Vida Markets 2025 Review: Everything You Need to Know

Executive Summary

This vida markets review looks at a South African forex broker. Vida Markets has been working in the international FX market since 2010, building experience over more than a decade of operations. The company is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 42734. This gives traders some regulatory protection for their trading activities.

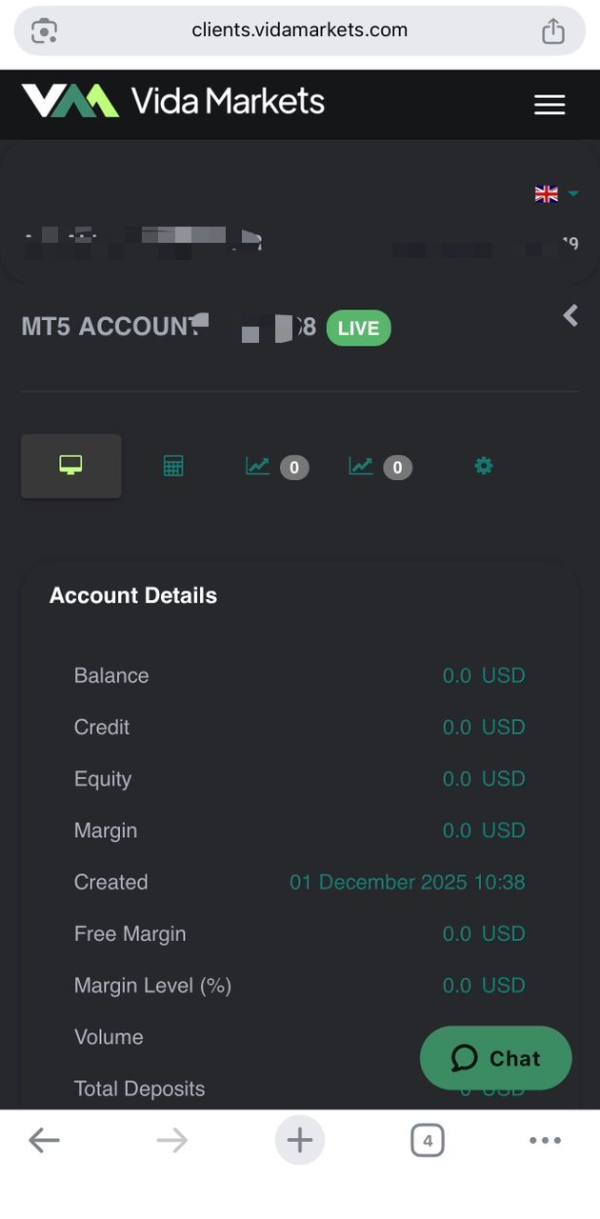

The broker stands out with a very low minimum deposit of just $25. This makes it easy for new traders to start forex trading without putting in a lot of money upfront. Vida Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, giving traders different options for their trading style. The broker also supports MAM/PAMM brokerage solutions. This makes it good for both regular traders and people who want managed account investments.

User reviews show Vida Markets has a rating of 3.6 out of 5 from 122 reviews on Trustpilot. This shows mixed feelings from users but is generally neutral. The broker mainly focuses on retail forex traders and investors who want PAMM account opportunities. It especially appeals to those who like low entry requirements and proven trading platforms.

Vida Markets does well in some areas like easy account access and platform choices. However, this vida markets review shows areas where more clear information would help potential clients. This includes details about spreads, customer service options, and complete fee information.

Important Notice

This review uses publicly available information and user feedback from various sources as of 2025. Vida Markets works mainly under South African rules through its FSCA regulation. Services may be different in other regions because of different regulatory requirements and legal frameworks.

The analysis in this vida markets review has not been done through direct testing of the broker's services. Instead, it relies on verified public information, regulatory data, and documented user experiences. Potential clients should do their own research and think about their specific trading needs and regulatory requirements before making any trading decisions.

Information accuracy may change over time. Readers should verify current terms, conditions, and offerings directly with Vida Markets before opening any trading accounts.

Rating Framework

Broker Overview

Vida Markets started working in the international forex market in 2010. The company positions itself as a technology-focused brokerage firm that wants to help traders make more money through advanced trading solutions. Vida Markets operates as an international FX brokerage with main regulatory oversight from South Africa's Financial Sector Conduct Authority (FSCA).

The broker's business model focuses on providing forex and contracts for difference (CFD) trading services to retail clients. It puts special emphasis on accessibility through low minimum deposit requirements and complete platform support. According to available information, Vida Markets has developed its services to work for both individual traders and those seeking managed account solutions through PAMM (Percentage Allocation Management Module) arrangements.

Vida Markets makes itself different in the competitive forex market through its dual-platform approach. The broker offers both MetaTrader 4 and MetaTrader 5 trading environments. This vida markets review finds that the broker's platform strategy works for traders with different experience levels and technical requirements. It covers everything from basic retail forex trading to more advanced algorithmic and automated trading strategies.

The company's regulatory framework operates under FSCA license number 42734. This provides South African regulatory oversight for its operations. This regulatory foundation offers clients certain protections and operational standards. However, the specific extent of client fund protection and dispute resolution mechanisms requires further clarification from the broker directly.

Regulatory Jurisdiction: Vida Markets operates under the regulatory authority of South Africa's Financial Sector Conduct Authority (FSCA) with license number 42734. This regulatory framework provides oversight for the broker's operations within South African financial services regulations. However, specific client protection details are not fully detailed in available public information.

Minimum Deposit Requirements: The broker maintains a very accessible minimum deposit requirement of $25. This positions it among the most accessible forex brokers for entry-level traders. This low barrier to entry makes Vida Markets particularly attractive for new traders testing forex markets or those with limited initial capital.

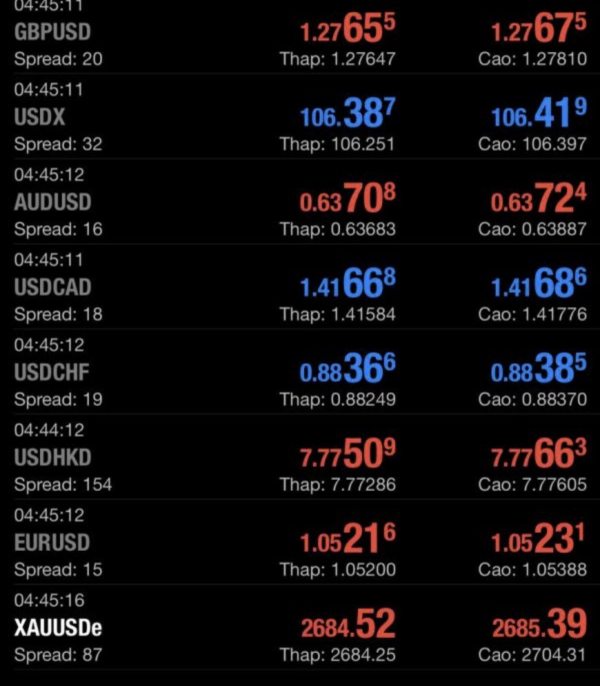

Trading Assets: Vida Markets focuses mainly on foreign exchange (FX) trading and contracts for difference (CFDs). However, specific details about the number of currency pairs, commodity CFDs, or other asset classes are not fully detailed in available public information.

Cost Structure: Available information shows EUR/USD spreads starting from 0 pips. However, complete spread ranges, commission structures, and other trading costs require direct verification with the broker. The specific fee structure for different account types and trading volumes is not detailed in available public sources.

Platform Options: The broker provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These cover the most widely used professional trading environments in the forex industry. Additionally, MAM/PAMM brokerage solutions are available for managed account arrangements.

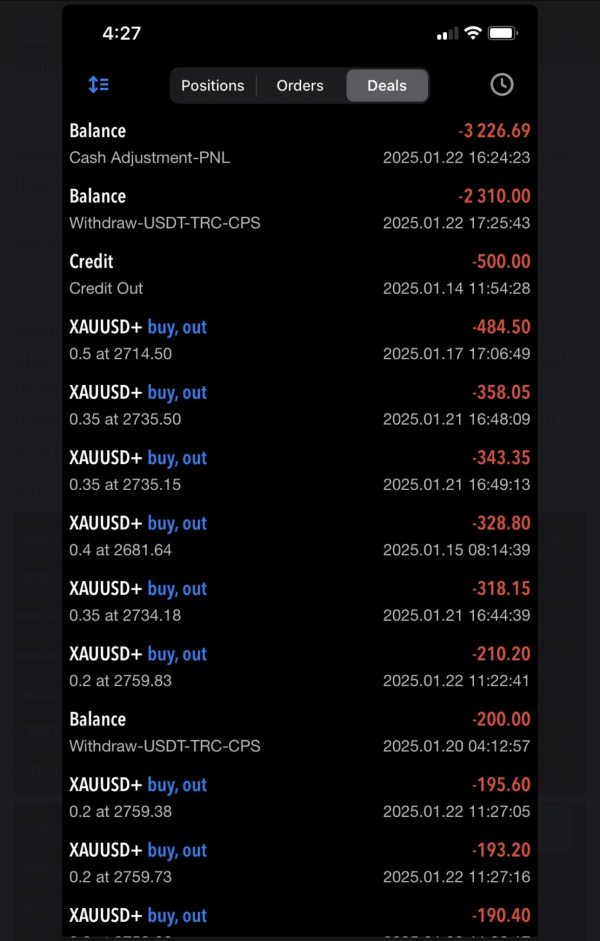

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not fully detailed in available public information. This would require direct inquiry with the broker.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available public information sources reviewed for this vida markets review.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Vida Markets shows strong accessibility through its $25 minimum deposit requirement. This represents one of the lowest barriers to entry among regulated forex brokers. This positioning makes the broker particularly attractive for new traders, students, or those seeking to test trading strategies with minimal capital risk.

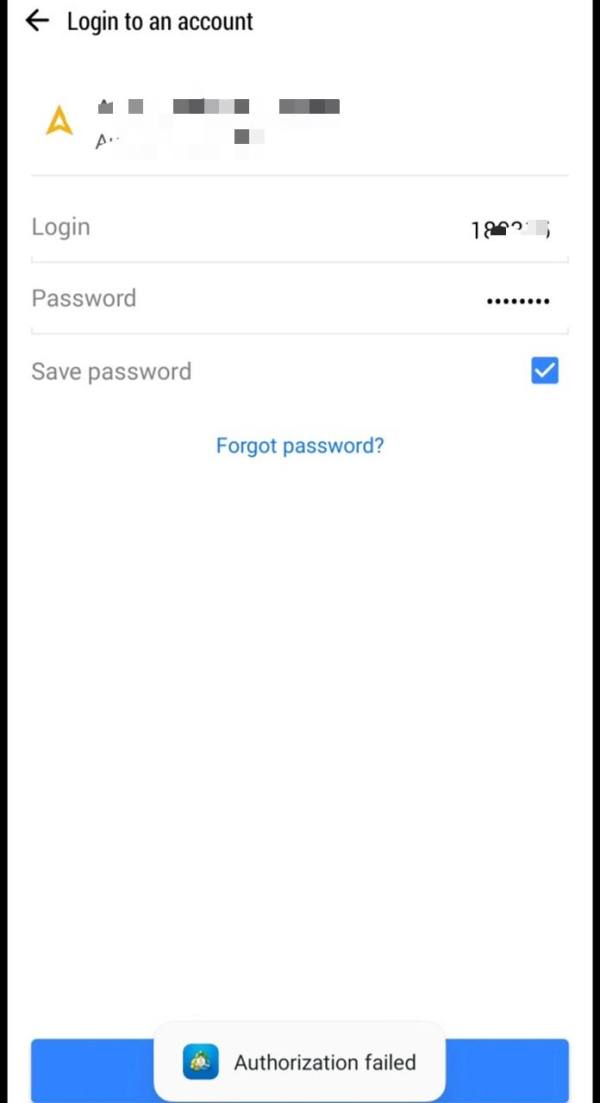

However, this vida markets review finds significant information gaps about account type variety and specific features. The broker's website and available public information do not fully detail whether multiple account tiers are available. It's also unclear what specific features differentiate potential account types or how account conditions scale with deposit levels.

The account opening process details are not fully available in public sources. This makes it difficult to assess the efficiency and requirements for new client onboarding. Additionally, specific information about Islamic account availability, professional account options, or corporate account structures is not detailed in available materials.

While the low minimum deposit represents a significant advantage, the lack of transparent information about account features limits evaluation. Details about leverage options and specific terms and conditions are also missing. Potential clients would need to engage directly with the broker to obtain complete account specification details.

The broker's platform offering represents a significant strength. It provides both MetaTrader 4 and MetaTrader 5 environments that serve different trader preferences and technical requirements. MT4 remains popular for its stability and extensive expert advisor (EA) support. MT5 offers enhanced analytical tools and multi-asset capabilities.

Vida Markets' support for MAM/PAMM solutions adds considerable value for traders interested in managed accounts or money management services. These tools enable experienced traders to manage multiple accounts and allow investors to allocate funds to successful trading strategies. This expands the broker's appeal beyond individual retail trading.

The availability of both major MetaTrader platforms ensures compatibility with the vast majority of third-party trading tools. This includes indicators and automated trading systems developed for the forex market. This platform diversity supports various trading styles, from manual analysis-based trading to fully automated algorithmic strategies.

However, available information does not fully detail additional tools such as proprietary research resources. Details about market analysis content, economic calendars, or educational materials are also missing. The extent of analytical resources, market commentary, or trader education programs is not clearly specified in available public information. This represents an area where additional transparency would benefit potential clients.

Customer Service and Support Analysis (Score: 6/10)

Available public information provides limited insight into Vida Markets' customer service infrastructure. Details about response times and support quality are not fully available. While the broker operates internationally, specific details about support channel availability, operating hours, and multilingual support capabilities are not fully detailed in available sources.

User reviews on Trustpilot show a mixed 3.6 out of 5 rating from 122 reviews. This suggests variable customer service experiences. However, specific feedback about support quality, response times, or problem resolution effectiveness is not detailed in the available review summaries.

The lack of transparent information about customer service channels represents a significant limitation for potential clients. People seeking to understand support availability before opening accounts face this challenge. Details such as live chat availability, phone support hours, email response times, and escalation procedures are not clearly specified in available public materials.

For a broker targeting international clients, complete customer service information is essential for building client confidence. The limited availability of specific support details in public sources suggests potential clients would need to test service quality directly. They could also request detailed support information during the account opening process.

Trading Experience Analysis (Score: 7/10)

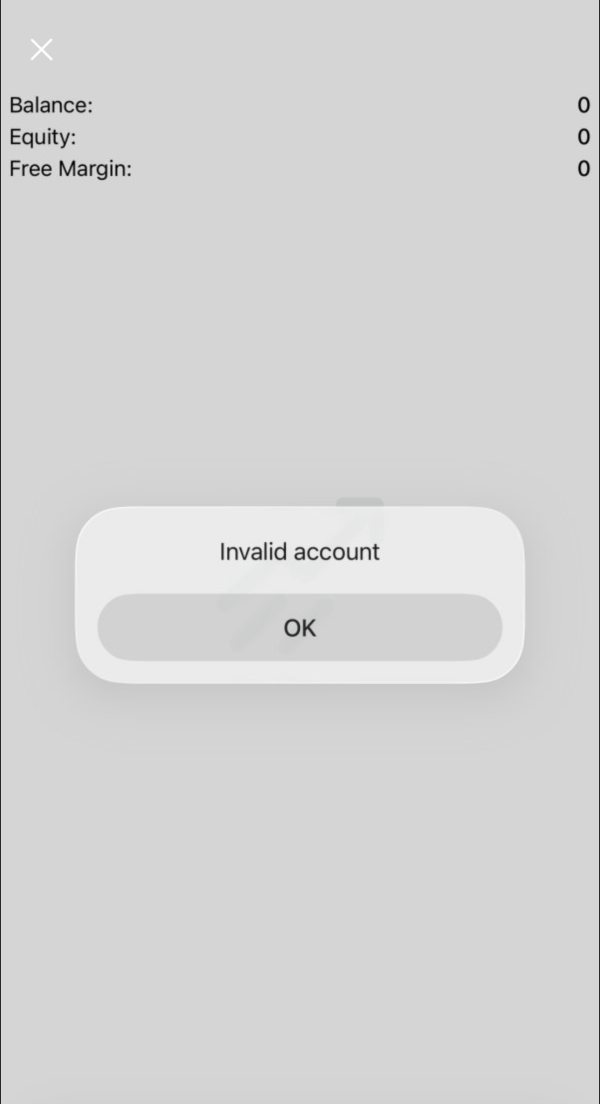

Available information shows that Vida Markets emphasizes fast trade execution. This represents a fundamental requirement for effective forex trading. However, specific performance metrics such as average execution speeds, slippage statistics, or order fill rates are not detailed in available public sources.

The dual MetaTrader platform offering supports diverse trading approaches and technical analysis requirements. Both MT4 and MT5 provide complete charting tools, technical indicators, and order management capabilities that meet professional trading standards. The platforms' stability and functionality are well-established in the industry.

However, this vida markets review finds limited specific information about spread consistency. Details about market depth or liquidity provision are also missing. While EUR/USD spreads are mentioned starting from 0 pips, complete spread tables, average spreads during different market conditions, or commission structures are not detailed in available sources.

The availability of MAM/PAMM solutions suggests sophisticated trade management capabilities. However, specific details about these services' performance, fees, or operational procedures are not fully available. Mobile trading capabilities and platform customization options also require direct verification with the broker.

Trustworthiness Analysis (Score: 7/10)

Vida Markets operates under FSCA regulation (license 42734). This provides a foundation of regulatory oversight from South Africa's financial services authority. The FSCA maintains standards for financial service providers. However, specific client protection measures, compensation schemes, or dispute resolution procedures applicable to Vida Markets clients are not detailed in available public information.

The broker's establishment in 2010 shows over a decade of market operation. This suggests operational stability and market experience. However, available information does not detail company ownership structure, financial backing, or transparency about corporate governance practices.

User feedback shows a moderate 3.6 out of 5 rating from 122 Trustpilot reviews. This indicates mixed but generally neutral client experiences. However, specific details about client fund segregation, bank relationships, or additional safety measures beyond basic regulatory compliance are not fully available in public sources.

The lack of detailed information about awards, industry recognition, or third-party certifications limits the ability to assess the broker's industry reputation fully. Additional transparency about operational practices, financial reporting, or independent audits would strengthen trustworthiness assessment.

User Experience Analysis (Score: 6/10)

User feedback shows moderate satisfaction levels. The 3.6 out of 5 Trustpilot rating from 122 reviews suggests mixed experiences among Vida Markets clients. However, specific details about user satisfaction drivers, common complaints, or positive experience highlights are not detailed in available review summaries.

The low $25 minimum deposit requirement significantly enhances accessibility for new traders or those with limited capital. This represents a positive user experience factor. This low barrier to entry allows users to test the broker's services without significant financial commitment.

However, limited information about account opening procedures makes it difficult to assess the overall onboarding experience fully. Details about verification requirements, deposit and withdrawal processes, or platform setup procedures are also missing. User interface design, platform customization options, and mobile trading experience details are not specified in available sources.

The availability of both MT4 and MT5 platforms provides user choice and flexibility. This accommodates different trader preferences and technical requirements. However, specific feedback about platform performance, stability, or user interface quality from actual clients is not detailed in available public information.

Conclusion

This complete vida markets review reveals a broker with distinct advantages in accessibility and platform variety. These are balanced by areas requiring greater transparency and detailed information provision. Vida Markets' $25 minimum deposit requirement represents exceptional accessibility for entry-level traders. Meanwhile, dual MetaTrader platform support and MAM/PAMM solutions cater to diverse trading needs.

The broker appears most suitable for new traders seeking low-cost market entry. It also works well for experienced traders requiring established platform infrastructure and investors interested in managed account solutions. However, the moderate user rating of 3.6 out of 5 suggests mixed client experiences that potential traders should consider carefully.

Key strengths include regulatory oversight through FSCA, low minimum deposits, complete platform options, and managed account solutions. Primary limitations involve limited transparency about spreads, fees, customer service details, and complete account features. Potential clients should conduct direct inquiries with Vida Markets to obtain detailed information not available in public sources before making trading decisions.