Is Local Bank safe?

Pros

Cons

Is Local Bank A Scam?

Introduction

Local Bank is a financial institution that positions itself within the forex market, offering a range of trading services and investment opportunities. As more traders venture into the world of forex trading, it becomes increasingly crucial to evaluate the reliability and safety of brokers. With the potential for scams and fraudulent activities in the industry, traders must exercise caution and conduct thorough research before entrusting their funds to any broker. This article aims to provide an objective analysis of Local Bank, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is vital for ensuring the safety of traders funds and the integrity of trading practices. Local Bank's regulatory status raises several concerns. It has been reported that the bank lacks current regulatory authorizations, with previous licenses from the Australian Securities and Investments Commission (ASIC) and the National Futures Association (NFA) being revoked. This lack of oversight is a significant red flag for potential clients.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Revoked |

| NFA | N/A | USA | Unauthorized |

The absence of a robust regulatory framework means that Local Bank does not adhere to the stringent standards enforced by top-tier regulators. This raises questions about the quality of services provided and the overall safety of client funds. Regulatory bodies play a crucial role in protecting investors by enforcing rules that ensure transparency, fair pricing, and ethical practices. Without such oversight, traders may be vulnerable to unfair practices and potential scams.

Company Background Investigation

Local Bank, also known as Local Financial Pty Ltd, boasts a history of over 120 years in the financial sector. However, its recent regulatory issues have cast doubt on its operational integrity. The ownership structure and management team of Local Bank are not well-documented, which contributes to concerns about transparency and accountability. A thorough analysis of the management's backgrounds is essential in assessing the bank's reliability. Without experienced and reputable leaders, the bank may struggle to maintain trust among its clients.

Transparency in operations and information disclosure is crucial for building client confidence. Local Bank's failure to provide clear and accessible information about its management and ownership structure raises questions about its commitment to ethical practices. Clients are encouraged to seek institutions that prioritize transparency, as this is often indicative of a trustworthy organization.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is paramount. Local Bank presents a complex fee structure that may not be immediately clear to potential clients. Traders should be cautious of any hidden fees or unusual cost policies that could impact their profitability.

| Fee Type | Local Bank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Structure | N/A | 0-0.5% |

| Overnight Interest Range | Varies | 0.5-1.5% |

The overall cost structure at Local Bank may not align with industry standards, which could lead to unexpected expenses for traders. Additionally, the lack of clarity surrounding commissions and spreads can create confusion, making it difficult for traders to accurately assess their potential costs. It is essential for traders to fully understand all associated fees before engaging with Local Bank.

Client Funds Security

The security of client funds is a critical aspect of any financial institution. Local Bank's measures for safeguarding client assets are currently under scrutiny. The absence of regulatory oversight raises concerns about fund segregation, investor protection, and negative balance protection policies.

Traders must be aware of the potential risks associated with depositing funds into a broker that lacks sufficient safeguards. Historical issues related to fund security can significantly impact a broker's reputation. Therefore, it is crucial to investigate any past controversies or disputes involving Local Bank concerning fund safety.

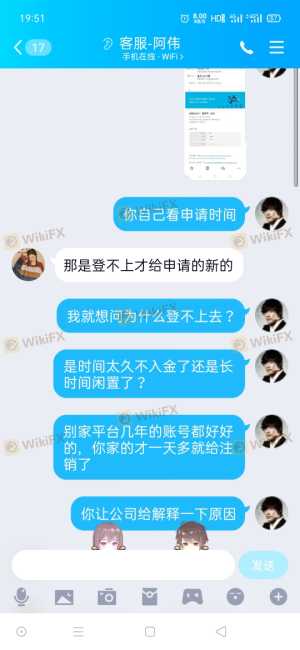

Customer Experience and Complaints

Client feedback is an invaluable resource for assessing the reliability of a forex broker. Local Bank has received mixed reviews from users, with many reporting difficulties in accessing customer support and resolving issues. Common complaints include long wait times for assistance, unhelpful responses, and a lack of effective communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Slow |

| Platform Stability Issues | High | Inconsistent |

Several users have shared their experiences of facing significant delays when attempting to withdraw funds, which raises concerns about the bank's operational efficiency. The quality of customer service is a crucial indicator of a broker's reliability, and Local Banks reported shortcomings in this area warrant caution for potential clients.

Platform and Trade Execution

A broker's trading platform is the primary interface through which clients interact with the market. Evaluating Local Banks platform performance is essential for understanding the user experience. Reports indicate that the trading platform may suffer from stability issues, affecting order execution quality and leading to slippage or rejected orders.

The user experience on the platform, including ease of navigation and reliability, is critical for traders looking to execute trades efficiently. Any signs of manipulation or technical glitches could further erode client trust in Local Bank.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Local Bank is no exception. A comprehensive risk assessment reveals several areas of concern that traders should consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight raises concerns. |

| Financial Stability | Medium | Historical issues with fund security. |

| Customer Support Risk | High | Poor response times and unresolved complaints. |

Traders are advised to exercise caution when dealing with Local Bank, particularly given the high regulatory risk and the historical issues surrounding customer support and fund safety. Implementing risk mitigation strategies, such as limiting deposit amounts and diversifying trading activities, can help safeguard investments.

Conclusion and Recommendations

In conclusion, the analysis of Local Bank raises significant concerns regarding its legitimacy and safety as a forex broker. The lack of current regulatory oversight, combined with mixed client experiences and unresolved complaints, suggests that traders should approach this institution with caution.

While Local Bank may offer some appealing trading conditions, the potential risks associated with engaging with an unregulated broker outweigh the benefits. Traders are encouraged to consider alternative options that prioritize regulatory compliance and customer support. Reliable brokers with strong regulatory backgrounds and positive client feedback should be prioritized to ensure a safer trading experience.

In summary, is Local Bank safe? The evidence suggests that traders should be wary and conduct thorough research before committing their funds.

Is Local Bank a scam, or is it legit?

The latest exposure and evaluation content of Local Bank brokers.

Local Bank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Local Bank latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.