Regarding the legitimacy of EMAR MARKETS forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is EMAR MARKETS safe?

Pros

Cons

Is EMAR MARKETS markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EMAR MARKETS (PTY) LTD

Effective Date:

2023-08-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

GROUND FLOOR THE PAVILION BUILDINGCNR OF PORTSWOOD AND DOCK ROADV A WATERFRONT CAPE TOWN8001Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Emar Markets A Scam?

Introduction

Emar Markets is a relatively new player in the forex trading arena, having been established in 2022 and claiming to offer a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. With its headquarters reportedly located in Saint Vincent and the Grenadines, Emar Markets positions itself as a competitive broker in the online trading landscape. However, the influx of unregulated brokers in the market necessitates that traders exercise caution and perform thorough due diligence before engaging with any trading platform. This article aims to evaluate the legitimacy of Emar Markets by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment.

To conduct this investigation, we have relied on various online reviews, regulatory databases, and firsthand user experiences. The evaluation framework centers on key aspects that define a trustworthy trading environment, including regulatory compliance, transparency, and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Emar Markets claims to be regulated by the National Futures Association (NFA) in the United States and the Financial Sector Conduct Authority (FSCA) in South Africa. However, upon further investigation, it becomes evident that Emar Markets is not a registered member of the NFA and does not hold a valid forex dealer membership or futures commission merchant license with the U.S. Commodity Futures Trading Commission (CFTC). Instead, it is only registered as an exempt commodity pool operator and commodity trading advisor, which does not authorize it to offer forex services.

The following table summarizes the core regulatory information for Emar Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Not Regulated |

| FSCA | 53070 | South Africa | Unverified |

The lack of proper regulatory oversight raises significant concerns regarding investor protection and the potential for unethical practices. Additionally, the offshore registration in Saint Vincent and the Grenadines, known for its lax regulatory environment, further diminishes the credibility of Emar Markets. Without stringent regulatory frameworks, traders face heightened risks of fraud and financial loss.

Company Background Investigation

Emar Markets was founded in 2022, making it a relatively new entrant in the forex brokerage industry. The company claims to operate from its headquarters in South Africa, but the legitimacy of this claim remains questionable due to the absence of verifiable regulatory oversight. The ownership structure and management team details are sparse, which raises concerns about transparency and accountability.

The lack of information regarding the management teams professional background and experience further complicates the assessment of Emar Markets. A reputable broker typically provides clear information about its leadership, including their qualifications and industry expertise. In contrast, Emar Markets appears to lack this level of disclosure, which may indicate a potential red flag for prospective traders. Transparency in corporate governance is essential for building trust, and the absence of such information can lead to skepticism regarding the company's operations.

Trading Conditions Analysis

Emar Markets presents itself as a broker with competitive trading conditions, including low minimum deposit requirements and high leverage options. However, the overall fee structure and trading conditions should be scrutinized closely. The broker advertises a minimum deposit of just $1, which may seem appealing to new traders. However, this low entry point does not compensate for the lack of regulatory oversight and potential hidden fees.

The following table compares the core trading costs associated with Emar Markets against industry averages:

| Fee Type | Emar Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 0.4 - 1.0 pips |

| Commission Model | Not Disclosed | Varies by Broker |

| Overnight Interest Range | Not Disclosed | Varies by Broker |

While Emar Markets claims to offer spreads starting from 0.1 pips, the lack of transparency regarding its fee structure raises concerns about potential hidden costs that could erode trading profits. Furthermore, the absence of clear information on commission rates and overnight interest charges can lead to unexpected expenses for traders, making it imperative to conduct thorough research before committing funds.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. Emar Markets does not provide clear information regarding its fund segregation policies, investor protection measures, or negative balance protection. Reputable brokers typically maintain client funds in segregated accounts to ensure that they are protected in the event of financial difficulties. However, Emar Markets has not disclosed whether it adheres to such practices.

The absence of guaranteed funds and investor protection mechanisms is a significant concern for traders. Without these safeguards, clients' investments are at risk, particularly in the event of insolvency or mismanagement. Historical issues related to fund safety or disputes have not been explicitly documented for Emar Markets, but the lack of regulatory oversight amplifies the potential risks associated with trading on this platform.

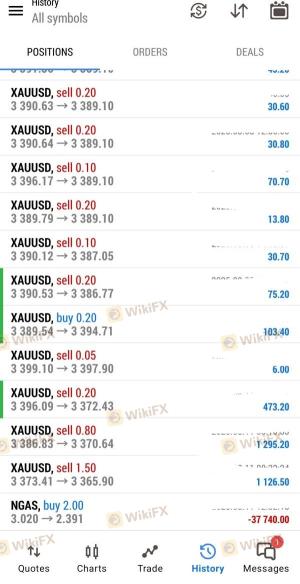

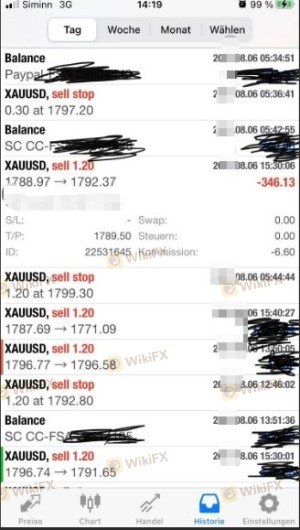

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Emar Markets reveal a troubling pattern of complaints, particularly regarding withdrawal issues and unresponsive customer support. Many users have reported difficulties in accessing their funds after requesting withdrawals, with some claiming that their accounts were deactivated without explanation.

The following table summarizes the main types of complaints received about Emar Markets along with their severity and company response:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Account Deactivation | High | Unresponsive |

| Customer Support Issues | Medium | Slow Response |

One typical case involves a trader who reported that their withdrawal request was approved via email, but no funds appeared in their bank account. Such incidents raise serious concerns about the brokers operational integrity and the reliability of its customer support.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Emar Markets claims to offer popular trading platforms such as MetaTrader 5 and cTrader. However, user experiences indicate that the execution quality may not meet expectations. Reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes.

The lack of transparency regarding the platforms operational metrics, such as execution speed and slippage rates, further complicates the assessment. Traders should be cautious of any signs of potential platform manipulation, as this can lead to unfair trading conditions.

Risk Assessment

Trading with Emar Markets carries several inherent risks due to its lack of regulation, transparency, and questionable customer experiences. The following table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated status increases risk of fraud. |

| Fund Safety | High | Lack of fund segregation and investor protection. |

| Customer Support | Medium | Reports of unresponsive support and withdrawal issues. |

| Platform Reliability | High | Concerns over execution quality and potential manipulation. |

To mitigate these risks, traders are advised to conduct thorough research, seek regulated alternatives, and prioritize brokers with established reputations and transparent practices.

Conclusion and Recommendations

In conclusion, while Emar Markets presents itself as an accessible and competitive trading platform, the evidence suggests that it operates with significant risks and red flags. The lack of legitimate regulatory oversight, transparency regarding fees, and troubling customer experiences point towards a potential scam.

Traders should exercise extreme caution when considering Emar Markets and may want to explore regulated alternatives that offer better security and reliability. Reputable brokers such as FXTM, FP Markets, and XM are recommended for those seeking a safer trading environment. Ultimately, protecting ones investment should be the top priority, and choosing a regulated broker is a crucial step in that direction.

Is EMAR MARKETS a scam, or is it legit?

The latest exposure and evaluation content of EMAR MARKETS brokers.

EMAR MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMAR MARKETS latest industry rating score is 4.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.