am broker 2025 Review: Everything You Need to Know

Abstract

AM Broker is a new player in the forex industry. It has earned an overall user trust score of 80/100 despite some concerns about how reliable it is. This am broker review shows key features like its offering of up to 1:500 leverage and many different tradable assets including forex, commodities, indices, stocks, CFDs, and cryptocurrencies. The broker also supports the well-known MT5 trading platform. It serves traders who want a varied investment portfolio and are interested in high-leverage trading. Many users like the broad asset selection and advanced trading tools, but opinions are mixed about account transparency and customer support. Some reports mention scam-related claims. AM Broker has both promising tools and areas that need work. This review brings together user feedback, regulatory insights from SVGFSA, and market data to help potential investors understand what to expect from AM Broker.

Notice

Please note that AM Broker is regulated by SVGFSA. However, specific regulatory details and license numbers have not been shared. The evaluation in this review is based on user feedback and available market data. There are differences among various reports, and while some users report good trading experiences, others have raised concerns about reliability and support quality. It is important for traders to do their own research and consider regional differences in regulatory oversight. This assessment is not meant to serve as final investment advice but rather aims to provide a balanced view based on available evidence and testimonials about AM Broker.

Score Framework

Broker Overview

AM Broker was first established as an online forex brokerage firm in 2018. It had earlier experience as a mortgage service provider since 2012. The dual-focus background has allowed the company to use its financial expertise in delivering both trading services and mortgage solutions. With a foundation built on trust and transparency, the company has tried to create a place in the competitive online trading market by offering access to many financial instruments. The core business focuses on forex trading. AM Broker also extends its services to include various financial products such as commodities, indices, stocks, CFDs, and cryptocurrencies. This multi-asset approach is designed to appeal to diversified investors who may be interested in exploring multiple trading options.

AM Broker has invested in modern trading technology. The firm supports the highly regarded MT5 platform, along with web-based and mobile trading alternatives. This makes its services more accessible and versatile, allowing traders to execute strategies smoothly across multiple devices. While the regulatory oversight by SVGFSA brings some compliance assurance, the lack of detailed regulatory disclosures has raised some concerns in the market. Nevertheless, AM Broker remains a popular option for traders interested in high-leverage opportunities and for those seeking access to a broad range of trading assets. This am broker review brings together opinions about its operational efficiency, regulatory standing, and overall market performance.

AM Broker is regulated by SVGFSA in its respective jurisdiction. This ensures a basic level of compliance with local financial regulations. However, specific regulatory details and license numbers are not provided, leaving some aspects open to interpretation.

The available information does not provide clear details on deposit and withdrawal methods. This leaves potential traders uncertain about the range of banking solutions. Details about the minimum deposit requirements are also not disclosed. This makes it difficult for new investors to assess the initial financial commitment.

Promotional bonuses and incentive structures are not clearly outlined in the accessible data. This means that any benefits beyond the standard trading conditions remain unclear. The range of tradable assets is extensive and includes forex, commodities, indices, stocks, CFDs, cryptocurrencies, and precious metals. This allows ample diversification for traders.

In terms of cost structure, neither the spread details nor the commission data has been specified in the available summaries. This might be a critical drawback when comparing with other brokers. AM Broker offers an impressive leverage ratio of up to 1:500. This is attractive to high-risk, high-reward traders.

The trading platform options are robust, with provision for MT5, MT5 Web, and a mobile platform. This ensures flexibility in trading environments. Regulatory or regional restrictions as well as language support details for customer service remain unspecified in the public data. This am broker review reflects the partial transparency in operational details and highlights that further information would be beneficial for prospective clients.

Detailed Scoring Analysis

1. Account Conditions Analysis

The information about account conditions for AM Broker is notably sparse. This contributes to the moderate score of 5/10. There is a lack of detailed disclosure about specific account types, making it challenging for traders to understand the various options available. This includes whether specialized accounts like Islamic accounts exist.

The absence of clear data on minimum deposit requirements adds confusion to the account opening process. Some users have raised concerns over the transparency of account conditions. The process of account set-up remains unclear in the available literature.

Various user feedback indicates that the onboarding process might not meet the expectations of traders used to more detailed disclosures in other brokerage reviews. This lack of information makes it difficult to compare AM Broker directly with its competitors in a fair manner. As a result, while the broker does offer access to a variety of financial instruments, the poor account information results in lower scores.

This am broker review emphasizes the need for better clarity on account terms and deposit details. This would improve overall user confidence in the platform.

AM Broker stands out positively when it comes to the range and quality of tools and resources available to its users. The support for the MT5 trading platform is a significant advantage. It offers advanced trading tools that appeal to both novice and experienced traders alike.

Users acknowledge the ease of access to various technical indicators and charting options. These facilitate comprehensive market analysis. In addition to the robust trading platform, the broker offers a wide selection of tradable assets, including forex, commodities, indices, stocks, CFDs, cryptocurrencies, and precious metals. This provides a well-diversified trading environment.

However, there is limited mention of additional features such as automated trading support, extensive educational resources, or in-depth market research tools. These can be critical for traders looking for a comprehensive trading ecosystem. Despite these missing elements, the balance largely favors a positive view of the tools and resources provided.

Overall, while there is room for improvement in the depth of research and educational materials, the current offering is solid enough to meet the needs of most active traders. This section of the am broker review underlines that while the primary tools are robust, further enhancements would elevate the platform's overall utility.

3. Customer Service and Support Analysis

Customer service and support at AM Broker have drawn mixed reviews from users. This results in a score of 6/10. Some traders have reported adequate service in terms of response times and general assistance.

However, a notable portion of feedback points to instances where customer support has been less responsive or lacking in professionalism. The channels through which support is provided remain insufficiently detailed in the available data. There are uncertainties about the availability of multi-language support or 24/7 assistance.

Users have cited longer waiting times during peak hours and expressed concerns over the effectiveness of issue resolution. Furthermore, while some customers have had positive interactions, others have recounted instances where queries were not fully addressed. This leads to dissatisfaction.

The discrepancy in service quality could be a result of inconsistent internal processes or staff training issues. This am broker review clearly demonstrates that while the platform does offer a customer support system, significant improvements in responsiveness, clarity of communication, and overall support structure would be essential. These improvements would boost user confidence and satisfaction and contribute to a more favorable trading experience overall.

4. Trading Experience Analysis

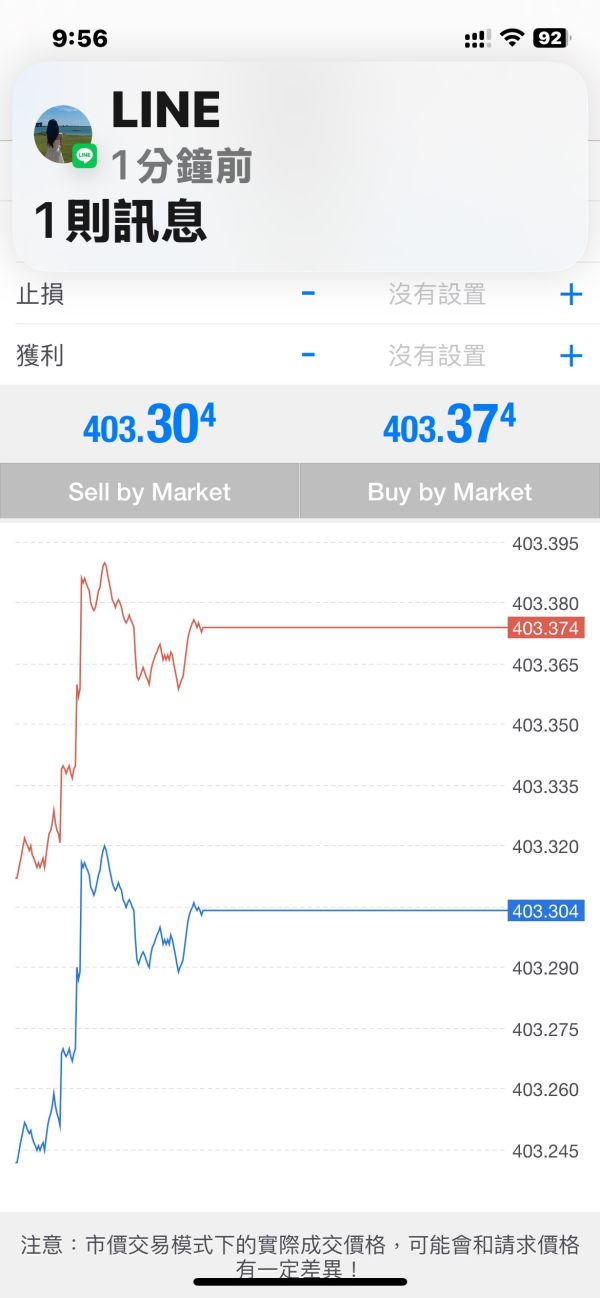

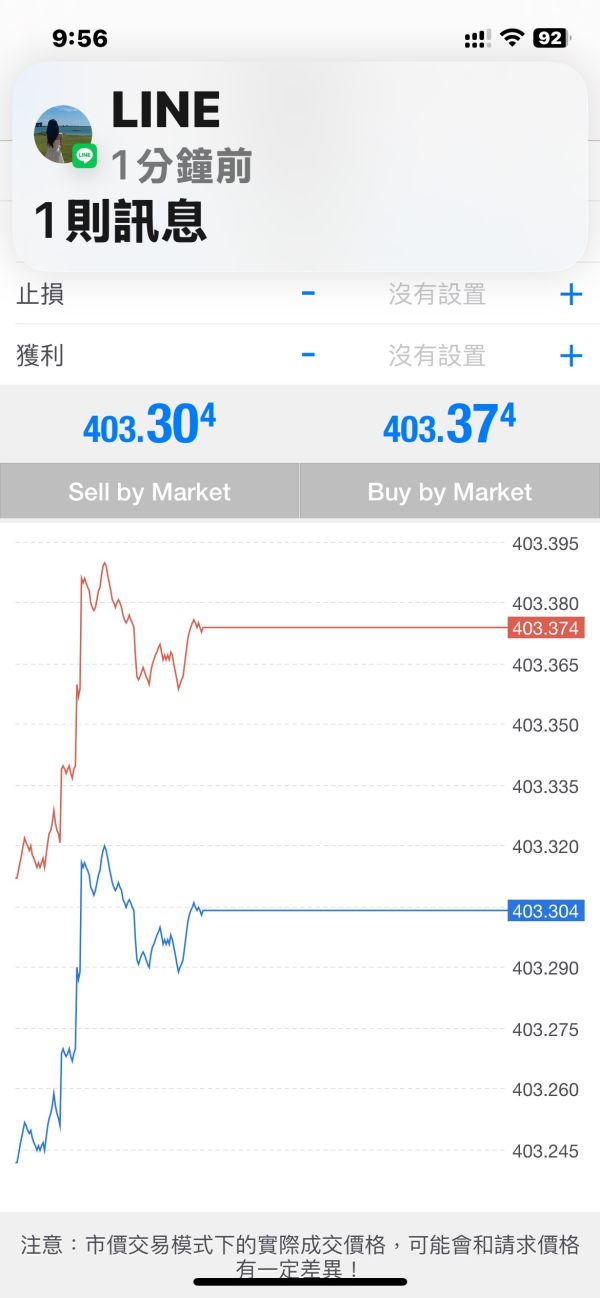

The overall trading experience provided by AM Broker is a blend of strengths and weaknesses. It earns a score of 7/10. Users have generally reported that the trading platform is stable and capable of handling high leverage scenarios thanks to the support of MT5.

The platform's technical analysis features, including a variety of indicators and order execution capabilities, are praised by many traders. However, despite these positives, there are concerns about occasional slippage and inconsistent order execution. These have been highlighted in user reviews.

Furthermore, while the platform boasts multi-device compatibility—covering web-based and mobile trading—it lacks specific feedback about the mobile experience. This leaves a gap in fully understanding its performance on different devices. Additionally, some instances of latency during periods of high market volatility have been noted. This can adversely impact timely order execution.

In conclusion, while the trading environment is generally robust with appealing high-leverage options and a diverse asset range, specific technical issues detract from an entirely seamless experience. This am broker review underscores that while the core trading experience is competent, strategic improvements in execution quality and platform optimization are necessary for enhanced performance.

5. Trustworthiness Analysis

Trustworthiness is one of the more contentious aspects of AM Broker. This is reflected in its score of 5/10. The broker is regulated by SVGFSA, which typically provides a foundational regulatory framework.

However, the lack of detailed regulatory disclosures—including license numbers—raises concerns about transparency. Several user reports highlight alarm bells, with some alleging that the broker has characteristics common to fraudulent operations. The absence of robust publicly available information about fund protection measures or detailed corporate governance further worsens these issues.

Industry observations note that the company's history includes instances of mixed reviews. Some users have even associated the broker with scam allegations. While regulatory oversight does exist, the minimal information provided undermines full confidence in the broker's commitment to safeguarding trader assets and ensuring professional conduct.

This am broker review documents these trust issues based on divergent user experiences and emphasizes that potential investors should exercise caution. They should conduct thorough personal investigations before engaging with the broker. Transparency and enhanced disclosure of operational procedures would be critical steps in improving overall trustworthiness.

6. User Experience Analysis

The user experience offered by AM Broker is subject to varied opinions. This leads to an overall score of 6/10. On the one hand, users appreciate the intuitive interface and ease of navigation provided by the MT5 platform.

This is complemented by clear charting and ordering functionalities. The design of the trading interface is generally regarded as modern and user-friendly. However, the registration and account verification processes remain inadequately detailed in available information.

This leaves some users facing uncertainties during onboarding. Additionally, issues like slow customer support responses and occasional platform instability during high traffic periods have been flagged by traders. While many users have reported satisfactory experiences in executing trades and accessing market data, recurring complaints about delayed assistance and incomplete guidance on funds management highlight the need for overall improvement.

Balancing these points, the user experience stands as average with notable potential for enhancement in both the technical and support aspects of the service. This am broker review suggests that focusing on streamlining registration processes, improving support communication, and providing clearer guidelines on account management could significantly elevate user satisfaction. These improvements would also enhance platform reliability.

Conclusion

In summary, AM Broker offers a mixed bag of attributes that may appeal to certain traders. It particularly suits those seeking high leverage and a diversified asset portfolio through the MT5 platform. However, this am broker review also highlights considerable areas for concern, notably the lack of transparency in account conditions, regulatory details, and inconsistent customer service.

While the trading tools and asset variety represent significant strengths, challenges with trustworthiness and user support temper the overall assessment. This broker is best suited for experienced traders who are comfortable with some uncertainty in exchange for the potential benefits of high leverage and a broad range of trading instruments. Prospective users should carefully weigh these pros and cons before committing.

They should ensure thorough personal research is undertaken for a well-informed investment decision.