Xzdl Global 2025 Review: Everything You Need to Know

Xzdl Global has emerged as a controversial player in the forex brokerage space, attracting both attention and skepticism. This review synthesizes various sources to provide a comprehensive overview of the broker's strengths and weaknesses, focusing on user experiences and expert opinions. Notably, the broker is unregulated, which raises significant concerns regarding its legitimacy and the safety of client funds.

Note: The lack of regulation across different regions is a pertinent factor to consider when evaluating Xzdl Global. Several sources have highlighted the potential risks associated with trading through this broker, urging potential clients to conduct thorough due diligence.

Ratings Overview

We evaluate brokers based on user feedback, expert analysis, and factual data regarding their services.

Broker Overview

Founded in 2022, Xzdl Global operates without any significant regulatory oversight, which is a major red flag for potential traders. The broker claims to provide access to a proprietary trading platform called FX6, which supports various asset classes, including forex, cryptocurrencies, and CFDs. However, the absence of licenses from recognized regulatory bodies raises questions about the safety of client funds and the overall reliability of the broker.

- Regulated Regions: Xzdl Global operates without regulatory approval, primarily targeting regions without stringent oversight.

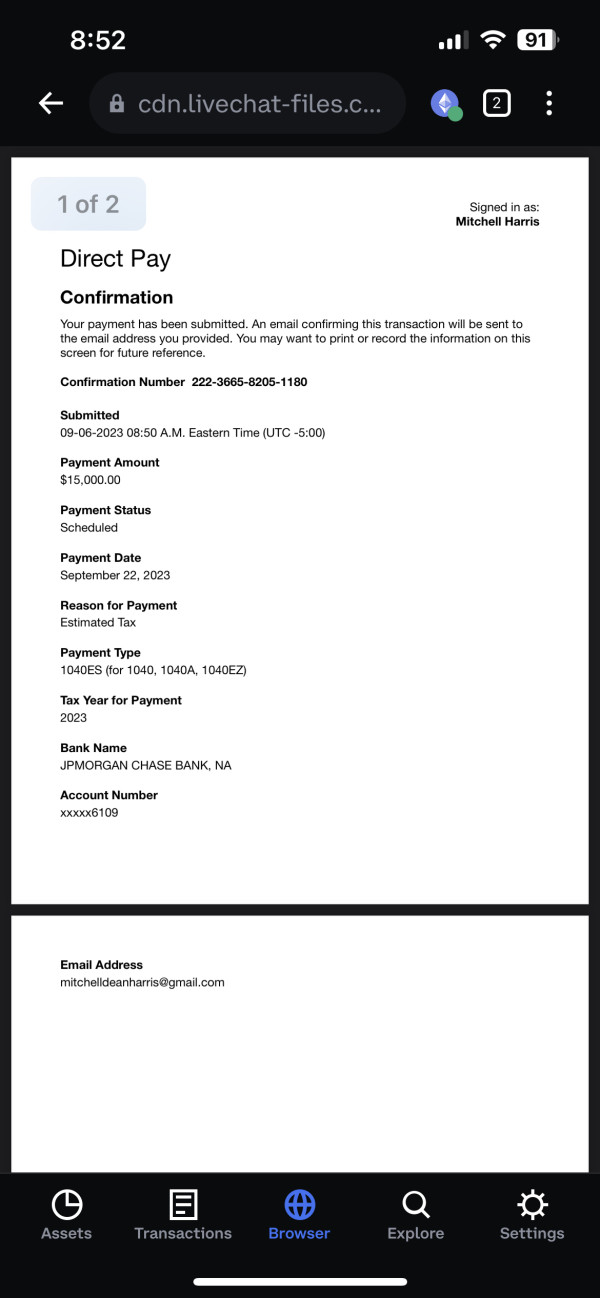

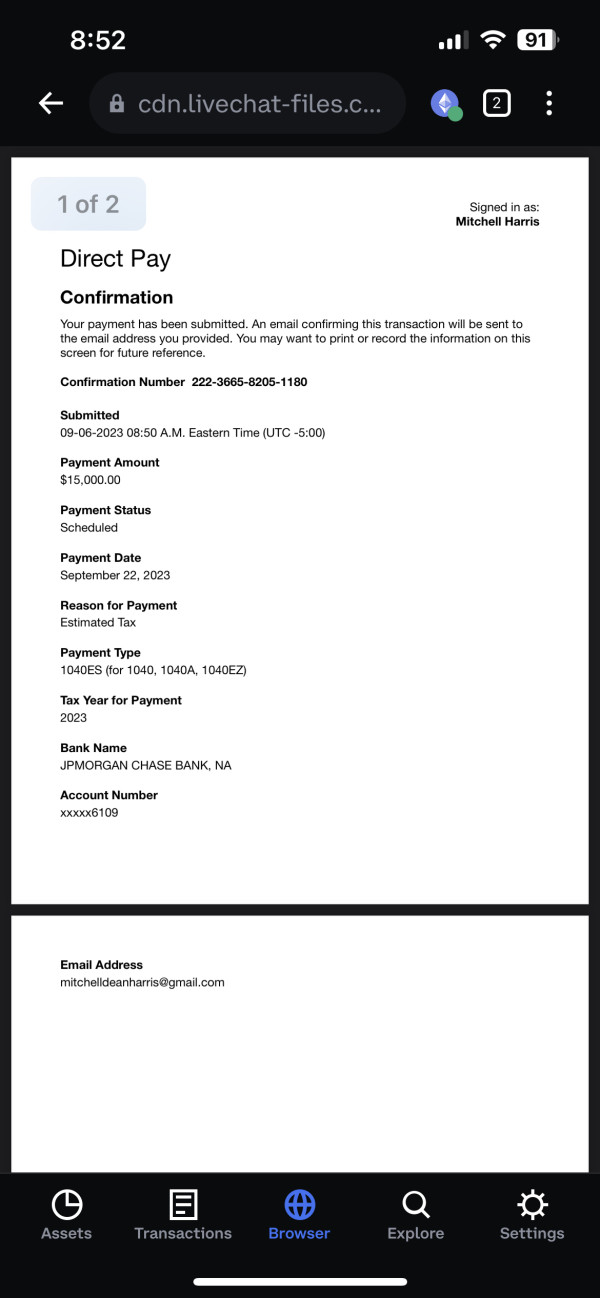

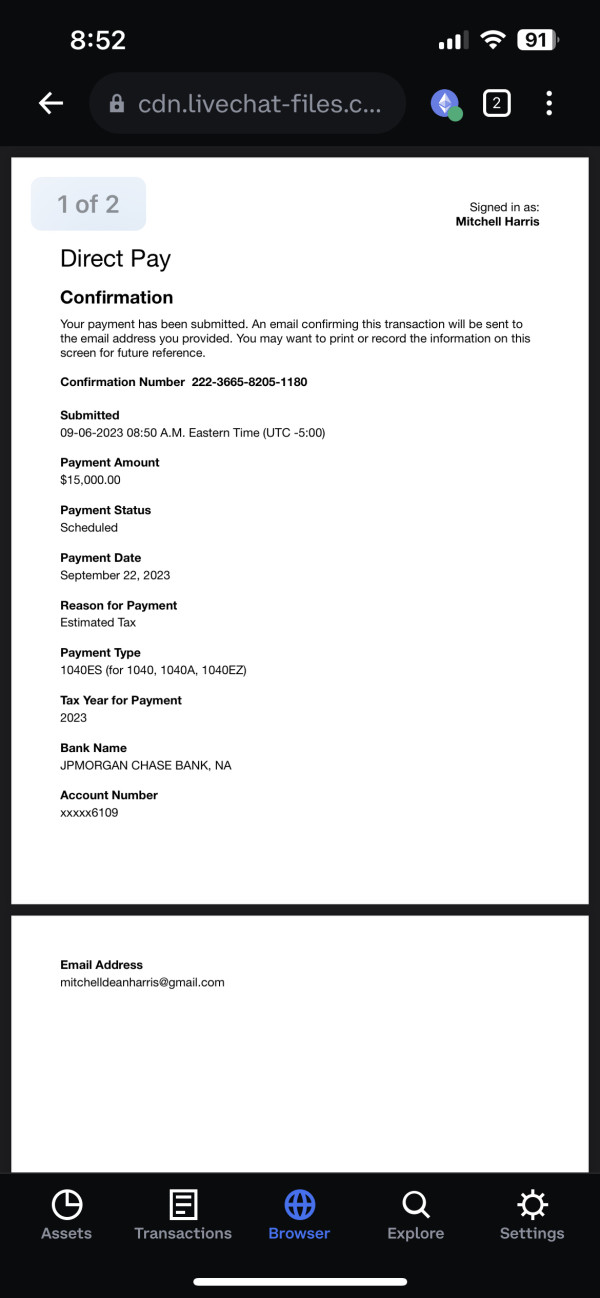

- Deposit/Withdrawal Currencies: The broker accepts deposits and withdrawals in USD, with options for bank transfers, credit/debit cards, and cryptocurrency transactions.

- Minimum Deposit: There is no specified minimum deposit requirement, making it accessible for new traders.

- Bonuses/Promotions: Xzdl Global does not offer any promotional bonuses or educational resources, which is a disadvantage for novice traders.

- Asset Classes: The broker provides trading opportunities in forex, cryptocurrencies, indices, commodities, and precious metals.

- Costs: The average spread starts at 1.6 pips, with no additional non-trading fees. However, reports suggest that withdrawal fees and conversion costs may apply depending on the payment method.

- Leverage: Traders can utilize leverage of up to 1:400, but this high leverage comes with increased risk.

- Trading Platforms: The primary platform is FX6, which is available for both desktop and mobile devices.

- Restricted Regions: Xzdl Global is not available in several jurisdictions, including Singapore, due to regulatory issues.

- Available Customer Support Languages: Customer support is primarily offered in English, with limited multilingual options.

Ratings Breakdown

-

Account Conditions (3.0/10): Xzdl Global offers a single account type with no minimum deposit. However, the lack of multiple account options limits flexibility for traders.

Tools and Resources (4.0/10): The proprietary FX6 platform includes basic analytical tools, but lacks advanced features that traders might expect from more established brokers.

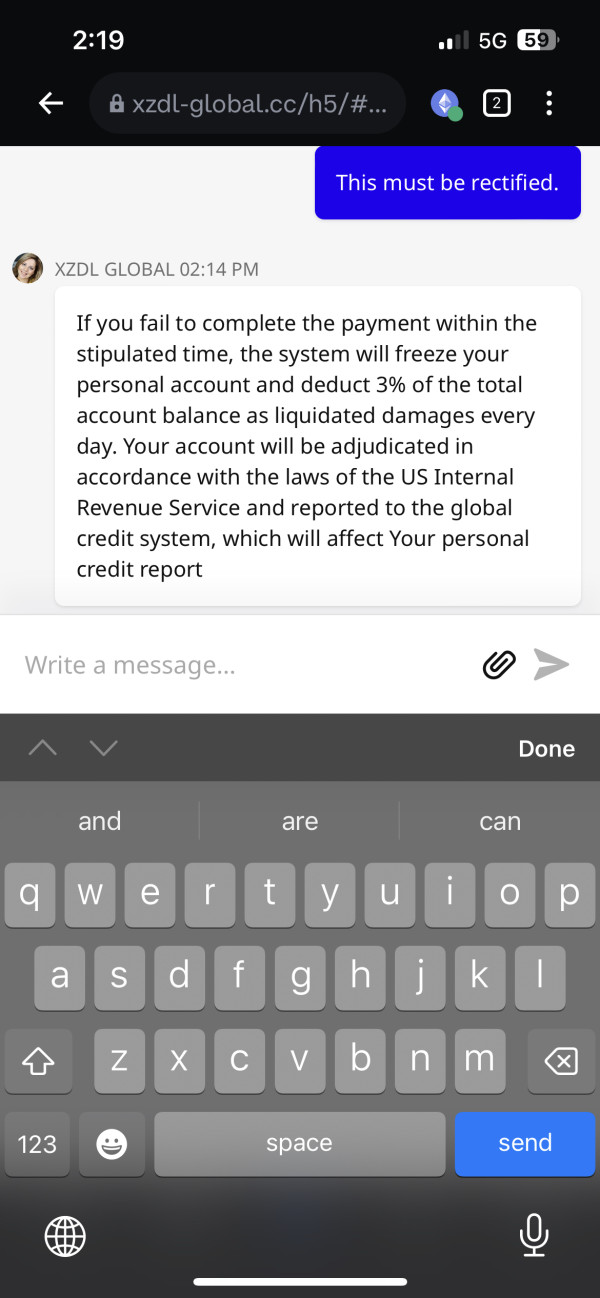

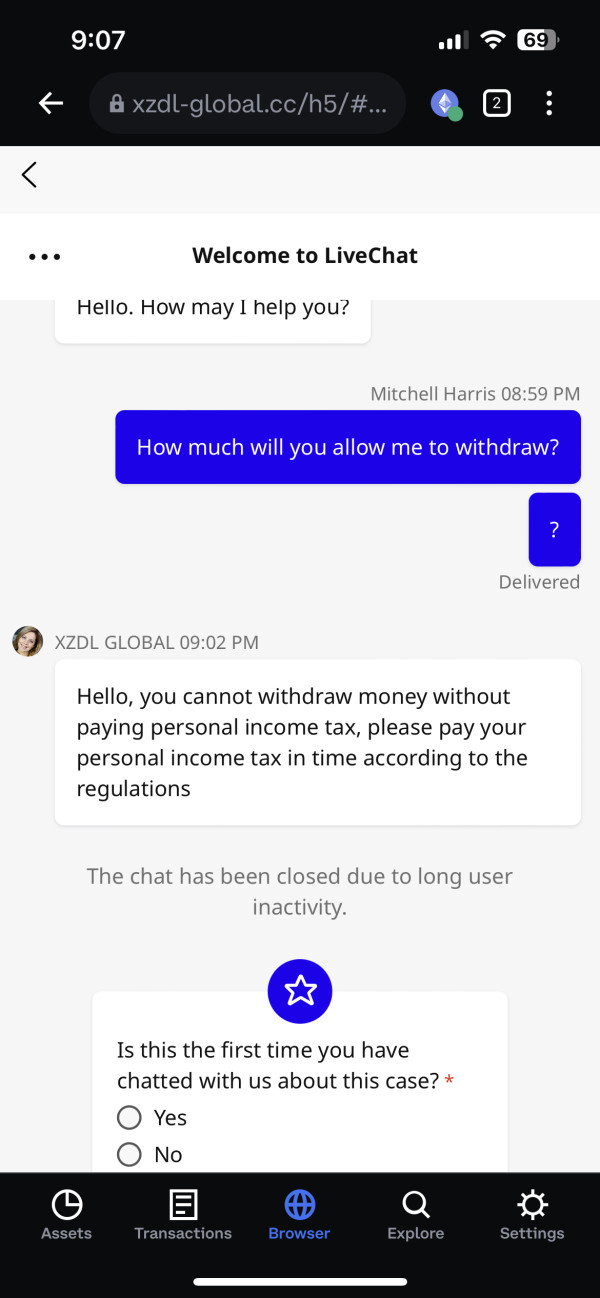

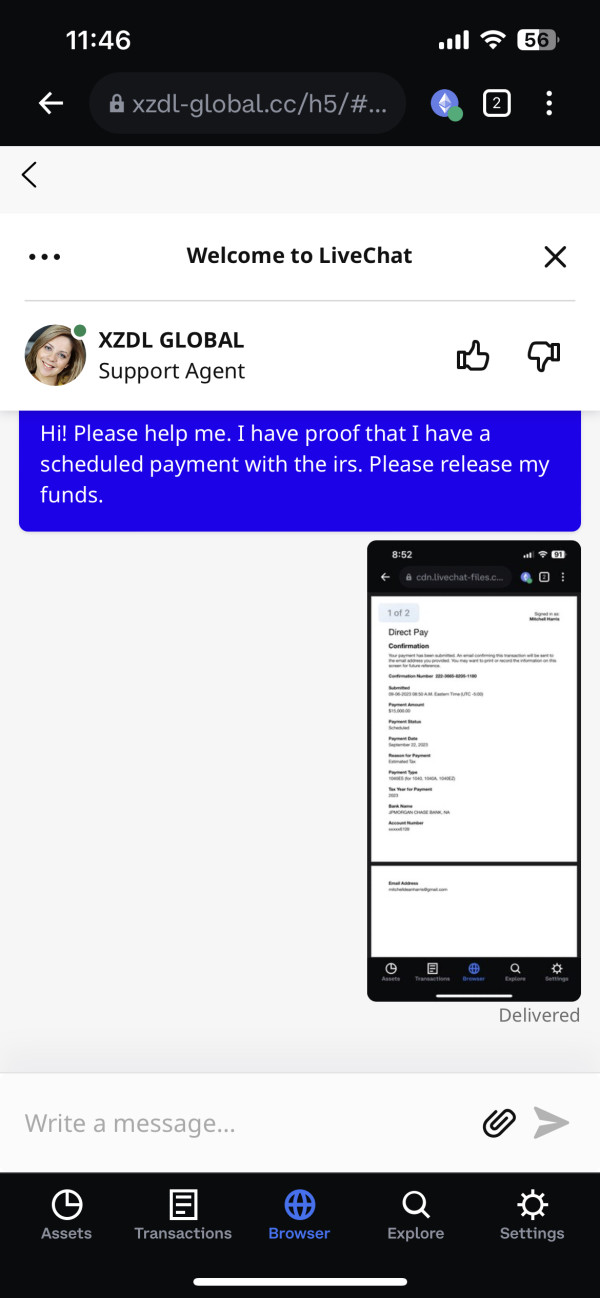

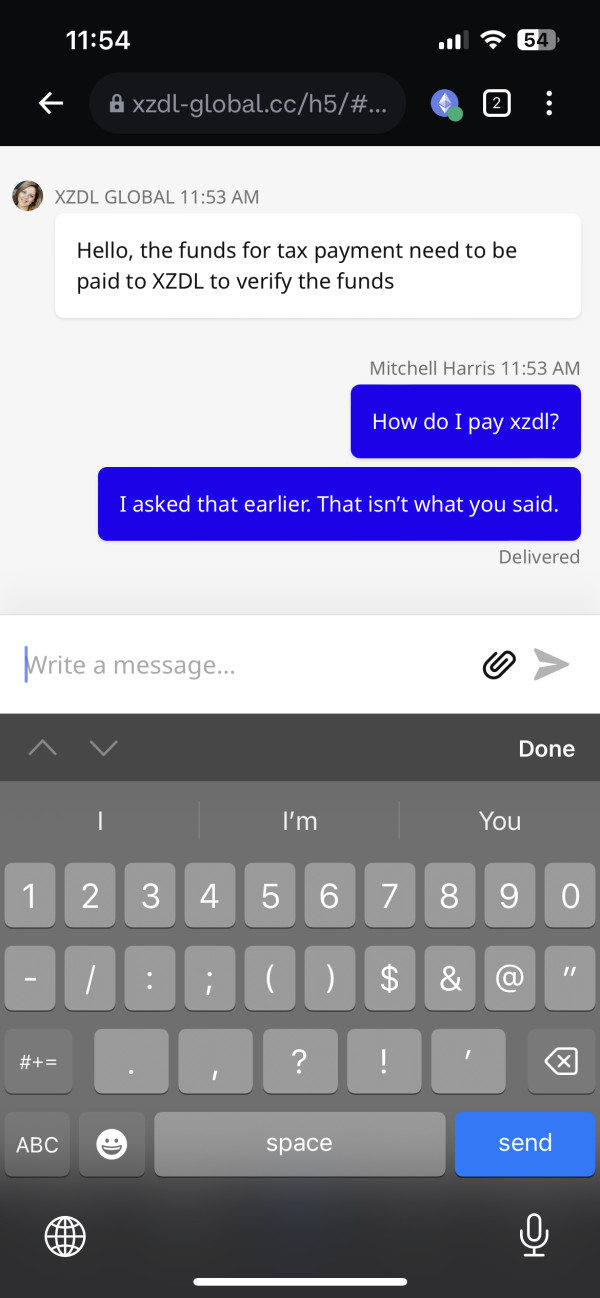

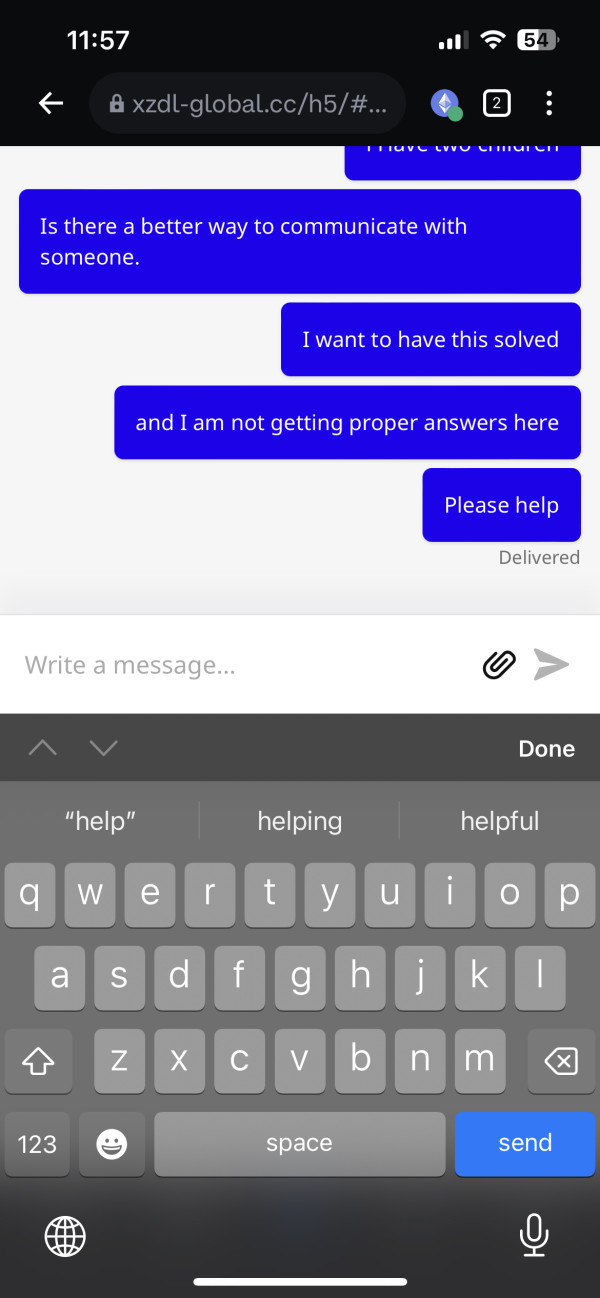

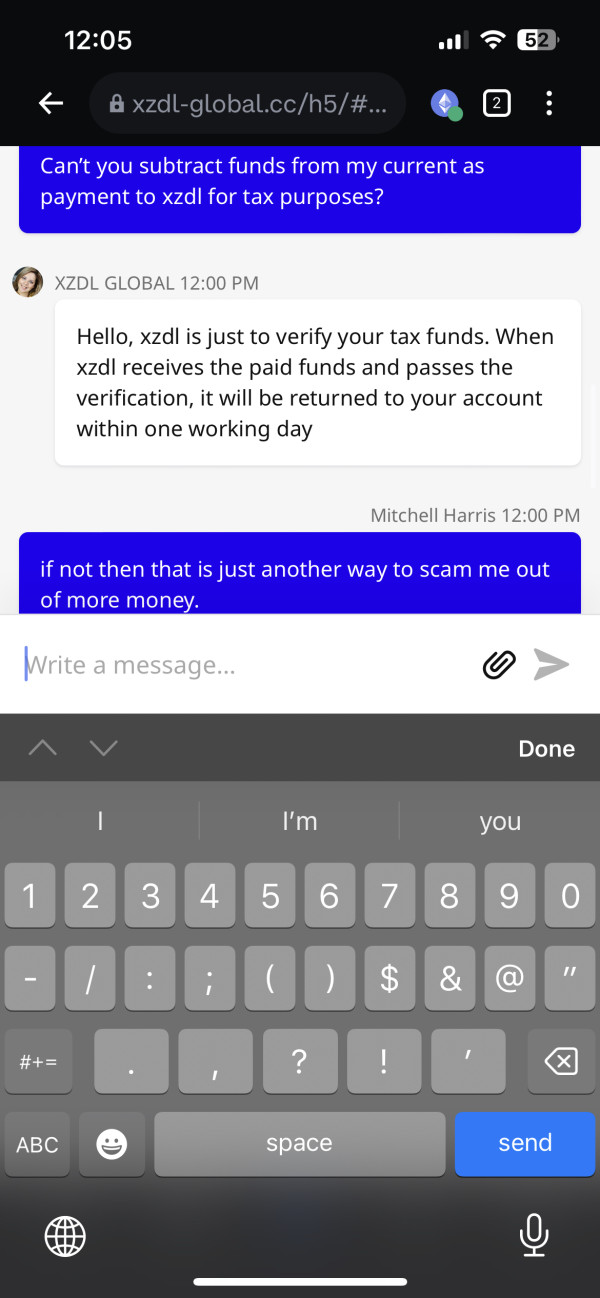

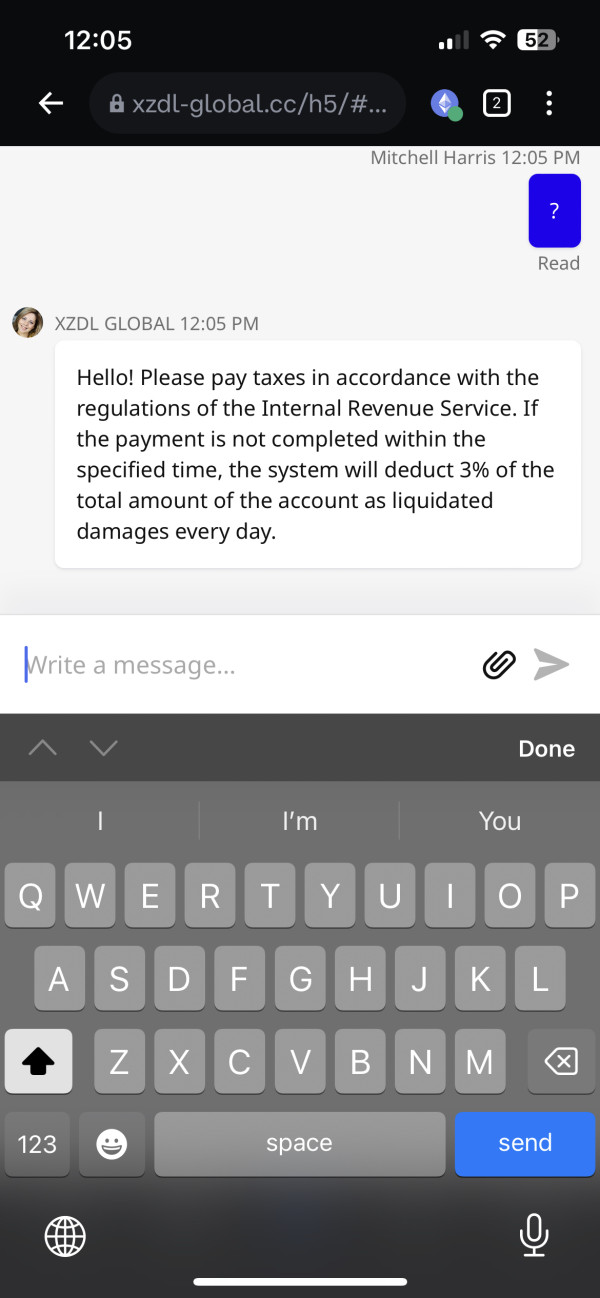

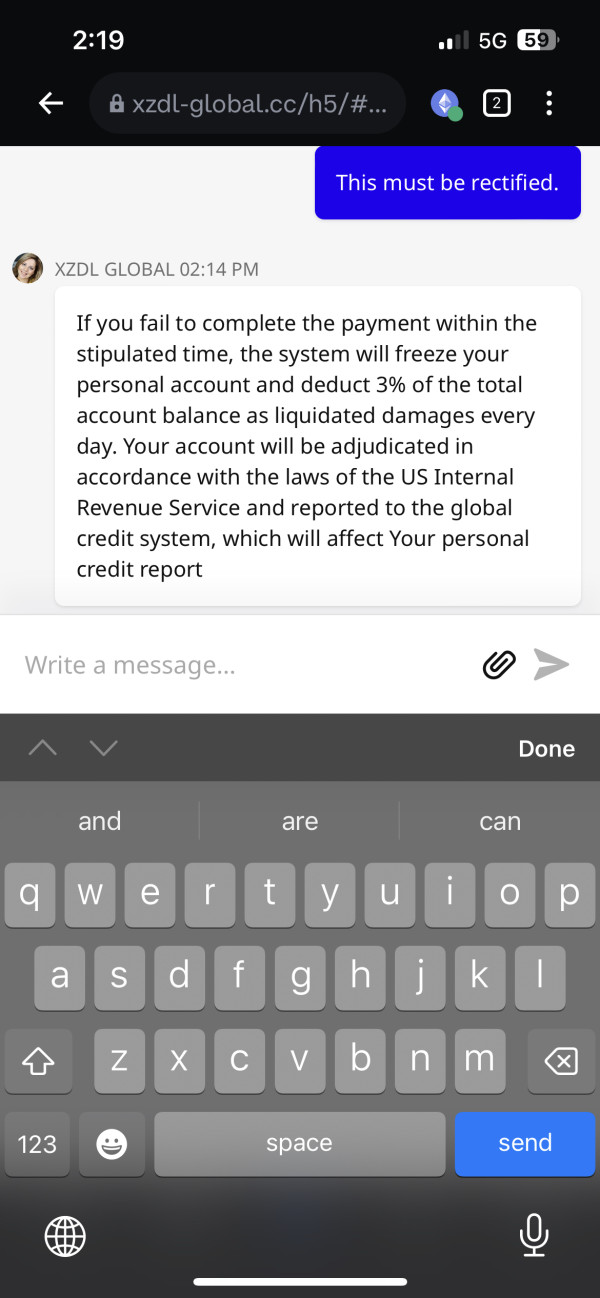

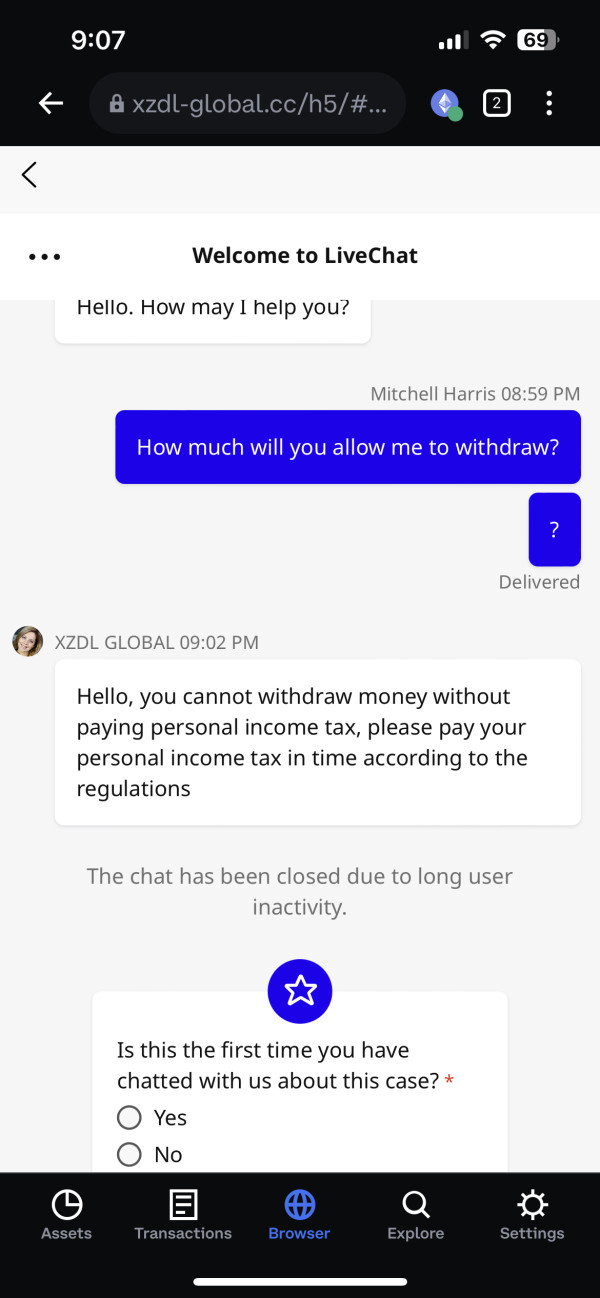

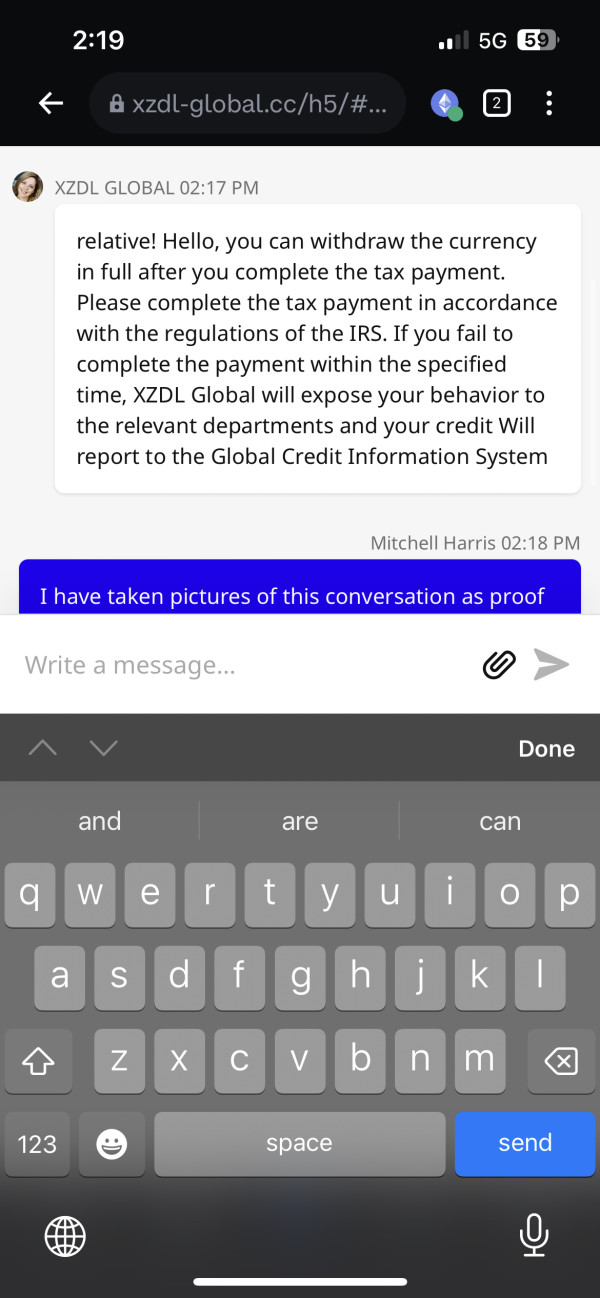

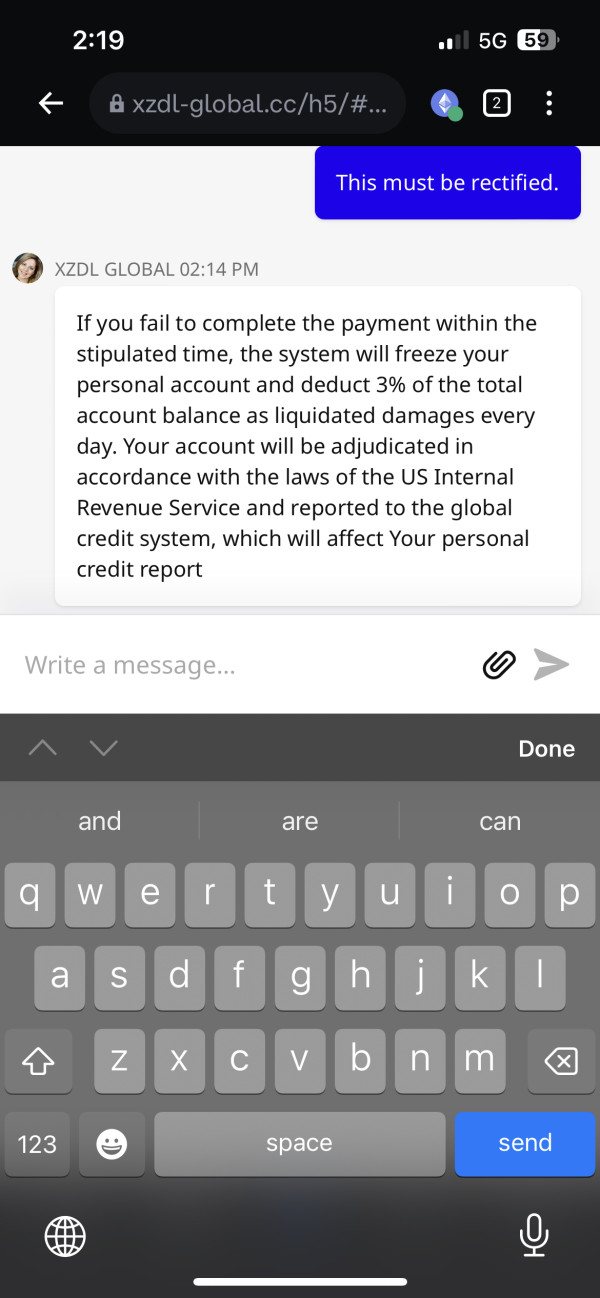

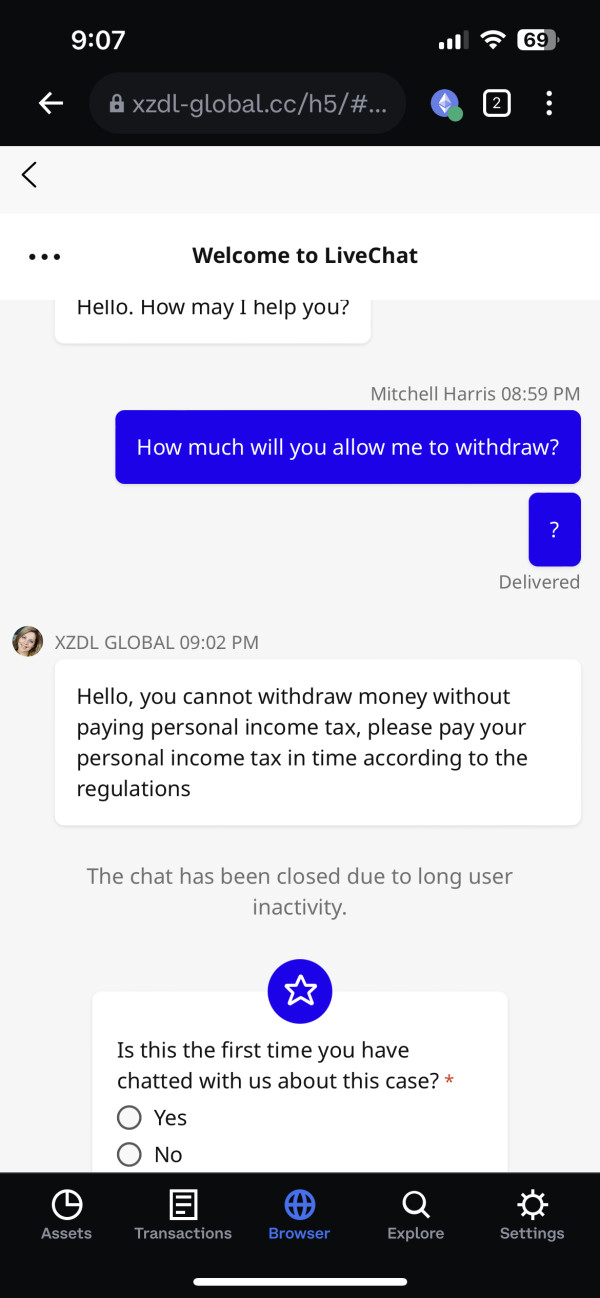

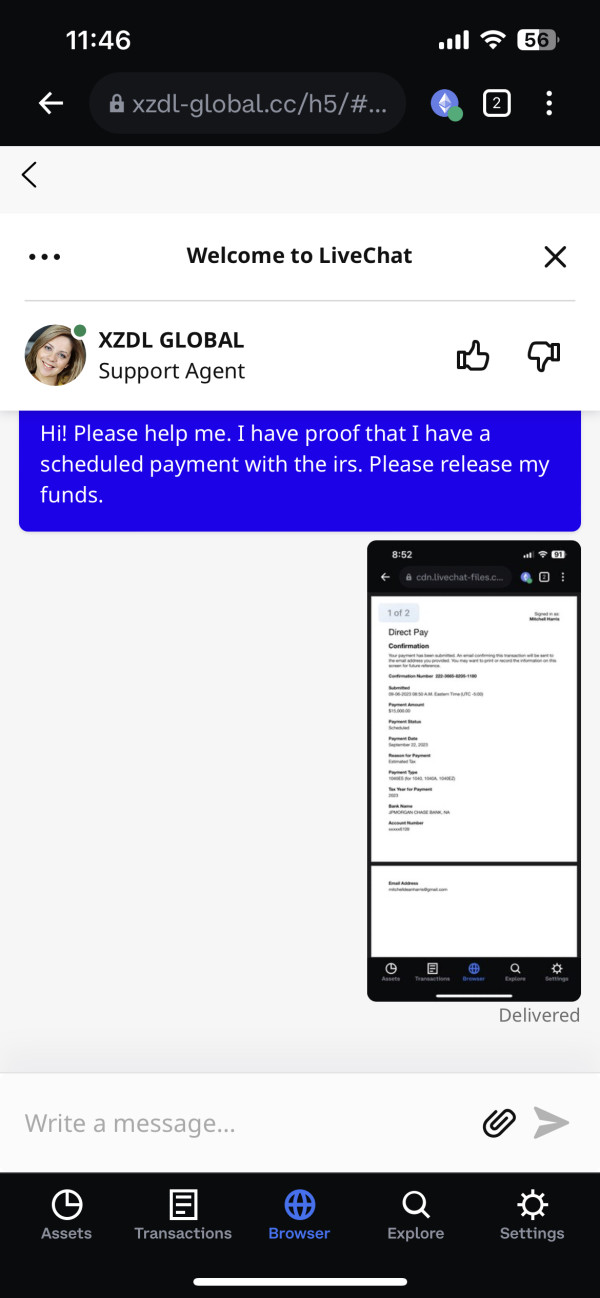

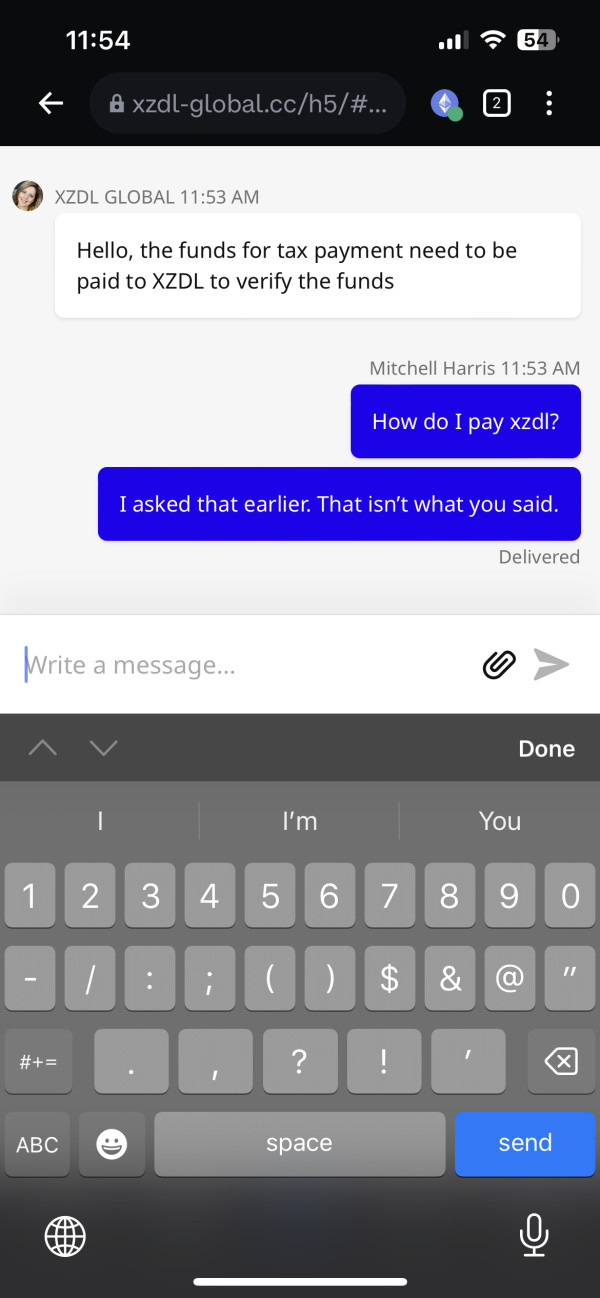

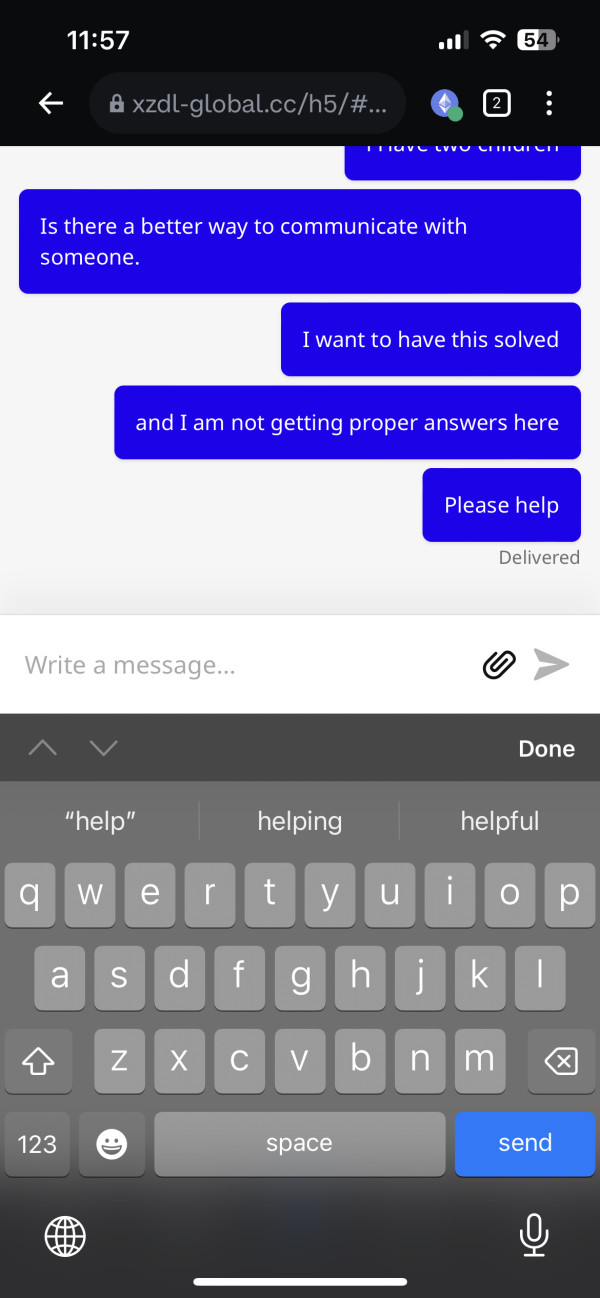

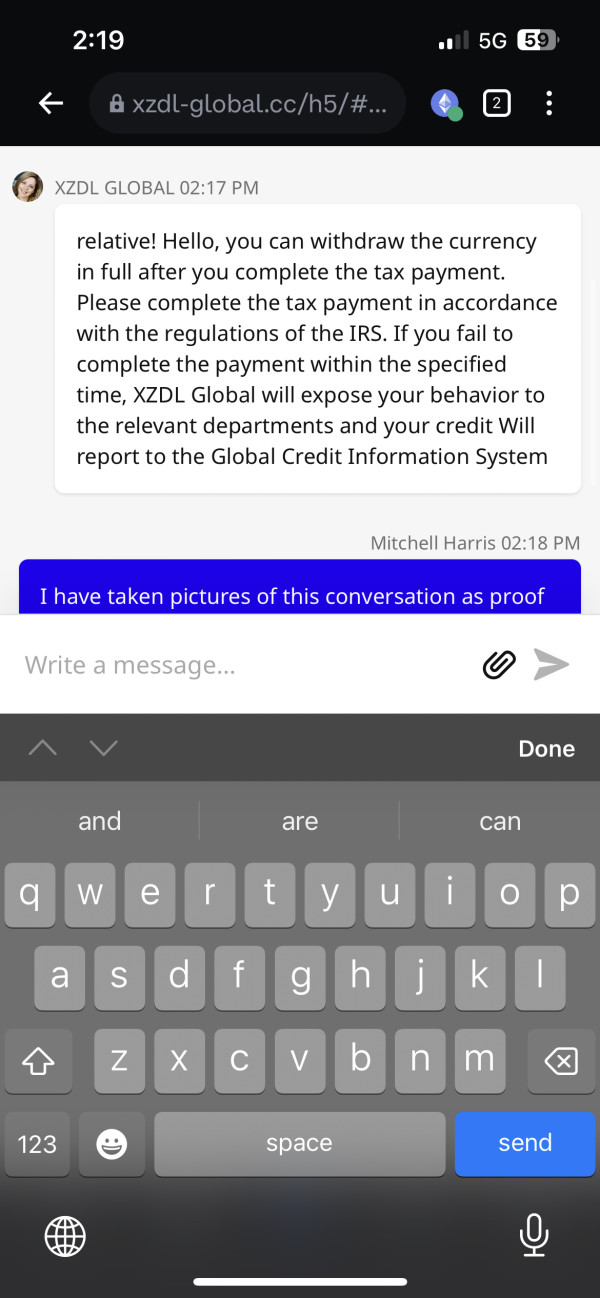

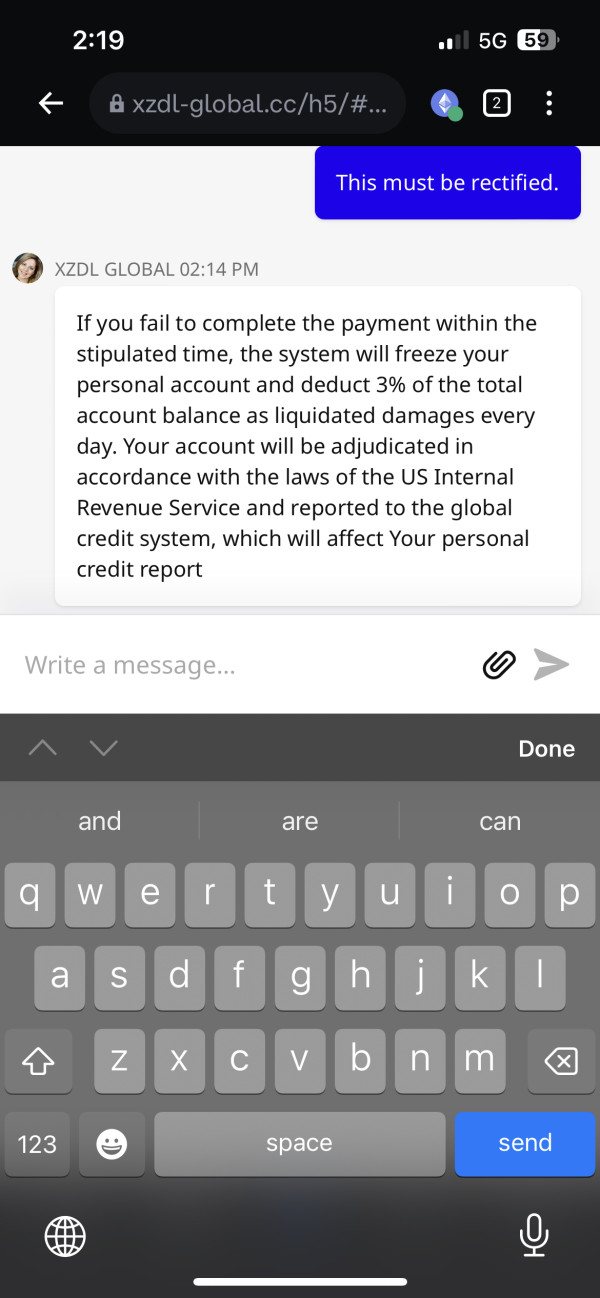

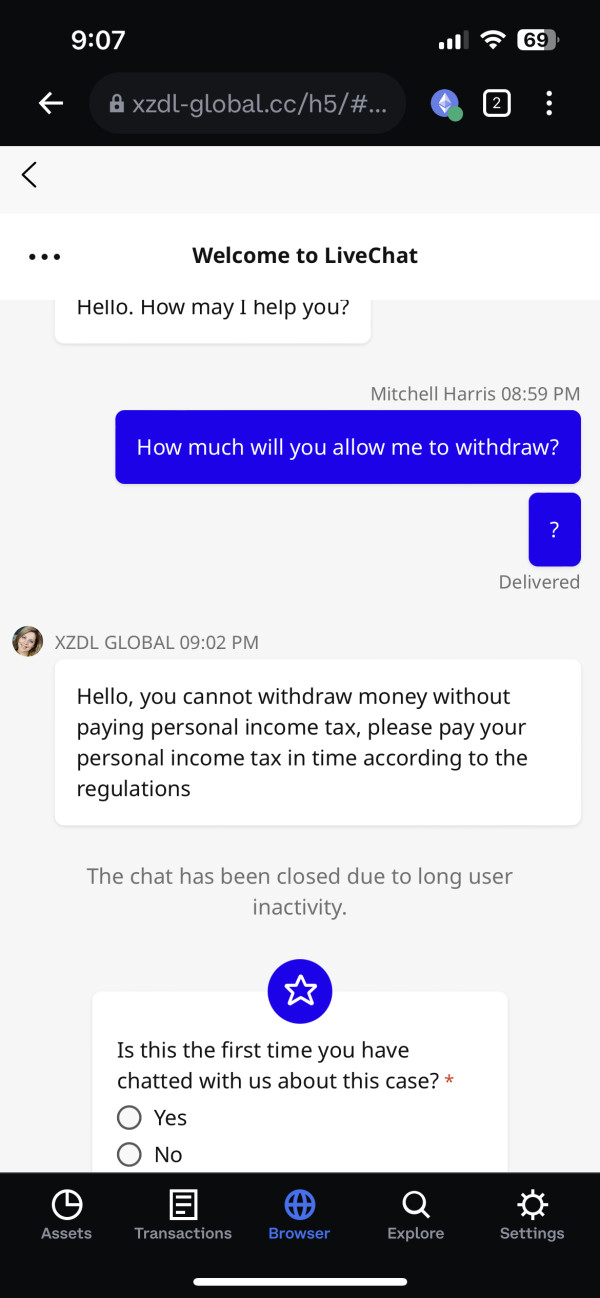

Customer Service (2.5/10): User reviews indicate slow response times and inadequate support. Many clients have expressed frustration with the lack of timely assistance when issues arise.

Trading Experience (3.5/10): While the platform is user-friendly, many users report that order execution can be slow, leading to missed opportunities in volatile markets.

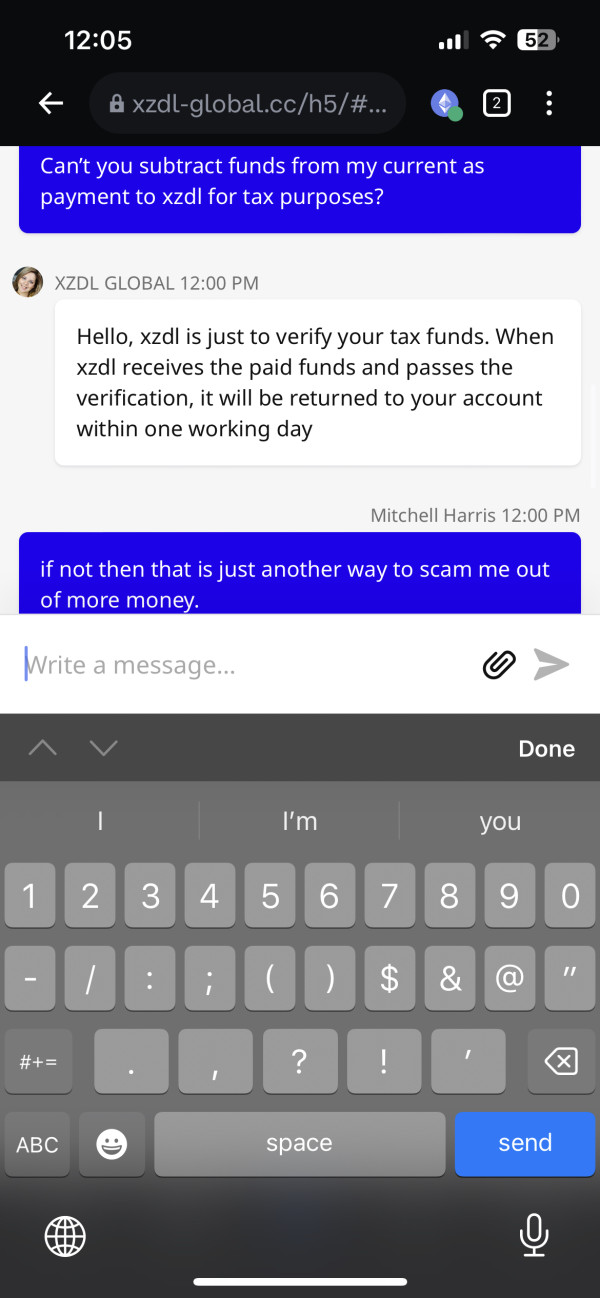

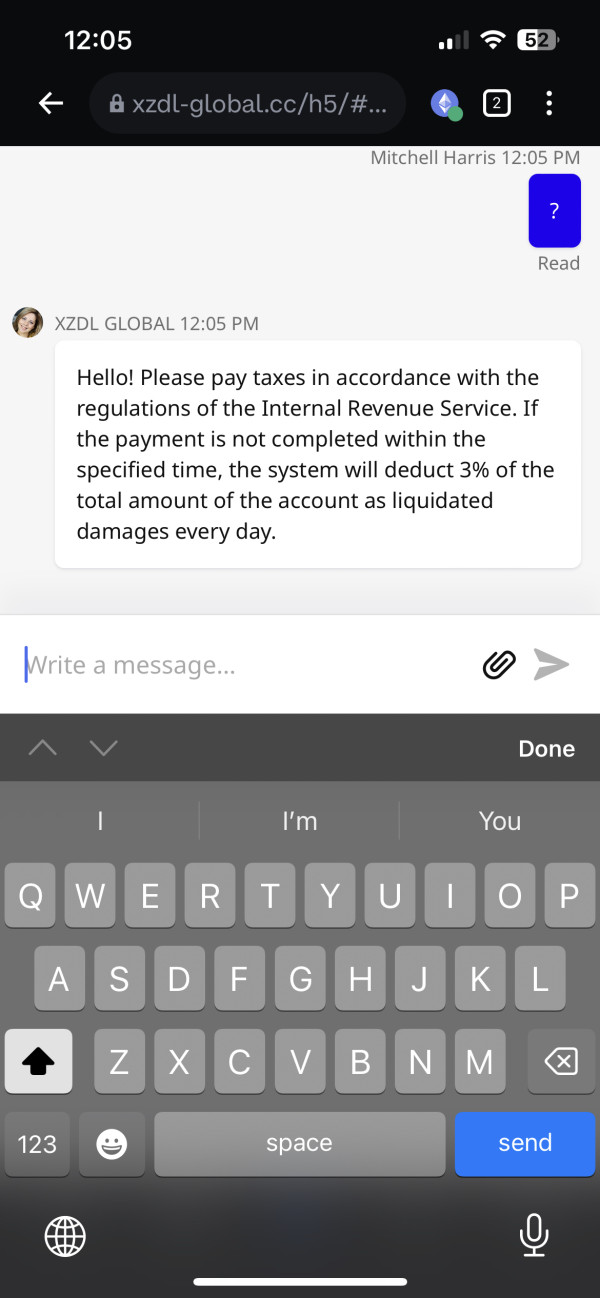

Trustworthiness (1.5/10): The absence of regulation and warnings from authorities like the FCA raise serious concerns about the safety of trading with Xzdl Global.

User Experience (4.0/10): Some users appreciate the accessibility of the platform and the variety of assets available. However, many have pointed out significant issues with withdrawal processes and account freezes.

Detailed Breakdown

-

Account Conditions: Xzdl Global only offers a single account type, which may not suit all traders' needs. The lack of options can be a drawback for those seeking tailored trading experiences.

Tools and Resources: The FX6 platform offers basic functionalities but lacks comprehensive educational resources and advanced analytical tools, making it less attractive for serious traders.

Customer Service: Reviews indicate that customer service is lacking, with many users reporting delays in response times and inadequate support. This can be particularly concerning in the fast-paced world of forex trading.

Trading Experience: Although the platform is straightforward to use, users have reported issues with order execution, particularly during high volatility, which can lead to significant financial losses.

Trustworthiness: The unregulated status of Xzdl Global is a major concern. The FCA has issued warnings against the broker, advising potential clients to exercise caution. This lack of oversight means that traders may not have access to compensation schemes in case of disputes.

User Experience: While some users have reported positive experiences with the platform's interface, the overall sentiment is marred by complaints about slow withdrawals and account management issues.

In conclusion, Xzdl Global presents itself as a forex broker with a range of trading options and a user-friendly platform. However, the significant risks associated with its unregulated status and poor customer service ratings suggest that potential clients should approach with caution. Always conduct thorough research and consider safer, regulated alternatives when choosing a broker for trading activities.