YT 2025 Review: Everything You Need to Know

Summary

YT Forex Broker has emerged as a new entrant in the forex market. The company positions itself to serve both novice and experienced traders across multiple markets. According to WikiFX monitoring data, this yt review reveals that the broker provides various trading services across multiple asset classes, though details remain limited. The platform has received mixed feedback from users. Some reviews are positive, while others include neutral assessments and exposure complaints that raise concerns about operations.

YT Broker operates in a competitive landscape where transparency and regulatory compliance are crucial factors for trader confidence. The company presents itself as a comprehensive trading solution for diverse trading needs. However, recent user reports indicate some concerning issues, particularly regarding fund withdrawal processes that have frustrated multiple clients. The broker targets a diverse user base, from beginners seeking educational resources to seasoned traders requiring advanced trading tools and market access.

Potential clients should carefully evaluate the available information before making trading decisions. Detailed regulatory and operational information remains limited in public sources, creating uncertainty about the broker's compliance status.

Important Notice

This yt review is based on publicly available information and user feedback collected from various sources. YT Broker may operate under different regulatory frameworks across various jurisdictions, creating complexity for international clients. Users must verify the applicable laws and regulations in their respective regions before engaging with the platform to ensure compliance. The regulatory status and compliance requirements may vary significantly between different geographical locations, affecting user protections.

This evaluation does not constitute investment advice or a recommendation to use or avoid this broker's services. Traders should conduct their own due diligence and consider their risk tolerance before making any trading decisions that could impact their financial situation. The information presented reflects the current available data and may change over time as the broker evolves its services and regulatory status.

Rating Framework

Based on available information, here are the ratings for YT Broker across key evaluation criteria:

Broker Overview

YT Trade represents a relatively new participant in the forex brokerage industry. The company attempts to establish its presence in an increasingly competitive market with multiple established players. According to WikiFX data, the company positions itself as a service provider for both novice traders seeking to enter the forex market and experienced professionals requiring comprehensive trading solutions across various asset classes. The broker's business model appears to focus on offering multiple trading services across various asset classes, though specific details about the company's founding date and corporate structure remain limited in available public information.

The platform operates in the foreign exchange market alongside other financial instruments. YT Broker provides access to what appears to be a standard range of trading products for different market segments. The platform's approach seems designed to cater to different trader experience levels, suggesting a comprehensive service offering that targets multiple user segments. However, this yt review finds that detailed information about the company's specific trading platforms, proprietary technology, or unique market positioning remains unclear from available sources.

The regulatory oversight and licensing information for YT Broker is not clearly specified in current public documentation. This lack of transparency raises important considerations for potential clients evaluating the platform's credibility and compliance standards.

Regulatory Status: Current available information does not clearly specify the regulatory authorities overseeing YT Broker's operations. This lack of transparent regulatory information represents a significant consideration for potential traders who need assurance about oversight.

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in available sources. User feedback indicates some clients have experienced difficulties with fund withdrawal processes that have caused frustration.

Minimum Deposit Requirements: The minimum initial deposit amounts for different account types are not clearly specified in current public information. This makes it difficult for potential clients to plan their initial investment.

Bonuses and Promotions: Information about promotional offers, welcome bonuses, or ongoing trading incentives is not available in current sources. Traders cannot evaluate potential benefits or special offers.

Tradeable Assets: YT Broker appears to offer forex trading services along with other financial instruments. The complete range of available markets and instruments requires further clarification from official sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current sources. This yt review cannot provide specific pricing comparisons with other brokers.

Leverage Ratios: Maximum leverage levels and margin requirements for different asset classes are not clearly specified in available documentation. Risk management parameters remain unclear.

Platform Options: The specific trading platforms offered by YT Broker, including mobile applications and web-based solutions, require further clarification from available sources. Technology specifications are not detailed.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined in current information. International accessibility remains uncertain.

Customer Support Languages: The range of languages supported by customer service teams is not specified in available sources. Communication options for international clients are unclear.

Account Conditions Analysis

The account structure and conditions offered by YT Broker remain somewhat unclear based on available public information. This yt review finds limited details about the various account types that may be available to different trader segments who require specific features. Without specific information about minimum deposit requirements, account tier benefits, or special features, potential clients cannot make informed comparisons with other brokers in the market. The absence of clear account opening procedures and verification requirements in public sources creates uncertainty about the onboarding process.

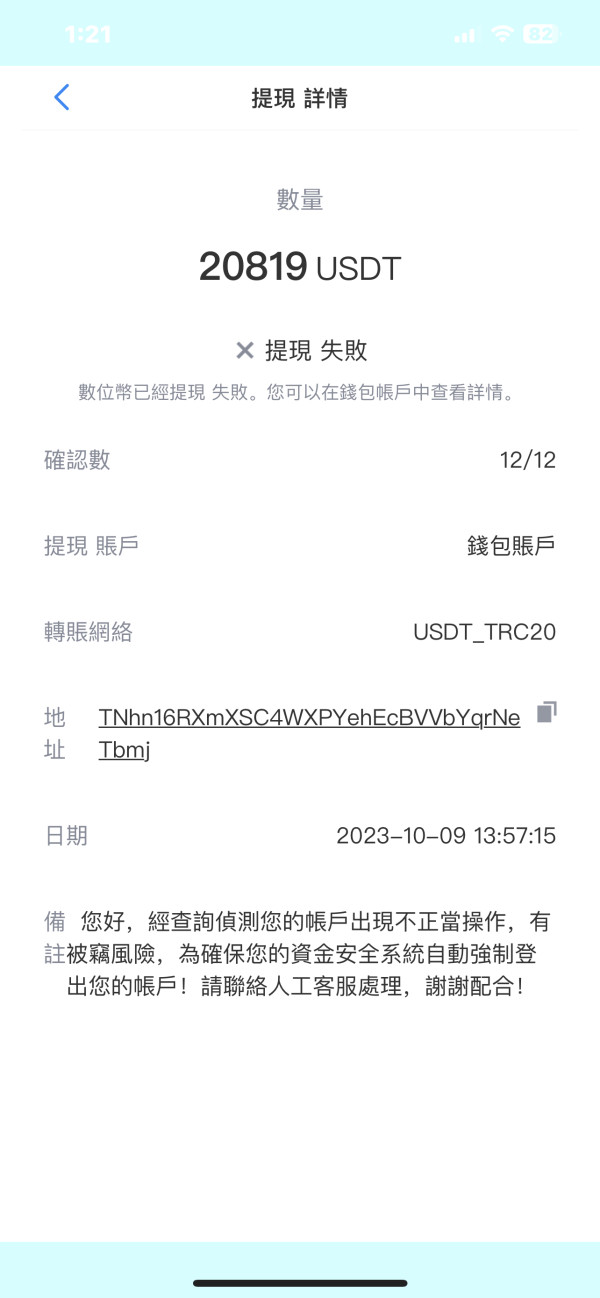

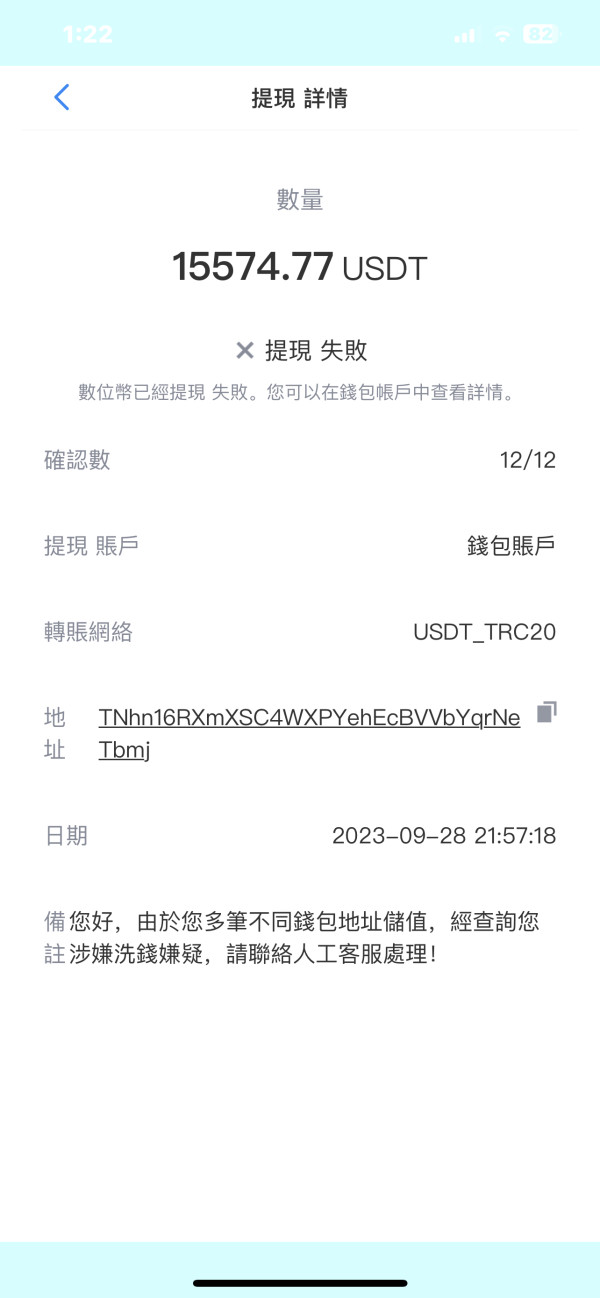

User feedback suggests that account management may present challenges, particularly regarding fund access and withdrawal procedures that have caused problems. According to WikiFX monitoring, at least one user reported experiencing difficulties withdrawing funds on multiple occasions, which raises concerns about account liquidity and operational procedures. The lack of detailed information about Islamic accounts, professional trader accounts, or other specialized account types makes it difficult to assess whether YT Broker can accommodate diverse trading needs and religious requirements.

The trading tools and educational resources provided by YT Broker are not comprehensively detailed in available sources. This analysis cannot identify specific research capabilities, market analysis tools, or educational materials that the platform may offer to its users who need support. The absence of clear information about charting capabilities, technical analysis tools, or automated trading support makes it challenging to evaluate the platform's suitability for different trading strategies and experience levels.

Without detailed information about research and analysis resources, potential clients cannot assess whether YT Broker provides adequate market insights, economic calendars, or expert analysis to support informed trading decisions. The availability of educational content for novice traders, including webinars, tutorials, or market guides, remains unclear from current sources and limits learning opportunities. Advanced traders seeking sophisticated analytical tools, algorithmic trading support, or API access cannot determine whether YT Broker meets their technical requirements based on available information.

Customer Service and Support Analysis

Customer service quality appears to be a significant concern based on available user feedback from multiple sources. According to WikiFX data, users have reported challenges with the support system, particularly regarding withdrawal processes and fund access that have created frustration. One documented case indicates that a user experienced repeated difficulties withdrawing funds, suggesting potential issues with customer service responsiveness or operational procedures that need improvement.

The specific customer support channels available, such as live chat, email support, phone assistance, or help desk systems, are not clearly detailed in current sources. Response times, service quality metrics, and availability hours for customer support teams remain unspecified for potential clients. The range of languages supported by customer service representatives and the geographical coverage of support services require clarification for international clients who need assistance.

Without comprehensive information about problem resolution procedures, escalation processes, or customer satisfaction measures, this evaluation cannot provide a complete assessment of YT Broker's commitment to customer service excellence. The reported withdrawal difficulties suggest that support quality may not meet standard industry expectations that clients deserve.

Trading Experience Analysis

The overall trading experience provided by YT Broker cannot be comprehensively evaluated due to limited available information about platform functionality and performance. This yt review finds insufficient data about execution speed, platform stability, or order processing quality to make definitive assessments about the trading environment that users experience. Without specific information about the trading platforms used, mobile application functionality, or web-based trading capabilities, potential clients cannot evaluate whether the technology meets their trading requirements.

Platform features such as one-click trading, advanced order types, or risk management tools remain unspecified in available sources. This creates uncertainty about the platform's capabilities for different trading styles and strategies.

The reported user difficulties with fund withdrawals may indicate broader operational challenges that could impact the overall trading experience. Market access, instrument availability, and trading conditions such as spread stability or slippage rates are not detailed in current public information, making it difficult to assess the platform's competitiveness in the current market environment.

Trust Factor Analysis

The trust factor for YT Broker presents several concerns based on available information from multiple sources. The lack of clear regulatory oversight and licensing details represents a significant transparency issue for potential clients who need assurance about protection. Without specific regulatory authority information, license numbers, or compliance documentation, traders cannot verify the broker's legal status and consumer protection measures that safeguard their interests.

User reports of withdrawal difficulties, as documented in WikiFX monitoring data, raise questions about operational reliability and fund security. The presence of exposure reports alongside mixed user reviews suggests that some clients have experienced problems with the platform's services that have not been resolved. The absence of detailed information about client fund segregation, deposit protection schemes, or financial reporting transparency creates additional uncertainty about the broker's trustworthiness.

Industry recognition, awards, or third-party certifications are not evident in available sources, which could otherwise help establish credibility. The handling of negative incidents and the company's response to user complaints remain unclear, making it difficult to assess the broker's commitment to maintaining client relationships and resolving disputes effectively.

User Experience Analysis

User experience with YT Broker appears mixed based on available feedback and documentation from various sources. WikiFX data indicates that the platform has received both positive and neutral reviews from users, but also includes exposure reports that highlight concerning experiences with operations. The overall user satisfaction levels cannot be definitively determined due to limited comprehensive feedback data available for analysis.

The registration and account verification processes are not clearly outlined in available sources. This makes it difficult to assess the ease of getting started with the platform for new clients. User interface design, navigation functionality, and overall platform usability remain unspecified, preventing evaluation of the platform's accessibility for traders of different experience levels who have varying technical skills.

The reported withdrawal difficulties suggest that fund management processes may not provide the smooth experience that traders expect from professional brokerage services. Common user complaints appear to center around operational issues rather than trading functionality, indicating potential areas where the broker may need to improve service delivery and customer satisfaction measures.

Conclusion

YT Broker presents itself as a forex trading platform targeting both novice and experienced traders across multiple markets. This evaluation reveals significant information gaps that potential clients should carefully consider before making decisions. While the broker offers multiple trading services, the lack of comprehensive regulatory information, unclear operational procedures, and reported user difficulties with fund withdrawals represent notable concerns that affect platform credibility.

The platform may be suitable for traders willing to work with a newer market entrant who accepts higher uncertainty levels. The limited transparency about account conditions, trading costs, and regulatory compliance makes it challenging to recommend without reservations about potential risks. The main advantages appear to be the diverse service offerings and focus on different trader segments who have varying needs.

The primary disadvantages include insufficient regulatory clarity and documented user concerns about fund access that have created problems. Potential clients should conduct thorough due diligence and consider more established alternatives until YT Broker provides greater transparency about its operations, regulatory status, and addresses the operational issues highlighted in user feedback.