Is GDPFX safe?

Business

License

Is GDPFX Safe or Scam?

Introduction

GDPFX is a forex broker that emerged in 2020, positioning itself within the competitive landscape of online trading. As a broker based in Australia, it offers various trading services, primarily utilizing the MetaTrader 4 platform. However, potential traders must exercise caution when evaluating forex brokers due to the inherent risks associated with trading and the prevalence of scams in the industry. Many brokers may promise high returns and low risks, but not all are regulated or trustworthy. This article aims to provide a comprehensive assessment of GDPFX by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation draws on data from multiple sources, including user reviews, regulatory disclosures, and industry analyses.

Regulatory and Legality

The regulatory framework is crucial for any forex broker, as it ensures compliance with financial laws and safeguards investors' interests. GDPFX claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, recent reports indicate that its license has been revoked, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001284466 | Australia | Revoked |

The revocation of GDPFX's license by ASIC is a serious red flag. Regulatory bodies like ASIC are known for their stringent oversight, and a revoked license often indicates past compliance issues or unethical practices. In addition, the lack of any current valid regulatory oversight means that investors may not have legal protections in place should issues arise. This situation necessitates a thorough examination of GDPFX's operational history and compliance with financial regulations.

Company Background Investigation

GDPFX is operated by Global Diman Pacific Pty Ltd, which was established in 2020. The company's relatively short history raises questions about its stability and trustworthiness. Information regarding the ownership structure is limited, and there is a lack of transparency about its management team and their qualifications.

The absence of detailed disclosures about the company's operational history and management raises concerns. A reputable broker typically provides comprehensive information about its leadership and operational practices. The lack of transparency can be a significant warning sign for potential investors, as it complicates the assessment of the broker's reliability and accountability.

Trading Conditions Analysis

When considering whether GDPFX is safe, evaluating its trading conditions is essential. The broker offers various trading instruments, including forex and CFDs, but the overall fee structure appears to be higher than industry standards.

| Fee Type | GDPFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The spread for major currency pairs at GDPFX is notably wider than the industry average, which can erode potential profits for traders. Additionally, the commission structure lacks clarity, with reports suggesting that fees may be higher than expected. Such conditions can significantly impact a trader's profitability and overall experience, raising further questions about the broker's safety and reliability.

Client Funds Security

The safety of client funds is paramount when evaluating a broker's credibility. GDPFX claims to implement several security measures, including segregated accounts for client funds. However, the effectiveness of these measures is questionable given the recent revocation of its ASIC license.

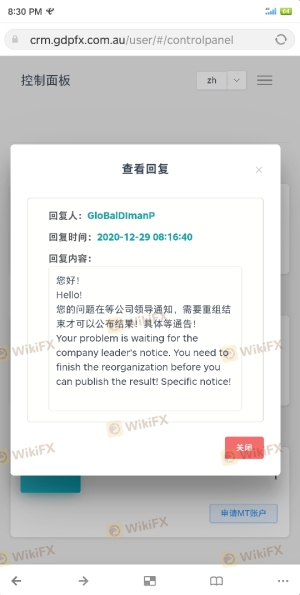

There have been no documented instances of negative balance protection or investor compensation schemes, which are critical components of a secure trading environment. Historical complaints against GDPFX indicate issues related to fund withdrawals and account accessibility, suggesting that the broker may not have robust measures in place to protect client investments. These factors contribute to the overall assessment of whether GDPFX is safe.

Customer Experience and Complaints

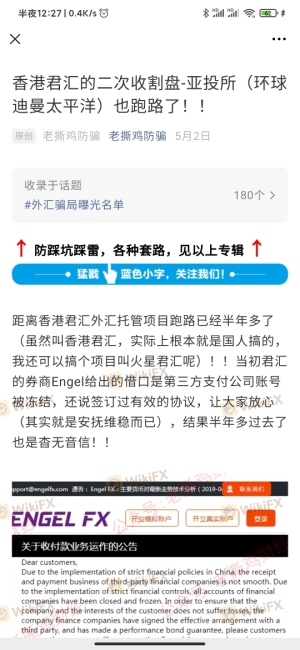

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of GDPFX reveal a pattern of complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Blocking | Medium | Slow response |

| Poor Customer Service | High | Unresolved |

Many users have reported being unable to withdraw their funds, with some claiming that their accounts were blocked after raising complaints. These issues highlight the potential risks associated with trading with GDPFX and suggest a lack of adequate customer support. Such complaints, especially when they are recurrent, contribute to the perception that GDPFX may not be a safe broker.

Platform and Execution

The trading platform offered by GDPFX is primarily MetaTrader 4, a widely used platform known for its reliability. However, user experiences indicate that the platform may suffer from performance issues, including slippage and order rejections.

Traders have reported instances of delays in trade execution, which can be detrimental in a fast-paced trading environment. Any signs of platform manipulation or unreliable execution can significantly affect traders' outcomes and raise concerns about the broker's integrity. Therefore, assessing the platform's performance is essential when determining if GDPFX is safe.

Risk Assessment

Using GDPFX presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | License revoked by ASIC |

| Withdrawal Issues | High | Frequent complaints about fund access |

| Trading Costs | Medium | Higher spreads than industry average |

| Customer Support | High | Poor response times and unresolved issues |

The high risk associated with regulatory compliance and withdrawal issues are significant factors that traders must weigh before engaging with GDPFX. To mitigate these risks, it is advisable to conduct thorough research, consider alternative brokers with better regulatory standing, and ensure that any trading decisions are made cautiously.

Conclusion and Recommendations

In conclusion, the evidence suggests that GDPFX may not be a safe broker for forex trading. The revocation of its ASIC license, coupled with numerous complaints regarding fund withdrawals and poor customer service, raises serious concerns about its legitimacy. Traders should be wary of engaging with GDPFX, particularly given the high risks associated with its operations.

For those seeking reliable alternatives, it is recommended to consider brokers that are well-regulated by top-tier authorities such as the FCA or ASIC. Brokers with a solid reputation and positive customer feedback offer a more secure trading environment. Overall, potential investors should prioritize safety and conduct thorough due diligence before selecting a broker.

Is GDPFX a scam, or is it legit?

The latest exposure and evaluation content of GDPFX brokers.

GDPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GDPFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.