Is YT safe?

Pros

Cons

Is YT Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, brokers play a pivotal role in facilitating trading activities for both novice and experienced traders. One such broker is YT, which has garnered attention for its range of trading services. However, as the forex market continues to attract traders worldwide, it is essential for individuals to approach broker selection with caution. The presence of unscrupulous brokers can lead to significant financial losses, making it imperative to assess the legitimacy and safety of any trading platform thoroughly. This article aims to investigate whether YT is safe or a potential scam, utilizing a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

One of the foremost indicators of a broker's trustworthiness is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards and practices. As for YT, the broker's regulatory information is crucial to determine its legitimacy in the market.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, YT does not appear to be regulated by any recognized financial authority. This lack of regulatory oversight raises significant concerns about the broker's operational legitimacy. Without a governing body to enforce compliance, traders may be exposed to higher risks, including potential fraud and mismanagement of funds. The absence of regulatory oversight can indicate a lack of accountability, making it essential for traders to exercise extreme caution before engaging with YT.

Company Background Investigation

To gain a deeper understanding of YT, it is important to analyze its company background, including its history, ownership structure, and transparency levels. YT has been operational for a limited period, and there is scant information available regarding its establishment and development. This lack of historical data can be a red flag for potential investors.

The ownership structure of YT is also unclear, which complicates the assessment of its credibility. A transparent company typically provides information about its founders, management team, and corporate governance. In YT's case, the absence of such details raises questions about the qualifications and experience of its leadership.

Furthermore, the level of information disclosure is critical for evaluating a broker's transparency. YT's website lacks comprehensive information regarding its operations, trading conditions, and risk disclosures. This opacity can hinder traders' ability to make informed decisions, further emphasizing the need for caution when considering whether YT is safe for trading.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. When evaluating YT, it is crucial to analyze its fee structure, including spreads, commissions, and overnight interest rates.

| Fee Type | YT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3.0% |

Currently, YT does not provide clear information on its trading fees, which can create uncertainty for traders. The absence of competitive spreads and transparent commission structures may indicate that YT's trading conditions are not favorable compared to industry standards. Furthermore, any unusual or hidden fees could potentially erode traders' profits and lead to dissatisfaction. Thus, the lack of clarity surrounding YT's trading conditions raises concerns about whether it is a safe broker to engage with.

Customer Funds Security

The safety of customer funds is paramount when selecting a forex broker. Traders must ensure that their investments are protected through adequate security measures. In the case of YT, an analysis of its fund safety protocols is essential.

YT's website does not provide comprehensive information regarding its fund security measures, such as whether it employs segregated accounts or investor protection schemes. The absence of these protections can expose traders to significant risks, particularly in the event of financial instability or operational issues within the brokerage.

Additionally, historical incidents of fund security breaches or disputes can provide insight into a broker's reliability. YT has not publicly disclosed any significant security issues; however, the lack of transparency regarding its fund safety measures raises concerns about the overall security of customer assets. This uncertainty emphasizes the importance of thorough due diligence before considering YT as a trading option.

Customer Experience and Complaints

Understanding customer feedback is crucial for assessing the overall reliability of a broker. Analyzing real user experiences can provide valuable insights into potential issues and the broker's responsiveness to complaints.

Common complaints associated with YT include difficulties in fund withdrawals and unresponsive customer support. Traders have reported challenges in accessing their funds, leading to frustration and distrust towards the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Inconsistent |

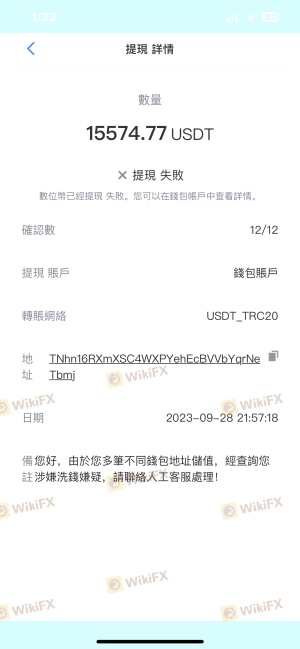

One notable case involved a trader who faced repeated obstacles when attempting to withdraw funds, leading to accusations of money laundering from YT. This incident not only highlights the severity of withdrawal issues but also demonstrates the potential for miscommunication and misunderstandings with the broker. Such complaints can significantly impact a broker's reputation and trustworthiness, raising further questions about whether YT is safe for trading.

Platform and Execution

The performance and reliability of a trading platform are critical factors for traders. A broker's platform should provide a seamless trading experience, with efficient order execution and minimal slippage.

In the case of YT, there is limited information available regarding the platform's performance and user experience. Traders have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can hinder trading effectiveness and lead to financial losses, further complicating the assessment of YT's overall reliability.

Additionally, any signs of platform manipulation or unfair practices can raise significant concerns about a broker's integrity. Without a transparent and efficient trading platform, the question of whether YT is safe becomes increasingly difficult to answer.

Risk Assessment

Using YT as a forex broker entails certain risks that traders should carefully consider. A comprehensive risk assessment can help identify potential pitfalls and inform decision-making.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Withdrawal issues reported |

The absence of regulatory oversight poses a significant risk, as traders may have limited recourse in the event of disputes or fraudulent activities. Furthermore, the unclear fee structure can lead to unexpected costs, impacting overall profitability.

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory compliance and transparent trading conditions.

Conclusion and Recommendations

After a comprehensive analysis of YT, it is evident that several red flags raise concerns about its safety and legitimacy. The lack of regulatory oversight, unclear trading conditions, and reported customer complaints suggest that YT may not be a reliable choice for forex trading.

For traders seeking a safe and trustworthy broker, it is advisable to consider alternatives that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Brokers such as Interactive Brokers, eToro, and Forex.com offer robust regulatory frameworks and transparent trading conditions, making them safer options for traders.

In summary, the question "Is YT safe?" leans towards a cautious "no," as potential risks and concerns outweigh the benefits. Traders should prioritize their financial security and choose brokers that provide clear information and regulatory protection.

Is YT a scam, or is it legit?

The latest exposure and evaluation content of YT brokers.

YT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YT latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.