Peto 2025 Review: Everything You Need to Know

Executive Summary

Peto forex broker emerges as a trading platform offering multiple asset classes with competitive trading conditions for retail traders. According to available information, this peto review reveals a broker that positions itself with a low minimum deposit requirement of $50 and maximum leverage reaching 1:500, making it accessible to newcomers in the forex market. The platform provides access to various financial instruments including forex currency pairs, commodities, precious metals, indices, stocks, cryptocurrencies, and contracts for difference.

Customer service quality has been highlighted as a standout feature. Reports indicate "top-notch" support levels, suggesting that Peto prioritizes client relationships and support infrastructure. The broker appears to target both novice traders seeking low-barrier market entry and experienced traders who prefer high-leverage trading opportunities.

However, regulatory information remains unclear in available documentation. This presents potential compliance considerations for prospective clients, which traders should carefully evaluate before opening accounts. The combination of accessible account conditions and diverse trading instruments positions Peto as a broker worth examining for traders seeking variety and flexibility in their trading environment.

Important Disclaimers

This evaluation is based on publicly available information and user feedback collected from various sources. Regulatory information for Peto forex broker was not clearly specified in available materials, which may indicate potential cross-regional compliance variations or regulatory gaps.

Prospective traders should independently verify regulatory status and compliance measures before engaging with the platform. The assessment methodology relies on aggregated user reports, platform specifications, and publicly disclosed information, but actual trading experiences may vary significantly from reported conditions. This review does not constitute investment advice or trading recommendations.

Rating Framework

Broker Overview

Peto operates as a multi-asset trading platform providing access to various financial markets through contracts for difference and direct trading instruments. The broker's business model centers on offering diverse trading opportunities across traditional forex markets, commodities, precious metals, stock indices, individual equities, and emerging cryptocurrency markets.

This comprehensive approach suggests Peto aims to serve as a one-stop trading destination for retail and potentially institutional clients. The platform's structure appears designed to accommodate different trader profiles, from conservative investors seeking stable currency pair trading to aggressive speculators interested in high-volatility cryptocurrency markets. According to available information, Peto focuses on providing competitive leverage ratios and maintaining relatively low entry barriers through modest minimum deposit requirements.

Specific establishment details, company background information, and founding timeline were not clearly specified in available materials. The broker offers trading across forex currency pairs, commodities including agricultural and energy products, precious metals such as gold and silver, major stock indices, individual company shares, cryptocurrencies, and various CFD instruments.

Regulatory oversight details remain unclear. No specific regulatory bodies or license numbers were mentioned in accessible documentation, which creates uncertainty about the broker's compliance framework.

Regulatory Jurisdiction: Specific regulatory information was not detailed in available materials, creating uncertainty about oversight and compliance frameworks.

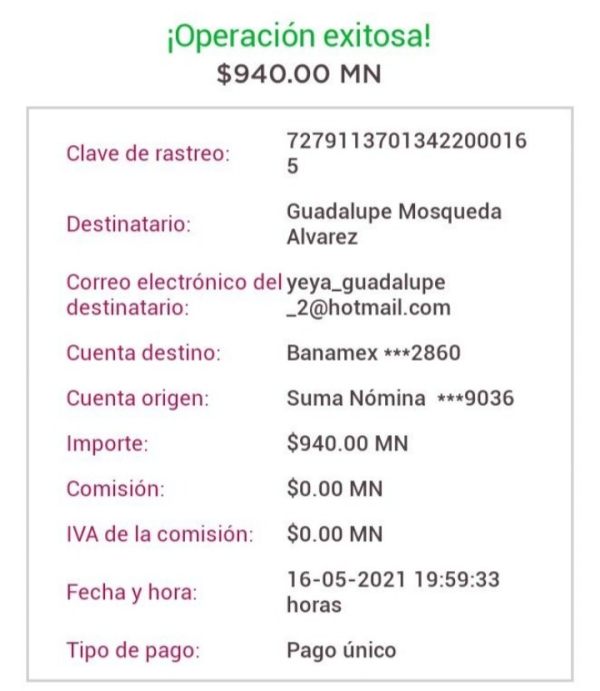

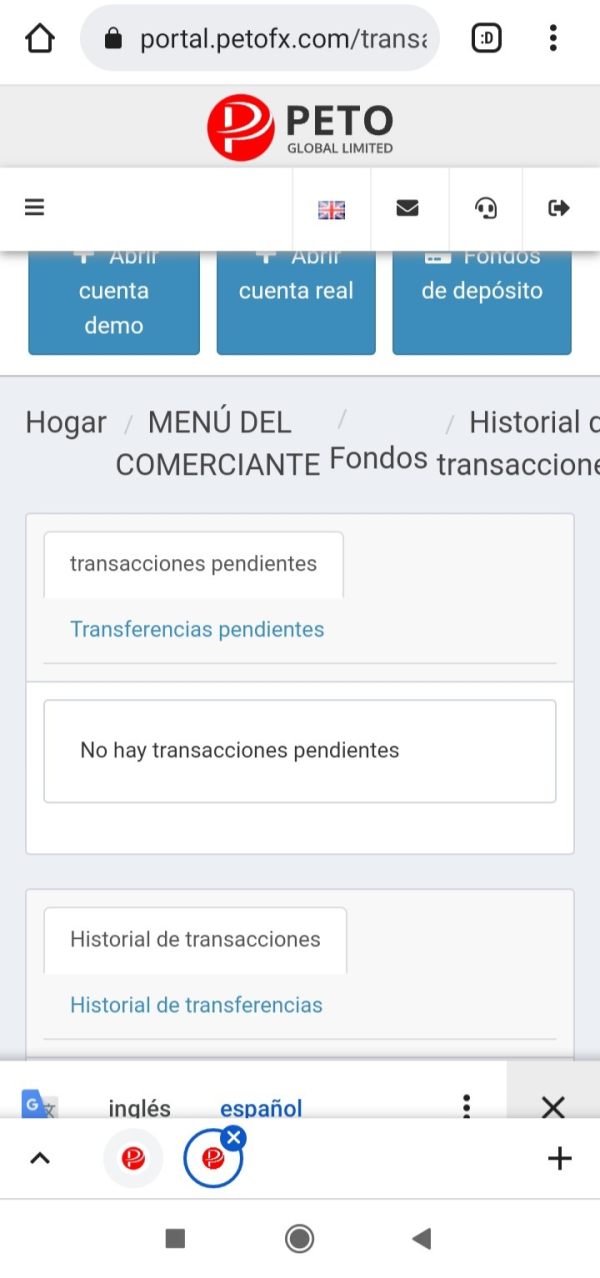

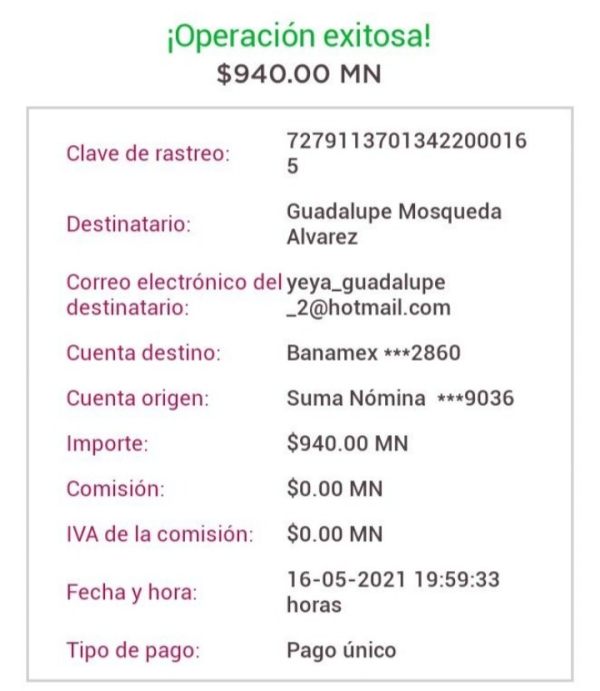

Deposit and Withdrawal Methods: Specific payment processing methods and withdrawal procedures were not comprehensively outlined in available documentation.

Minimum Deposit Requirement: The platform requires a minimum deposit of $50, positioning it as accessible for entry-level traders.

Bonus and Promotions: Information regarding welcome bonuses, deposit incentives, or ongoing promotional programs was not specified in available materials.

Available Trading Assets: The broker provides access to forex currency pairs, commodities, precious metals, stock indices, individual stocks, cryptocurrencies, and contracts for difference across multiple asset classes.

Cost Structure: Detailed information about spreads, commission structures, overnight financing costs, and other trading-related fees was not comprehensively available in reviewed materials.

Leverage Ratios: Maximum leverage reaches 1:500, offering significant position amplification for qualified traders.

Platform Options: Specific trading platform software and technology infrastructure details were not clearly outlined in this peto review materials.

Geographic Restrictions: Regional availability and trading restrictions were not specified in accessible documentation.

Customer Support Languages: Supported languages for customer service were not detailed in available information.

Account Conditions Analysis

Peto's account structure centers around accessibility and flexibility, though specific account tier details were not comprehensively outlined in available materials. The $50 minimum deposit requirement positions the broker competitively within the retail trading space, particularly for newcomers who may be hesitant to commit larger initial capital amounts.

This low barrier to entry aligns with brokers targeting emerging market traders and those beginning their forex trading journey. The account opening process specifics were not detailed in reviewed materials, leaving questions about verification requirements, documentation needs, and approval timelines. While the minimum deposit appears competitive, the absence of detailed account type information makes it difficult to assess whether multiple tier options exist or if all clients operate under uniform conditions.

Special account features, such as Islamic accounts, professional trader classifications, or institutional service levels, were not specified in this peto review documentation. The leverage offering of 1:500 suggests the broker may cater to traders seeking significant position amplification, though this also indicates higher risk exposure that may not suit all trading strategies or risk tolerance levels.

Without detailed information about account maintenance fees, inactivity charges, or other ongoing costs, prospective clients should inquire directly about the complete fee structure before committing funds.

Peto's trading environment encompasses multiple asset categories, providing traders with diversification opportunities across traditional and emerging markets. The inclusion of forex currency pairs offers access to major, minor, and potentially exotic currency combinations, while commodity trading extends to agricultural products, energy markets, and industrial materials.

Precious metals trading typically includes gold, silver, platinum, and palladium, offering inflation hedging opportunities and portfolio diversification benefits. Stock indices provide exposure to major global markets, while individual equity trading allows for company-specific investment strategies.

Cryptocurrency inclusion reflects modern trading demands, though specific digital assets and trading conditions were not detailed. Research and analysis resource availability was not specified in available materials, leaving uncertainty about economic calendars, market analysis, technical indicators, and educational content. The absence of detailed information about charting capabilities, automated trading support, and third-party tool integration limits assessment of the platform's analytical sophistication.

Educational resources, including webinars, tutorials, market commentary, and trading guides, were not mentioned in reviewed documentation.

Customer Service and Support Analysis

Customer service quality emerges as a notable strength in available feedback, with reports describing Peto's support as "top-notch." This positive assessment suggests the broker prioritizes client relationships and maintains responsive support infrastructure.

However, specific details about support channels, availability hours, and response time metrics were not provided in reviewed materials. The quality of customer service often reflects a broker's overall operational standards and commitment to client satisfaction, and positive feedback in this area may indicate well-trained support staff, efficient problem resolution processes, and proactive client communication. However, without specific examples or detailed user experiences, the scope and consistency of this service quality remain unclear.

Multi-language support capabilities were not specified, which could impact international clients requiring assistance in their native languages. Similarly, support channel options such as live chat, telephone, email, or social media were not detailed, making it difficult to assess accessibility and convenience for different client preferences.

The absence of specific problem resolution case studies or detailed user testimonials limits the ability to evaluate how effectively Peto handles complex issues, account problems, or trading disputes that may arise during normal business operations.

Trading Experience Analysis

Trading experience assessment proves challenging due to limited specific feedback about platform performance, execution quality, and user interface design. While general user sentiment appears positive, detailed information about order execution speed, slippage rates, platform stability, and mobile trading capabilities was not comprehensively available in this peto review materials.

Platform functionality completeness, including advanced order types, risk management tools, and customization options, remains unclear without specific technical specifications. The trading environment's sophistication level, whether suitable for algorithmic trading, expert advisors, or automated strategies, was not detailed in available documentation.

Mobile trading experience, increasingly important for modern traders, lacks specific assessment in reviewed materials. Features such as mobile app availability, functionality parity with desktop platforms, and mobile-specific tools would significantly impact overall user satisfaction but remain unspecified. Market access quality, including available trading hours, instrument availability, and liquidity conditions, requires further investigation.

Without specific data about spreads during different market conditions, execution quality metrics, or trading environment transparency, prospective clients should conduct thorough due diligence before committing to the platform.

Trust and Regulation Analysis

Regulatory oversight represents a significant concern in this peto review, as specific regulatory bodies, license numbers, and compliance frameworks were not clearly identified in available materials. This regulatory uncertainty creates potential trust issues for traders who prioritize heavily regulated brokers with clear oversight mechanisms.

Fund safety measures, including client fund segregation, deposit protection schemes, and financial compensation programs, were not detailed in reviewed documentation. These protections typically provide crucial safeguards for client capital and represent fundamental trust indicators for forex brokers, making their absence a notable concern for risk-conscious traders. Company transparency regarding ownership structure, financial statements, business operations, and corporate governance remains unclear.

The absence of detailed company information may concern traders who prefer comprehensive transparency about their broker's business operations and financial stability. Industry reputation assessment proves difficult without specific regulatory track records, industry awards, or third-party certifications, and the lack of detailed compliance history, regulatory actions, or industry recognition limits the ability to evaluate Peto's standing within the broader forex brokerage community.

User Experience Analysis

Overall user satisfaction assessment remains incomplete due to limited comprehensive feedback in available materials. While customer service receives positive mentions, broader user experience elements such as platform usability, account management efficiency, and overall satisfaction levels lack detailed evaluation.

Interface design and platform usability were not specifically addressed in reviewed materials, though these factors significantly impact daily trading operations and user satisfaction. Modern traders expect intuitive interfaces, responsive design, and seamless functionality across different devices and operating systems, making this information gap notable for potential users. Registration and verification process efficiency was not detailed, though these initial experiences often shape long-term client relationships.

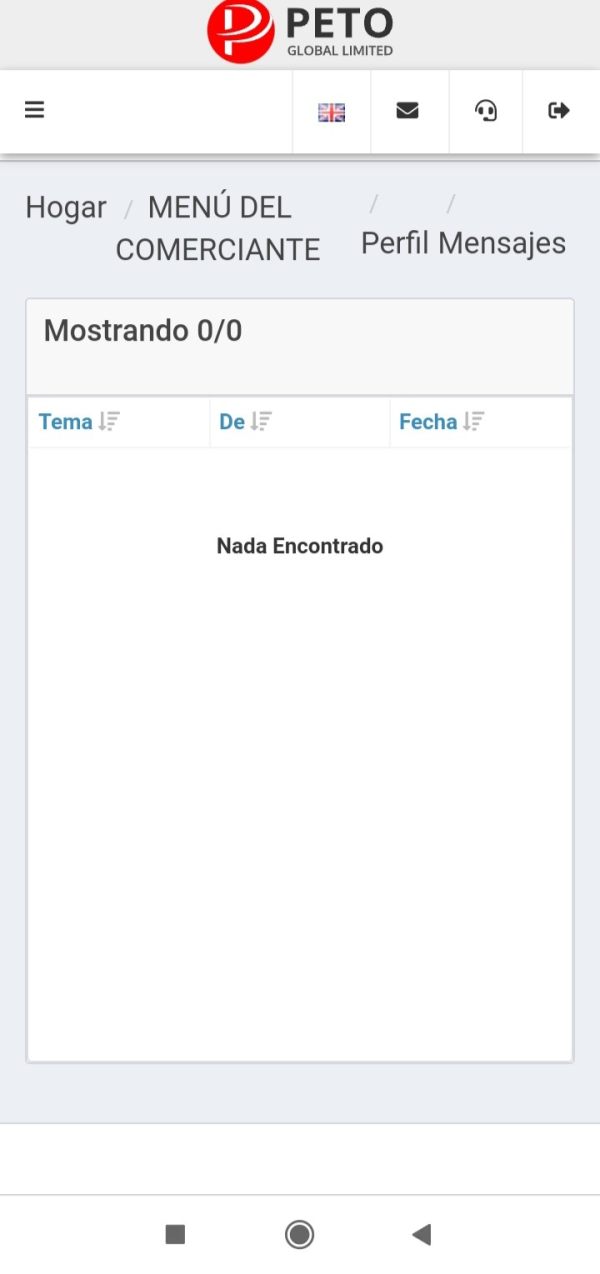

Streamlined onboarding processes, clear documentation requirements, and reasonable verification timelines contribute significantly to positive user experiences. Funding operation experiences, including deposit processing times, withdrawal efficiency, and payment method reliability, were not comprehensively covered, though these practical considerations often determine user satisfaction more than trading features. Common user complaints or recurring issues were not identified in available materials, limiting the ability to assess potential problem areas or operational weaknesses that might impact future client experiences.

Conclusion

Peto forex broker presents a mixed profile with notable strengths in customer service quality and competitive account conditions, balanced against significant transparency concerns regarding regulatory oversight. The combination of low minimum deposits and high leverage ratios creates an accessible trading environment for both novice and experienced traders seeking position amplification opportunities.

The broker appears most suitable for traders prioritizing diverse asset access and responsive customer support over regulatory transparency. New traders may appreciate the low entry barriers, while experienced traders might value the high leverage and multi-asset trading capabilities.

However, the lack of clear regulatory information may concern risk-averse traders who prioritize heavily regulated brokers. Primary advantages include competitive minimum deposit requirements, significant leverage availability, and reportedly excellent customer service, while key disadvantages center on regulatory uncertainty, limited detailed user experience feedback, and insufficient transparency regarding trading conditions and operational procedures. Prospective clients should conduct thorough independent research and consider their regulatory preferences before engaging with the platform.