations before opening accounts. Additionally, customer support is provided in multiple languages, ensuring accessibility for a diverse user base from different countries. This section of the thunder markets review captures essential details for potential users to assess whether the broker's operational model aligns with their trading preferences and risk tolerance.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The account conditions at Thunder Markets have several notable aspects that need careful consideration. Despite the absence of detailed descriptions regarding the specific types of accounts offered, the information indicates a minimum deposit requirement of $500, which is higher than many competitors. This level is considered moderate within the industry but may present a hurdle for budding traders. Those who prefer lower capital commitments to test the broker's services may find this barrier too high for initial exploration. The absence of detailed account features, such as whether specialized accounts are available, adds to the overall ambiguity. In addition, there is no clear description of the account opening process. This leaves room for potential delays and complications during sign-up that could frustrate new clients.

With only a single user review reporting a TrustScore of 2.75, it is apparent that existing clients have experienced challenges. These challenges likely relate to the broker's account conditions and overall service quality. Compared to other industry players, this broker's threshold for entry and the lack of transparency regarding account differentiation are concerning issues. This section of the thunder markets review emphasizes that while the broker's minimum deposit might not be excessive for seasoned traders, it could potentially deter newcomers. New traders typically seek more flexible entry conditions and detailed account options that help them understand what they're getting into before committing significant funds.

Thunder Markets provides the MetaTrader 4 platform as its key trading tool. This is a widely recognized and reputable system within the industry that most traders are familiar with. MT4 is celebrated for its user-friendly interface and extensive range of technical analysis tools. These features can serve both novices and experienced traders who need reliable charting and analysis capabilities. The platform supports automated trading via Expert Advisors , thereby enhancing execution efficiency and operational consistency for those who prefer algorithmic trading strategies.

However, the information provided does not elaborate on additional trading resources. Important tools such as in-depth research reports, educational materials, or market analysis are typically found with other brokers but seem limited here. The absence of robust research facilities might limit decision-making support for traders who rely on comprehensive market insights. Although the fundamental trading functionalities are intact through MT4, richer resource offerings could significantly improve the overall trading experience.

In the broader context of competitive trading platforms, relying solely on MT4 might not meet expectations. Many traders today look for integrated analytical components, educational resources, and proprietary research tools that help them make better trading decisions. As highlighted in this thunder markets review, while the core platform is highly dependable and familiar, there remains significant scope for expanding auxiliary resources. Such improvements could bolster trader confidence and enhance strategic trading approaches for both new and experienced clients.

6.3 Customer Service and Support Analysis

Customer service and support at Thunder Markets play a crucial role in shaping user experience. The broker offers multi-language support, which is an advantageous feature for international clients who prefer to communicate in their native languages. Multiple communication channels are believed to be available—including live chat and email—ensuring that users have several avenues to seek assistance. These channels can help with both technical issues and general inquiries about trading conditions and account management.

Despite these seemingly robust channels, detailed metrics on response times and resolution efficiency are not provided. This leaves some uncertainty regarding the immediacy and quality of support that traders actually receive when they need help. Furthermore, while Thunder Markets appears committed to combining technical assistance with high-quality customer service, the lack of specific case studies or detailed user experiences makes evaluation difficult. It becomes challenging to determine the reliability of these services under pressure or during market stress.

In comparison to other brokers noted for their rapid and exemplary support, Thunder Markets' offerings seem somewhat conventional. This analysis underscores that while the multi-language capacity is a strong asset, further information on specific support performance could lend additional confidence to prospective clients. The overall impression is that although support channels are available, improvements in transparency regarding service metrics would help significantly. Better documentation of case resolutions and response times would bolster user trust and confidence in the broker's commitment to client service.

6.4 Trading Experience Analysis

The trading experience on Thunder Markets is largely delivered through the MetaTrader 4 platform. This setup exhibits both strengths and areas that need improvement for optimal trader satisfaction. On one hand, the reliability and familiarity of the MT4 platform provide traders with essential functionalities. These tools are required for executing and managing trades effectively in various market conditions.

Yet, the available information does not detail the platform's performance during volatile market periods. Important factors like stability during high-impact news events or the speed of order execution remain unclear. Such factors are crucial for scalpers and active traders who particularly value timely execution and minimal latency in their trading environments. Moreover, specifics regarding mobile trading experience and enhanced platform functionalities are not clearly outlined. Features like customizable interfaces and advanced charting tools that many traders expect today are not well documented.

The overall trading environment is further impacted by variable spreads and potentially higher transaction costs. These costs may increase during periods of market stress, which remains a concern for cost-conscious traders. Given the sparse user feedback, evidenced by only one review indicating a TrustScore of 2.75, it is difficult to fully assess practical trading nuances. As noted in this thunder markets review, while the technological backbone is in place, the absence of detailed performance metrics is concerning. The lack of extensive user feedback suggests that potential traders should exercise caution and perhaps conduct supplementary tests before committing to live trading with Thunder Markets.

6.5 Trust Analysis

The trustworthiness of Thunder Markets requires careful examination due to several mixed signals. Bearing the regulatory oversight of the SFSA lends some degree of credibility to the broker's operations. Yet, the absence of explicit license details diminishes this clarity and raises questions about the actual level of regulatory protection available to traders.

This lack of transparency in regulatory documentation is concerning. Combined with a low TrustScore of 2.75 from the limited available user feedback, it raises serious concerns regarding overall reliability and client satisfaction. Additionally, there is minimal publicly available information regarding the broker's internal risk management protocols. The measures taken to secure client funds and protect against operational risks are not clearly documented.

In the context of fund safety and industry best practices, such omissions are significant. They leave traders questioning the robustness of the broker's internal controls and whether their money will be safe. Furthermore, there is no evidence of any proactive communication regarding past issues or negative events. Such communication typically serves to build trust with prospective clients by showing transparency and accountability.

Compared to other brokers with higher ratings and more comprehensive transparency displays, Thunder Markets appears to lag behind significantly. The broker fails to provide the level of transparency and security assurance that modern traders expect. This analysis of trust factors—as underscored throughout this thunder markets review—suggests that while the broker may offer innovative trading features, its operational transparency needs major improvement. User confidence levels must be addressed before it can meet the highest industry standards that serious traders demand.

6.6 User Experience Analysis

User experience with Thunder Markets is an essential component in evaluating its overall service offering. Available data indicates significant room for improvement in this critical area. With only one user review reporting a TrustScore of 2.75, it is evident that overall satisfaction among clients may be lacking significantly.

The limited feedback makes it challenging to assess key aspects of the user journey. Important elements such as the ease of account registration, the intuitiveness of the trading platform interface, and the efficiency of fund management processes remain unclear. While the use of the familiar MT4 platform should typically offer a seamless experience, there is insufficient evidence to confirm this. It's uncertain whether the platform integration translates into a smooth user journey from onboarding to active trading.

Additionally, the relatively high minimum deposit requirement may detract from user-friendliness. Unspecified account types create further confusion, particularly for novice traders who need clear guidance on what options are available to them. Areas such as website navigation, detailed instructional resources, and a comprehensive FAQ section are also not extensively documented. These missing elements potentially create barriers for new users who need guidance and support during their initial experience.

In summary, this section of the thunder markets review reflects concerning gaps in user experience design. Despite some foundational elements being in place, the overall user experience could benefit from enhanced transparency and additional user-centric features. More robust engagement mechanisms are needed to build trust and satisfaction among a broader audience of potential traders.

7. Conclusion

Thunder Markets presents an array of enticing features for certain types of traders. These include a high leverage option of up to 1:400 and access to multiple asset classes, paired with the reliable MT4 trading technology that many traders already know. However, significant concerns remain regarding its transparency and overall trustworthiness. These issues are evidenced by a low user TrustScore and a lack of clarity in account types and fee structures that leave many questions unanswered.

This broker may be best suited for experienced, active traders with sufficient capital. These traders can navigate the higher minimum deposit requirement and potential hidden complexities that less experienced traders might struggle with. Prospective clients should weigh the benefits of diverse trading instruments and multi-language support against the broker's current limitations. Careful consideration of these factors is essential before making any financial commitments to Thunder Markets.