Is ESTA safe?

Business

License

Is Esta Safe or Scam?

Introduction

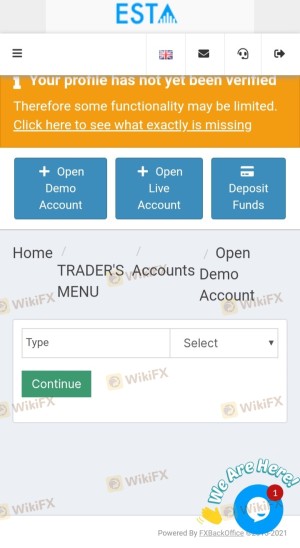

Esta Trade, an online forex broker, has emerged as a player in the competitive foreign exchange market. With promises of low spreads, high leverage, and an intuitive trading platform, it attracts a range of traders from novices to experienced professionals. However, the influx of unregulated brokers in the forex space has made it imperative for traders to conduct thorough due diligence before committing their funds. This article aims to evaluate whether Esta Trade is a legitimate trading entity or a potential scam. Our investigation is based on a comprehensive analysis of various sources, including regulatory statuses, customer feedback, and overall trading conditions.

Regulation and Legitimacy

The regulatory landscape is crucial for any trading platform, as it ensures that brokers adhere to specific standards, thereby protecting traders' interests. Unfortunately, Esta Trade operates without any significant regulatory oversight. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation raises red flags. Regulatory bodies, such as the FCA in the UK or CySEC in Cyprus, enforce strict guidelines to ensure transparency, fund segregation, and investor protection. Esta Trade's lack of any such oversight indicates a potential risk for traders, as they may have little recourse in the event of disputes or financial issues. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment, which often attracts unscrupulous operators. Thus, the question remains: Is Esta safe? The evidence suggests otherwise.

Company Background Investigation

Understanding the background of a broker can provide insights into its legitimacy. Esta Trade was established in 2020 and claims to offer a range of trading instruments, including forex, cryptocurrencies, and CFDs. However, the lack of detailed information regarding its ownership structure and management team is concerning. A reputable broker typically provides transparency about its leadership and operational history.

The broker's website lacks substantial information about its team, which raises questions about the expertise and reliability of those managing the platform. Moreover, the absence of legal documents or clear company registration details further complicates the picture. Without a transparent ownership structure, it is challenging to ascertain the credibility of Esta Trade, making it imperative for potential clients to tread carefully. The anonymity surrounding the company contributes to the skepticism about its operations. When asking Is Esta safe?, the lack of transparency is a significant concern.

Trading Conditions Analysis

A broker's trading conditions can significantly impact a trader's experience. Esta Trade advertises a low minimum deposit requirement of $10 and offers leverage up to 1:500. While these features may seem attractive, they often come with hidden costs that can erode profitability. The following table outlines the core trading costs associated with Esta Trade:

| Cost Type | Esta Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.2 pips | 1.0 pips |

| Commission Model | $1 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads appear competitive, the commission structure raises concerns. The low commission rate may entice traders, but it is crucial to consider the overall trading environment. Additionally, the broker's lack of segregation of funds poses a risk to traders' capital. If a broker cannot guarantee the safety of client funds, the question of Is Esta safe? becomes increasingly relevant.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. Esta Trade does not offer any form of investor protection, such as segregated accounts or negative balance protection. These measures are standard in regulated environments and are designed to safeguard traders' investments.

The absence of such protections means that traders could potentially lose their entire investment if the broker encounters financial difficulties. Furthermore, there have been reports of withdrawal issues, where clients have faced delays or outright refusals when trying to access their funds. This history of complaints raises serious concerns about the broker's financial stability and operational integrity. The lack of safety measures indicates that Is Esta safe? is a question that remains unanswered positively.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Reviews about Esta Trade are mixed, with many users expressing frustration over withdrawal processes and unresponsive customer service. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Fair |

| Misleading Information | High | Poor |

For example, several traders have reported that their withdrawal requests were met with excessive delays, often taking weeks or months to process. In some cases, clients were pressured to deposit additional funds before they could access their existing balances. Such practices are indicative of a potentially fraudulent operation, further complicating the question of Is Esta safe? The overall negative sentiment surrounding customer experiences is a critical factor to consider.

Platform and Trade Execution

The trading platform offered by Esta Trade is MetaTrader 4, a widely used and respected platform in the industry. While MT4 is known for its reliability and user-friendly interface, the execution quality on Esta Trade raises concerns. Reports of slippage and rejected orders have surfaced, which can severely impact trading outcomes.

Additionally, the broker's lack of transparency regarding order execution policies adds to the skepticism. If traders cannot trust the execution quality, it undermines the entire trading experience. Therefore, when evaluating Is Esta safe?, the platform's performance and reliability are essential considerations.

Risk Assessment

Engaging with Esta Trade presents several risks that potential clients should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud potential |

| Fund Security Risk | High | Lack of investor protection measures |

| Execution Risk | Medium | Reports of slippage and rejected orders |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues |

Given these risks, it is crucial for traders to consider their risk tolerance and investment goals before engaging with Esta Trade. To mitigate these risks, potential clients should thoroughly research and consider alternative brokers with better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Esta Trade operates as an unregulated broker with significant risks. The lack of regulatory oversight, poor customer feedback, and questionable trading conditions raise serious concerns about the broker's legitimacy. Therefore, it is advisable for traders to exercise extreme caution when considering Esta Trade as a trading partner.

For those seeking a reliable forex trading experience, it is recommended to explore alternatives that are regulated by reputable authorities, such as those based in the UK or Cyprus. These options typically offer better protection for client funds and more transparent operations. Ultimately, the question Is Esta safe? is best answered with a resounding caution against engaging with this broker.

Is ESTA a scam, or is it legit?

The latest exposure and evaluation content of ESTA brokers.

ESTA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ESTA latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.