dbinvesting 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive dbinvesting review examines a relatively new forex broker that has been operating since 2020. Based on available information from multiple sources, dbinvesting presents itself as a regulated trading platform under FSA (Seychelles) and ESCA (UAE) oversight, offering a neutral overall assessment suitable for both beginners and experienced traders. The broker's key highlights include competitive leverage up to 1:200, with some sources indicating potential ratios as high as 1:1000, and generally positive user feedback regarding withdrawal speeds and execution quality.

According to user reviews analyzed across multiple platforms, traders appreciate the platform's reliability and customer service responsiveness. The primary target audience encompasses novice traders seeking a user-friendly introduction to forex markets, as well as experienced traders looking to capitalize on higher leverage opportunities. dbinvesting operates primarily through the MetaTrader 5 platform, providing access to over 35 forex currency pairs, commodities including gold and silver, stock indices, and various cryptocurrencies including Bitcoin.

The minimum deposit requirement of 200 EUR/USD positions the broker competitively within the retail forex market segment.

Important Notice

Regulatory Variations: dbinvesting operates under different regulatory frameworks across regions. The broker is regulated by FSA (Seychelles) and ESCA (UAE), and users should carefully consider which regulatory jurisdiction applies to their trading activities. Different regulatory entities may offer varying levels of investor protection and operational standards. Review Methodology: This evaluation is based on publicly available information, user feedback from verified review platforms, and official broker documentation.

The analysis aims to provide objective and comprehensive insights while acknowledging that individual trading experiences may vary significantly based on personal circumstances and market conditions.

Rating Framework

Broker Overview

Founded in 2020, dbinvesting has established itself as a multi-asset trading platform headquartered in Seychelles. The company operates with a focus on providing comprehensive trading services across multiple financial markets, positioning itself to serve both retail and institutional clients. According to official sources, the broker aims to combine technological innovation with regulatory compliance to create a secure trading environment. The business model centers on providing access to global financial markets through advanced trading technology.

dbinvesting generates revenue through spread-based pricing and potentially commission structures, though specific fee details require further clarification from official sources. The company emphasizes transparency and customer-centric service delivery as core operational principles. dbinvesting utilizes MetaTrader 5 as its primary trading platform, offering clients access to professional-grade trading tools and analytical resources.

The asset portfolio encompasses over 35 forex currency pairs, covering major, minor, and exotic pairs, alongside commodities including precious metals like gold and silver, energy products, stock indices from major global markets, and a selection of popular cryptocurrencies including Bitcoin and alternative digital assets. Regulatory oversight comes from FSA (Seychelles) and ESCA (UAE), providing multi-jurisdictional compliance framework for international operations.

Regulatory Jurisdictions: dbinvesting operates under FSA (Seychelles) and ESCA (UAE) regulatory frameworks, ensuring compliance with international financial standards and providing clients with regulatory protection mechanisms. Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources, requiring direct verification with the broker for comprehensive payment options.

Minimum Deposit Requirements: The broker maintains a minimum deposit threshold of 200 EUR/USD, positioning itself competitively within the retail forex market segment and making it accessible to beginning traders. Bonus and Promotional Offers: dbinvesting reportedly offers promotional bonuses up to $20,000 to attract new clients, though specific terms and conditions require verification directly with the broker.

Available Trading Assets: The trading portfolio includes over 35 forex currency pairs spanning majors, minors, and exotics, precious metals including gold and silver, energy commodities, global stock indices, and popular cryptocurrencies, providing diversification opportunities across multiple asset classes. Cost Structure: Detailed information regarding spreads, commissions, and other trading costs was not specified in available sources, necessitating direct inquiry with the broker for comprehensive fee schedules.

Leverage Ratios: Maximum leverage reaches 1:200 according to most sources, with some reports indicating potential ratios up to 1:1000, subject to regulatory restrictions and client classification. Platform Options: The broker provides MetaTrader 5 platform access, supporting various trading strategies, automated trading systems, and comprehensive technical analysis tools suitable for different trading approaches.

Geographic Restrictions: Specific information regarding geographic restrictions was not detailed in available sources and requires verification for compliance with local regulations. Customer Support Languages: Available customer support languages were not specified in source materials, though multilingual support is typically expected from international brokers.

This dbinvesting review continues with detailed analysis of each rating criterion to provide comprehensive insights for potential clients.

Account Conditions Analysis

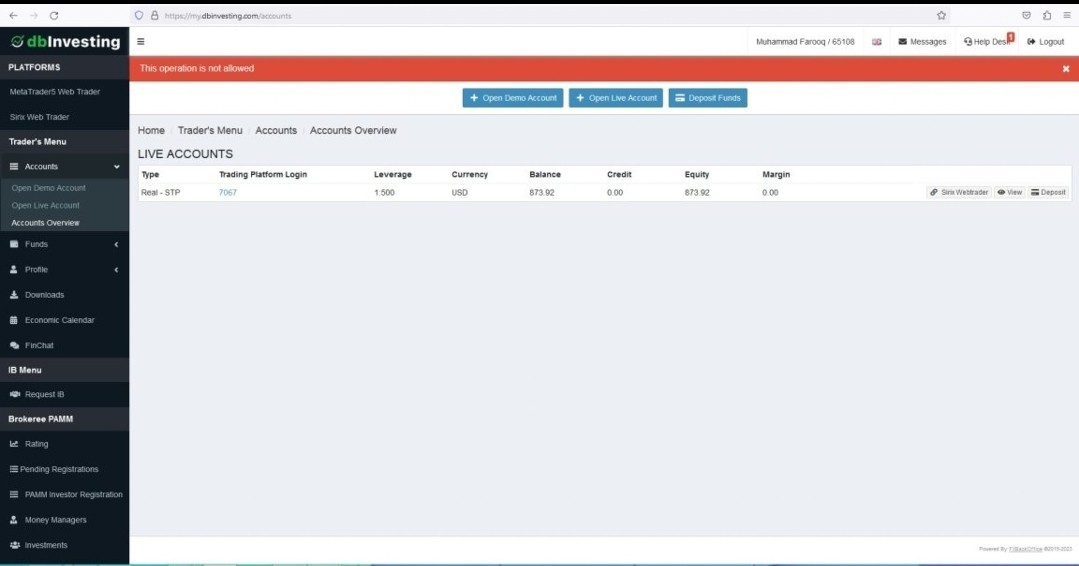

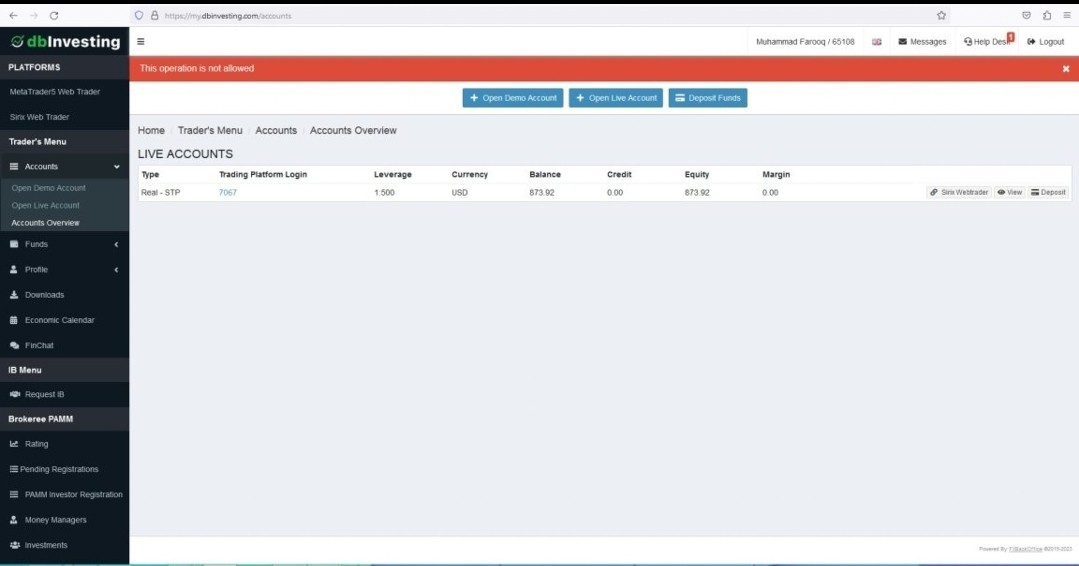

dbinvesting's account structure presents a balanced approach to retail forex trading, though specific account type variations were not detailed in available source materials. The minimum deposit requirement of 200 EUR/USD positions the broker competitively within the industry standard range, making it accessible to beginning traders while maintaining sufficient capital requirements for serious trading activities. The leverage offering up to 1:200 provides substantial trading power for clients, with some sources suggesting even higher ratios may be available under certain circumstances.

This leverage range accommodates both conservative traders seeking moderate exposure and aggressive traders pursuing maximum capital efficiency. User feedback generally indicates satisfaction with account terms and conditions, suggesting competitive offering compared to industry alternatives. Account opening procedures appear streamlined based on user experiences, though specific verification requirements and documentation needs were not detailed in available sources.

The broker's regulatory compliance under FSA and ESCA frameworks suggests standard KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are implemented. Special account features such as Islamic accounts, VIP tiers, or institutional offerings were not specified in source materials, requiring direct verification with the broker for comprehensive account options. The overall account conditions receive positive user feedback, indicating competitive terms within the retail forex market segment.

User Feedback Reference: Multiple review sources indicate general satisfaction with account terms, with users particularly appreciating the accessibility of the minimum deposit requirement and competitive leverage offerings. This dbinvesting review finds the account conditions suitable for the target demographic of beginning to intermediate traders.

dbinvesting's technological infrastructure centers on MetaTrader 5 platform integration, providing clients with professional-grade trading tools and comprehensive analytical capabilities. The MT5 platform offers advanced charting features, multiple timeframe analysis, custom indicator support, and automated trading system compatibility, meeting the needs of various trading strategies and experience levels. The platform supports Expert Advisors (EAs) and signal services, enabling automated trading strategies and copy trading opportunities.

Technical analysis tools include standard indicators, drawing tools, and market depth information, providing comprehensive market analysis capabilities. The multi-asset trading environment allows portfolio diversification across forex, commodities, indices, and cryptocurrencies within a single platform interface. Research and analysis resources were not specifically detailed in available sources, though MT5 platform typically includes economic calendar integration, market news feeds, and fundamental analysis tools.

Educational resources and training materials were not mentioned in source documentation, representing a potential area for broker enhancement. The platform's mobile accessibility and web-based trading options were not specifically addressed in available materials, though MT5 typically provides cross-device compatibility. User feedback suggests satisfaction with trading tools and platform functionality, indicating reliable performance and comprehensive feature sets.

User Experience Reference: Traders report positive experiences with platform stability and tool availability, with particular appreciation for the MT5 interface and execution quality. This dbinvesting review recognizes the strong technological foundation provided through MT5 integration, though additional proprietary tools and resources could enhance the overall offering.

Customer Service and Support Analysis

dbinvesting's customer support framework appears to prioritize responsiveness and professional service quality based on available user feedback. The support team reportedly assists with various client inquiries, from account setup to technical trading questions, though specific communication channels and availability hours were not detailed in source materials. User experiences suggest generally positive interactions with customer service representatives, with particular praise for withdrawal processing speed and query resolution efficiency.

The professional approach to client communication appears consistent across different user experiences, indicating standardized service protocols and trained support staff. Response times appear competitive based on user feedback, though specific service level agreements or guaranteed response timeframes were not documented in available sources. The support team's ability to handle both technical and account-related inquiries suggests comprehensive training and adequate staffing levels.

Multilingual support capabilities were not specified in source materials, though international brokers typically provide multiple language options. Live chat, email, and phone support availability requires direct verification with the broker for comprehensive contact options. The overall customer service experience receives positive user ratings, with particular appreciation for professionalism and problem-solving capabilities.

However, more detailed information regarding support hours, languages, and specific service guarantees would strengthen the service offering transparency.

Client Testimonial Reference: Users consistently mention helpful customer service experiences and quick resolution of issues, particularly regarding account management and withdrawal processes. This dbinvesting review notes the positive service reputation while acknowledging the need for more detailed service level information.

Trading Experience Analysis

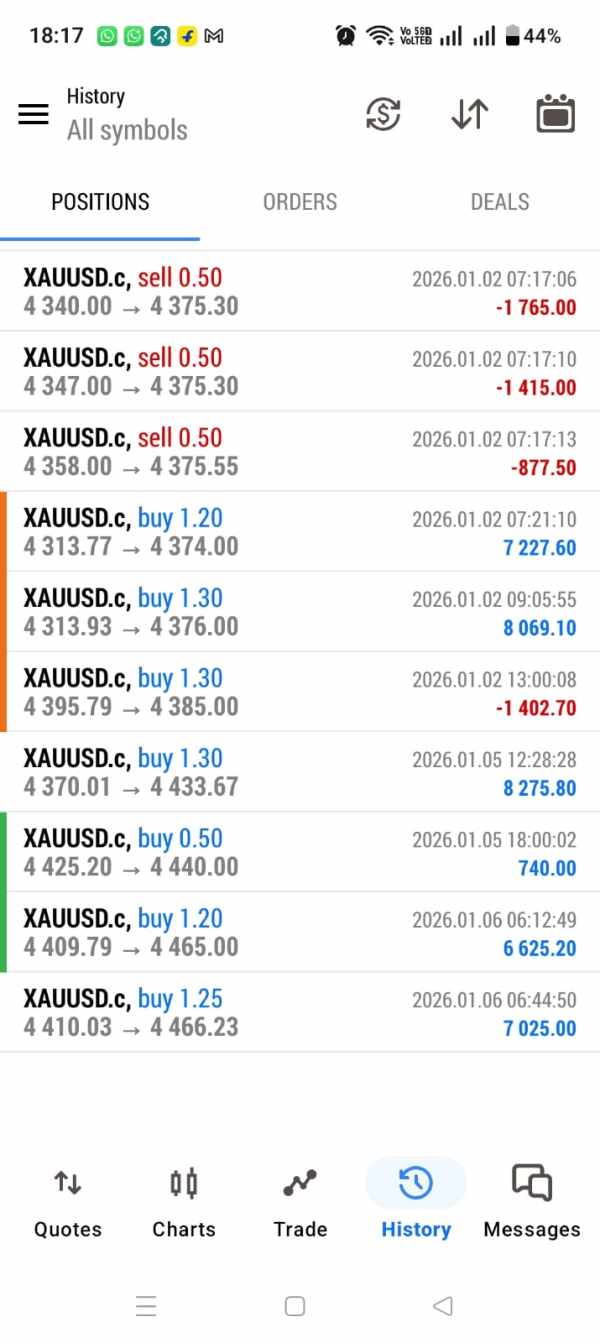

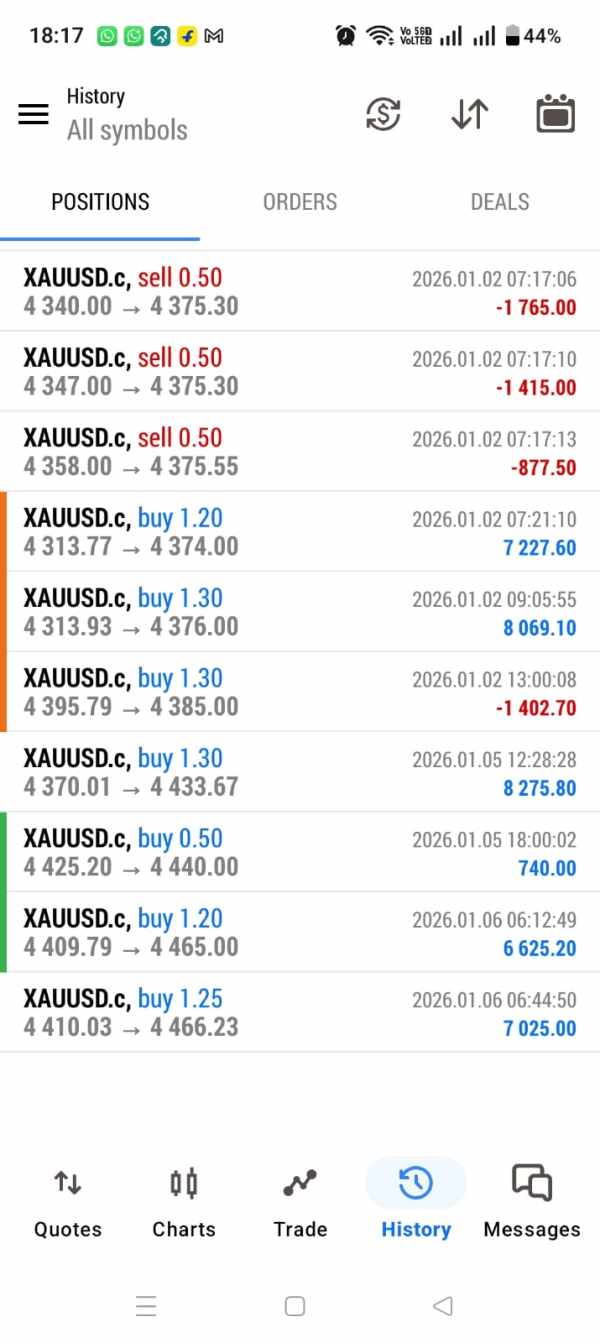

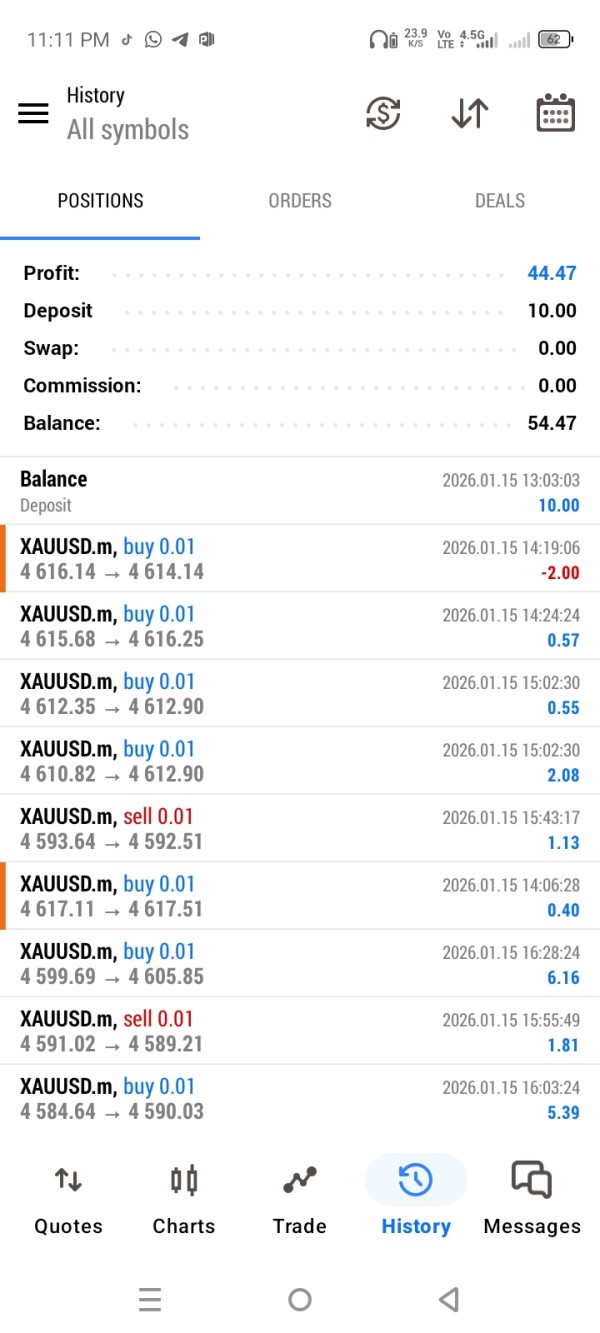

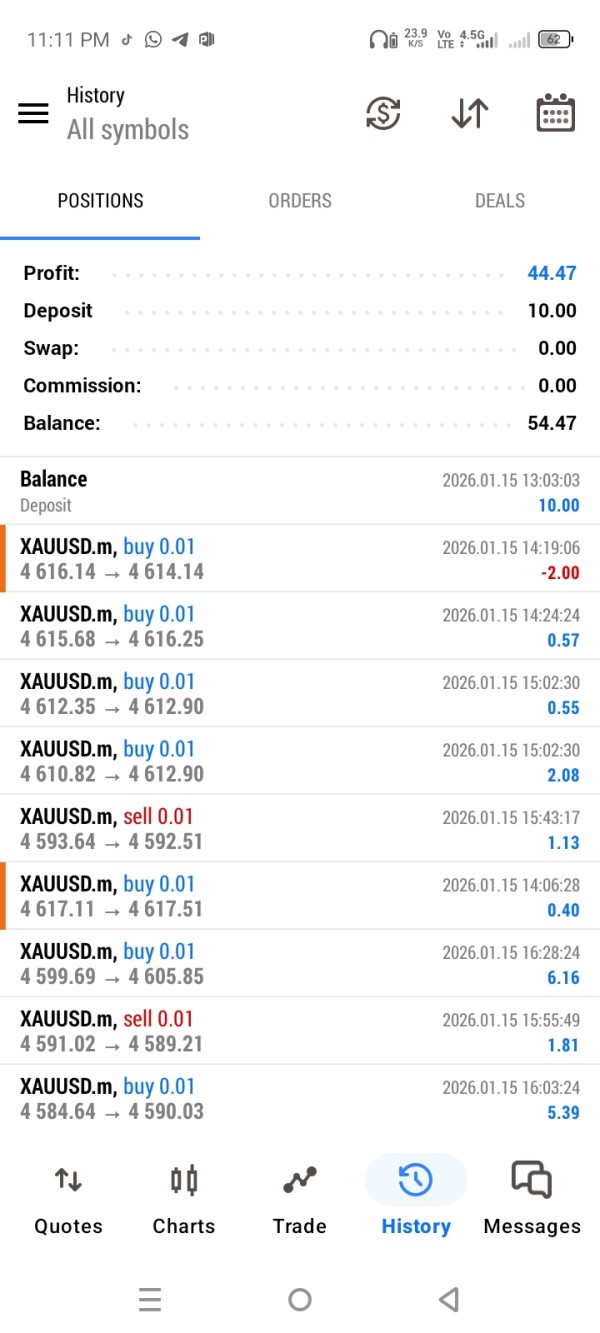

The trading experience with dbinvesting appears to meet user expectations based on feedback across multiple review platforms. Users report good order execution quality with minimal slippage, suggesting reliable liquidity provision and efficient order processing systems. Platform stability receives positive mentions, indicating robust technological infrastructure supporting consistent trading operations.

The MetaTrader 5 platform provides comprehensive trading functionality, including multiple order types, risk management tools, and real-time market data. Users appreciate the platform's reliability during volatile market conditions, suggesting adequate server capacity and technical maintenance. The execution speed appears competitive based on user experiences, supporting both scalping and longer-term trading strategies.

Trading environment quality, including spread competitiveness and liquidity depth, receives generally positive user feedback, though specific spread comparisons were not detailed in available sources. The multi-asset trading capability allows portfolio diversification and cross-market opportunities within a single platform environment. Mobile trading experience and web platform functionality were not specifically addressed in available materials, though MT5 typically provides comprehensive multi-device support.

The overall trading environment appears suitable for various trading styles, from conservative position trading to more active day trading approaches.

Performance Feedback: Users consistently report satisfaction with execution quality and platform reliability, with particular appreciation for fast withdrawal processing and minimal technical issues. This dbinvesting review finds the trading experience meets industry standards while acknowledging the need for more detailed performance metrics and comparative analysis.

Trust and Reliability Analysis

dbinvesting's regulatory status under FSA (Seychelles) and ESCA (UAE) provides foundational legitimacy for its operations, though the specific license numbers and regulatory compliance details were not fully detailed in available sources. These regulatory frameworks offer client protection mechanisms and operational oversight, though the level of investor protection may vary between jurisdictions. Fund security measures and client money segregation policies were not specifically detailed in source materials, representing important areas requiring clarification for potential clients.

The broker's operational transparency could be enhanced through more detailed disclosure of regulatory compliance measures and client protection protocols. Company background information indicates establishment in 2020, making it a relatively new market participant without extensive operational history for comprehensive track record evaluation. The absence of significant negative publicity or regulatory actions suggests stable operations, though longer-term performance data remains limited.

Third-party verification of regulatory status and operational legitimacy requires direct confirmation with relevant regulatory bodies. User feedback regarding fund security and withdrawal reliability appears generally positive, though some clients express typical concerns about newer broker entities. The overall trust profile benefits from regulatory oversight while requiring enhanced transparency regarding specific compliance measures and client protection protocols.

Industry reputation and peer recognition were not detailed in available sources, suggesting opportunity for increased market visibility.

Regulatory Verification: FSA and ESCA regulation provides legitimate operational framework, though detailed license verification and compliance reporting would strengthen trust credentials. This dbinvesting review acknowledges regulatory legitimacy while noting areas for enhanced transparency and client protection disclosure.

User Experience Analysis

Overall user satisfaction with dbinvesting appears positive based on aggregated feedback from multiple review platforms. Users appreciate the combination of competitive trading conditions, reliable platform performance, and responsive customer service, creating a generally favorable trading environment for the target demographic. The platform interface and usability receive positive mentions, though specific interface design details and user navigation features were not comprehensively detailed in available sources.

The MT5 platform integration provides familiar functionality for experienced traders while maintaining accessibility for beginners. Registration and account verification processes appear streamlined based on user experiences, though specific procedural details and timeframes were not documented in source materials. The onboarding experience seems efficient, allowing quick access to trading functionality once account setup is complete.

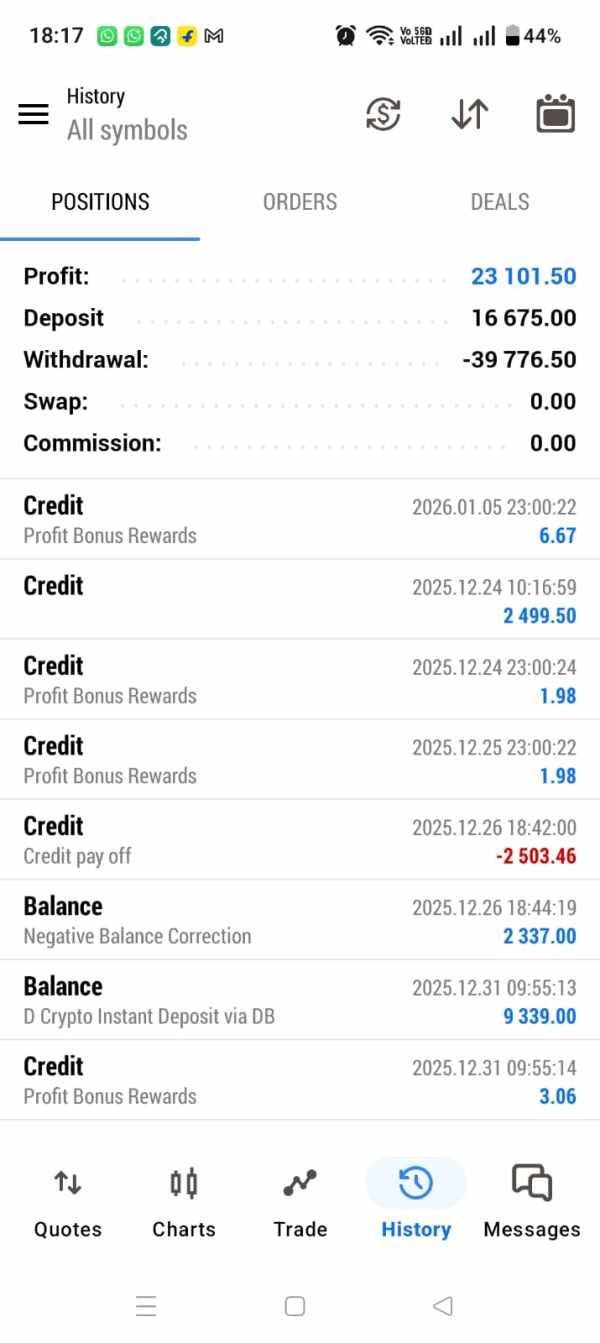

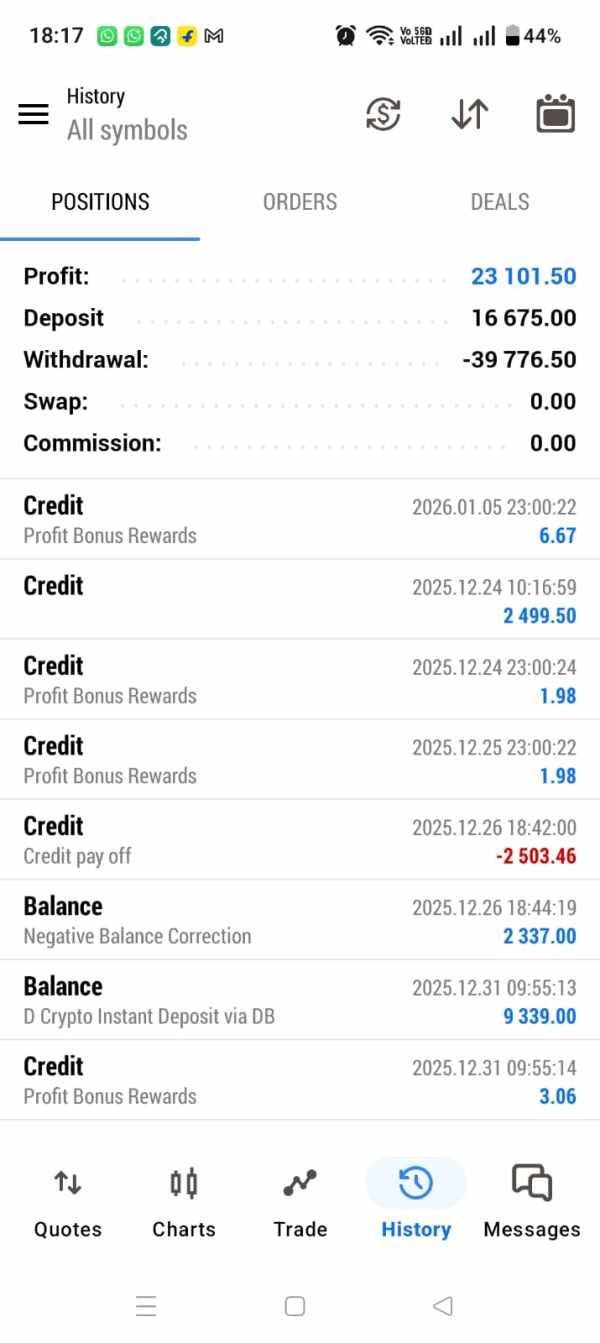

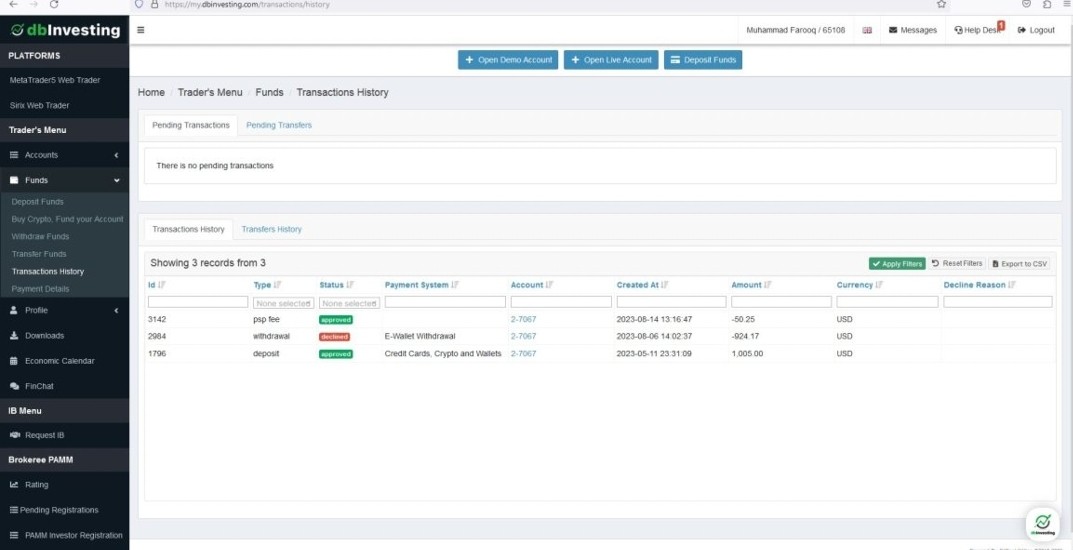

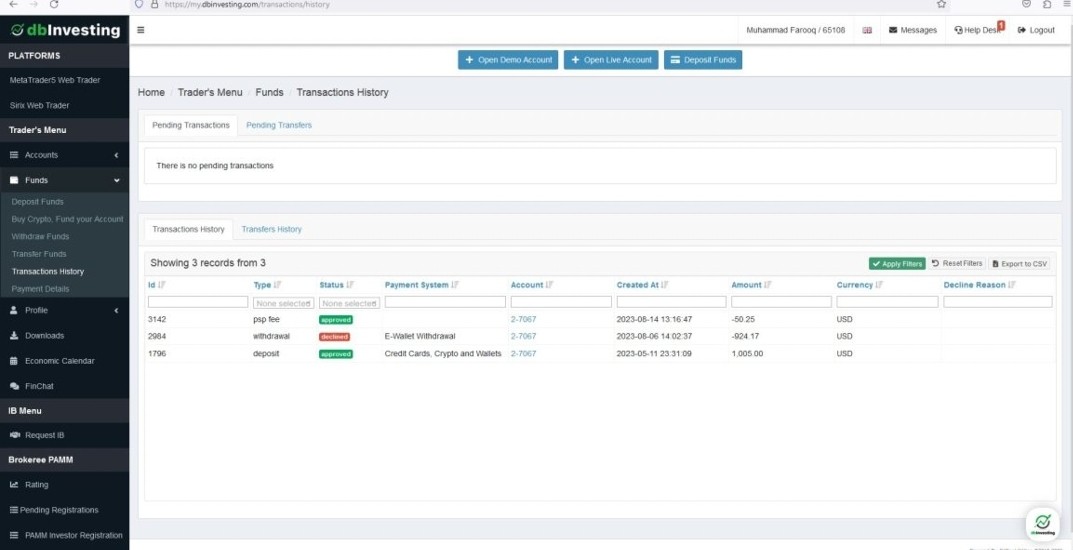

Fund management operations, particularly withdrawal processing, receive consistent positive feedback for speed and reliability. This aspect of user experience appears to be a particular strength, building confidence in the broker's operational efficiency and client service commitment.

User Demographics: The broker appears to successfully serve both beginning traders seeking accessible entry points and experienced traders utilizing higher leverage opportunities. Common user complaints were not specifically detailed in available sources, suggesting generally satisfactory service levels across different client segments.

Improvement Opportunities: Enhanced transparency regarding fee structures, more detailed educational resources, and expanded platform features could further improve user experience. This dbinvesting review recognizes strong user satisfaction while identifying areas for continued service enhancement and market position strengthening.

Conclusion

This comprehensive dbinvesting review reveals a relatively new but competently operated forex broker offering competitive trading conditions through regulated operations under FSA and ESCA oversight. The broker successfully combines accessible minimum deposit requirements with competitive leverage options, creating an attractive proposition for both beginning and experienced traders seeking diverse market access. The primary strengths include fast withdrawal processing, positive user experiences, reliable MT5 platform integration, and responsive customer service.

However, areas for improvement include enhanced transparency regarding fee structures, more detailed regulatory compliance disclosure, and expanded educational resources to support client development. dbinvesting appears most suitable for traders seeking a regulated broker with competitive leverage, multi-asset trading capabilities, and reliable operational performance. Beginning traders will appreciate the accessible minimum deposit and user-friendly experience, while experienced traders can utilize the higher leverage options and comprehensive platform functionality.

The broker's regulatory compliance and positive user feedback suggest legitimate operations, though the relatively short operational history requires continued monitoring for long-term performance validation.