Local Bank Review 1

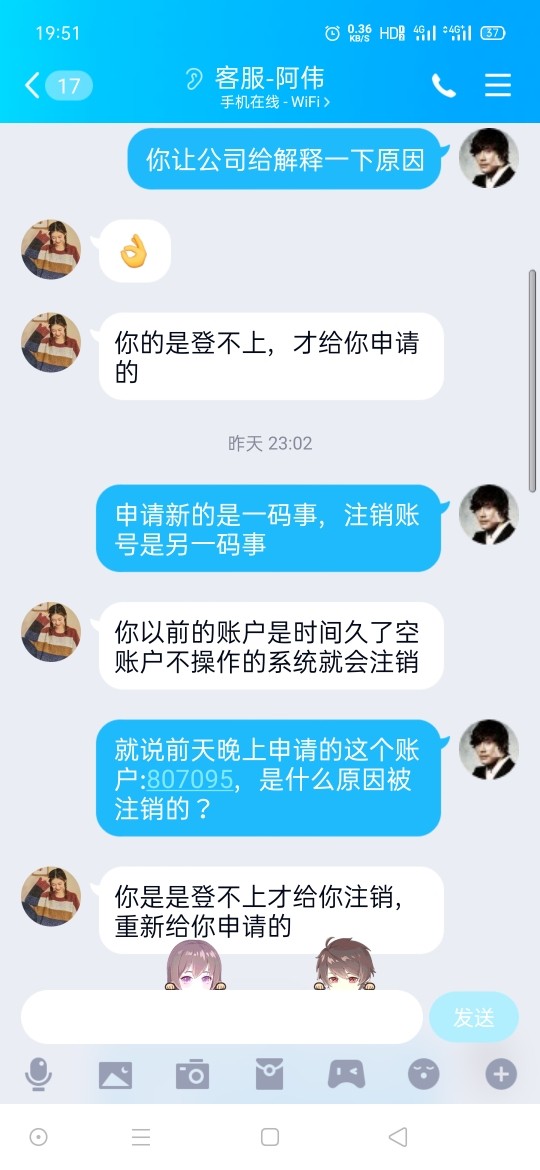

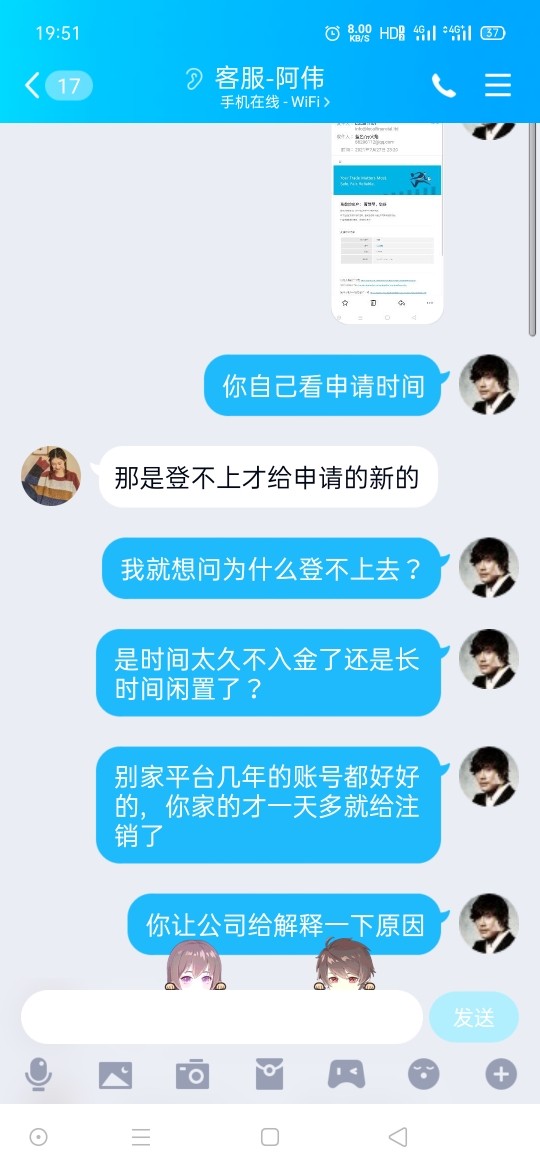

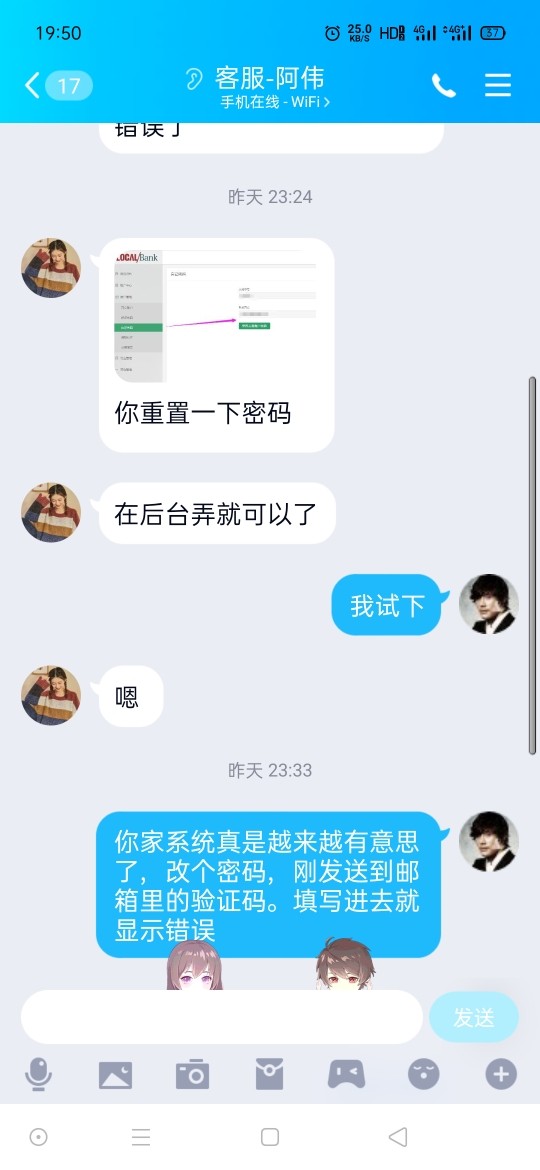

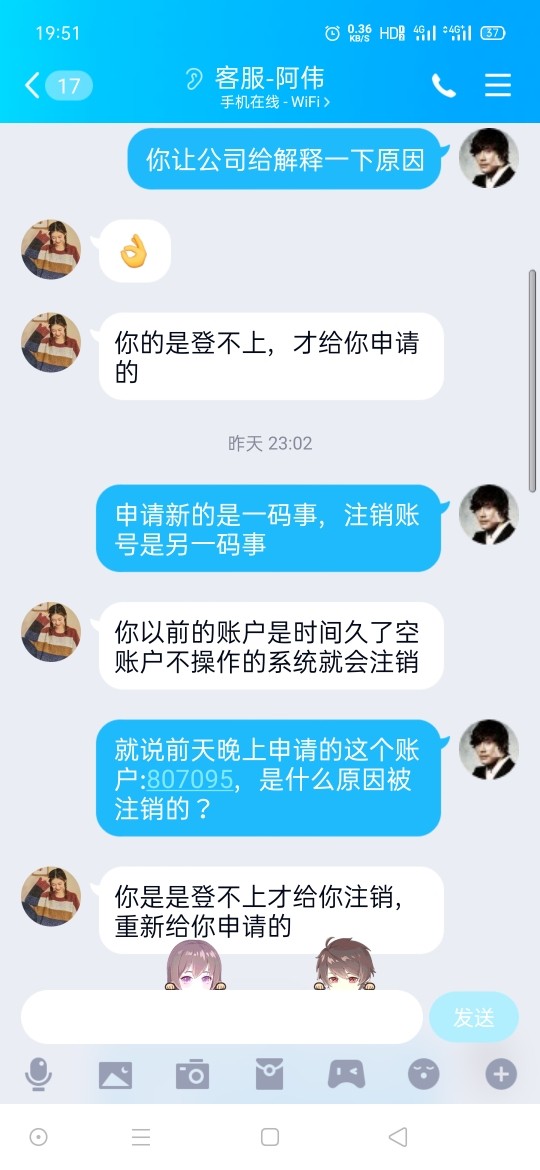

The new account was deleted. Customer service listed many reasons. Stay away from it.

Local Bank Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The new account was deleted. Customer service listed many reasons. Stay away from it.

This complete local bank review looks at Local Bank's performance as a financial services provider in 2025. Local Bank keeps a solid reputation in its community and does especially well in customer service. The bank has received lots of positive feedback from users, with 218 five-star reviews and 15 seven-star ratings that show consistently high customer satisfaction.

Local Bank's main strength is its commitment to providing products and services designed for its community's unique needs. This personal approach works well with both individual customers and business clients, making the bank a trusted local financial partner. The bank operates multiple locations across Tahlequah, Park Hill, Grove, Sallisaw, and Hulbert to ensure accessible banking services throughout its service area.

The bank mainly targets local consumers and small to medium-sized businesses seeking personal banking solutions. Unlike larger national banks, Local Bank focuses on understanding and addressing the specific financial needs of its regional market by offering customized services that reflect local economic conditions and customer preferences. This community-centered approach has proven effective in building strong, long-term customer relationships and maintaining competitive positioning within its operational territory.

Local Bank operations may vary significantly across different regions due to varying regulatory requirements and local market demands. Each branch location may offer slightly different products, services, and procedures based on state-specific banking regulations and community needs. Potential customers should verify specific offerings and requirements with their local branch before making banking decisions.

This review analysis is based on available user feedback, observable market performance, and publicly accessible information. Due to limited regulatory transparency in available materials, some aspects of the bank's compliance status and detailed operational metrics could not be fully verified. Readers should conduct additional research and consult directly with Local Bank representatives for the most current and accurate information regarding specific banking products and services.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available information |

| Tools and Resources | N/A | Banking tools and resources not specified in source materials |

| Customer Service and Support | 9/10 | Exceptional user satisfaction evidenced by 218 five-star reviews |

| Banking Experience | N/A | Detailed transaction experience data not available |

| Trust and Reliability | N/A | Limited regulatory and compliance information available |

| User Experience | 8/10 | Strong community feedback and tailored service approach |

Local Bank operates as a community-focused financial institution serving multiple locations across Oklahoma, including Tahlequah, Park Hill, Grove, Sallisaw, and Hulbert. While specific establishment dates are not detailed in available information, the bank has shown consistent commitment to providing quality customer service and maintaining strong community relationships. The institution's business model centers on delivering personal financial solutions that address the unique needs of local consumers and businesses.

The bank's operational approach emphasizes community engagement and customized service delivery. Rather than adopting a one-size-fits-all strategy common among larger financial institutions, Local Bank focuses on understanding individual customer requirements and market-specific conditions. This approach has enabled the institution to build a loyal customer base and maintain competitive positioning within its service areas.

Regarding trading platforms and investment services, specific information about Local Bank's digital banking infrastructure and investment offerings is not detailed in available materials. Similarly, comprehensive regulatory oversight details and specific asset management capabilities require direct consultation with bank representatives. This local bank review acknowledges these information gaps while focusing on verified customer satisfaction and service quality metrics.

Regulatory Oversight: Specific regulatory compliance details and oversight agencies are not clearly specified in available information sources. Potential customers should inquire directly about FDIC insurance status and regulatory compliance.

Deposit and Withdrawal Methods: Available deposit and withdrawal options are not detailed in source materials. Standard banking services likely include traditional methods, but specific details require direct bank consultation.

Minimum Deposit Requirements: Minimum deposit requirements for various account types are not specified in available information. These details vary by account type and should be verified with local branches.

Promotional Offers: Current promotional offers and incentive programs are not detailed in source materials. Potential customers should inquire about available promotions when opening accounts.

Available Banking Products: Specific banking products and services offered are not fully detailed in available information. Standard community bank offerings likely include checking, savings, and lending services.

Fee Structure: Detailed fee schedules and cost structures are not specified in source materials. This local bank review recommends direct consultation for accurate fee information.

Credit and Lending: Specific credit products and lending terms are not detailed in available information sources.

Digital Banking Platform: Online and mobile banking capabilities are not specified in source materials.

Service Area Restrictions: Services appear focused on Oklahoma communities, but specific geographic limitations require verification.

Customer Service Languages: Available customer service languages are not specified in source materials.

Account condition evaluation for Local Bank faces limitations due to insufficient detailed information in available sources. Standard community banking practices suggest the institution likely offers various checking and savings account options tailored to local market needs. However, specific minimum balance requirements, account maintenance fees, and special account features such as senior citizen accounts or student banking options are not detailed in accessible materials.

The bank's community focus suggests account conditions are likely designed to be accessible and competitive within the local market. Community banks typically offer more flexible terms and personalized account management compared to larger institutions. However, without specific documentation of account terms, conditions, and requirements, a comprehensive evaluation cannot be completed.

Potential customers should directly contact Local Bank branches to obtain detailed account condition information, including opening requirements, fee schedules, and available account types. This local bank review recommends thorough discussion of account terms before making banking decisions.

Evaluation of Local Bank's tools and resources faces significant information limitations. Modern banking typically includes online banking platforms, mobile applications, financial planning tools, and digital account management resources. However, specific details about Local Bank's digital banking infrastructure and available customer tools are not specified in source materials.

Community banks often provide personalized financial guidance and local market expertise as primary resources for customers. This approach may emphasize human interaction and relationship-based service over sophisticated digital tools. However, without specific information about available resources, educational materials, or digital banking capabilities, comprehensive assessment remains incomplete.

The bank's strong customer satisfaction ratings suggest that whatever tools and resources are available meet customer expectations effectively. However, potential customers seeking specific digital banking features or investment tools should inquire directly about available options and capabilities.

Customer service represents Local Bank's strongest evaluated area, earning a 9/10 rating based on exceptional user feedback. The institution has received 218 five-star reviews and 15 seven-star ratings, indicating consistently high customer satisfaction levels. This outstanding performance suggests the bank successfully delivers personalized, responsive customer service that meets community expectations.

Community banks typically excel in customer service by providing personalized attention and building long-term relationships with customers. Local Bank appears to exemplify this approach, with customer feedback indicating satisfaction with service quality and responsiveness. The high volume of positive reviews suggests consistent service delivery across multiple locations and customer interactions.

While specific details about customer service hours, available contact methods, and response times are not detailed in source materials, the overwhelmingly positive customer feedback indicates effective service delivery. The bank's community focus likely enables more personalized attention and faster issue resolution compared to larger institutions.

Banking experience evaluation faces information limitations due to insufficient details about Local Bank's operational processes and customer interaction systems. Modern banking experience typically encompasses digital platform functionality, transaction processing efficiency, account management ease, and overall customer journey satisfaction.

The bank's strong customer satisfaction ratings suggest positive overall banking experiences, though specific details about transaction processing, digital banking capabilities, and operational efficiency are not available in source materials. Community banks often provide more personalized banking experiences through relationship-based service models.

Customer feedback indicates satisfaction with banking services, suggesting that available platforms and processes meet user expectations. However, without specific information about digital banking features, transaction capabilities, or operational systems, comprehensive banking experience assessment remains incomplete. This local bank review recommends direct consultation for detailed operational information.

Trust and reliability assessment faces challenges due to limited regulatory and compliance information in available sources. Banking trust typically depends on regulatory oversight, deposit insurance, financial stability, and institutional transparency. However, specific details about Local Bank's regulatory status, FDIC insurance, and compliance history are not detailed in accessible materials.

The bank's strong customer satisfaction ratings and community presence suggest positive local reputation and reliable service delivery. Community banks often build trust through long-term local relationships and consistent service quality. However, without specific regulatory compliance information or financial stability data, comprehensive trust assessment remains incomplete.

Potential customers should verify FDIC insurance status, regulatory oversight, and compliance history directly with the bank. Trust evaluation should include confirmation of deposit protection and regulatory compliance before establishing banking relationships.

User experience evaluation shows positive indicators based on available customer feedback. The bank's 218 five-star reviews and 15 seven-star ratings suggest high overall user satisfaction levels. Local Bank's community-focused approach appears to create positive user experiences through personalized service and local market understanding.

Community banks typically provide superior user experiences through relationship-based service models and personalized attention. Local Bank appears to successfully implement this approach, with customer feedback indicating satisfaction with overall banking relationships. The bank's multiple location strategy across Tahlequah, Park Hill, Grove, Sallisaw, and Hulbert suggests convenient access for regional customers.

While specific details about digital user interfaces, account management systems, and customer journey optimization are not available, positive customer feedback indicates effective user experience delivery. The bank's target market of local consumers and businesses appears well-served by current service approaches and available banking solutions.

This local bank review reveals Local Bank as a community-focused financial institution excelling in customer service delivery and local market engagement. The bank's exceptional customer satisfaction ratings, evidenced by 218 five-star reviews, demonstrate consistent service quality and customer relationship management. Local Bank appears well-suited for local consumers and business customers seeking personalized banking solutions and community-based financial services.

The institution's primary strengths include outstanding customer service, community-tailored products, and strong local market presence across multiple Oklahoma locations. However, limited information transparency regarding regulatory compliance, specific banking products, and operational details represents areas requiring direct customer inquiry. Potential customers should verify specific services, regulatory status, and account conditions through direct bank consultation before making banking decisions.

FX Broker Capital Trading Markets Review