EMAR Markets 2025 Review: Everything You Need to Know

Executive Summary

EMAR Markets is a new online forex broker. It has entered the competitive foreign exchange trading world with mixed reactions from traders. This emar markets review shows a broker that offers some good trading conditions like a very low minimum deposit of just $1 and high leverage up to 1:3000, but it also has several problems that potential traders should think about carefully.

The broker targets both retail and institutional clients. It positions itself as an easy-to-use platform for traders of all skill levels. However, our detailed analysis shows that EMAR Markets operates with limited regulatory transparency. The company is registered in Saint Vincent and the Grenadines without clear oversight from major financial authorities. Despite providing what users call good customer support, the platform has received some negative reviews that raise questions about its reliability and trustworthiness in the highly regulated forex industry.

Important Disclaimers

This review is based on public information and user feedback collected from various sources as of 2025. EMAR Markets is registered in Saint Vincent and the Grenadines, and the regulatory status remains unclear with no mention of oversight from major financial regulatory bodies. Trading conditions and policies may vary between different regions and can change over time. Readers should do their own research and verify all information directly with the broker before making any trading decisions. The forex market involves substantial risk, and past performance does not guarantee future results.

Rating Framework

Broker Overview

EMAR Markets has emerged as a new player in the online forex trading industry. Specific founding details are not clearly mentioned in available sources. The company is registered in Saint Vincent and the Grenadines and focuses on providing trading services to both retail and institutional clients worldwide. According to information from trading review platforms, EMAR Markets positions itself as a complete trading solutions provider that aims to deliver accessible forex trading services across various market conditions.

The broker operates as an online brokerage firm that has been described as "rapidly growing" despite its recent entry into the market. EMAR Markets' business model centers around providing access to multiple asset classes through popular trading platforms. It targets traders who seek both competitive trading conditions and reliable customer support. However, the company's background information remains limited in publicly available sources.

The platform offers access to MetaTrader 4 (MT4) and cTrader trading platforms. These platforms cater to different user preferences and trading styles. MT4 is widely recognized for its extensive functionalities and automated trading capabilities, while cTrader provides a user-friendly interface with advanced charting features. Available trading assets include forex pairs, commodities, indices, and cryptocurrencies. This provides traders with diverse investment opportunities across multiple markets. However, specific regulatory oversight from major financial authorities is not mentioned in the available information, which may be a concern for traders prioritizing regulatory compliance and fund safety.

Regulatory Jurisdiction: EMAR Markets is registered in Saint Vincent and the Grenadines. Specific regulatory oversight details are not clearly mentioned in available sources.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods are not detailed in the available information sources.

Minimum Deposit Requirements: The broker offers an exceptionally low minimum deposit requirement of just $1. This makes it highly accessible for beginning traders.

Bonuses and Promotions: Available information does not mention specific bonus programs or promotional offers currently available to traders.

Available Trading Assets: The platform provides access to multiple asset classes including forex currency pairs, commodities, stock indices, and cryptocurrencies. This offers diversified trading opportunities.

Cost Structure: Spreads begin from 1 pip. Specific commission structures and additional fees are not detailed in the available sources.

Leverage Options: EMAR Markets offers maximum leverage up to 1:3000. This is considerably high compared to many regulated brokers in major jurisdictions.

Platform Options: Traders can access both MT4 and cTrader trading platforms. This provides flexibility in trading interface preferences.

Geographic Restrictions: Specific regional restrictions are not mentioned in the available information sources.

Customer Service Languages: Available customer service languages are not specifically detailed in the current information. This comprehensive emar markets review continues to examine each aspect of the broker's offerings in detail.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

EMAR Markets presents very attractive account opening conditions that particularly appeal to new traders entering the forex market. The standout feature is the remarkably low minimum deposit requirement of just $1. This removes significant financial barriers for beginners who want to test the platform without substantial initial investment. This accessibility factor significantly contributes to the positive rating in this category.

The broker offers leverage up to 1:3000. This is exceptionally high compared to regulated brokers in major jurisdictions like the EU or UK, where leverage is typically capped at 1:30 for retail traders. While this high leverage can amplify both profits and losses, it provides experienced traders with significant trading flexibility. However, the available information lacks specific details about different account types, their features, and any tiered benefits that might be available to traders with larger deposits.

The account opening process details are not thoroughly documented in available sources. This makes it difficult to assess the efficiency and requirements for new account setup. Additionally, there is no mention of specialized account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions. Despite these information gaps, the combination of low entry barriers and high leverage options makes EMAR Markets accessible to a wide range of traders. The lack of detailed account structure information prevents a higher rating.

According to this emar markets review, the basic account conditions are attractive. Potential traders should seek additional clarification directly from the broker regarding specific account features and requirements.

EMAR Markets provides access to two well-established trading platforms: MetaTrader 4 (MT4) and cTrader. This represents a solid foundation for trading operations. MT4 is renowned in the industry for its comprehensive functionality, extensive technical analysis tools, and robust automated trading capabilities through Expert Advisors (EAs). cTrader offers a more modern interface with advanced charting capabilities and is particularly favored by traders who prefer intuitive design and sophisticated order management features.

However, the available information reveals significant gaps in the broker's educational and research offerings. There is no specific mention of market analysis reports, economic calendars, trading signals, or educational resources that many established brokers provide to support their clients' trading decisions. This absence of comprehensive research tools and educational materials limits the platform's value proposition. It particularly affects novice traders who benefit from guided learning resources and market insights.

The lack of information about additional trading tools is concerning. There are no mentions of advanced charting packages, sentiment indicators, or proprietary analysis software. This suggests that EMAR Markets may be focusing primarily on platform access rather than comprehensive trading support. While the MT4 and cTrader platforms do provide substantial built-in functionality, the absence of broker-specific tools and resources represents a missed opportunity to enhance the overall trading experience.

For traders who rely heavily on fundamental analysis or prefer comprehensive market research, the current tool set may feel limited. This is especially true compared to more established brokers that offer extensive research departments and educational programs.

Customer Service and Support Analysis (Score: 8/10)

Customer service emerges as one of EMAR Markets' strongest attributes based on available user feedback. Multiple sources indicate that the broker provides "superb support" and maintains good customer service standards that meet the needs of retail traders. This positive reception from users suggests that the broker has invested in developing effective support systems and training competent customer service representatives.

User testimonials highlight the responsiveness and helpfulness of the support team. This is particularly important in the fast-paced forex trading environment where technical issues or account problems can directly impact trading opportunities. The fact that customer support is consistently mentioned as a positive aspect in user reviews indicates that EMAR Markets prioritizes client satisfaction and maintains professional service standards.

However, specific details about support availability are not clearly outlined in the available information. There are no mentions of operating hours, response times, and available communication channels like live chat, email, or phone support. Additionally, there is no mention of multilingual support capabilities, which could be important for the broker's international client base.

The absence of detailed information about support infrastructure is notable. There are no mentions of dedicated account managers for larger accounts or specialized technical support teams. Despite these information limitations, the consistently positive user feedback about customer service quality justifies the high rating in this category. This suggests that EMAR Markets has successfully established effective client support systems.

Trading Experience Analysis (Score: 7/10)

The trading experience at EMAR Markets centers around competitive spread offerings starting from 1 pip. This places the broker within reasonable market standards for retail forex trading. The availability of both MT4 and cTrader platforms provides traders with flexibility to choose their preferred trading environment based on individual needs and experience levels. MT4's widespread adoption and extensive community support make it an excellent choice for automated trading strategies, while cTrader's modern interface appeals to traders who prioritize user experience and advanced order management.

However, critical information about execution quality is not available in the current sources. There are no details about average execution speeds, slippage rates, and order fill reliability. These factors are crucial for assessing the actual trading experience, particularly during high-volatility market conditions when execution quality becomes paramount. The lack of specific information about liquidity providers, server locations, or execution models like ECN, STP, or market maker makes it difficult to fully evaluate the trading environment quality.

The high leverage offering of up to 1:3000 can significantly impact the trading experience. It provides opportunities for substantial position sizes with relatively small capital. However, this also introduces considerable risk, particularly for inexperienced traders who may not fully understand leverage implications. The absence of detailed information about mobile trading applications and their functionality represents another gap in assessing the complete trading experience.

This emar markets review finds that basic trading conditions appear competitive. The lack of transparency about execution infrastructure and performance metrics prevents a more comprehensive evaluation of the actual trading experience quality.

Trust and Safety Analysis (Score: 5/10)

Trust and safety represent the most concerning aspects of EMAR Markets' offering. The primary issue is the lack of clear regulatory oversight from major financial authorities. The broker's registration in Saint Vincent and the Grenadines, while legal, does not provide the same level of investor protection and regulatory oversight that traders might expect from brokers regulated by authorities such as the FCA, CySEC, or ASIC.

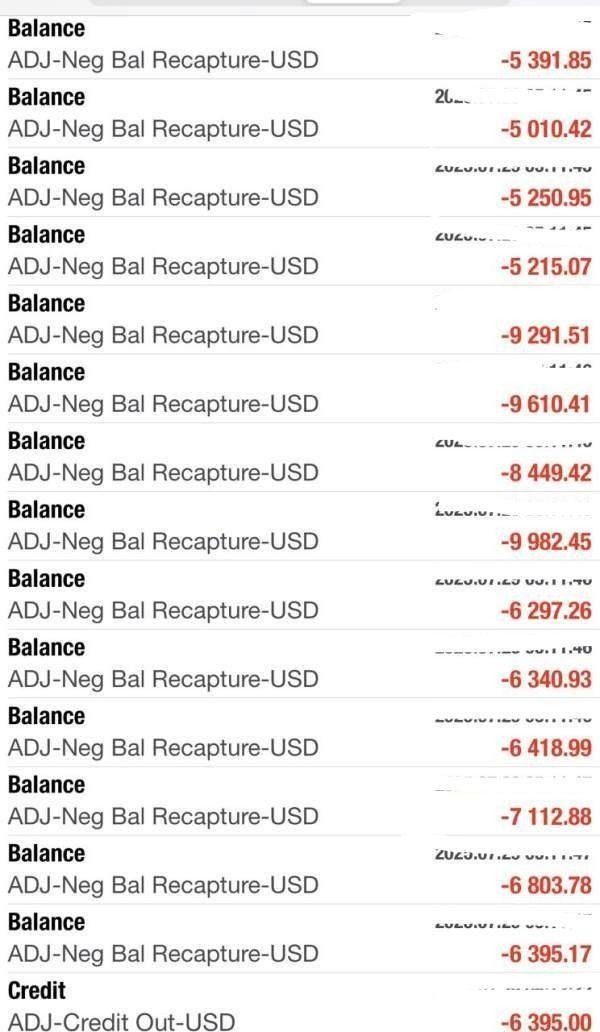

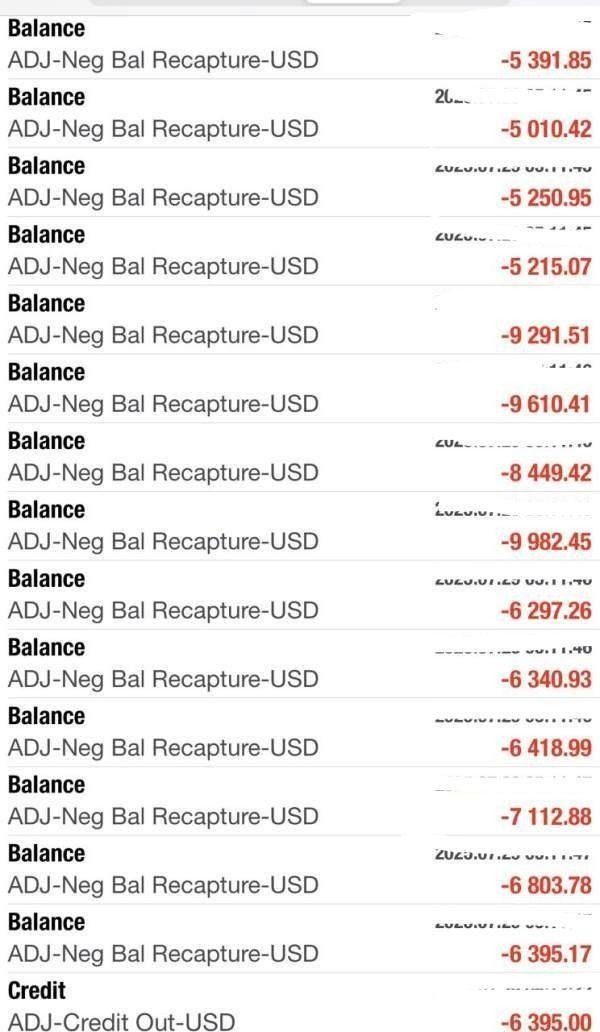

The absence of specific regulatory license numbers or mentions of compliance with major regulatory frameworks raises questions about the broker's commitment to maintaining industry-standard safety protocols. Available sources indicate relatively low trust scores from review platforms. This reflects broader market skepticism about the broker's reliability and long-term stability.

There is no available information about crucial safety measures. These include segregated client funds, investor compensation schemes, or independent auditing of client accounts. These protections are standard among well-regulated brokers and their absence or lack of transparency significantly impacts the trust rating. The limited information about the company's financial backing, management team, or corporate governance structure further compounds these concerns.

Some negative reviews mentioned in available sources suggest that there may be ongoing issues with client satisfaction or service delivery. Specific details about these complaints are not provided. The combination of unclear regulatory status, limited transparency about safety measures, and negative user feedback creates a challenging environment for building trader confidence and trust in the platform's long-term reliability.

User Experience Analysis (Score: 6/10)

User experience at EMAR Markets presents a mixed picture based on available feedback and platform offerings. Some users praise the customer support quality. However, there are also mentions of negative reviews that suggest inconsistent satisfaction levels among the client base. The low minimum deposit requirement of $1 creates an excellent entry point for new traders to test the platform without significant financial commitment, which positively impacts the initial user experience.

The availability of both MT4 and cTrader platforms caters to different user preferences and experience levels. This allows traders to select the interface that best matches their trading style and technical requirements. However, specific information about user interface design, account management portal functionality, and overall platform navigation ease is not detailed in available sources.

Registration and account verification processes are not specifically described. This makes it difficult to assess how streamlined the onboarding experience is for new clients. Similarly, there is limited information about the deposit and withdrawal experience, including processing times, available methods, and any associated fees that might impact user satisfaction.

The presence of negative reviews suggests that some users have encountered issues with the platform. The specific nature of these complaints is not detailed in available sources. This mixed feedback indicates that while EMAR Markets may satisfy some users' needs, there are areas where the platform may not meet all client expectations consistently.

The lack of detailed information about mobile app functionality, educational resources, and additional user support tools suggests limitations. The overall user experience may be more basic compared to established brokers that offer comprehensive client portals and extensive user support resources.

Conclusion

EMAR Markets presents a mixed proposition in the competitive forex brokerage landscape. The broker offers some attractive features such as an extremely low $1 minimum deposit and high leverage up to 1:3000. However, significant concerns about regulatory transparency and trust factors cannot be overlooked. The platform appears most suitable for beginning traders who want to test forex trading with minimal initial investment and experienced traders who understand and accept the risks associated with less regulated trading environments.

The broker's strengths lie in its accessible entry conditions and reportedly strong customer support. These features may appeal to traders prioritizing service quality and low barriers to entry. However, the lack of clear regulatory oversight, limited transparency about safety measures, and mixed user feedback suggest that traders should approach EMAR Markets with caution and thorough due diligence.

Potential users should carefully weigh the attractive trading conditions against the regulatory and trust concerns. This is particularly important when considering their individual risk tolerance and trading objectives. While EMAR Markets may serve as an entry point for new traders, more experienced traders or those with substantial capital might prefer brokers with stronger regulatory credentials and more comprehensive safety protections.