Is XZDL Global safe?

Business

License

Is Xzdl Global Safe or Scam?

Introduction

In the dynamic landscape of the forex market, Xzdl Global has emerged as a player offering various trading services and instruments. Established in 2022, the broker aims to cater to a global clientele with its proprietary trading platform and high leverage options. However, the rapid growth of online trading platforms has also led to an increase in fraudulent activities, making it essential for traders to exercise due diligence when selecting a broker. This article aims to provide a comprehensive evaluation of Xzdl Global, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The findings are based on an analysis of multiple sources, including user reviews, regulatory warnings, and industry reports.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its trustworthiness. A regulated broker is subject to oversight by financial authorities, which helps ensure fair trading practices and the protection of client funds. In the case of Xzdl Global, it is important to note that the broker operates without any valid regulatory authorization.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Xzdl Global has been flagged by various financial authorities, including the UK's Financial Conduct Authority (FCA), which issued a warning against the broker for providing financial services without proper authorization. This lack of regulation poses a significant risk to traders, as they have no recourse to regulatory protections in case of disputes or financial losses. The absence of a regulatory framework raises serious concerns about the safety of funds and the overall legitimacy of Xzdl Global.

Company Background Investigation

Xzdl Global is relatively new in the forex trading landscape, having been founded in 2022. The company claims to operate from London, yet it has not disclosed any verifiable information regarding its physical location or ownership structure. This lack of transparency is alarming, as it creates doubts about the broker's accountability and reliability.

Moreover, the management team behind Xzdl Global has not been publicly identified, which further complicates the assessment of the broker's credibility. In reputable financial institutions, a well-defined management team with relevant experience is critical for operational integrity. Without this information, potential investors are left in the dark, raising questions about the company's commitment to ethical business practices.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. Xzdl Global claims to offer competitive trading conditions, including high leverage up to 1:400 and a variety of trading instruments. However, the absence of a clear fee structure and potential hidden costs necessitates scrutiny.

| Fee Type | Xzdl Global | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.6 pips | 0.5-1.5 pips |

| Commission Model | None | $5-$10 per lot |

| Overnight Interest Range | Varies | Varies |

While Xzdl Global advertises low spreads, user reviews indicate that the actual trading experience may differ. Some traders have reported unexpected fees and challenges in the withdrawal process, suggesting that the advertised trading conditions may not reflect reality. This inconsistency raises further concerns about the broker's transparency and reliability.

Client Fund Safety

The safety of client funds is a primary concern for any trader. Xzdl Global claims to separate client funds from its operational capital, a standard practice that is meant to protect traders in the event of a broker's insolvency. However, without regulatory oversight, there is no guarantee that these claims are upheld.

Moreover, the broker does not provide any information about investor protection schemes or negative balance protection policies. This lack of information is troubling, especially considering that traders could potentially lose more than their initial investment without any safety net. Historical complaints about fund withdrawals and account freezes further exacerbate concerns regarding the security of funds held with Xzdl Global.

Customer Experience and Complaints

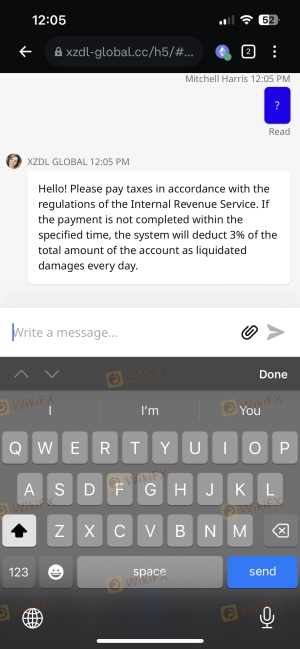

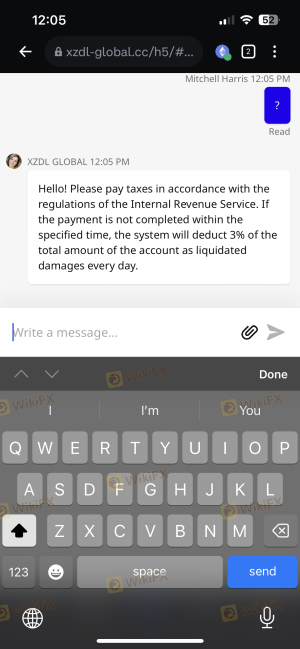

Customer feedback is invaluable in assessing a broker's reliability. Reviews of Xzdl Global reveal a mixed bag of experiences, with many users expressing dissatisfaction with the broker's customer support and withdrawal processes. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow withdrawal process | High | Unresponsive |

| Poor customer support | Medium | Limited assistance |

| Account freezes | High | No clear resolution |

For instance, several traders have reported that their accounts were frozen without warning, and they faced difficulties in retrieving their funds. This pattern of complaints suggests systemic issues within the broker's operational framework, raising serious doubts about its overall safety and reliability.

Platform and Trade Execution

The trading platform is a critical component of a broker's service. Xzdl Global operates its proprietary FX6 platform, which claims to offer a user-friendly interface and support for algorithmic trading. However, user experiences indicate that the platform may not perform as advertised.

Issues such as slippage, order rejections, and slow execution times have been reported, raising concerns about the quality of trade execution. Moreover, the absence of established trading platforms like MetaTrader further limits traders' options and may deter experienced traders who prefer more robust trading tools.

Risk Assessment

Using Xzdl Global comes with inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Security Risk | High | Lack of investor protection mechanisms |

| Customer Service Risk | Medium | Poor response to complaints and issues |

Given the lack of regulation and the numerous complaints regarding fund security and customer support, it is crucial for potential clients to weigh these risks against their trading goals. To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers with established track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Xzdl Global exhibits several red flags that warrant caution. The broker's lack of regulation, transparency issues, and numerous customer complaints raise serious concerns about its safety and legitimacy. While it may offer attractive trading conditions, the underlying risks make it a potentially unsafe option for traders.

For those considering trading with Xzdl Global, it is advisable to proceed with extreme caution. New traders, in particular, should seek out regulated brokers that provide robust investor protection and transparent trading conditions. Some reputable alternatives include brokers like IG Markets, OANDA, and Forex.com, which are well-regarded within the industry and offer comprehensive regulatory oversight.

Ultimately, the decision to engage with Xzdl Global should be made with careful consideration of the risks involved, as the question of "Is Xzdl Global safe?" leans heavily towards "No" based on the current available evidence.

Is XZDL Global a scam, or is it legit?

The latest exposure and evaluation content of XZDL Global brokers.

XZDL Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XZDL Global latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.