FxPlayer 2025 Review: Everything You Need to Know

Executive Summary

FxPlayer stands as a forex broker that has carved out a position in the competitive trading landscape since its establishment in 2014. This fxplayer review examines a broker that operates as an Introducing Broker of BMFN, which stands for Boston Merchant Financial. The company offers traders access to multiple financial markets through a No Dealing Desk model. The broker distinguishes itself through regulatory oversight from reputable authorities including the Australian Securities and Investment Commission, the Financial Conduct Authority, and the Financial Supervision Commission.

FxPlayer caters to a diverse range of traders, from beginners seeking their first trading experience to seasoned professionals requiring advanced trading conditions. The broker offers multiple account types designed to accommodate different trading styles and capital requirements. With a focus on providing tight spreads and access to various financial instruments including forex, indices, CFDs, and commodities, FxPlayer positions itself as a comprehensive trading solution. However, user feedback indicates mixed satisfaction levels, with a rating of 5.5 out of 10. This suggests room for improvement in service delivery and user experience.

Important Notice

This review is based on available public information, user feedback, and regulatory data accessible at the time of writing. FxPlayer operates through different regulatory entities across various jurisdictions. This may result in varying trading conditions, available instruments, and service offerings depending on the client's location and regulatory framework. Traders should verify specific terms and conditions applicable to their region before opening an account.

The evaluation methodology employed in this review incorporates analysis of regulatory compliance, user testimonials, available trading conditions, and industry standards. Information presented may vary as brokers regularly update their offerings and terms of service.

Rating Framework

Broker Overview

FxPlayer emerged in the forex trading landscape in 2014. The company established itself as an Introducing Broker operating under the umbrella of Boston Merchant Financial. The company has built its reputation on providing No Dealing Desk execution, which theoretically ensures that client orders are passed directly to liquidity providers without broker intervention. This model appeals to traders who prioritize transparent order execution and minimal conflicts of interest.

The broker operates as a hybrid model, functioning both as an a-book and b-book broker. This allows for flexibility in handling different types of client orders and risk management. This approach enables FxPlayer to offer competitive pricing while maintaining operational efficiency across various market conditions.

According to available information, FxPlayer provides access to multiple asset classes including foreign exchange pairs, stock indices, contracts for difference, and commodity markets. The broker's regulatory framework encompasses oversight from three significant financial authorities: the Australian Securities and Investment Commission, the Financial Conduct Authority in the United Kingdom, and the Financial Supervision Commission. This multi-jurisdictional regulatory approach provides clients with enhanced protection and operational transparency. This comprehensive fxplayer review indicates that while the broker offers solid regulatory backing, specific details about trading platforms and advanced features require further investigation by potential clients.

Regulatory Framework

FxPlayer operates under a robust regulatory framework through its parent company BMFN. The company holds licenses from three prominent financial authorities. The Australian Securities and Investment Commission provides oversight for Australian operations, while the Financial Conduct Authority governs UK-related activities. Additionally, the Financial Supervision Commission offers regulatory supervision. This creates a multi-layered compliance structure that enhances client protection.

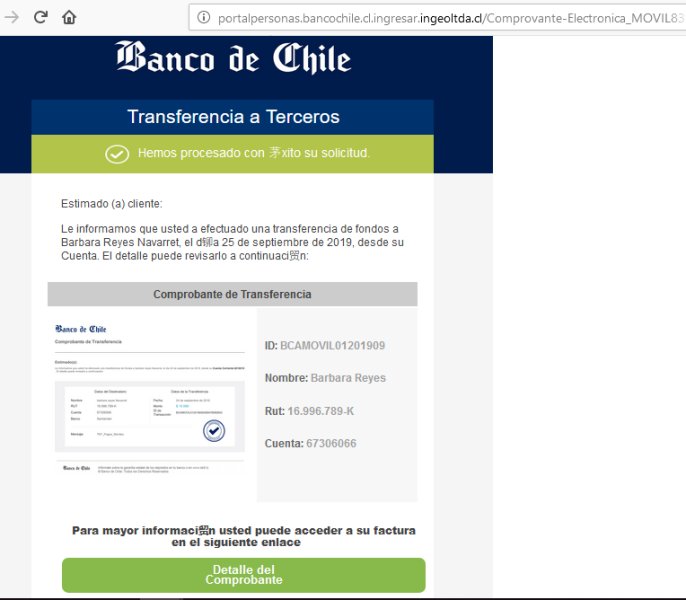

Funding Methods

Specific information regarding deposit and withdrawal methods was not detailed in available documentation. Potential clients should contact the broker directly to understand available funding options, processing times, and any associated fees for financial transactions.

Minimum Deposit Requirements

The minimum deposit requirements for different account types were not specified in the available information. This lack of transparency may require prospective traders to engage directly with the broker for detailed account opening requirements.

Information regarding bonus programs, promotional offers, or special incentives for new clients was not mentioned in available sources. Traders interested in promotional benefits should inquire directly with FxPlayer about current offers.

Available Trading Instruments

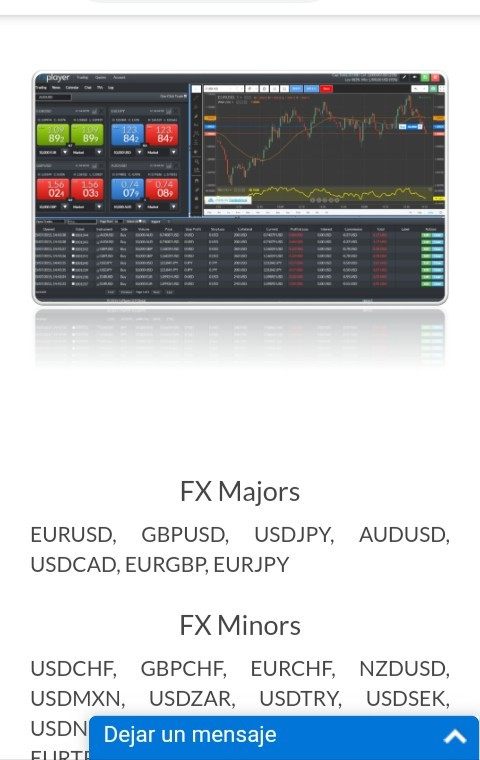

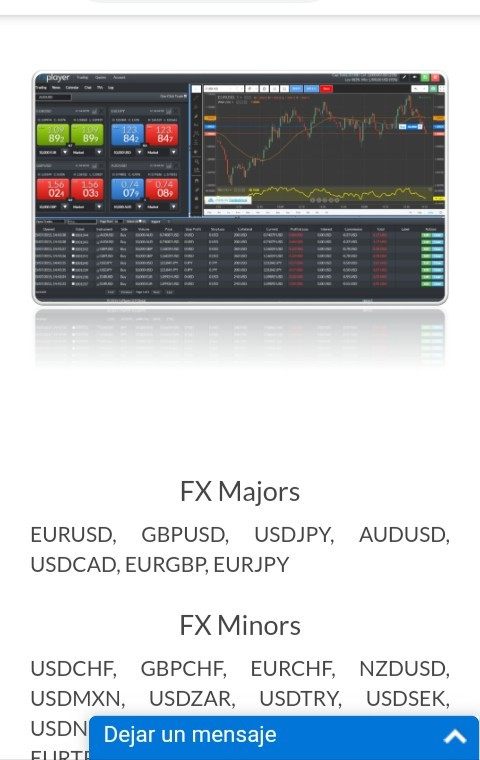

FxPlayer provides access to a diverse range of financial instruments designed to meet various trading strategies. The asset classes include major and minor foreign exchange pairs, global stock indices, contracts for difference across multiple markets, and commodity trading opportunities. This variety allows traders to diversify their portfolios and explore different market sectors.

Cost Structure

The broker advertises tight variable spreads as part of its competitive pricing strategy. However, specific commission structures, overnight financing rates, and other trading costs were not detailed in available information. This fxplayer review notes that traders should request comprehensive cost breakdowns before committing to any account type.

Leverage Options

Leverage ratios and maximum leverage available to different client categories were not specified in the source materials. Given regulatory variations across jurisdictions, leverage options likely differ based on client location and account classification.

While the broker operates as a No Dealing Desk provider, specific information about available trading platforms, their features, and compatibility across different devices was not detailed in available documentation.

Geographic Restrictions

Information regarding restricted countries or regional limitations was not provided in the source materials.

Customer Support Languages

Available customer support languages were not specified in the reviewed information.

Detailed Rating Analysis

Account Conditions Analysis

FxPlayer's account structure demonstrates effort to accommodate diverse trader requirements through multiple account type offerings. According to available information, the broker provides five distinct account categories. This suggests a tiered approach to serve traders with varying experience levels and capital allocations. This variety typically allows brokers to customize trading conditions, spreads, and features based on account classification.

However, this fxplayer review identifies significant transparency gaps in account condition disclosure. The absence of clearly stated minimum deposit requirements across different account types creates uncertainty for potential clients attempting to evaluate their options. Similarly, the lack of detailed fee structures, including commission rates, overnight financing costs, and withdrawal fees, hampers comprehensive cost analysis.

The account opening process details were not extensively documented in available sources. This makes it difficult to assess the efficiency and user-friendliness of the onboarding experience. Additionally, information regarding specialized account features such as Islamic accounts for Sharia-compliant trading, VIP accounts with enhanced conditions, or demo accounts for practice trading was not readily available.

While the broker's No Dealing Desk model suggests favorable execution conditions, the overall account conditions receive a moderate rating due to limited transparency in critical areas. These areas directly impact trading costs and accessibility.

FxPlayer's offering in the tools and resources category shows promise through its diverse range of tradeable instruments spanning forex, indices, CFDs, and commodities. This variety provides traders with opportunities to diversify their portfolios and explore different market sectors. This is particularly valuable for those seeking to spread risk across multiple asset classes.

However, significant information gaps exist regarding the specific trading platforms available to clients. Modern traders expect robust platform ecosystems that include desktop applications, web-based interfaces, and mobile solutions with comprehensive charting capabilities, technical analysis tools, and order management features. The absence of detailed platform information in available documentation raises questions about the technological infrastructure supporting client trading activities.

Educational resources, market analysis tools, and research capabilities were not mentioned in the source materials. These components are increasingly important for broker competitiveness, particularly when serving less experienced traders who require guidance and market insights to develop their trading skills.

Automated trading support, including compatibility with expert advisors or algorithmic trading systems, was not addressed in available information. This omission is notable given the growing popularity of systematic trading approaches among retail and professional traders alike.

Customer Service and Support Analysis

Customer service evaluation for FxPlayer faces significant limitations due to sparse information availability regarding support channels, response times, and service quality metrics. The absence of detailed customer service information in this fxplayer review reflects a broader transparency issue that may concern potential clients.

Effective customer support typically encompasses multiple communication channels including live chat, email support, telephone assistance, and potentially social media engagement. Response time expectations, availability hours, and the technical expertise of support staff are crucial factors that influence overall client satisfaction and problem resolution efficiency.

Multilingual support capabilities were not documented. This could limit accessibility for international clients who prefer communication in their native languages. Given FxPlayer's multi-jurisdictional regulatory framework, language support diversity would be expected to accommodate clients across different regions.

The quality of customer service often becomes apparent through user feedback and testimonials. However, specific client experiences regarding support interactions, problem resolution effectiveness, and overall satisfaction with assistance quality were not detailed in available sources. This information gap contributes to the moderate rating assigned to customer service and support.

Trading Experience Analysis

The trading experience evaluation for FxPlayer centers primarily on the advertised tight spreads. These represent a competitive advantage in cost-conscious trading environments. Tight spreads directly impact trading profitability, particularly for high-frequency traders and scalping strategies where small cost differences can significantly affect overall performance.

However, comprehensive trading experience assessment requires examination of multiple factors beyond spread competitiveness. Order execution speed, slippage frequency, requote occurrences, and platform stability during high-volatility periods are critical components that influence trader satisfaction and success rates.

Platform functionality, including the availability of advanced order types, one-click trading capabilities, customizable interfaces, and comprehensive charting tools, significantly impacts daily trading operations. The absence of detailed platform specifications in available documentation limits the ability to fully evaluate the technological trading environment provided by FxPlayer.

Mobile trading capabilities have become essential for modern traders who require market access and position management flexibility. Without specific information about mobile platform features, compatibility, and performance, potential clients cannot adequately assess whether FxPlayer meets their mobility requirements.

The broker's No Dealing Desk model theoretically supports transparent order execution. However, real-world performance metrics and user experiences would provide more concrete evidence of execution quality.

Trust and Reliability Analysis

FxPlayer's trust and reliability profile benefits significantly from its regulatory framework encompassing oversight from three respected financial authorities. The Australian Securities and Investment Commission, Financial Conduct Authority, and Financial Supervision Commission each maintain rigorous standards for broker operations, capital requirements, and client protection measures.

Regulatory compliance provides essential safeguards including segregated client fund requirements, operational transparency standards, and dispute resolution mechanisms. These protections are fundamental for trader confidence, particularly when depositing significant capital amounts or engaging in substantial trading activities.

However, this evaluation identifies information gaps regarding specific client fund protection measures. Examples include investor compensation schemes, insurance coverage, or detailed segregation procedures. While regulatory oversight implies certain protections, explicit disclosure of safety measures would enhance transparency and client confidence.

Company financial stability, operational history, and any regulatory actions or penalties were not detailed in available information. A comprehensive trust assessment would typically include examination of the broker's financial health, ownership structure, and regulatory compliance history.

The absence of detailed information about negative event handling, dispute resolution procedures, and company transparency measures limits the ability to provide a more definitive trust evaluation in this fxplayer review.

User Experience Analysis

User experience assessment for FxPlayer reveals mixed satisfaction levels. Available user ratings indicate a 5.5 out of 10 score. This moderate rating suggests that while some clients find the service acceptable, significant room exists for improvement across various service dimensions.

User satisfaction typically correlates with multiple factors including platform usability, customer service responsiveness, trading condition competitiveness, and overall service reliability. The moderate rating implies that FxPlayer meets basic expectations but may not excel in areas that drive exceptional client satisfaction.

Interface design and platform usability were not specifically addressed in available documentation. This makes it difficult to assess whether technology limitations contribute to user satisfaction challenges. Modern traders expect intuitive, responsive interfaces that facilitate efficient trading operations and portfolio management.

The account opening and verification process efficiency can significantly impact initial user impressions. However, specific information about onboarding experience was not available. Similarly, funding and withdrawal process convenience, which directly affects user satisfaction, lacked detailed documentation.

Common user complaints and specific areas of concern were not identified in available sources. This limits the ability to understand particular pain points that may be affecting overall satisfaction levels. This information would be valuable for potential clients seeking to understand likely service challenges.

Conclusion

FxPlayer presents itself as a regulated forex broker with solid regulatory backing from multiple respected authorities. The company offers diverse trading instruments through a No Dealing Desk model. The broker's multi-jurisdictional regulatory framework provides important client protections, while its range of account types suggests effort to accommodate different trader requirements.

However, this comprehensive evaluation reveals significant transparency gaps that may concern potential clients. Limited information regarding specific trading costs, platform capabilities, customer service quality, and detailed account features creates uncertainty for traders attempting to make informed broker selection decisions.

FxPlayer appears most suitable for traders who prioritize regulatory oversight and are willing to engage directly with the broker to obtain detailed information about trading conditions and services. The moderate user satisfaction rating suggests that while the broker provides functional services, expectations should be managed regarding service excellence.

Potential clients should conduct thorough due diligence, including direct communication with FxPlayer representatives, to obtain comprehensive information about trading conditions, costs, and service capabilities before committing to account opening.