Is XENA EXCHANGE safe?

Pros

Cons

Is Xena Exchange Safe or Scam?

Introduction

Xena Exchange is a cryptocurrency trading platform that positions itself as a professional-level exchange catering to active traders and financial institutions. Established in 2017 and originally based in the United Kingdom, it has attracted attention for its advanced trading tools and features. However, as the cryptocurrency market continues to evolve, traders must exercise caution when evaluating exchanges for their trading needs. The potential for scams and fraudulent activities in the industry necessitates a careful assessment of any trading platform's legitimacy and safety.

This article aims to provide a comprehensive analysis of Xena Exchange, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. Our investigation is based on a review of various online resources, user testimonials, and expert analyses to determine whether Xena Exchange is a safe trading environment or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial in assessing its safety and reliability. Xena Exchange operates in an unregulated environment, which raises significant concerns for potential users. The absence of regulatory oversight means there is no governing body to ensure compliance with financial standards, which can lead to issues regarding the protection of user funds and fair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation is a critical red flag for Xena Exchange. Regulated brokers are required to meet stringent requirements set by financial authorities, which often include regular audits, transparency in operations, and investor protection measures. The absence of such oversight at Xena Exchange means traders face higher risks, including the potential for fraud and manipulation. Historical compliance issues have been noted, with many users reporting difficulties in fund withdrawals and lack of transparency regarding fees and trading practices.

Company Background Investigation

Xena Exchange was founded by a team of professionals with backgrounds in traditional finance, including former employees from major banks like JPMorgan and Deutsche Bank. This pedigree initially gave the exchange credibility, as it aimed to bridge the gap between conventional trading methods and the emerging cryptocurrency market. However, the company's ownership structure remains somewhat opaque, with limited information available about its current management and operational practices.

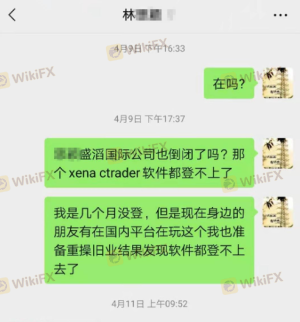

The company's transparency is questionable, as it does not provide comprehensive disclosures about its ownership or operational strategies. This lack of clarity can be concerning for potential users, as it raises questions about accountability and the ability to resolve disputes. Furthermore, the exchange has experienced several operational challenges, including reported downtime and technical issues, which have negatively impacted user experiences.

Trading Conditions Analysis

Xena Exchange operates with a fee structure that is generally competitive within the cryptocurrency trading landscape. However, the specifics of its fees and commissions can be confusing for users, leading to potential misunderstandings.

| Fee Type | Xena Exchange | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.03% | 0.25% |

| Commission Model | Varies | 0.10% - 0.25% |

| Overnight Interest Range | Varies | Varies |

While the trading fees are relatively low, the lack of clarity regarding additional charges, such as withdrawal fees and potential hidden costs, can create issues for traders. Users have reported unexpected fees during withdrawals and trading activities, which can lead to dissatisfaction and mistrust. The overall trading conditions at Xena Exchange warrant careful consideration, as any unusual fee policies can indicate underlying issues with the platform.

Customer Fund Safety

The safety of customer funds is paramount in evaluating any trading platform. Xena Exchange claims to implement several security measures to protect user assets, including cold storage for funds and multi-factor authentication for account access. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Xena Exchange does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies. The absence of these crucial safety nets can leave users vulnerable to significant financial losses, especially in the event of platform insolvency or operational failures. Additionally, there have been reports of users experiencing difficulties when attempting to withdraw their funds, which raises concerns about the exchange's reliability in safeguarding customer assets.

Customer Experience and Complaints

User feedback is a vital component of assessing the overall reliability of a trading platform. Xena Exchange has received mixed reviews from users, with many expressing concerns about the quality of customer support and the responsiveness of the platform to user issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Technical Glitches | Medium | Inconsistent |

| Lack of Support Options | High | Limited options |

Common complaints include prolonged withdrawal times, unresponsive customer support, and technical issues that hinder trading activities. For example, some users have reported being unable to access their accounts or facing delays in executing trades, which can be detrimental in the fast-paced cryptocurrency market. These complaints highlight significant areas of concern regarding Xena Exchange's commitment to customer satisfaction and operational reliability.

Platform and Trade Execution

The performance of a trading platform is critical to the user experience. Xena Exchange offers a trading interface that is designed to be user-friendly, yet there have been reports of stability issues and execution delays. Users have noted instances of slippage during high volatility periods, which can lead to unexpected losses.

The overall quality of order execution at Xena Exchange has been called into question, with some traders reporting instances of rejected orders or delayed executions. These issues can significantly impact trading strategies, especially for active traders relying on timely execution of trades. The potential for platform manipulation or unfair trading practices must also be considered, particularly in an unregulated environment.

Risk Assessment

Using Xena Exchange presents several risks that potential users should be aware of. The absence of regulatory oversight, combined with reported operational issues and customer complaints, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about safety and accountability. |

| Fund Safety Risk | High | Lack of investor protection and reports of withdrawal issues. |

| Technical Risk | Medium | Stability issues and execution delays can impact trading performance. |

To mitigate these risks, potential users should conduct thorough research before engaging with Xena Exchange. It is advisable to consider alternative platforms that offer better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Xena Exchange may not be a safe trading environment for potential users. The lack of regulation, coupled with reported issues regarding fund safety and customer support, raises significant alarm bells. Traders should exercise extreme caution when considering this platform for their trading activities.

For those seeking a reliable trading experience, it is recommended to explore alternative exchanges that are regulated and have a proven track record of customer satisfaction. Platforms with robust regulatory oversight, transparent fee structures, and responsive customer support can provide a safer and more reliable trading experience.

Is XENA EXCHANGE a scam, or is it legit?

The latest exposure and evaluation content of XENA EXCHANGE brokers.

XENA EXCHANGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XENA EXCHANGE latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.